Buy These AI Stocks Today

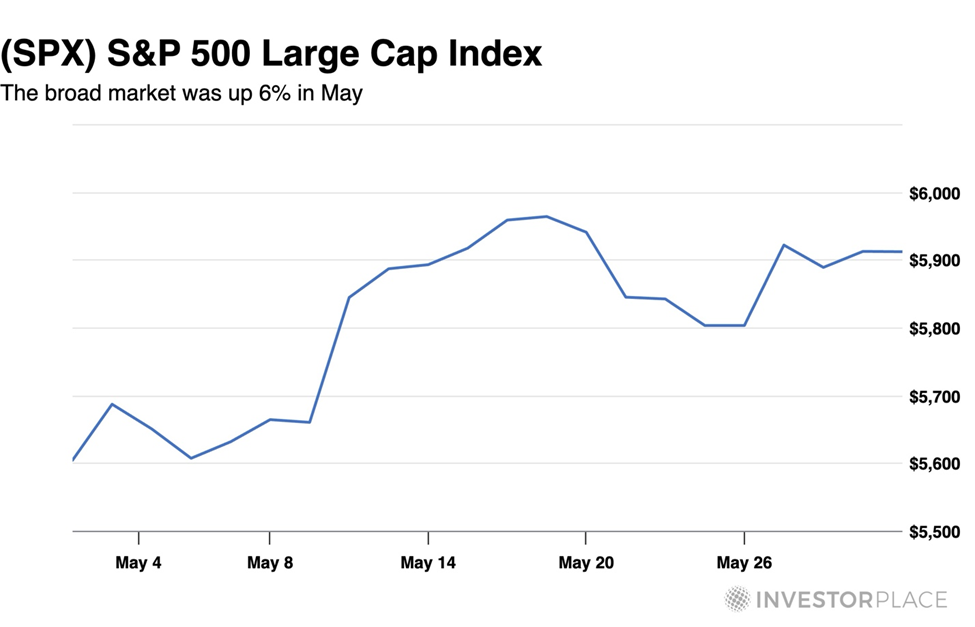

Do we need to fear fallout from the Trump/Musk feud?… Luke Lango’s latest agentic AI research… how Nvidia proved me wrong… making double-digit returns in today’s volatility with Jeff Clark

The “big, beautiful breakup” between President Donald Trump and Elon Musk that began late last week and continued over the weekend is far more gossip than news.

But there are some investment implications:

- Tesla’s stock: It tanked 15% last Thursday but popped nearly 4% on Friday – great for nimble traders

- EV tax incentives: If Trump further targets EV incentives – both consumer and manufacturing – they would hit Tesla and the broader EV sector

- The “Big Beautiful Tax Cut 2.0”: Musk is trying to sabotage Trump’s signature bill. If he is successful and the tax cuts don’t materialize, it’s likely to affect everything from corporate earnings forecasts to consumer spending

- Space Exploration Funding: A Trump backlash could cut NASA or DoD contracts critical to SpaceX, chilling investor confidence in space startups and slowing progress in the commercial space race

- Tech Regulation: Trump could weaponize antitrust threats or regulatory scrutiny against Musk’s companies – Tesla, X, even Neuralink or Starlink

Though we can’t completely rule out collateral damage somewhere in this realm of possibility, our hypergrowth expert Luke Lango says that – big picture – we have a big nothingburger on our hands.

From Luke’s Innovation Investor Daily Notes:

Let’s take a deep breath and remember – this is all just noise.

This is the same political circus we’ve been watching for months.

Trade talks, tariff threats, billionaire beefs, political potshots — it’s all theater. Bark, not bite. And bark doesn’t move earnings. Bark doesn’t move the economy. And it sure as hell doesn’t kill the AI megatrend.

So, let the politicians yell. Let the billionaires tweet. The long-term picture hasn’t changed. AI is still transforming the global economy and creating massive economic value everywhere it turns.

Following Luke’s redirect to AI, where are we in the technological and cultural transformation?

As we’ve been covering here in the Digest, we’re hurtling toward “agentic AI.”

Luke explains that this dramatic advancement presents AI not as a tool but as a colleague and collaborator – and perhaps in some areas, a replacement.

Back to Luke:

We’ve officially crossed into a new era: that of Agentic AI.

Instead of a model that can offer a clever retort or write its own poem, this iteration of AI can:

- Set goals

- Design workflows

- Initiate subtasks

- Self-correct

- Call external tools

- Track progress

- Report back or even act on outcomes

These agents will take a vague objective – “launch a product campaign,” “revise the codebase,” “generate a pitch deck,” “run a growth audit” – and complete the task end-to-end.

Meta provides a real-world example.

Last week, The Wall Street Journal highlighted how the tech giant’s internal “AI Marketing Engine” can already run A/B tests, generate visuals from brief prompts, and allocate ad budgets dynamically. It plans to replace 90% of manual ad workflows within the next 18 months.

The implications for a human workforce are dramatic.

Back to Luke:

A business that once required entire teams of marketers, designers, analysts, and managers will soon be run by autonomous AI agents with prompt-driven brains and reinforcement learning feedback loops.

As we’ve written many times, those human workers are now (or soon will be) unnecessary. Some will be retrained to direct/oversee the AI agents, but many will lose their jobs entirely. They’ll be redundant.

So, what happens to all that former salary expense for Meta (and the slew of other companies that will follow suit)?

Those dollars fall to the bottom line, fattening profit margins, wowing Wall Street analysts, and fueling a stock price surge.

The coming AI profit explosion

Somewhere over the last 12 months, you’ve likely read a headline suggesting we’re in an “AI bubble.”

For a few illustrations, here was The Motley Fool:

Prediction: The Artificial Intelligence (AI) Bubble Will Burst in 2025. Here’s Why.

Then Forbes:

Experts Predict The Bubble May Burst For AI In 2025

And here’s Barron’s:

The Dot-Com Bubble Burst 25 Years Ago. AI Could Be Next

Some believe we’re amid a hype-fueled buying frenzy, but the substance isn’t there. Therefore, we’re hurtling toward the eventual “reveal” when we’ll recognize that the emperor has no new clothes on, followed by a market crash for the ages.

Might that happen?

Sure.

Is that likely to happen for top-tier AI/tech stocks?

No.

But even if it does, that drawdown would be a buying opportunity, not a reason to panic sell.

Let’s examine the “AI bubble” case, and why it would be a huge opportunity for investors.

First, let’s return to the salary cost savings that we just highlighted.

Say that bears are correct – AI profits are smoke and mirrors because the technology will eventually be commoditized, having a deflationary impact on prices.

Even if that’s true, cost savings fueled by AI adoption should lead to a price surge.

Remember the elements of our price-to-earnings ratio: 1) price, 2) earnings, and 3) the multiple that investors are willing to pay for those earnings – a proxy for sentiment.

If tech companies don’t generate one extra dime of AI profits, and if investors don’t become one iota more bullish, all else equal, leading AI stocks still push higher as companies slash salary expense by eliminating jobs, boosting bottom-line earnings.

Is it any surprise that analysts have been raising earnings forecasts for Meta?

Turning to the revenue (earnings) side…

Although some companies are still looking for the best way to monetize AI, the idea that AI profits aren’t real is absurd.

And it’s not just “some AI profits” – for many, it’s a “tidal wave” of AI profits.

I’m a prime example of an investor who didn’t grasp the enormity of the revenue potential.

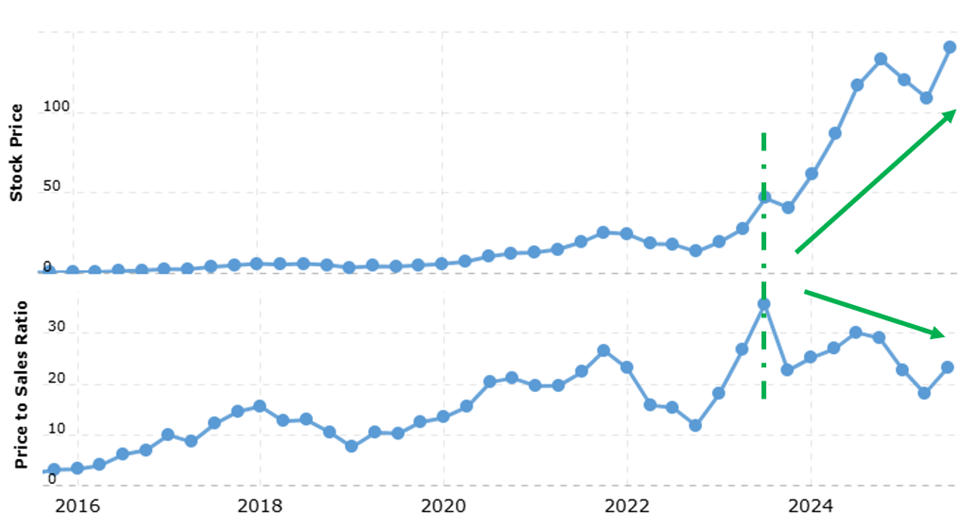

In the fall of 2023, Nvidia’s stock was soaring thanks to AI-fueled excitement. The buying frenzy pushed its price-to-sales ratio to an absurd, eye-watering level that I’ll tell you in a moment.

First, to contextualize it, the S&P’s long-term median price-to-sales level is 1.58; the highest it’s ever gotten is 3.04, back in December of 2021.

So, how high did Nvidia’s price-to-sales ratio get?

40.

I expected a significant pullback in Nvidia’s stock price because I couldn’t envision sales growth being dramatic enough to relieve pressure from that nosebleed price-to-sales ratio.

I was wrong.

As you can see below, though Nvidia’s price is now markedly higher than it was in fall 2023 (marked by a vertical dotted line), its price-to-sales ratio is dramatically lower today for one simple reason…

Sales (and profits) have exploded.

Source: MacroTrends.net

Bottom line: Perhaps some AI-related stocks are in a bubble, but to claim that the entire sector is bubbly is wrong and puts you at risk of missing an enormous opportunity.

And, of course, as I’ve stressed repeatedly in the Digest, if you’re worried about AI coming for your job, then the best thing you can do is invest in AI.

As the old saying goes, “If you can’t beat ‘em, join ‘em.”

So, what’s our action step exactly?

Luke just gave away a handful of picks:

[We’re about to hit the moment when] the entire conversation shifts from “what can AI do?” to “what’s still left for humans?”

But don’t panic; position.

If you’re an investor, get into the right AI stocks. Own:

- The infrastructure – think NVDA, ANET, AMD

- The platform builders – MSFT, GOOGL, META, etc.

- The appliers – NET, SNOW, PLTR, UBER, IOT, and more.

(Disclosure: I own AMD, MSFT, and GOOGL.)

This isn’t an exhaustive list of Luke’s top AI picks. He recently put together three proprietary AI indices that help investors identify the best AI stocks to buy today as this megatrend transforms the global economy.

Here’s the framework:

- There’s the “AI Foundational Five.” These are the five big tech leaders building and hosting the core AI models.

- The “AI Builders 15.” These are the 15 top hardware and infrastructure companies powering AI’s rise, building the critical backbone.

- The “AI Appliers 15.” These companies are the innovators using AI to transform how we live and work, building apps and tools on top of the infrastructure.

If you’re an Innovation Investor or Early Stage Investor subscriber, these baskets are available to you right now.

To review the specific holdings, click here to login as an Innovation Investor subscriber, and here as an Early Stage Investor subscriber.

To learn more about joining Luke in his flagship Innovation Investor service, click here.

Here’s Luke’s bottom line:

When it comes to AI, the past five years took us from poetry to autonomous task completion.

The next five could take us even further, from saving minutes to shaving off entire workdays – from agents that respond to agents that run.

We’ve already seen incredible progress being made in this industry.

But to quote Bachman–Turner Overdrive… you ain’t seen nothin’ yet.

Before we sign off…

While we’re bullish on AI and the vast wealth building potential directly ahead of us today, we’re not blind to the risk of heightened volatility.

As I write Monday, Treasury Secretary Scott Bessent, Commerce Secretary Howard Lutnick, and Trade Representative Jamieson Greer are meeting China’s Vice Premier He Lifeng, Beijing’s lead trade negotiator.

We’re hopeful for an agreement that unlocks rare earth elements to the U.S. and eases export controls to China. If so, the market jumps higher. But if talks aren’t successful, we’re going to see significant selling pressure.

It’s hard to think of a time when stocks faced greater headline risk. Whether it’s news on trade wars, inflation, an unexpected tweet from President Trump, or a Fed that disappoints Wall Street expectations, stocks have the potential to soar or collapse on any given day.

But for traders who know what they’re doing, this type of “anything goes” market is fantastic for short-term profits.

Our trading expert Jeff Clark can testify to this. Over the last handful of months, as stocks have gyrated up and down, Jeff gave his subscribers the chance to make…

- 78% in three days on Marvell Technologies (MRVL)

- 132% in nine days on the VanEck Vectors Gold Miners ETF (GDX)

- 74% in one day on Target (TGT)

- And 117% in one day on the SPDR S&P 500 ETF (SPY)

This Wednesday at 10 a.m. ET, he’s holding a live event to tell you how you can generate similar returns in your portfolio.

Here’s Jeff with a preview:

We look to buy stocks that are deeply oversold, and we look to sell/short stocks that have pushed too far into overbought territory.

On Wednesday, I’ll walk you through more details, as well as exactly what’s coming next… and how you can position yourself not just to survive but to profit in spades.

I’ll reveal 10 compelling opportunities flashing right now, as well as the powerful new tool I’ve built with TradeSmith to find them daily.

If you’ve ever wanted to turn volatility into your biggest advantage, join us for the Countdown to Chaos.

We’re big believers in Jeff’s short-term trading approach. Even if you’re a buy-and-hold investor, knowing how to trade is a fantastic way to generate fresh capital to pour into your long-term high-conviction holds – even more so if volatility presents great buying opportunities in your favorite stocks.

To register for Jeff’s event on Wednesday, just click here.

We’ll keep you updated on all these stories here in the Digest.

Have a good evening,

Jeff Remsburg