The InvestorPlace Inflation Protection Plan – InvestorPlace

Your guide to protecting and growing your wealth during periods of high inflation…

Across America, poll after poll after poll shows that our No. 1 retirement worry is running out of money in old age.

And for good reason…

People in retirement don’t earn a regular income, so they typically have far less financial flexibility than they had earlier in life.

Plus, running out of money and being forced into a dumpy nursing home is high on almost everyone’s “Please don’t let this happen to me” list.

As we save for retirement or are in retirement already, we face a variety of financial threats. Any number of bad things can cause you to outlive your money, including:

- Not accumulating enough savings…

- Having to pay big medical bills…

- Losing money in our investments…

(Just to name a few.)

From 2000 to 2019, “high inflation” wasn’t on the list.

During that 20-year period, U.S. inflation averaged 2.1% per year, which is considerably lower than the long-term average annual inflation rate of 3%.

Thanks to low inflation, you could say the monetary foundation on which we were building our financial lives was stable.

I wish I could tell you the next 10 years will bring more stability…

However, I can’t tell you that. Not even close.

Over the past two years, a series of massive tectonic shifts have rocked our country’s monetary foundation.

The resulting earthquakes have transformed the landscape, reversed the flow of rivers, and erased landmarks forever.

Thanks to these massive tectonic shifts – which I’ll detail in just a moment – we should all move “high inflation” to one of the biggest threats retirees face today… and will face for the next decade.

I’ll show you why high inflation isn’t a “transitory” worry, but something that will likely decimate the savings of millions of Americans.

Most importantly, I’ll show you how to protect yourself against inflation… and potentially emerge from the coming financial chaos wealthier than you are right now.

If you’re worried about running out of money in retirement, this may be the most important thing you ever read.

Unfortunately, the people most at risk are the millions of people who played by the rules, worked hard, and saved money with a comfortable, low-stress retirement in mind.

A Bad Idea From the 1970s Returns…

When people talk about the 1970s, a handful of iconic things always come up.

The Vietnam War. Watergate. Disco. Bell-bottoms.

The decade is also known for its brutal economic climate, with high inflation its key feature.

As I mentioned, the long-term rate of U.S. inflation is 3%, but in the ’70s, inflation blazed at average annual rate of 7%.

This rate of inflation devalued the U.S. dollar by over 50% during the decade.

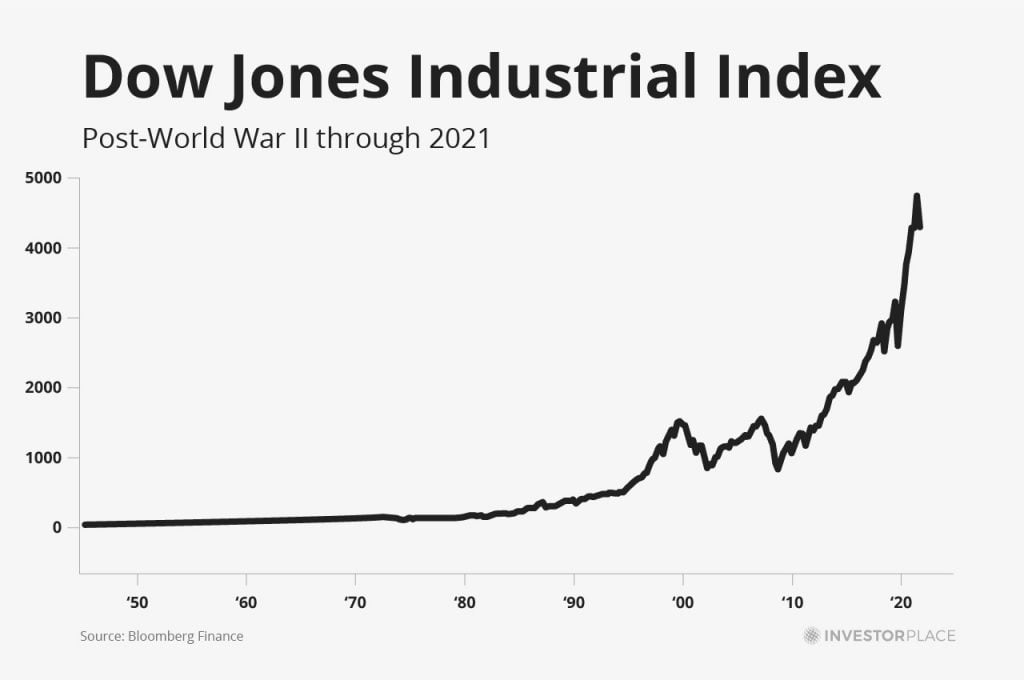

High inflation also made stock market investing a disaster.

Adjusted for inflation, the Dow Jones Industrial Average lost roughly three quarters of its value from 1966 to 1982.

Running a business, a household, or a retirement portfolio during this strange and volatile time was filled with danger. Small missteps could produce bankruptcy.

Many people who started their retirement in the 1960s and early ’70s suffered horribly… thanks to inflation.

“Strange and volatile” also accurately describes the world we’ve been living in since 2020…

First, we lived through the worst pandemic in generations. The resulting lockdowns hit the economy like a meteor from outer space.

In response, governments printed money in gigantic and unprecedented quantities. Entire oceans of new money were created and began sloshing around the world.

Then, just as we were nearing the end of the worst of the pandemic, Russia invaded Ukraine, oil skyrocketed, and the prospect of World War III was put on the table.

During this strange and volatile time, high inflation came back with a vengeance.

In January 2022, inflation reached a 40-year high.

In February 2022, it climbed even higher.

Now, a long period of high inflation like we experienced in the 1970s has become a real prospect.

I believe everyone should factor a decade of harmful inflation into their financial plans.

It’s one of the biggest threats to your financial well-being you’ll ever face.

The huge catalyst behind this threat is something you’re not hearing from most financial advisers and certainly not from the mainstream media.

In the next section, I’ll show you what the mainstream media doesn’t have the brains or the backbone to show you. Then, a little later, we’ll dive into what you can do to protect yourself and your nest egg…

Joining us to do that are InvestorPlace top analysts Louis Navellier, Luke Lango, and Eric Fry.

For example, Louis will tell you how even amid the volatility, stocks are still a great inflation hedge while Luke makes a case for stocking up on the “new gold.”

They will share which investments make the best inflation hedges. And we’ll even provide an easy way for you to act on each idea if you choose.

By Brian Hunt, InvestorPlace CEO

In geography, a “confluence” is the meeting of two or more bodies of water, typically rivers.

At confluences, one river’s flow meets another’s.

The velocity, temperature, and sediment content of each river clash and mix.

The union of two rivers creates tremendous energy and change… and often incredible sights.

For example, the picture below is the confluence of the Rhône and Arve rivers in Geneva, Switzerland. The brown Arve’s high silt content creates a striking contrast with the blue-green Rhône .

Just like these two rivers, right now, two colossal world-changing megatrends are coming together in a historic confluence.

As they play out over the next decade, they will ensure high inflation is here to stay.

The first megatrend is something I mentioned a moment ago.

In response to the COVID-19 pandemic, governments around the world printed historic amounts of money and injected it into the global economy.

More money was printed in a span of three years than was printed in the previous 100 years.

As you can see in the chart below, the U.S. monetary base skyrocketed in 2020.

In February 2022, the U.S. national debt hit $30 trillion for the first time.

That was nearly a $7 trillion increase from January 2020, just before COVID-19 pandemic.

Add in the future promises made via Social Security, Medicaid, and Medicare, and the U.S. government has a mind-boggling $100 trillion in unfunded liabilities.

(Other major economic powers – like Europe and Japan – face similar gigantic problems.)

Although the U.S. government spent a record amount of money during the coronavirus pandemic, these debt-driven structural problems existed well before.

The government has been spending way beyond its means for years.

Today, the U.S. government owes more money to more people than anyone else in the world.

And many Americans are begging the government to owe even more…

The Dignity of Work and Saving… Replaced by the Handout

Building a good life in America during the 20th century was simple: You worked hard. You contributed to the success of the nation. You saved money. You paid a modest amount of taxes.

And the vast majority of your neighbors were in the same boat.

People like you were respected and valued.

That’s not the America we live in today.

Around 10 years ago, the content of our national character started to change. (And not for the better if you ask me.)

You see, around 2010, America experienced massive shift in how we view success and govern our country. Despite zero fanfare, this historic “paradigm shift” has put our country on an entirely different path than the one that made it the greatest, most prosperous country on Earth.

This paradigm shift has made it so U.S. citizens who succeed through hard work and fiscal responsibility are valued less and less.

This critical part of our “national soul” is being gradually replaced with a desire for endless government benefits and an utter disregard for financial responsibility.

The dignity of work that means so much to so many people is being replaced with waiting for the next “stimmie” check… the next handout… the next government job… the next free home loan… the next free this or that.

We’re slouching toward full-blown socialism and a government takeover of our economy.

We’re slouching toward an era where the government’s share of our economy explodes higher.

We’re slouching toward a time when few proposed new government spending programs are vetoed, no matter how harebrained they are.

Here’s how this shift occurred…

We’ve Crossed the Point of No Return

Although the debate between capitalism and socialism gets plenty of attention in the press, virtually no one talks about the root cause of exactly why America has taken a “hard turn” in the direction of the government taking a larger and larger share of our economy.

I’m not running for office. I’m in the business of informing people about what’s going on. I’m in the business of helping people achieve financial freedom.

I’m not here to sugarcoat things or trying to make you believe the Tooth Fairy exists.

I’ll give you straight talk even when straight talk is painful.

And if the ideals of free enterprise, fiscal responsibility, and the dignity of work mean anything to you, what’s happening sure is painful.

As I write this, the U.S. national debt is over $30 trillion.

That’s about $91,000 in debt for every man, woman, and child in the country.

In 2021, the government spent $2.8 trillion more than it collected in taxes. And don’t forget about the future promises made via Social Security, Medicaid, and Medicare, which add up to more than $100 trillion in unfunded liabilities.

I wish I could tell you the government’s financial situation is about to get better.

But it’s about to get worse.

And it’s thanks to the tectonic shift I mentioned a moment ago.

This tectonic shift has everything to do with something called “net tax recipients.”

A “net tax recipient” is someone who receives more money from the government than they pay in taxes.

For example, if you pay $10,000 in taxes but receive $15,000 in benefits from government programs like unemployment benefits, food stamps, and Social Security, then you’re a net tax recipient.

For much of American history, the percentage of people who got more than they put in remained relatively low… under 20%.

And it’s no surprise.

Hard work, self-reliance, and free enterprise were essential parts of the American character.

Years ago, America didn’t look favorably upon someone sitting on the couch and waiting for the next unemployment check.

But over the past 40 years, the percentage of people getting more in government benefits than they pay in has exploded.

Politicians discovered they could win more elections by promising more and more “free benefits.”

The percentage of Americans who are “net tax recipients” has exploded as a result. As I write you,

Well over half of the people in this country get more than they put in.

I believe in having a social safety net.

We’re a wealthy country and we can afford to help those in need.

But when I think about how our “social safety net” has turned into a “social featherbed,” I grow very concerned.

When you think about the ramifications such a high ratio of “takers vs. makers” has for our country’s financial health and stability, you realize it’s a terrifying development.

When more than half of a country’s citizens receive more in benefits than they pay in, we’ve crossed a very dangerous line.

That’s when the majority discovers it can vote itself more and more benefits… while paying for less and less of those benefits out of their own pockets.

When you reach this “point of no return,” the net tax recipient majority will always vote for politicians who promise more benefits… more spending… more freebies.

At the same time, any politician who campaigns on sound financial policies has zero chance of winning an election.

If you’re a believer in financial responsibility and the ideals of the Founding Fathers, this situation should scare the hell out of you.

As the ability of a tax recipient majority to vote itself government benefits rises, the financial well-being of the country declines.

Once the majority of a country receives more in government benefits than it takes in, each election turns into a competition among politicians to see who can offer more benefits paid by others.

Eventually, the political will to oppose reckless spending and borrowing dies… we turn on our most successful citizens… and the country starts on a road to financial ruin.

These days, any discussion between the makers and the takers and the politicians who represent them are like two wolves and a sheep discussing what to have for dinner.

As someone who loves America and the ideals it was founded on, it pains me to see this state of affairs.

But this trend – of net tax recipients holding our government’s purse strings – is glacial in nature.

It is a massive, deeply entrenched force that’s decades in the making.

As governments have done for centuries, the U.S. government will pay off these impossible debts, spending programs, and unfunded obligations by printing huge amounts of money.

By itself, this a huge problem that will produce inflation and devalue every dollar you’ve saved for retirement.

However… another megatrend has slammed into the world and created another huge danger to every dollar you’ve saved.

That megatrend is called “deglobalization.”

And it will raise the price of everything.

Globalization Is About to Run in Reverse… and Make Everything You Buy More Expensive

“Made in China.”

You’ll find those three words stamped on billions upon billions of things in America.

Clothes. Toys. Furniture. Electronics.

This is because during the 30-year period from 1989 to 2019, we got addicted to cheap stuff from China.

We spent those decades offshoring a huge amount of our manufacturing capacity to the world’s most populous nation… and helped it become the world’s largest manufacturer.

What a turn of events!

Most people don’t know that for much of the 20th century, China wasn’t a notable part of the global economy.

It spent the century plagued by civil wars, Japanese invasions, and a disastrous experiment with communism.

But in the 1990s, China opened back up for business with the rest of the world. Its enormous population went to work in factories that sprung up all over the country.

Thanks to its abundance of cheap labor, Chinese companies could produce these things for much less than their U.S. counterparts.

Because China could produce many things so cheaply, many North American and European companies went on an “offshoring” spree and moved their manufacturing capacity to China.

From 1989 to 2019, the United States willingly became dependent on China for the manufacture of all kinds of things.

Medicine… clothing… children’s toys… textiles… electronics.

China was happy to encourage U.S. dependence on its manufacturing base.

Since China rejoined the global economy in the 1990s, it has been doing everything it can do get an edge over the United States.

The Chinese government has subsidized many of its industries and allowed them to run at a loss so they could undercut and destroy American factories and vital industries.

This has made America dangerously reliant on China for many of our most critical products and raw materials.

And that’s just how China planned it.

The United States chose to ignore how the supply of many things its people deem necessary to everyday life could be interrupted or stopped because of war, pandemics, or souring U.S.-Chinese relations.

For example, did you know that 80% of the antibiotics we consume in the U.S. comes from China?

Did you know that we hardly make any penicillin in the United States anymore? Chinese producers sold it at such low prices that they drove out nearly all the U.S. and European producers.

Now, we’re hugely dependent on China for penicillin and other antibiotics, including those for superbugs.

Did you know that more than 50% of the drugs we take in the U.S. are made from ingredients that come from China?

If China wanted to cut off the supply of drugs and medicine it sends to the United States, we’d quickly have a major health crisis here.

Despite this danger, America chose “cheap” instead of “secure” for decades.

Then you have China’s stranglehold hold on the markets for many vital raw materials…

The most dangerous of which is the production of critical materials called “rare earth metals.”

Rare earth metals are vital to the production of solar panels, electric vehicle batteries, computers, missile guidance systems, radar, and satellites.

They are a HIGHLY strategic resource… just as critical to our nation’s defense as oil is – and the United States has to buy 80% of its rare earth metals from China! China could easily cripple major parts of the U.S. military simply by refusing to ship rare earth metals to us.

It’s like two armies are lined up on a battlefield….

But before one side can fire its cannons, it has to go over and get on its knees and beg to buy fuses from the enemy.

Depending on China Was a Huge Strategic Blunder

The COVID-19 pandemic revealed that dependence on China and supply chains that stretch around the world present a very dangerous situation for the United States.

At any time, a pandemic or the changing whims of Chinese leaders could choke off our only ready source of critical medicines, rare earth metals, and other essential goods.

Our preference for cheap stuff from China has seriously undermined our economic security.

Thanks to COVID-19, millions of Americans are waking up to the fact that our dependence on Chinese manufacturing makes our country weak…

And that as long as we are dependent on China we will never truly be strong and self-reliant.

This is why we are about to see a huge American “onshoring” boom.

We’re about to see a boom in U.S. manufacturing capacity.

We’re about to greatly increase our ability to produce clothing, toys, electronics, cars, appliances, and hundreds of other things.

This big push to make the U.S. safe and secure comes with a tradeoff however…

It will require more than a trillion dollars of new investment.

Moreover, retooling huge parts of our economy won’t happen in two years.

More like 20 years.

This enormous capital expenditure will raise the price of everything… and act as an inflationary tailwind.

That’s the tradeoff we make for ensuring we are secure and self-reliant.

Ukraine Invasion Will Drive Inflation Over the Next 20 Years

During the same time that the United States was choosing “cheap stuff” over “secure economy,” Europe made a similar series of fateful decisions.

It chose to become dependent on crude oil and natural gas from Russia.

It’s estimated that Europe gets 40% of its natural gas from Russia, which is a giant producer of the stuff.

Today, the European Union is the largest importer of natural gas in the world.

Europe could have relied more on domestic nuclear and coal energy, but over and over, its shortsighted leaders chose “cheap” and “green” over “secure.”

Never mind that Europe was counting on what is essentially a “gangster state” for a huge portion of its energy needs.

It was convenient and cheap to buy Russian energy rather than develop a diversified suite of domestic and foreign energy sources.

Russia’s invasion of Ukraine has shown this way of structuring an economy is very dangerous.

When Russian oil and gas went under sanctions in February 2022, European energy prices skyrocketed. It also tied Europe’s hands and made its peace-bargaining position with Russian President Vladimir Putin much weaker.

Just like the United States depending on Chinese manufacturing has proven to be foolish and dangerous, Europe depending on Russian gas has proven to be the same.

Now that Russia’s invasion of Ukraine has made Europeans wake up and realize their blunder, we are about to see a massive and historic push by Europe to increase its energy security.

The continent is set to spend more than a trillion dollars on energy security. It is sizing up to be one of the largest, most expensive spending trends in history.

Europe is going to spend that money on renewable energy, liquefied natural gas infrastructure, and nuclear energy.

It will adopt an “all of the above” mentality. If some nation or entity can provide Europe with energy and it’s not from Russia, Europe will buy it.

Stopping its dependence on Russian energy is the smart move for Europe. It will make Europe more secure.

But just like the U.S. plan to become less dependent on China, this plan will cost more than a trillion dollars.

This transition won’t happen over two years. It will take 20 years.

Thanks to the massive “deglobalization” trend away from depending on countries like Russia and China for critical ingredients of U.S. and EU economies, the price of everything will go up.

Two of the largest economies on the planet are about to choose “secure” over “cheap.”

And that’s going to be really expensive.

My prediction: Pairing the huge money printing of the past three years with the price-raising deglobalization push will produce inflation in the 4% to 5% annual range for the rest of the 2020s.

The Big Money Illusion: Inflation Could Wipe Out Millions of Retirees

Unfortunately, the people most at risk from the coming inflation are the millions of people who played by the rules, worked hard, and saved money with a comfortable, low-stress retirement in mind.

High inflation is already starting to wipe these people out.

And it will only get worse over the next decade.

I worry that many people won’t survive this huge wipeout.

And it all comes down to what I call the “Big Money Illusion.” Let me explain…

We all know inflation has become a huge problem in America.

In January 2022, the government reported that inflation was running at 7.5% per year.

Truth is, it’s probably even higher than that. What most people don’t realize is the government is trying to downplay and underestimate inflation so people don’t riot in the streets. (More on that in a moment.)

But for now, let’s take the government at its word and say inflation was running at 7.5%.

At the same time that inflation was running at 7.5% per year, the yield an investor could earn in government bonds was a paltry 1.5%.

I hardly have to tell you this is a horrible situation for investors saving up to live a better life and looking to earn income on their savings.

You earn 1.5% in yield… yet lose 7.5% of your wealth through inflation!

That’s a real-world loss of 6%.

This brings up a big secret of wealth that many people never learn…

What really matters when it comes to the returns you earn in places like cash, bonds, or stocks are your REAL returns.

Real returns are the returns you earn after accounting for inflation.

For example, if you earn 10% in an investment and inflation runs at 7%, your real return is just 3%.

Or, if you earn 1% in a bank account but inflation runs at 5%, your real return is negative 4%.

I like to say real returns are “the returns you can eat.”

Real returns are what matters when it comes to buying essential things like food, gasoline, medical care, and insurance.

Real returns are what matter when it comes to your true quality of life.

Real returns matter because if the value of your stocks go up 5% but inflation runs at 5%, you haven’t actually grown wealthier.

All you did was tread water.

The gains you made in stocks don’t buy any more food or gasoline or medical care than they did a year before.

People see this idea at work in a big way when it comes to buying a home.

Let’s say the value of your home increases 25% over a span of three years…

… while inflation makes the price of everything go up 25% over those same three years.

That 25% increase makes you feel wealthier.

You can brag about the increase to your friends and family.

However…

If you sell your house, the reality is you didn’t make a dime.

Real returns deliver a brutal reality: If the price of everything goes 25% along with the value of your house, you aren’t any wealthier.

Any house you buy will be 25% more expensive.

The food and gasoline and everything else you buy will be 25% more expensive than it was three years ago.

It might feel like you’re 25% wealthier, but you actually aren’t.

You fell for a Big Money Illusion.

With inflation at 7% per year… a dollar of savings will be worth just 82 cents in three years.

Not the way we expect our retirement nest egg to grow.

What’s worse is right now financial advisers around the country are urging their clients to invest in supposedly “safe” government and corporate bonds.

For example, if a client is 70 years old and retired, a financial adviser will urge them to keep at least 80% of their savings in bonds.

Going back to the real return problem we just discussed…

Over the past year, government bonds have yielded 1.5%.

But inflation ran at 7.5%.

That’s a real return of negative 6%.

That’s a huge loss of wealth – one the average American retiree can’t afford to take.

Yet…

Millions upon millions of people are taking those losses as we speak!

Right now, billions upon billions of dollars in real wealth are evaporating from American retirement accounts!

I can practically see the money going up to “money heaven.”

If you lose real wealth at a rate of 6% a year, in six years, you’ll have 31% less money… and in 10 years, you’ll have 46% less money.

American retirees can’t afford to absorb those real return losses.

Yet… left with few good alternatives… financial advisers are herding their clients into this horrible situation. A situation where their clients lose huge amounts of their buying power every year.

It’s shaping up to be one of the biggest financial disasters of all time.

Why the Government Lies About Inflation

Soon, the government is going to start crowing about how it has beaten inflation.

Maybe inflation goes down from 7.5% to 4% or 5%.

But when the government says it has beaten inflation… that there’s nothing to see here, to go back to your homes and your regularly scheduled program…

I want everyone out there to know one thing…

The government is lying.

In the summer of 2021, Americans were hit with the worst price increases in 30 years.

The price of gasoline, cars, bread, beef, coffee, housing – you name it – began soaring.

The harmful price increases were the result of the government’s massive money printing in previous years.

Governments hate reporting high rates of inflation.

High inflation makes it hard for voters to get by.

It erodes the value of their savings.

When voters get upset about that, they vote politicians out of office.

So, it was with reluctance that the Biden administration reported in late 2021 that inflation was running at a 7% annual rate.

These figures – and the underlying problem they represent – have the American public very worried. (Rightfully so.)

The pain of inflation hits us every time we buy food and fill up our cars with gas.

The media is filled with reports of high inflation these days.

The fact that inflation is so widely followed… so analyzed… so discussed… makes what I’m about to tell you all the more incredible.

Everything you see in the mainstream media about inflation is missing the big story here.

I’ll repeat: The government is lying to you about inflation.

And the mainstream media is too ignorant or too corrupt to expose it.

This lie is SO big and SO harmful that it qualifies as one of the greatest frauds in the history of our country.

Before I explain how the Big Lie works, I must warn you and everyone else out there…

You’re about to learn some ugly things about America.

They could make you very angry.

You can’t unlearn what I’m about to tell you.

It could make you seriously question some long-held beliefs you may have about our country.

But in the end, you’ll be better off knowing. It’s better to be informed than in the dark. So let’s dive right in…

Remember how I mentioned how a lot of people get upset when there’s high inflation?

Politicians want to have their cake and eat it too.

They want to spend massive amounts of money to accumulate power and ensure their reelection…

But they know reporting high rates of inflation will get them kicked out of office. So…

Politicians are basically incentivized to lie about inflation.

Here’s how the Big Lie works…

The Big Lie Is Right in Front of Your Face

In America, the most widely followed gauge of inflation is the Consumer Price Index, or CPI.

The CPI tracks a basket of goods and services people buy, like appliances, cars, gasoline, food, housing, and medical care.

The CPI is purported to monitor changes to the cost of living.

The government reports the changes in CPI each month.

When you read headlines and articles about inflation, you read about changes in the CPI.

And, it has real-world ramifications…

The CPI is used to adjust the cost-of-living payments made to more than 50 million people on Social Security, as well as pension payments made to military and federal employee retirees.

Because of this, the CPI is a HUGE deal when it comes to government budgets and directly affects how much money is paid out to massive amounts of retirees.

Despite being one of the most widely used, most widely followed numbers in America today, the CPI is a fantasy that often drastically underestimates the rate of inflation.

I’m about to use some grade-school math to show you how the Big Lie works.

You may be tempted to skip over it. Don’t.

Get educated. Know what’s going on. Don’t be an easy mark.

The math is easy, but it’s critically important.

The Crazy Way the Government Calculates the CPI: Why “OER” is “BS”

Housing is one of the largest expenses most of us will ever pay in our lives – whether you are a renter or homeowner.

Because of that, Housing represents about one third of the CPI, making it by far the largest and most important component of the CPI.

Now, when any normal, rational person thinks about the changes in the cost of housing, they think of changes in the price of homes and apartment buildings.

If home prices in your area increase 25% over the span of three years, the cost of housing has increased 25%, right?

When home (and apartment building) prices increase, maintenance costs go up. Insurance costs go up. Taxes go up.

The cost of every important thing related to the ownership and upkeep of that structure goes up. So, the owners of those structures increase rents as the underlying price of the structures go up.

Again… ask any rational adult and they will agree that any useful and legitimate measure of inflation should take changes in home prices into account.

But that’s not how the government does it.

Instead, the government uses something called Owner’s Equivalent Rent (OER) to calculate the housing component of CPI.

They gather OER information with surveys that ask homeowners how much they think they would pay in rent if they were renting the home. The answers to that question are collected, aggregated, and used to report changes in housing costs.

This is an absurd way to report changes in housing costs.

Homeowners aren’t renting, so typically they have no idea what rent costs are. Also, people tend to fool themselves on many important matters of money.

This absurd way of calculating changes in housing costs leads to instances of laughable inaccuracy.

However, the Case-Shiller U.S. National Home Price Index – the most widely followed gauge of U.S. home prices – showed that home prices increased 18.79% year-over-year on average, across America.

This index is calculated using real home price transactions.

It’s sort of like the “Dow Jones Industrial Average” of home prices.

The massive difference in the government’s absurd calculation and real-life changes in home prices allowed the government to say inflation was running at 7% in December 2021.

Who do you believe in this situation?

The government, which is incentivized to lie, and homeowners who never think about rent…

Or actual home price transactions?

When you get right down to it, having the government police inflation and report its own inflation statistics is laughable.

It’s like letting a 5-year-old girl police her own candy consumption and report on it to her parents. Of course, she’s going to BS it all the time.

Over time, this absurd way of calculating CPI leads to vast understatements in the rate of inflation. It leads to people suffering from a mass delusion… a “money illusion” that makes them think they are wealthier than they actually are.

It allows the government to silently steal small amounts of money from your bank account every month. This theft is particularly disgusting because it is hidden and lied about in every CPI report.

It also allows the government to spend a lot more money than it would if people knew the REAL rate of inflation. This debases our currency.

This is one of the biggest frauds in American history.

Inflation is running at 7%, but savers can only earn 1.5% in bonds. What are people who are saving for retirement or already retired to do?

Deglobalization is happening. That train has already left the station – and it will continue to drive prices up.

Add in the government’s bogus inflation numbers, and the situation goes from bad to dire. It’s much worse than most people think.

Fortunately, there are ways you can avoid this historic wipeout. There are ways to fight inflation and protect and grow your wealth in the process. Here at InvestorPlace, we have a number of resources available to help you to do just that.

In the next section, we’re going to dive into five different “inflation proof” investments you can make to help protect your wealth. (Later on, we’ll even give you tips on how to best allocate an inflation-proof portfolio.)

Let’s jump right in…

By Brian Hunt, InvestorPlace CEO

During periods of high inflation, your money loses value.

Consider: That burger on the dollar menu suddenly goes from $1 to $1.09.

While on a small scale that doesn’t seem like much, when you see a 9% increase or more across all goods, it makes a big difference.

For example, in 2021 an average family of four spent about $1,071 per month, or $267 a week, on groceries.

A year later, costs of food have soared 10.8%. That brings that average bill to $1,200 per month or, $300 a week.

That’s a roughly $130-per-month increase. Our groceries will cost us about $1,560 more this year than last.

If you’re a millionaire, that may not sound like much. But if you’re in the middle class, that’s a “line item” you’ll circle in red at the end of the year.

And that’s just groceries!

Gasoline… utility bills… used and new vehicles… appliances… furniture and bedding… everything is up!

As we’ve discussed, if you’re nearing or in retirement, the bad news is that inflation is way ahead of bond rates. For working people, it’s just as bad, as inflation is far outpacing the rise in real wages.

Just take a look at this chart:

And this only goes through the end of 2021. Since then, inflation is up even more.

It all goes back to your REAL returns. If inflation is outpacing our savings and/or the money we bring in from our jobs, we need to find other ways to ensure we are net positive.

In the following pages, our InvestorPlace analysts – Eric Fry, Louis Navellier, and Luke Lango – will join us to share five types of investments you can make right now to help protect and grow your money during times of high inflation.

First up is one you are probably quite familiar with…

Inflation Hedge No. 1: Stocks

By Louis Navellier

Editor of Market360, Growth Investor, Accelerated Profits, Breakthrough Stocks, and Power Options

“A people however, who are possessed of the spirit of Commerce – who see, & who will pursue their advantages, may achieve almost anything.”

This quote is likely one you haven’t heard before, but I bet you’ll recognize who it came from: one of America’s Founding Fathers and the first president of the United States, George Washington.

George Washington wrote this in 1784, but it holds just as true today. We’ve seen folks like Jeff Bezos go from your “average Joe” to dominating the e-commerce industry with his company, Amazon.

We also have billionaire Mark Zuckerberg, who founded Facebook in college and turned it into the No. 1 social media site in the world.

Or consider Bill Gates, founder of Microsoft, who carries $104 billion to his name. His company took the computer software industry by storm, and its market cap $2 trillion.

These men didn’t become billionaires overnight. They were talented and worked very hard to get ahead in life. They are the epitome of the American dream.

Now, while I will be first to admit that I am no Bill Gates or Jeff Bezos, I do like to say that my life story is also the embodiment of the American dream.

I’m the son of a stone mason. I worked my way through college in the hardscrabble neighborhoods of California’s East Bay region.

Given my background, I now have an abundant life. I run a billion-dollar financial business. I’m a multimillionaire with beautiful homes in Nevada and Florida. My children attended the best schools. I’m able to collect the luxury cars I used to dream about as a kid.

Capitalism allowed me to build a wealthy life, but that character of America is changing.

As Brian noted in the previous section, we are living in a world that is much different then what we are used to. One where a global pandemic shut down the global economy for the better part of a year… one where numbers are fudged and then used to make decisions… and where inflation is running the highest it’s been 40 years…

It’s not pretty out there. But, as I’ll show you, stocks can be a great hedge for what’s coming…

Savers Are Getting Crunched

Inflation is a term that gets thrown around a lot.

You might have heard how Germany experienced massive inflation after World War I… and its paper money became worthless. Or, you might have heard how Venezuela recently experienced massive inflation… and its paper money became worthless.

But what exactly is inflation?

Inflation is an increase in the supply of money… which decreases the value of each “unit” of money. In America’s case, that unit is the dollar.

Let’s say a country has $100 million in its monetary system. People and businesses use these dollars to pay each other for goods and services. When people earn money, they park of some of those dollars in banks.

Now, let’s say the political leaders of this country decide to launch a big social welfare program and fight a war at the same time. The trouble is that the government doesn’t have enough money to spend on them. It has already budgeted all of its tax revenue for other things.

For sake of simplicity, let’s say the government can’t borrow the money it needs for the welfare program and the war. Let’s also say that it’s politically unacceptable to raise taxes.

One option political leaders often choose – and they’ve done this for centuries – is to print new money to pay for the welfare program and the war.

They choose to “debase” their currency.

In this example, that’s what the government decides to do. The government prints up $20 million to pay for the social program. This increases the number of dollars in circulation by 20%. Remember, we started with $100 million and then added $20 million more, a 20% increase.

Because many new dollars make their way into the economy, people start noticing that prices are increasing…

The price of a $30,000 car works its way up to $36,000 (a 20% increase). The price of a $5 sandwich works its way up to $6 (a 20% increase).

Remember, neither the car nor the sandwich get 20% bigger or better. (In fact, they may be getting smaller and worse.)

The value of the money simply fell… and caused the prices you see every day to increase. If you hold a lot of money in the bank during this inflation, you suffer a huge loss in purchasing power.

A big problem savers have with the U.S. dollar and other paper currencies is that they are controlled by political leaders who have huge incentives to spend more than they take in… which massively devalues the money over time.

This problem goes back thousands of years – even back to Roman times – when people used precious metals like gold and silver as money.

To ensure they could spend more and more money, Roman leaders would mint more and more coins… while putting less and less precious metal – like silver – in the coins and more and more “base” metals – like bronze – in them.

They literally devalued their money.

And it’s happening today. Because of inflation, $100 in 1982 is now worth around $297.93 and climbing today. But don’t think it’s a problem from just the 1980s…

The amount of devaluation since just 2008 is shocking. From 2008 to the beginning of 2022, the purchasing power of the U.S. dollar has fallen by over 33%. This is an incredible loss of your purchasing power.

And as Brian shared above, right now it’s getting even worse.

So, what should you do about it to protect yourself?

Buy stocks.

Why Stocks Are One of Your Ultimate “Devaluation Plays”

I want to take you back to 1980…

During that year, the Rubik’s Cube debuted… Mount St. Helens erupted… The Empire Strikes Back hit movie theaters…

And the Dow Jones Industrial Average sat at a mere 838.49 (it’s now above 30,000). At the time, few people realized we were on the cusp of the greatest bull market in U.S. history. Starting at the 838.49 level in 1980, the Dow Jones soared to 10,787 by 2000… a gain of 1,187%. Keep in mind, that’s just the “average” gain among the 30 large companies that make up the index.

Top companies gained much, much more.

- Microsoft, for example, soared 50,000% during the 1980–2000 boom.

- Home Depot soared 20,000% during the boom.

- Amgen soared 40,000%.

- Cisco soared as much as 42,000% during the boom.

A modest investment of $5,000 in one of these winners could have grown into more than $2 million.

During the 1980–2000 super boom, innovations like computers, cell phones, and the internet changed the way we work and live… and our home prices soared.

However, few people realize the real, fundamental reason the 20-year period from 1980 to 2000 saw stock prices soar at incredible rates to new highs…

That’s because few people know that the 1980s and ’90s were a period of significant inflation.

The average annual inflation rate during this super boom was 4.2%.

Thanks to inflation, $1 in 1980 was worth just $0.44 by 2000.

It turns out that a 4.2% annual rate of inflation has proven to be a mild, stock market-boosting rate of inflation.

To be clear, when inflation runs at 4.2% for 10 years, any dollar you have in the bank loses 33% of its value.

A 4.2% annual rate of inflation is not good for people who keep all of their money in the bank or under a mattress.

However, we know that rate is extraordinary for stocks.

That rate acts as a stimulant to the economy. It greases the wheels of commerce and keeps things “buoyant.”

Remember, from 1980 to 2000, the Dow Jones soared 1,187%… and top-performing companies gained much more.

Stocks are such a great inflation hedge because they represent ownership in real businesses. And great businesses function as inflation “pass through” vehicles. Those are businesses that “pass through” the price increases that occur as a result of inflation.

For example, if inflation sends the price of sugar and cocoa up by 5%, Hershey will “pass through” those input increases by raising the price of chocolate by 5%.

Or… if inflation sends the price of writing software code up by 7%, Microsoft will “pass through” those input costs by 7% by raising the price of its software.

Great businesses like Hershey and Microsoft function as inflation pass-through vehicles because people love their products and services (or at least can’t stand the idea of switching).

So… as inflation increases the price of input costs, these businesses can recoup those higher costs by charging more for their products. The nominal price of inputs and product prices might change, but the businesses’ profit margins do not. They simply “pass through” the inflation, which allows their profits and market values to rise along with prices.

As an investor in these companies, those values get passed to you in the way of profits as the share price of the stocks go up… at a much higher rate than your standard savings account, which still sits at less than a 1% return rate. (Much lower than the current rate of inflation… which results in negative real returns.)

Of course, you can’t just throw a few darts at the S&P 500 to find the best stocks.

You need to find the best type of stocks… and then dig deeper to find the best individual stocks within that group.

Here at InvestorPlace we have a number of top-notch analysts to help you scour the market and point you to the best opportunities on the market to protect and grow your wealth.

**********

Inflation Hedge No. 1: Stocks

As we mentioned, while stocks make a great inflation hedge, you can’t just throw a dart, invest in a few, and hope for the best. If you want to get exposure to stocks and don’t know where to start, there are a number of exchange-traded funds (ETFs) you could consider.

Two worth mentioning are SPDR S&P 500 ETF Trust (SPY), which tracks the S&P 500, a basket of the biggest-by-market cap stocks, and Cambria Shareholder Yield ETF (SYLD). SYLD is a basket of companies that generate lots of cash flow and return the most amount of money to shareholders in the form of dividends and share buybacks.

**********

Inflation Hedge No. 2: Gold

By Brian Hunt, InvestorPlace CEO

First, let’s agree on what “insurance” is…

In my book, buying insurance comes down to spending a little bit of money to hedge yourself against a disaster.

Throughout our lives, we spend a little bit of money on insurance and hope we never have to use it.

For example, home insurance costs a small fraction of your home’s value. You buy it and hope you never have to use it.

The same goes for car insurance. It costs a fraction of your car’s value, so you buy it and hope you never have to use it.

It’s the same with “wealth insurance.” You can buy wealth insurance and hope you never have to use it.

There are lots of different types of wealth-insurance policies out there. They involve intricate details, lots of forms to sign, and payments of big fees to advisers and salespeople.

But I’d rather keep things simple and keep money in my pocket instead of putting it in a salesman’s pocket. You might be in the same boat.

Here’s how we can do it…

Put a small portion of our wealth in gold.

That’s it. That’s all it takes to get wealth insurance and protect your family against a financial disaster.

You don’t need complicated insurance products.

You don’t need to pay big fees to a salesperson.

Just pay a small commission to a gold seller, store the gold in a safe place, and you’re done. Or, you can make it even easier and buy a gold ETF in your online brokerage account. (We’ll provide a couple of gold ETF options in a moment.)

Here’s why this “insurance” is important…

The Ultimate Way to Insure Your Finances Against Wars and Disasters

Some smart people out there predict a worsening geopolitical situation, wars, and a decline in the value of dollar, and all the things we talked about in the first section of this report.

Even if you’re more optimistic and think things will be fine, I think you’ll agree that it makes sense to own some insurance in case a financial disaster strikes.

People would likely flock to gold in a global financial disaster…and cause its price to soar.

For example, the decade from 1970 to 1980 was marked by war, recession, and very high inflation. This made the 1970s a terrible decade for stocks and bonds. But it was terrific for gold owners.

As people fled stocks for precious metals, gold gained more than 2,000% during decade.

And that wasn’t the only time gold proved valuable during rough times…

For the past few thousand years, gold has seen a lot of competitors try to become the “ultimate form of real money.” Folks have used nearly everything – cigarettes, butter, stones, livestock, salt, seashells, and even tulips – to store their wealth and trade for goods.

But when crisis hits… when wars break out… when bank runs grip a nation… when it’s really time to just “grab the money and run,” we keep coming back to gold as the ultimate form of money.

Gold beats the competition for six reasons…

- Gold is easily transported. Real estate is a good store of wealth, but you can’t move it.

- Gold is divisible. If I owe both Sally and David but have just one piece of gold, I can split it in half.

- Gold does not rust or crumble. Folks have used cattle as money, but cows don’t survive long in a locked vault.

- Gold is consistent all over the world. I’ll accept the pure gold you mined in Canada just as easily as I’ll accept the pure gold you mined in Mexico.

- Gold has intrinsic value. Gold has wonderful conductivity, it’s malleable, and it doesn’t break down… so it has many industrial uses.

- Gold cannot be created by governments. People who saw their wealth disappear in the great inflation of the 1970s know that keeping their wealth in paper money can be disastrous.

For those reasons, gold has been money for more than 2,000 years. and it’s what makes gold the perfect form of wealth insurance.

The good news is that you don’t have to buy a huge amount of gold to have a good insurance policy.

You can place just 5% of your portfolio into gold.

Its place in your portfolio could mean a huge difference in your family struggling to get by…or doing well.

How a Gold Position Could Make You Wealthy During a Crisis

Let’s say you have a $100,000 portfolio with 95% of it in blue-chip stocks and income-paying bonds.

If the predicted financial disaster doesn’t strike, your stocks and bonds will increase in value. Your gold will probably hold steady in price or decline a little. Since the bulk of your portfolio is in stocks and bonds, you’ll do just fine.

But what if the financial disaster strikes? I’ve heard some top analysts say gold could climb to $6,000 an ounce in a financial disaster scenario.

Let’s say a financial disaster sends the value of your stocks and bonds down 33%. That would be a massive decline. This epic financial disaster would cut your $95,000 position in stocks and bonds by 33%, leaving you with $63,332.

But let’s say this disaster also causes gold to rise to $6,000 an ounce.

Right now, let’s say gold is around $2,000 per ounce. A rise to $6,000 would produce a 3X increase in the value of your gold. It would cause the value of your $5,000 gold stake to rise to $15,000.

Post-financial disaster, you’d be left with $78,332 ($63,332 from stocks and bonds + $15,000 from gold).

The disaster still would hit you, but not nearly as hard. Your insurance would play a big role in limiting the damage.

But what if you think the chances of financial disaster are higher than “unlikely”? What if you’re more worried than the average Joe?

If you are, simply increase the “insurance” portion of your portfolio. Instead of a 5% position in gold, you could increase it to 15%.

If the previously mentioned financial disaster were to strike your $100,000 portfolio weighted 85% in stocks/bonds and 15% in gold, the 50% decline in your $85,000 stocks/bonds position would leave you with $42,500. Gold’s increase to $6,000 an ounce would increase your $15,000 gold position to $45,000.

Your large gold-insurance position makes it so post-financial disaster, your portfolio is worth $87,500… a manageable 12.5% overall decline. That may not sound great, but it’s a heck of a lot better than seeing your overall portfolio decline by 33%.

As you can see, the larger your gold insurance policy, the better you would do in a financial-disaster scenario.

But keep in mind, if the financial disaster doesn’t strike, you won’t benefit as much, because you hold less money in stocks and bonds, which do well if the economy carries on. Also keep in mind…it would take a serious financial disaster to send stocks down by 33% and gold up to $6,000.

Depending on what you think the chances of a financial disaster are, you can adjust your gold insurance policy. It all depends on your goals and beliefs.

Think the chances of disaster are slim? Consider a gold-insurance policy equivalent to 1% to 5% of your portfolio.

Think the chances of disaster are high? Consider a gold-insurance policy equivalent to 15% to 20% of your portfolio.

Is financial disaster around the corner? I don’t know the answer.

Nobody does.

But if you buy some “wealth insurance” in the form of gold, you don’t need to know the answer. It’s simple. It’s easy. It’s low-cost.

You buy gold and hope you never have to use it.

You’ll do fine if things continue. You’ll do fine if the crap hits the fan. And the peace of mind you get from owning gold “insurance” is worth even more than the money it could save you.

And I’m not just talking about physical gold…

How to Amplify Gold’s Power to Create Wealth

You might have heard some advisers say that if gold soars in value during a crisis, the companies that mine gold could soar even more.

That’s because when the price of a natural resource doubles, triples, or quadruples in price, the profit margins of the companies that produce the natural resource can skyrocket.

For example, let’s say you own a gold-mining company. Your company can produce gold for $1,300 per ounce.

Let’s also say the current selling price for gold is $2,000 per ounce. This means your profit margin is $700 per ounce.

Now let’s say the price of gold rises from $2,000 per ounce to $4,000 per ounce. This is a 100% increase in the price of gold.

But your company’s profit margin just soared from $700 per ounce to $2,700 per ounce… a 3.85X increase.

This kind of financial magic is called leverage…and it can produce incredible stock market gains.

For example, from 2002 to 2008, the price of gold climbed from $300 per ounce to $1,000 per ounce.

During this time, leading gold company Kinross Gold Corp. (KGC) climbed from $2.25 per share to nearly $27 per share (a 1,093% gain). Another gold company, Yamana Gold Inc. (AUY), climbed from around $1.53 a share to more than $19 per share (a 1,165% gain). The gains were so great in this market that a simple gold stock index gained 692%.

These types of gains are impressive. But please keep in mind that these companies are also typically riskier investments. In fact, they’re some of the riskiest stocks in the entire market.

That’s because mining is a capital-intensive business. The firms have no control over their product. When gold falls in price, these companies can fall more than 50% in a short time.

But if a financial crisis forces the value of gold much higher and paper currencies much lower, these companies could rise 500%…1,000%…or more.

Gold is the ultimate form of wealth insurance. I buy it and hope to never have to use it. It’s a vital part of my overall wealth plan. I hope it’s part of yours.

**********

Inflation Hedge No. 2: Gold

If buying physical gold or picking up a few gold miners isn’t right for you, there are some gold ETFs worth mentioning:

- VanEck Gold Miners ETF (GDX) is a basket of the world’s largest gold-mining companies.

- SPDR Gold Shares (GLD) owns physical gold and tracks the metal’s price movements.

Both of these options give you the benefits of owning gold without having to own and store the physical metal or figure out which mining companies offer the best opportunity.

**********

Inflation Hedge No. 3: Oil and Energy

By Eric Fry

Editor, Smart Money, Fry’s Investment Report, The Speculator, and Absolute Return

Inflation isn’t good for much, but it does tend to benefit hard-asset investments like gold and resource company shares. During the inflationary 1970s, for example, energy stocks delivered a total return of 73%… after inflation!

By comparison, the S&P 500 Index delivered a 16% loss after inflation during that wicked decade. That analysis comes courtesy of NYU Stern and Tuck School of Business at Dartmouth College.

I am not predicting that the current inflationary trend will produce a similarly powerful boon to energy stocks, but neither am I predicting it won’t. At the margin, inflation is a friend to the energy sector.

And right now it’s not just inflation that’s affecting the energy market. As we’ve been showing you, a number of factors are driving market volatility and inflation right now.

I’m here to tell you that although it may seem like Big Oil is on its way out, it’s not. And oil and energy companies provide a great inflation hedge for savvy investors.

EVs Won’t Destroy Oil Demand… Yet

Today, more than half of every barrel of crude oil becomes fuel for an internal combustion vehicle. So, it makes sense that electric vehicles (EVs) would reduce net demand for crude… eventually.

While recent years demand for EVs has risen sharply, that day is not likely to arrive any time soon.

Even though EVs will capture a growing share of the global auto market, the total auto market will also continue to grow larger. The number of gas-powered automobiles on the road will continue to increase for several more years. The U.S. Energy Information Administration says the total number of internal combustion vehicles on the world’s roads will not peak until 2038.

Meanwhile, because crude demand from other end users will continue growing past that date, the International Energy Agency (IEA) expects worldwide oil demand to be at least 25% higher in 2050 than it is today. That’s the IEA’s “reference case” scenario. Under alternative scenarios, the IEA says worldwide crude demand could top a whopping 150 million barrels per day (MBPD) – or about 50% above current levels.

Furthermore, renewable energy is not oil-free energy.

Producing an EV, for example, requires about twice as much energy as producing an internal combustion engine vehicle. This differential results mostly from battery production, which uses a lot of energy to extract and refine metals like copper and nickel.

And it’s not just EVs that are using massive amounts of oil…

Demand for Oil Is Growing

Around the globe, demand for oil is rebounding sharply. China and the United States have been spearheading this demand recovery. China’s crude consumption, for example, is already hitting new record-high levels that are more than 10% above the country’s pre-COVID peak. Here in the U.S., crude consumption is just shy of pre-COVID levels.

Meanwhile, demand for crude in many other major economies remains well below pre-COVID levels. For example, the 38 major economies of the Organization for Economic Cooperation and Development (OECD) are currently consuming about three MBPD fewer than before COVID struck. Similarly, crude oil consumption by the global aviation industry remains well below pre-COVID levels.

Prior to the pandemic, air travel consumed about eight MBPD of crude – or close to 8% of global supply. That demand plummeted below one MBPD during the worst of the pandemic. It has been steadily recovering ever since but remains about two MBPD below pre-COVID levels.

If these two sources of demand – OECD and aviation – merely returned to pre-COVID levels, global crude demand would jump about five MBPD to 104 MBPD. That figure would not only be the highest level ever but would also be about two MBPD higher than the world’s oil producers have ever supplied to the market.

No problem, the experts say, the OPEC producers could easily satisfy that additional demand…

But could they?

The Organization of the Petroleum Exporting Countries (OPEC) is currently producing about 27.5 MBPD. In order to provide an additional five MBPD to the crude market, OPEC would have to boost its production to 32.5 MBPD. In theory, OPEC has 33 MBPD of total capacity. But it has not pumped crude at that annual pace since 2016.

Moreover, the United States has supplied almost all of the world’s crude production growth during the last decade, not OPEC. Shale oil plays provided most of that bounty, as U.S. shale production nearly doubled between 2016 and 2020.

That amazing feat will not be easy to repeat. U.S. shale oil production topped out at 9.4 MBPD two years ago and is currently running at 8.7 MBPD.

A fresh wave of investment in exploration and production (E&P) could boost output somewhat, but very few U.S. oil companies are expressing any intention to do so. They are hesitant to repeat the errors of past cycles when high oil prices tempted them to overspend on future production projects.

Furthermore, shareholders are pressuring these companies to defer new E&P investments in favor of using corporate cash to pay down debt, boost dividends, and/or repurchase shares.

These factors are not the only headwinds for new investment; green energy groupthink is also preventing the oil industry from boosting E&P spending. Oil company executives read the same issues of The Wall Street Journal as everyone else, and they watch the same episodes of Jim Cramer’s Mad Money on CNBC. So just like everyone else, they “know” that EVs and renewable energy technologies have become an existential threat to the oil industry.

As a result, many oil company executives see the EV revolution as black-hooded “Death,” approaching with a scythe in hand to escort the oil industry into the afterlife. Even though this inevitable threat is not an immediate one, many oil company executives are behaving as if it is. They are keeping their wallets in their back pockets.

According to Rystad Energy, global investments in oil and gas exploration and production have plummeted by about 65% since the 2014 peak.

This non-spending will reduce future crude production, which could lead to soaring oil prices. Additionally, as oil companies slash their spending on exploration and development, their free cash flow will surge. As this cash piles up, reported earnings will also surge, as will the capacity to “return capital” to shareholders.

We’re seeing it all happen right now.

Bottom line: A tightening oil market, coupled with a rising inflationary trend, provides ample reason to add an oil stock hedge to your portfolio.

**********

Inflation Hedge No. 3: Oil and Energy

If you are looking to get exposure to the oil and energy sector, consider SPDR S&P Oil & Gas Exploration & Production ETF (XOP) which holds a basket of oil and natural gas producers.

Another option is Alerian MLP ETF (AMLP), which is a compilation of oil and gas transportation and storage assets.

**********

Inflation Hedge No. 4: Bitcoin

By Luke Lango

Editor Hypergrowth Investing, Innovation Investor, Early Stage Investor, Crypto Investing Network, and Ultimate Crypto

From 2008 to when he retired from the U.S. Senate in 2015, Tom Coburn provided a one-of-a-kind resource to citizens of the United States.

Every year, Coburn and a team of staffers produced what became known as the “Wastebook.”

Wastebook reports were long, detailed documents that listed the ridiculous ways the U.S. government was wasting taxpayer money.

For example, the 2014 Wastebook detailed how one government project spent $865,000 to train mountain lions to walk on treadmills.

One year, Coburn noted that $331,000 was spent on a grant to study the condition of being “hangry.”

And in what might take the cake, Coburn’s report once noted how the Pentagon was spending $1 billion to destroy $16 billion in unneeded ammunition.

If you’re a student of history, you know the crazy things I just listed are drops in the ocean of government decisions that can be classified as dumb, corrupt, ridiculous, or a mix of all three.

All too often, government is the cause of – not the solution to – our problems, of which there are plenty worth worrying about.

Still, I’m a born optimist.

I believe things will be better in 20 years than they are now. I believe free minds and free markets will create more and more prosperity every year for the rest of my life.

However… given the government’s long history of destabilizing the lives of regular people with things like runaway inflation, war, and communist policies, I believe in owning some insurance in case things go haywire.

After all, when I get into a car, I don’t expect to get into an accident, but I wear my seatbelt just in case. You’re reading this report, so there’s a good chance you feel the same.

You believe in insurance and want to own some “hedges” in case the world’s financial system gets destabilized like it did in 2008. (Which, as we’ve been explaining, is very possible…)

Below, I’ll explain how governments debase the value of your hard-earned money – and why bitcoin is the best insurance policy to protect your wealth.

So let’s get started…

The Scourge of People Who Save Money

Governments have a long history of debasing currencies.

When governments want to pay for wars and big social programs, they often create extra currency units (like dollars).

Every currency unit that is created devalues the existing currency units. This is called “inflating” the money supply.

Inflation is a way for governments to quietly clip small bits of value from the dollars in your wallet and bank account. It’s a particularly sneaky activity because it allows a government to take wealth from its citizens without suffering the “blowback” of raising taxes.

And, as we highlighted earlier, inflation is one of the greatest dangers a person saving for retirement faces. It can massively impair the future buying power of the money you save today.

To get an idea of how a free-spending, constantly inflating government can devalue its currency, have a look at the chart below. It shows how the U.S. dollar has lost over 90% of its value since 1870.

History is full of examples… of hardworking, cautious folks losing their wealth at the hands of free spending government officials who don’t think twice about debasing their currencies in order to get reelected.

After a world-altering event like COVID-19, that desire expands exponentially.

This is why the allure of today’s digital money – cryptocurrencies that only exist in fixed amounts and cannot be debased – will grow and grow over the coming decade.

Over time, conventional currencies become less and less valuable. But the limited supply of cryptocurrencies like bitcoin should repel the effects of conventional currency inflation… making cryptos great vehicles for storing wealth. This will give them a big advantage over government-backed paper currencies.

Governments around the world have racked up debts and unfunded obligations on a scale never seen before. The governments and citizens of the world’s biggest countries show no desire to face up to reality. There is no will to curb spending, nor to scale back making lavish future promises.

But innovative technology is making it so individual savers don’t have to put up with reckless governments. That’s why they will continue to adopt cryptocurrencies in which to save, spend, borrow, and transfer money.

In fact, there’s already evidence of this happening. A report by Digital Assets Data found that bitcoin is used as a store of value and an alternative to local fiat currencies in countries with high inflation and unstable monetary and banking policies.

As you can see in the graph below, peer-to-peer bitcoin transactions (directly from one to another with no go-between) spiked in countries that saw sky-high inflation. And those spikes happened independently of the underlying price of bitcoin.

When people needed to keep their savings from becoming virtually worthless in their local currency, they turned to bitcoin as a means to preserve those savings.

The potential market for this new kind of money is incredible.

Understanding Bitcoin as an Inflation Hedge

Similar to gold, bitcoin serves as a store of value during turbulent economic conditions. It can also be a go-to means of value exchange, like the U.S. dollar.

In fact, in the case of bitcoin, it’s even better than gold as a store of value in the sense that its total supply is known with absolute certainty. There will only ever be 21 million bitcoins in circulation (once they’ve all been mined), even if demand soars into the stratosphere.

Plus, bitcoin is not a corporation or a government that bends to doing what’s easy or convenient in a given moment. Bitcoin has no president or CEO, no board of directors who can intervene and rain down cash bailouts on the over-spenders.

The digital ledger that marks and secures bitcoin’s exchange is maintained through an open-source protocol. That means anyone can read and review it, and anyone can run the code that defines the rules and parameters of its network and its operation on their own computer.

The decision making for bitcoin’s future is spread out more evenly among folks who own it and have skin in the game.

Why Volatility Is a Good Thing

As an investment, bitcoin has arrived as a desired asset class that, because of its volatility, has the potential for life-changing gains. I believe bitcoin has a shot at becoming the world’s digital reserve currency – which could send it to $100,000 and even higher.

That makes bitcoin a highly attractive alternative to the $18 trillion in negative-yielding debt currently floating around.

The volatility we’ve seen won’t last forever…

More and more people are trading bitcoin every day. As more and more people transact in bitcoin – and futures and options – they will reduce bitcoin’s volatility and make it more attractive to hold.

I believe that while bitcoin’s volatility is advantageous over the short term, over the long term it will enjoy a virtuous, self-reinforcing cycle of less volatility and more public participation. That will lead to even less volatility and even more public participation… which will produce a huge increase in the size and power of cryptocurrencies.

I’m super-bullish on bitcoin’s future. It’s a thoughtful currency play that counters the our current inflationary environment. Consider it digital gold.

Bitcoin and altcoins are increasingly sought-after alternatives. They offer a potentially more secure and better way to lessen the risk of holding cash.

In my view, bitcoin’s future has never looked brighter, nor has there been a better time to get in on this world-changing technology to help hedge against the chaos that continues.

New to cryptocurrency and unsure where to start? Not to worry, InvestorPlace has you covered.

**********

Inflation Hedge No. 4: Bitcoin

The best way to get exposure to Bitcoin (BTC) is to simply buy it on any of the major cryptocurrency exchanges.

**********

Inflation Hedge No. 5: Real Estate

By Brian Hunt, CEO, InvestorPlace

No guide on protecting and growing your wealth would be complete without covering one of the greatest wealth building tools on the planet.

That tool is real estate.

Most smart people love the idea of owning real estate.

Land is a permanent asset. You can earn income from real estate. You can safely leverage it. It has an excellent track record of producing returns.

For these reasons, real estate has been a powerful wealth preservation and growth vehicle for thousands of years. We believe it has a place in any inflation-proof portfolio.

In this section, we explain how it works.

We’ll start out by saying the power of real estate hits you when you take a simple walk outside and look around. The power of real estate will look you right in the face.

What will you see outside?

If you’re in a good-sized town or city, if you go outside for a walk, you’ll see apartment buildings, office buildings, gas stations, hospitals, hotels, convenience stores, and all kinds of shops.

Or maybe you live near a mall, an airport, or a factory.

The places I’ve just described are fixtures in everyday modern life. They are modern life.

We live in homes and apartments. We work in offices and factories. We go to the gym. We go to the doctor. We go shopping and eat out at restaurants. We buy gasoline, groceries, and gadgets. We store things in warehouses and self-storage units.

Even if you live in the middle of “nowhere,” you’re likely surrounded by acres and acres of profit-producing farms or timberland.

In America, we make hundreds of millions of transactions every day for what we want and need. At the center of all these different transactions – the foundation it all rests on – is real estate.

Restaurants, offices, shops, grocery stores, homes, labs, factories, storage facilities, warehouses, and hotels all need physical locations. People need to live in apartments and houses.

That means billions of dollars will be paid in rent every single month in America.

We need real estate in a much more profound way than we “need” new Teslas, new iPhones, new clothes, or new sneakers. Real estate is the most fundamental and necessary asset in the world.

Try buying food from a grocer with no stand or store. Try farming with no fields. Try operating a store with no walls, no doors, and no roof.

You can’t do it. You have to have real estate.

As a result, we all pay rent – either indirectly or directly – every single day.

When you buy food, you pay a little bit of the grocer’s rent.

When you visit the doctor, you pay a little bit of her rent.

When you buy a shirt, you pay a little bit of the store’s rent.

When you buy something on Amazon, you pay a little bit of Jeff Bezos’ rent.

When you buy a month of Netflix, you pay a little bit of that company’s rent.

All across America, huge rivers of rent payments flow from town to town, state to state, and coast to coast.

The value of all those rent checks runs north of $1 trillion annually… multiple times the value of all the cars and smartphones sold in the United States.

Why “Wealth” and “Real Estate” Are Synonyms

As I said, we all pay rent in some form or another.

That’s why “wealth” and “real estate” are virtually synonymous in America.

You might recall becoming aware of this fact at a young age. Wherever you grew up, chances are very good that the richest families owned the best real estate.

Real estate is power and wealth. Wealth and power are real estate.

Since the demand for real estate is so pervasive and so reliable, owning real estate can easily become one the most lucrative, most empowering things you ever do. It’s a much safer, much more predictable way to invest than the stock market.

Whether you like it or not, investing forces you to make bets on the future. It forces you to make some forecasts.

With this in mind, think about these facts…

- It’s very hard to predict which tech company will produce the best app or the best gadget. But it’s very easy to predict that all those companies will have to pay office rent.

- It’s very hard to predict which restaurant chains will dominate in five years. But it’s very easy to predict that all those restaurants will have to pay their landlords or they will quickly go out of business.

- It’s very hard to predict which stores on New York City’s legendary Fifth Avenue will be the most successful in a decade. But it’s very easy to predict that all the stores on Fifth Avenue will have to pay rent in order to survive.

In fact, I can confidently say the following …

Predicting which app, gadget, store, or restaurant concept will be successful five years from now is the equivalent of a 20-foot put in golf (difficult). Predicting that all the companies in all those businesses will need real estate and be willing to pay big bucks in rent is the equivalent of a two-inch put (close to unmissable).

A 20-foot put… or a two-inch put? Which would you rather your wager your savings and retirement nest egg on?

It’s not a trick question.

Because quality real estate is in such high demand, it typically holds its value in an inflationary environment. As the price you pay for things goes up, so do the value of your real estate holdings.

Chances are, you knew owning real estate is a good idea before you started reading this guide. Now that we have that out of the way, let’s talk about how to do it.

Speaking generally, there are two ways to go about it as an investor: directly or indirectly…

Direct Real Estate Investment

When you invest in real estate directly, you buy and manage the property yourself. This can be very lucrative, but it also takes a lot of time and energy to do it properly. Plus, there are many challenges.