When Jensen Huang Puts on a Tie… Something Big Is Happening

The leather jacket is coming off… what the latest moves of Nvidia’s founder mean for AI’s future…

You can tell a lot about a person by what they wear.

That saying is usually meant as a reminder that people judge your professionalism and character based on your appearance.

But sometimes defying expectations says a lot.

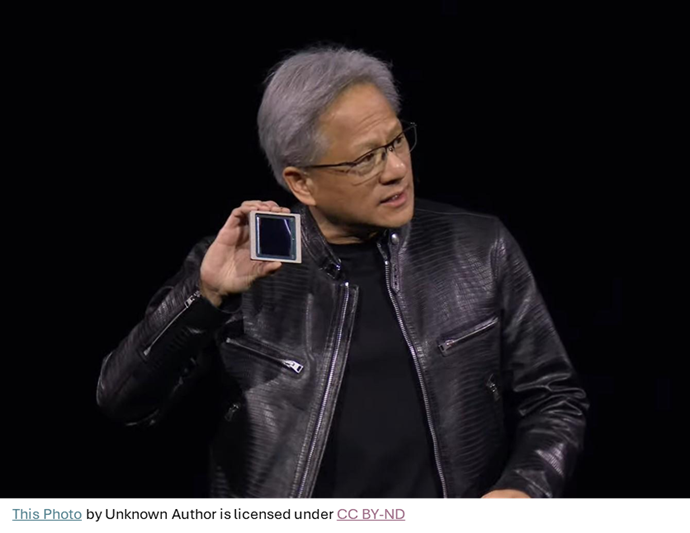

You rarely see NVIDIA Corp. (NVDA) CEO Jensen Huang without one of his leather jackets – it’s his signature look at product launches, keynotes and investor events.

Until last week…

While accompanying President Donald Trump to the Middle East, Huang showed up in Saudi Arabia wearing a suit and tie to meet the Crown Prince of Saudi Arabia.

This was a signal that something big was happening.

You see, behind closed doors, a major international deal was taking shape. One that not only opened the floodgates of AI investment from the Middle East, but also potentially handed NVIDIA a new kind of global influence.

So today, let’s go over why this Saudi deal – and two more catalysts – will change America’s economy forever, and unleash a torrent of money, and opportunity, for savvy investors.

Plus, I’ll go over a step you can take as soon as Wednesday, May 28, that will put you in line for the next round of Trump administration-fueled AI wealth.

Let’s jump into it…

All Dressed Up to Ink a New Deal

During his visit, Huang unveiled a massive new partnership between NVIDIA and Saudi Arabia’s HUMAIN – a cutting-edge AI firm.

Specifically, NVIDIA will ship 18,000 Blackwell chips to Saudi Arabia to build out a 500-megawatt AI data center.

Huang stated:

AI, like electricity and internet, is essential infrastructure for every nation. Together with HUMAIN, we are building AI infrastructure for the people and companies of Saudi Arabia to realize the bold vision of the Kingdom.

This is only the first phase, though. Over the next five years, the plan includes scaling up to several hundred thousand NVIDIA GPUs, establishing what are termed as “AI factories” to drive innovation in cloud computing, robotics and other forms of AI.

Make no mistake, this isn’t just another business deal. This is NVIDIA cementing its position as the core infrastructure provider for the global AI Revolution.

Here’s what I mean…

Saudi Arabia wants to diversify its economy away from oil. One of the ways it can do that is by becoming a major global hub for AI.

Now, HUMAIN was founded by Saudi Arabia’s Public Investment Fund. So, the signal here is clear.

There’s a global race for AI dominance. NVIDIA is in the lead, and it’s pulling further and further away from the pack. And it should stay on any smart investor’s “buy list.”

I would be remiss if I didn’t mention that this wasn’t NVIDIA’s only major deal this week.

First, the company announced something called DGX Cloud Lepton, which is a new service that’s going to make its AI chips directly available to more AI developers through the cloud.

This will allow NVIDIA to continue to dominate the AI space if everybody programs for it.

Secondly, according to recent reports, NVIDIA is in advanced talks to invest in PsiQuantum, a startup working on building commercially viable quantum computers.

This would mark a major investment for NVIDIA in the quantum computing space.

Why does this matter?

See, NVIDIA has grown rapidly in recent years, thanks to artificial intelligence and its AI chips. The company still plans two more future iterations of its Blackwell chip. But by the end of the decade, NVIDIA may be unable to put more transistors on a chip as they approach the “atomic” level.

Quantum computing represents the next frontier beyond AI. While today’s AI runs on NVIDIA’s GPUs, tomorrow’s computing challenges may require quantum computers.

By getting in early with PsiQuantum, NVIDIA is positioning itself at the intersection of today’s AI boom and tomorrow’s quantum revolution.

Bottom line: Jensen Huang isn’t just thinking about this quarter or next year. He’s carving a path into every critical technology that will define computing for the next decade.

Still the “Stock of the Decade”

The point is NVIDIA has defied the skeptics and cynics this year.

When the market was under pressure from tariff tensions and interest rate uncertainty, the company maintained exceptional earnings growth, sales acceleration, and institutional buying. My system model gave it a “Buy” rating for most of the year based on these metrics – a clear signal of its continued leadership.

Now, this shouldn’t be a surprise. Everybody knows NVIDIA is a fantastic company.

But here’s the reality. My system flagged NVIDIA’s strength long before the developments I discussed with you today.

If you’ve been a longtime reader of mine, you know NVIDIA has been and continues to be the shining star. I’ve gone on record saying it is the “stock of the decade,” and I stand by that. It remains far and away the leader of the AI Revolution.

And it clearly shows no signs of slowing down, either.

I won’t beat around the bush; NVIDIA has brought me and my premium readers a lot of success. In fact, I brought my readers’ attention to the company in 2016, when it was trading for a split-adjusted $1.

Those who followed my lead would have made roughly 7,000%!

And the good news is, if you missed out, NVIDIA is still a “Buy” according to my proprietary system.

But NVIDIA won’t be the only company at the forefront of the next wave of the AI Revolution…

Liberating the Tech Sector

NVIDIA’s Middle East deal and moves into quantum computing are just one example of President Trump’s three-part economic plan, which I’ve been calling “Liberation Day 2.0.”

This part is Tech Liberation.

In addition to helping the big AI chipmakers like NVIDIA make huge deals across the world, the White House also has begun reversing regulatory restrictions on things like artificial intelligence, crypto, and cloud infrastructure.

Private capital is flowing fast – with more than $2 trillion committed to domestic tech projects so far.

The message is clear: Innovation-first policies are back, and the smart money knows it.

Add it all up, and we’re talking about a massive transformation of the American economy that could send a $10 trillion shockwave through the markets.

The moves we’ve seen from the Trump administration so far are just the beginning.

So, on Wednesday, May 28, at 1 p.m. Eastern, I’m hosting my Liberation Day 2.0 Summit to reveal the other two parts of President Trump’s three-pronged strategy… and more about the three companies my system has flagged as the biggest potential winners.

You can reserve your spot for this free event by clicking here.

Make no mistake, the implications for investors who position themselves correctly could be life-changing. So, be sure to save your spot now so you don’t miss your chance on the next wave of this AI-fueled economic boom before it takes off.

Sincerely,

Louis Navellier

Editor, Market 360

The Editor hereby discloses that as of the date of this email, the Editor, directly or indirectly, owns the following securities that are the subject of the commentary, analysis, opinions, advice, or recommendations in, or which are otherwise mentioned in, the essay set forth below:

NVIDIA Corp. (NVDA)