Updated on February 28th, 2025 by Bob Ciura

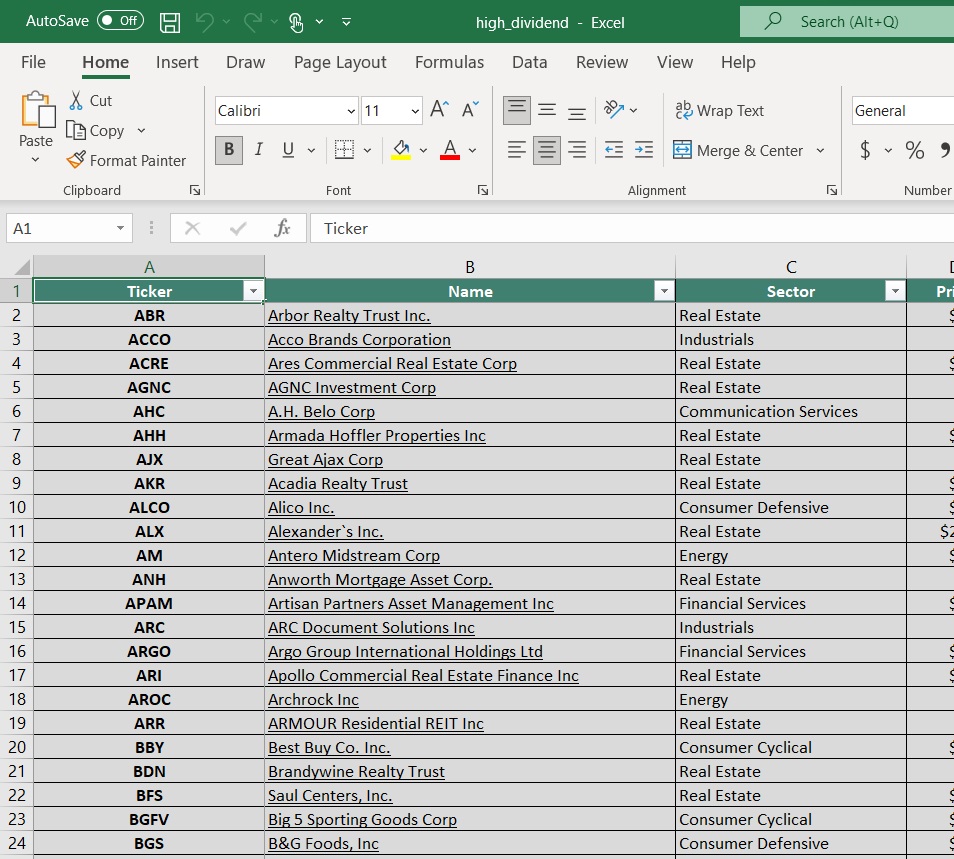

High dividend stocks means more income for every dollar invested. All other things equal, the higher the dividend yield, the better.

Income investors often like to find low-priced dividend stocks, as they can buy more shares than they could with higher-priced securities.

In this research report, we analyze 13 stocks trading below $10.00 per share and offering high dividend yields of 5.0% and greater.

Additionally, the free high dividend stocks list spreadsheet below has our full list of individual securities (stocks, REITs, MLPs, etc.) with with 5%+ dividend yields.

Keep reading to see analysis on these 13 high-yielding securities trading below $10.00 per share. The list is sorted by dividend yield, in ascending order.

Table of Contents

Low-Priced High Dividend Stock #13: Choice Properties REIT (PPRQF) – Dividend Yield of 5.6%

Choice Properties Real Estate Investment Trust invests in commercial real estate properties across Canada. The company has a high-quality real estate portfolio of over 700 properties which makes up over 60 million square feet of gross leasable area (GLA).

Choice Properties’ portfolio is made up of over 700 properties, including retail, industrial, office, multi-family, and development assets. Over 500 of Choice Properties’ investments are to their largest tenant, Canada’s largest retailer, Loblaw.

Choice Properties Real Estate Investment Trust (CHP.UN) reported a net loss of $663 million for the third quarter of 2024, compared to a net income of $435.9 million for the same period in 2023.

This decline was primarily driven by a $1.26 billion unfavorable adjustment in fair value of the Trust’s Exchangeable Units, reflecting an increase in the Trust’s unit price.

However, the Trust saw positive performance in its operating metrics, with funds from operations (FFO) per unit diluted increasing by 3.2% to $0.258.

During the quarter, the Trust achieved a strong occupancy rate of 97.7%, led by retail (97.6%) and industrial (98.1%) sectors, and recorded a 3.0% year-over-year increase in Same-Asset NOI on a cash basis.

Click here to download our most recent Sure Analysis report on PPRQF (preview of page 1 of 3 shown below):

Low-Priced High Dividend Stock #12: LXP Industrial Trust (LXP) – Dividend Yield of 6.1%

Lexington Realty Trust owns equity and debt investments in single-tenant properties and land across the United States. The trust’s portfolio is primarily industrial equity investments.

The trust grows the industrial portfolio by financing, or by acquiring new investments with long-term leases, repositioning the portfolio by recycling capital and opportunistically taking advantage of capital markets.

Additionally, the company supplies investment advisory and asset management services for investors in the single-tenant net-lease asset market.

On February 13th, 2025, Lexington reported fourth quarter 2024 results for the period ending December 31st, 2024. The trust announced adjusted funds from operations (AFFO) of $0.16 per share for the quarter, a penny short of the prior year quarter.

For Q4, the trust completed 1.0M square feet of new leases and lease extensions, which increased base and cash base rents by 66.3% and 42.6%, respectively. Lexington also invested $21 million in ongoing development projects. The trust’s stabilized industrial portfolio was 93.6% leased. At quarter end, Lexington had leverage of 5.9X net debt to adjusted EBITDA.

Click here to download our most recent Sure Analysis report on LXP (preview of page 1 of 3 shown below):

Low-Priced High Dividend Stock #11: Ford Motor Co. (F) – Dividend Yield of 6.4%

Ford Motor Company was first incorporated in 1903 and in the past 120 years, it has become one of the world’s largest automakers. It operates a large financing business as well as its core manufacturing division, which produces a popular assortment of cars, trucks, and SUVs.

Ford posted fourth quarter and full-year earnings on February 5th, 2025, and results were better than expected. Adjusted earnings-per-share came to 39 cents, which was seven cents ahead of estimates.

Revenue was up almost 5% year-over-year for the quarter to $48.2 billion, which also beat estimates by $5.37 billion. The fourth quarter was the highest revenue total the company has ever produced.

Ford Blue increased 4.2% to $27.3 billion in revenue for the fourth quarter, beating estimates of $25.9 billion. Model e revenue was down 13% year-over-year to $1.4 billion, $400 million less than expected.

Ford Pro revenue was up 5.3% to $16.2 billion, beating estimates for $15.6 billion.

For this year, Ford expects full-year adjusted EBIT of $7 to $8.5 billion, and for adjusted free cash flow of $3.5 billion to $4.5 billion, with capex of $8 to $9.5 billion.

Click here to download our most recent Sure Analysis report on Ford (preview of page 1 of 3 shown below):

Low-Priced High Dividend Stock #10: Kearny Financial Corp. (KRNY) – Dividend Yield of 6.5%

Kearny Financial Corp. is a bank holding company. Headquartered in Fairfield, New Jersey, the bank operates 43 branches, primarily in New Jersey along with a couple of locations in New York City. Over the years, Kearny has evolved from being a traditional thrift institution into a full-service community bank.

Kearny had enjoyed tremendous growth over the past decade as it executed on this strategy to enlarge and diversify the bank. However, the shift in the interest rate environment and uncertainty in the commercial real estate market has provoked significant uncertainty around Kearny’s operating outlook going forward.

Kearny reported a large loss tied to one-time expenses in 2024, and the company has been hampered by falling net interest income as well.

In the company’s Q2 2025 results, reported January 30th, 2025, Kearny reported a profit of $0.11 per share. This was up sharply from a 22 cent per share loss in the same period of the prior year, though that number reflects various one-time non-recurring charges.

Click here to download our most recent Sure Analysis report on KRNY (preview of page 1 of 3 shown below):

Low-Priced High Dividend Stock #9: Aegon Ltd. (AEG) – Dividend Yield of 6.7%

Aegon NV is a financial holding company based in the Netherlands. The company provides a wide range of financial services to clients, including insurance, pensions, and asset management.

Aegon has five core operating segments: Americas, Europe, Asia, Asset Management Holding and Other Activities. The firm’s most widely recognized brand is Transamerica, which Aegon acquired in 1999.

On February 20th, 2024, Aegon reported results for H2-2024. Operating capital grew 14% over the prior year’s period thanks to improved performance in the U.S. As Aegon expects to be hurt by lower interest rates, it provided guidance for essentially flat operating capital of €1.2 billion in 2025.

Click here to download our most recent Sure Analysis report on AEG (preview of page 1 of 3 shown below):

Low-Priced High Dividend Stock #8: Geopark Limited (GPRK) – Dividend Yield of 7.1%

GeoPark Limited (GPRK) explores and produces oil and natural gas in Colombia, Ecuador, Argentina and Brazil. It was founded in 2002, it is based in Bogota, Colombia. GeoPark is superior to other Latin American oil and gas producers in some aspects.

It has a market-leading drilling success rate of 81% and has drastically reduced its operating costs, from $19 per barrel in 2013 to $13 per barrel in 2023-2024. Approximately 90% of its production is cash flow positive even at Brent prices of $25-$30.

This means that GeoPark is a low-cost producer, which is of paramount importance in a commodity business. On the other hand, GeoPark is highly sensitive to the dramatic cycles of the prices of oil and gas. As a result, it has exhibited an extremely volatile performance record, with losses in 4 of the last 10 years.

In early November, GeoPark reported (11/6/24) financial results for the third quarter of fiscal 2024. The average daily production of oil and gas decreased -4% over the prior year’s quarter, primarily due to the divestment of the Chilean business in January.

In addition, the price of oil incurred a correction. Nevertheless, thanks to lower operating costs and lower capital expenses, earnings-per-share rose 9%, from $0.44 to $0.48.

Click here to download our most recent Sure Analysis report on GPRK (preview of page 1 of 3 shown below):

Low-Priced High Dividend Stock #7: Clipper Realty (CLPR) – Dividend Yield of 8.1%

Clipper Realty is a Real Estate Investment Trust, or REIT, that was founded by the merger of four pre-existing real estate companies. The founders retain about 2/3 of the ownership and votes today, as they have never sold a share.

Clipper Properties owns commercial (primarily multifamily and office with a small sliver of retail) real estate across New York City.

Clipper Realty Inc. (CLPR) reported strong third-quarter 2024 results, with record revenues of $37.6 million, a 6.8% increase from the same period in 2023, driven largely by growth in residential leasing and higher occupancy.

Net operating income (NOI) reached a record $21.8 million, while adjusted funds from operations (AFFO) hit $7.8 million, or $0.18 per share, up from $6.3 million, or $0.15 per share, a year earlier.

Click here to download our most recent Sure Analysis report on CLPR (preview of page 1 of 3 shown below):

Low-Priced High Dividend Stock #6: Itau Unibanco Holding SA (ITUB) – Dividend Yield of 9.1%

Itaú Unibanco Holding S.A. is headquartered in Sao Paulo, Brazil. The bank has operations across South America and other places like the United States, Portugal, Switzerland, China, Japan, etc.

On November 5th, 2024, Itaú Unibanco reported third-quarter results for 2024. The company reported recurring managerial result for the third quarter of 2024 was approximately $2.1 billion USD, reflecting a 6.0% increase from the previous quarter.

The recurring managerial return on equity stood at 22.7% on a consolidated basis and 23.8% for operations in Brazil. Total assets grew by 2.6%, surpassing $590 billion USD, while the loan portfolio increased by 1.9% globally and 2.1% in Brazil for the quarter, with year-on-year growth rates of 9.9% and 10.0%, respectively.

Key drivers included personal, vehicle, and mortgage loans, which saw quarterly growth rates of 3.1%, 3.0%, and 3.9%, respectively.

Click here to download our most recent Sure Analysis report on ITUB (preview of page 1 of 3 shown below):

Low-Priced High Dividend Stock #5: SFL Corporation (SFL) – Dividend Yield of 11.8%

Ship Finance International Ltd is an international shipping and chartering company. The company’s primary businesses include transporting crude oil and oil products, dry bulk and containerized cargos, as well as offshore drilling activities.

It owns 18 oil tankers, 15 dry bulk carriers, 38 container vessels, 7 car carriers, and 2 ultra-deep water drilling units. Ship Finance International operates primarily in Bermuda, Cyprus, Malta, Liberia, Norway, the United Kingdom, and the Marshall Islands.

On February 12th, 2025, SFL reported its Q4 and full-year results for the period ending December 31st, 2024. SFL achieved total revenues of $229.1 million during the quarter, down 10.3% compared to the previous quarter.

This figure is lower than the cash received as it excludes approximately $9.9 million of charter hire, which is not identified as operating revenues pursuant to U.S. GAAP.

Net income came in at $20.2 million, or $0.15 per share, compared to $44.5 million, or $0.34 per share, in the previous quarter. No shares were repurchased during the quarter. About $90 million remains under SFL’s share repurchase plan.

Click here to download our most recent Sure Analysis report on SFL (preview of page 1 of 3 shown below):

Low-Priced High Dividend Stock #4: Prospect Capital (PSEC) – Dividend Yield of 12.5%

Prospect Capital Corporation is a Business Development Company, or BDC, that provides private debt and private equity to middle–market companies in the U.S.

The company focuses on direct lending to owner–operated companies, as well as sponsor–backed transactions. Prospect invests primarily in first and second lien senior loans and mezzanine debt, with occasional equity investments.

Source: Investor Presentation

Prospect posted second quarter earnings on February 10th, 2025, and results were somewhat weak. Net investment income per-share acme to 20 cents, while total investment income fell from $211 million to $185 million year-over-year.

NII per-share fell from 21 cents in Q1, and 24 cents from the year-ago period. Total interest income was $169 million for the quarter, down from $185 million in the prior quarter, and $195 million a year ago. It also missed estimates by about $2 million.

Total originations were $135 million, down sharply from $291 million in the previous quarter. Total payments and sales were $383 million, up from $282 million in Q1. That implies net originations at -$248 million versus a net addition of just over $8 million in Q1. Q3-to-date originations so far are a net of +$91 million.

Click here to download our most recent Sure Analysis report on PSEC (preview of page 1 of 3 shown below):

Low-Priced High Dividend Stock #3: Horizon Technology Finance (HRZN) – Dividend Yield of 13.7%

Horizon Technology Finance Corp. is a BDC that provides venture capital to small and medium–sized companies in the technology, life sciences, and healthcare–IT sectors.

The company has generated attractive risk–adjusted returns through directly originated senior secured loans and additional capital appreciation through warrants.

Source: Investor Presentation

On October 29th, 2024, Horizon released its Q3 results for the period ending September 30th, 2024. For the quarter, total investment income fell 15.5% year-over-year to $24.6.7 million, primarily due to lower interest income on investments from the debt investment portfolio.

More specifically, the company’s dollar-weighted annualized yield on average debt investments in Q3 of 2024 and Q3 of 2023 was 15.9% and 17.1%, respectively.

Net investment income per share (IIS) fell to $0.32, down from $0.53 compared to Q3-2023. Net asset value (NAV) per share landed at $9.06, down from $9.12 sequentially.

After paying its monthly distributions, Horizon’s undistributed spillover income as of June 30th, 2024 was $1.27 per share, indicating a considerable cash cushion.

Click here to download our most recent Sure Analysis report on HRZN (preview of page 1 of 3 shown below):

Low-Priced High Dividend Stock #2: Ellington Credit Co. (EARN) – Dividend Yield of 14.7%

Ellington Credit Co. acquires, invests in, and manages residential mortgage and real estate related assets. Ellington focuses primarily on residential mortgage-backed securities, specifically those backed by a U.S. Government agency or U.S. government–sponsored enterprise.

Agency MBS are created and backed by government agencies or enterprises, while non-agency MBS are not guaranteed by the government.

On November 12th, 2024, Ellington Residential reported its third quarter results for the period ending September 30th, 2024. The company generated net income of $5.4 million, or $0.21 per share.

Ellington achieved adjusted distributable earnings of $7.2 million in the quarter, leading to adjusted earnings of $0.28 per share, which covered the dividend paid in the period.

Net interest margin was 5.22% overall. At quarter end, Ellington had $25.7 million of cash and cash equivalents, and $96 million of other unencumbered assets.

Click here to download our most recent Sure Analysis report on EARN (preview of page 1 of 3 shown below):

Low-Priced High Dividend Stock #1: Orchid Island Capital (ORC) – Dividend Yield of 16.4%

Orchid Island Capital is a mortgage REIT that is externally managed by Bimini Advisors LLC and focuses on investing in residential mortgage-backed securities (RMBS), including pass-through and structured agency RMBSs.

These financial instruments generate cash flow based on residential loans such as mortgages, subprime, and home-equity loans.

Source: Investor Presentation

The company reported a net income of $17.3 million, or $0.24 per common share, significantly improving from a net loss of $80.1 million in the same quarter last year. This net income comprised $0.3 million in net interest income and $4.3 million in total expenses.

Additionally, Orchid recorded net realized and unrealized gains of $21.2 million, or $0.29 per common share, from Residential Mortgage-Backed Securities (RMBS) and derivative instruments, including interest rate swaps.

Click here to download our most recent Sure Analysis report on Orchid Island Capital, Inc. (ORC) (preview of page 1 of 3 shown below):

Final Thoughts

When a stock offers an exceptionally high dividend yield, it usually signals that its dividend is at the risk of being cut. This rule certainly applies to most of the above stocks.

Nevertheless, some of the above stocks are highly attractive now thanks to their cheap valuation and still-high yield even after a potential reasonable dividend cut.

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

Other Sure Dividend Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].