How an Elon Musk Venture May Offer Security in the Meltdown

Editor’s note: “How an Elon Musk Venture May Offer Security in the Meltdown” was previously published in February 2025 with the title, “The Best Elon Musk Venture for Unlocking 2025 Gains.” It has since been updated to include the most relevant information available.

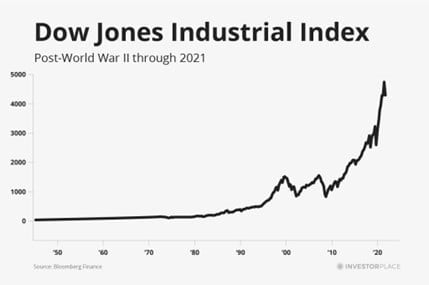

We won’t sugarcoat it; the stock market is in turmoil right now.

Yesterday – Monday, March 10 – the Dow Jones lost almost 1,000 points. The S&P 500 dropped nearly 3%, while the Nasdaq crashed 4%.

It was one of the worst days on Wall Street since September 2022. And it continues what has been a horrible few weeks for stocks.

The S&P has sunk 9% from its recent highs in February, essentially matching its largest correction since 2022.

The Nasdaq has crashed almost 14%, its largest correction since 2022.

The Russell 2000 has collapsed more than 17%, also matching its largest correction since 2022.

Collectively, the “Magnificent 7” tech stocks have slumped over 20%, slipping into their first bear market since – you guessed it – 2022.

This is, by most metrics, the worst stock market selloff in more than two years.

But that may also mean it’s the best buying opportunity we’ve seen in that time, too…

Be Greedy When Others Are Fearful

As Wall Street legend Warren Buffett says, it’s best to be greedy when others are fearful.

Historically speaking, this rings true.

According to the weekly American Association of Individual Investors (AAII), investor sentiment is currently as bearish as it’s basically ever been. Since the 1980s, every time investor sentiment was as bearish as it is today, stocks always soared over the next 12 months for an average gain of nearly 30%.

Meanwhile, the Nasdaq 100 has dropped below its most important technical support line – the 200-day moving average – for the first time in over a year. It has done the exact same thing precisely 11 times before since 1990.

Every time the market played strong defense at these levels and stayed within 4% of its 200-day moving average over the subsequent two weeks, stocks always rebounded over the next 12 months, with average gains of over 25%. This happened in early 1992, early 1996, late 1997, early 2004, mid-2010, late 2014, and late 2018.

So… while stocks are in turmoil right now… the data is saying that this may end up being a great buying opportunity.

Taking a Cue From Elon Musk

To help us find the best stocks to buy amid this market meltdown, we are setting our sights on someone who probably knows more about making money than anyone else – the world’s richest man himself, Elon Musk.

Long gone are the days when Elon Musk was merely ‘the Tesla guy.’

The billionaire entrepreneur has brought electric cars to the mainstream and reimagined rocket launches and space travel. He’s working to develop brain implant technology that allows humans to control devices with their thoughts. He aims to reinvent social media with X and introduce fully autonomous humanoid robots via Tesla’s (TSLA) Optimus.

And now Musk is taking on his boldest mission yet—tackling government waste as President Trump’s head of Department of Government Efficiency (DOGE).

As if he wasn’t already powerful enough, the world’s richest man has become infinitely more influential since Donald Trump won the White House.

A lot of investors are saying that’s a good thing for Tesla stock. And it could be. But we think investors focused on TSLA are considering the wrong Musk company for 2025.

Of all of his ventures, Tesla is not the one positioned for the most success this year.

That would be xAI, his AI startup.

xAI: A Brief Overview

Founded about two years ago, xAI was created to develop foundational AI models to rival that of OpenAI’s ChatGPT and Google’s Gemini. In that time, xAI has launched several models, the latest of which – Grok-3 – just debuted in late February. And from the looks of it, the AI is quite capable.

It was developed using over 10 times the computing resources of its predecessor, Grok-2, leveraging a massive data center equipped with approximately 200,000 GPUs. The model introduces sophisticated reasoning features, which allow it to deconstruct problems into manageable components and perform self-fact-checking to ensure accuracy before providing solutions. And it also includes a new Deep Search feature – an integrated AI-powered search engine designed to reduce the time users spend hunting for information by providing detailed explanations for its responses.

According to xAI, Grok-3 outperforms other incumbent AI models like ChatGPT, Gemini, and DeepSeek in areas such as mathematics, science, and coding.

It seems to be a new landmark model.

And thanks to this rapid success, xAI is currently in talks to raise up to $10 billion from multiple investors at a $75 billion valuation…

Meaning that, less than two years after it was launched, xAI is already worth more than 70% of the companies in the S&P 500.

But this may still be just the beginning for the startup.

Revolutionary Minds, Revolutionary Companies

Of course, the thing about world-changing businesses is that they start with world-changing people. Those folks have revolutionary ideas. And when funded with billions of dollars, they turn those ideas into world-changing businesses.

After all, Apple (AAPL) only became what it is today thanks to Steve Jobs, who came up with the idea of the iPhone. Jobs then leveraged the enormous amount of money Apple was making off its computers to create the iPhone. And voila… Apple became a trillion-dollar company.

Similarly, Microsoft (MSFT) grew into a tech titan because of Bill Gates, who came up with the idea of Windows. Gates used the money Microsoft was making off its PCs to further develop Windows. And that allowed Microsoft to become a trillion-dollar company.

World-changing people with ample resources create world-changing businesses.

So… if you want to invest in world-changing businesses… start with the world-changing people gathering the resources necessary to bring their visions to life.

That is exactly the situation we have with Musk and xAI today.

Invest in a World-Changer Like Elon Musk

We certainly believe that Elon Musk is a world-changer.

He co-founded PayPal (PYPL), the world’s largest digital payment platform, now worth more than $70 billion…

And SpaceX, the world’s largest private space rocket firm, valued at $180 billion.

He pioneered one of the world’s largest automakers in Tesla… worth more than the next 10 biggest automakers combined.

And he’s also the man behind Neuralink, The Boring Company, and X.

Musk has influenced how we pay for things, what cars we drive, how we communicate online, how we see space…

I’d venture to say that he is one of the most influential business figures of the past 20 years.

A great example of world-changing.

And not only has he turned his focus to a new business venture at the heart of possibly the most transformative technology the world has ever seen… but he’s also reportedly on the verge of acquiring $10 billion in funding to turn his AI vision into a reality… all while having the ear and trust of the president of the United States.

Would you bet against him here?

I don’t think I would.

The Final Word on Elon Musk

As we mentioned, xAI has already launched an impressive AI chatbot, which many experts claim stacks up pound-for-pound with ChatGPT. And the firm achieved this with minimal outside funding.

Just imagine what Musk and company will be able to cook up with an extra $10 billion.

The possibilities are endless.

When all is said and done, xAI could be Musk’s biggest venture yet. And 2025 could be the startup’s breakout year.

Right now, you have an opportunity to get in on this profit potential before the company takes off.

Of course, xAI is barely two years old. It is still a private startup, which means you can’t invest directly via stocks.

But we’ve found a promising ‘backdoor’ way to take part in its imminent exponential growth.

If xAI does win the multi-trillion-dollar AI race… and Elon Musk does it again… this stock could absolutely soar.

Learn more about xAI and its portfolio-boosting potential now.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.

P.S. You can stay up to speed with Luke’s latest market analysis by reading our Daily Notes! Check out the latest issue on your Innovation Investor or Early Stage Investor subscriber site.