PubMatic Inc PT Lowered to $19 at Lake Street Capital Markets

PubMatic Inc PT Lowered to $19 at Lake Street Capital Markets

Source link

PubMatic Inc PT Lowered to $19 at Lake Street Capital Markets

Source link

“Saarland“

Published on February 27th, 2025 by Bob Ciura

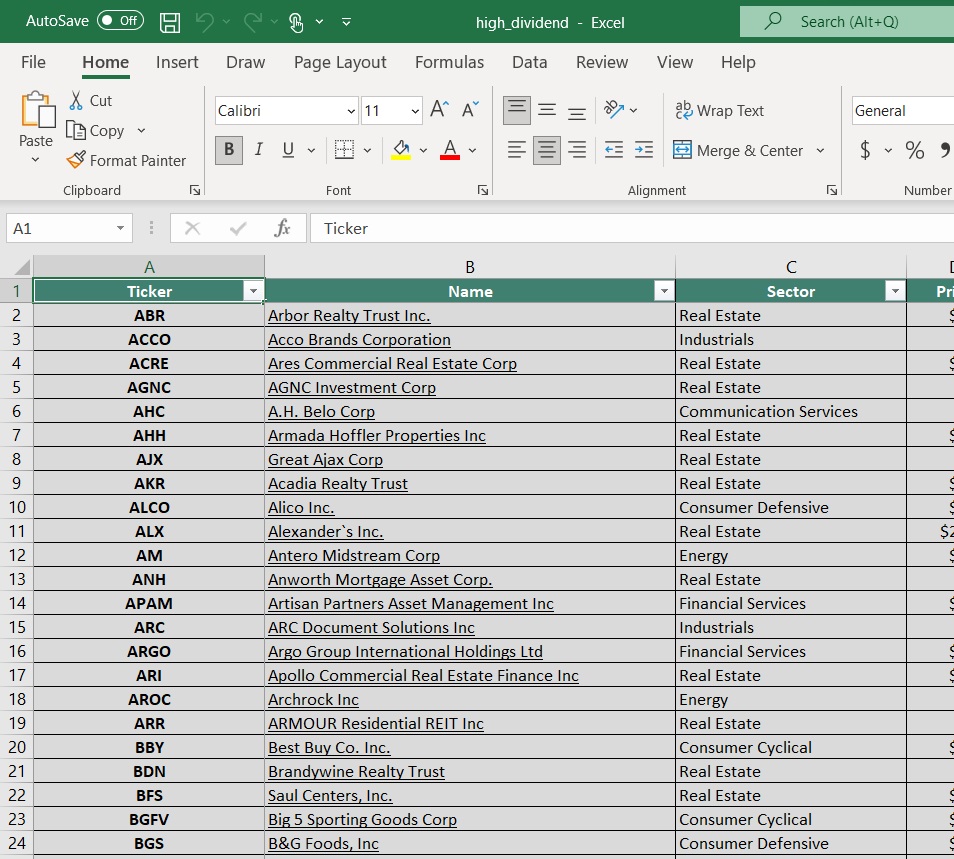

Passive income stocks help you build rising income for retirement and/or financial freedom. Passive income stocks are meant to be purchased once and never sold.

The beauty of earning passive income is that it allows investors to generate income for doing almost nothing.

The average dividend yield in the S&P 500 Index remains low at just 1.3%. As a result, income investors should focus on higher-yielding securities, if they want additional income from their stock portfolios.

With this in mind, we compiled a list of high dividend stocks with dividend yields above 5%. You can download your free copy of the high dividend stocks list by clicking on the link below:

This article will discuss 10 passive income stocks with current yields over 6%.

Importantly, these 10 stocks have durable competitive advantages and strong underlying earnings, which support their dividends.

These 10 passive income stocks also have dividend payout ratios at or below 70%, which indicates a sustainable dividend right now.

The 10 passive income stocks are listed below by current dividend yield, in ascending order.

You can instantly jump to any specific section of the article by using the links below:

Newtek One provides financial and business services to the small- and medium-sized business market in the United States.

What makes NewTek a unique company is that a good portion of its income is derived from subsidiaries that provide a wide array of business services to its large client base.

The company also gets a significant amount of its income from being an issuer of SBA (Small Business Administration loans), which only very few BDCs are licensed to do. This is not your typical BDC that only generates income from interest rate spreads, but also from a much wider range of small business services.

On November 6th, 2024, Newtek reported its Q3 results for the period ending September 30th, 2024. This was the third quarter of the second year of Newtek reporting as a financial holding company following its completion of the National Bank of New York City acquisition.

For the quarter, the company produced a net income of $11.9 million, or $0.45 per share. This compares to net income of $10.9 million, or $0.43 per share, for the prior-year period.

Click here to download our most recent Sure Analysis report on NEWT (preview of page 1 of 3 shown below):

Verizon Communications was created by a merger between Bell Atlantic Corp and GTE Corp in June 2000. Verizon is one of the largest wireless carriers in the country.

Wireless contributes three-quarters of all revenues, and broadband and cable services account for about a quarter of sales. The company’s network covers ~300 million people and 98% of the U.S.

On January 24th, 2025, Verizon announced fourth quarter and full year results. For the quarter, revenue grew 1.7% to $35.7 billion, which beat estimates by $360 million.

Source: Investor Presentation

Adjusted earnings-per-share of $1.10 compared favorably to $1.08 in the prior year and was in-line with expectations. For the year, grew 0.6% to $134.8 billion while adjusted earnings-per-share $4.59 compared to $4.71 in 2023.

For the quarter, Verizon had postpaid phone net additions of 568K, which was better than the 449K net additions the company had in the same period last year. Retail postpaid net additions totaled 426K.

Wireless retail postpaid phone churn rate remains low at 0.89%. Wireless revenue grew 3.1% to $20.0 billion while the Consumer segment increased 2.2% to $27.6 billion.

Click here to download our most recent Sure Analysis report on VZ (preview of page 1 of 3 shown below):

Edison International is a renewable energy company that is active in energy generation and distribution. It also operates an energy services and a technologies business. The company was founded in 1987 and is headquartered in Rosemead, CA.

On October 29, 2024, Edison International reported its financial results for the third quarter ended September 30, 2024.

The company delivered a GAAP net income of $516 million, or $1.33 per diluted share, marking a substantial increase from $155 million, or $0.40 per diluted share, in the same quarter last year.

On an adjusted basis, Edison achieved core earnings of $582 million, or $1.51 per diluted share, up from $531 million, or $1.38 per diluted share, in Q3 2023.

Revenue for the quarter was $5.20 billion, reflecting a 10.61% year-over-year growth and surpassing expectations by $192.39 million.

Click here to download our most recent Sure Analysis report on Edison International (EIX) (preview of page 1 of 3 shown below):

Ford Motor Company was first incorporated in 1903 and in the past 120 years, it has become one of the world’s largest automakers. It operates a large financing business as well as its core manufacturing division, which produces a popular assortment of cars, trucks, and SUVs.

Ford posted fourth quarter and full-year earnings on February 5th, 2025, and results were better than expected. Adjusted earnings-per-share came to 39 cents, which was seven cents ahead of estimates.

Revenue was up almost 5% year-over-year for the quarter to $48.2 billion, which also beat estimates by $5.37 billion. The fourth quarter was the highest revenue total the company has ever produced.

Ford Blue increased 4.2% to $27.3 billion in revenue for the fourth quarter, beating estimates of $25.9 billion. Model e revenue was down 13% year-over-year to $1.4 billion, $400 million less than expected.

Ford Pro revenue was up 5.3% to $16.2 billion, beating estimates for $15.6 billion.

For this year, Ford expects full-year adjusted EBIT of $7 to $8.5 billion, and for adjusted free cash flow of $3.5 billion to $4.5 billion, with capex of $8 to $9.5 billion.

Click here to download our most recent Sure Analysis report on Ford (preview of page 1 of 3 shown below):

The AES (Applied Energy Services) Corporation was founded in 1981 as an energy consulting company. It now has businesses in 14 countries and a portfolio of approximately 160 generation facilities.

AES produces power through various fuel types, such as gas, renewables, coal, and oil/diesel. The company has more than 36,000 Gross MW in operation.

AES Corporation reported third quarter results on October 31st, 2024, for the period ending September 30th, 2024. Adjusted EPS rose 18% to $0.71 for Q3 2024.

The company constructed and acquired 2.8 GW of renewable energy year-to-date, and is on course to add 3.6 GW of new projects online in 2024.

Source: Investor Presentation

Leadership expects to achieve the high end of its 2024 guidance for adjusted EPS of $1.87 to $1.97 for the full fiscal year. Additionally, the company reaffirms it also still expects annual EPS growth of 7% to 9% from 2023 through 2027.

The company is actively engaged in developing and acquiring new energy projects.

It currently has a backlog of 12.7 GW of renewables. AES expects to complete the majority of these projects through 2027.

Click here to download our most recent Sure Analysis report on AES (preview of page 1 of 3 shown below):

Enterprise Products Partners was founded in 1968. It is structured as a Master Limited Partnership, or MLP, and operates as an oil and gas storage and transportation company.

Enterprise Products has a large asset base which consists of nearly 50,000 miles of natural gas, natural gas liquids, crude oil, and refined products pipelines.

It also has storage capacity of more than 250 million barrels. These assets collect fees based on volumes of materials transported and stored.

Source: Investor Presentation

Enterprise Products Partners reported strong fourth-quarter 2024 earnings, delivering $1.6 billion in net income, or $0.74 per common unit, representing a 3% increase over the prior year.

Adjusted cash flow from operations rose 4% to $2.3 billion, with the company declaring a quarterly distribution of $0.535 per unit, a 4% year-over-year increase.

Enterprise also continued its capital return strategy, repurchasing 2.1 million common units during the quarter and 7.6 million units for the full year, bringing total buybacks under its program to $1.1 billion.

For the full year, the company posted $9.9 billion in EBITDA, moving 12.9 million barrels of oil equivalent per day.

Click here to download our most recent Sure Analysis report on EPD (preview of page 1 of 3 shown below):

Midland States Bancorp (MSBI) is the holding company of Midland States Bank, a community bank that was founded in 1881 and is headquartered in Effingham, Illinois.

It operates 53 branches in Illinois and Missouri and provides a wide range of banking products and services to individuals, businesses, municipalities and other entities. Midland States Bancorp has total assets of $7.5 billion.

In late January, Midland States Bancorp reported (1/23/25) results for the fourth quarter of fiscal 2024. Its net interest margin expand sequentially from 3.10% to 3.19% and its net interest income grew 2%.

However, the bank incurred massive charge-offs on loans ($103 million) and provisions for loan losses ($93.5 million).

As a result, it switched from earnings-per-share of $0.74 to an excessive loss per share of -$2.52, missing the analysts’ consensus by $3.19.

Midland States Bancorp has acquired seven smaller banks since 2009. As a result, it grew its asset base by 12% per year on average over the last nine years.

It had also grown its earnings-per-share by 6.9% per year on average during 2015-2023 but it incurred a loss in 2024 due to massive loan charge-offs and high deposit costs, which resulted from high interest rates.

Click here to download our most recent Sure Analysis report on MSBI (preview of page 1 of 3 shown below):

Whirlpool Corporation, founded in 1955 and headquartered in Benton Harbor, MI, is a leading home appliance company with top brands Whirlpool, KitchenAid, and Maytag.

Roughly half of the company’s sales are in North America, but Whirlpool does business around the world under twelve principal brand names. The company, which employs about 44,000 people, generated nearly $17 billion in sales in 2024.

Source: Investor Presentation

On January 29th, 2025, Whirpool reported fourth quarter 2024 results. Sales for the quarter totaled $4.14 billion, down 18.7% from fourth quarter 2023.

Ongoing earnings per diluted share was $4.57 for the quarter, 19% higher than the previous year’s $3.85 per share.

Whirlpool issued its 2025 guidance, seeing ongoing earnings-per-share coming in at approximately $10.00 on revenue of $15.8 billion.

Additionally, Whirlpool expects cash provided by operating activities to total roughly $1 billion, with $500 to $600 million in free cash flow.

Click here to download our most recent Sure Analysis report on WHR (preview of page 1 of 3 shown below):

MPLX LP is a Master Limited Partnership that was formed by the Marathon Petroleum Corporation (MPC) in 2012. In 2019, MPLX acquired Andeavor Logistics LP.

The business operates in two segments:

In early February, MPLX reported (2/4/25) financial results for the fourth quarter of fiscal 2024. Adjusted EBITDA and distributable cash flow (DCF) per share grew 9% and 7%, respectively, primarily thanks to higher tariff rates and increased volumes of liquids and gas.

MPLX maintained a healthy consolidated debt to adjusted EBITDA ratio of 3.1x and a solid distribution coverage ratio of 1.5x.

Click here to download our most recent Sure Analysis report on MPLX (preview of page 1 of 3 shown below):

The Western Union Company is the world leader in the business of domestic and international money transfers. The company has a network of approximately 550,000 agents globally and operates in more than 200 countries.

About 90% of agents are outside of the US. Western Union operates two business segments, Consumer-to-Consumer (C2C) and Other (bill payments in the US and Argentina).

Western Union reported mixed Q4 2024 results on February 4th, 2025. Revenue increased 1% and diluted GAAP earnings per share increased to $1.14 in the quarter, compared to $0.35 in the prior year on higher revenue and a $0.75 tax benefit on reorganizing the international operations.

Revenue rose, despite challenges in Iraq on higher Banded Digital transactions and Consumer Services volumes.

CMT revenue fell 4% year-over-year even with 3% higher transaction volumes. Branded Digital Money Transfer CMT revenues increased 7% as transactions rose 13%. Digital revenue is now 25% of total CMT revenue and 32% of transactions.

Consumer Services revenue rose 56% on new products and expansion of retail foreign exchange offerings. The firm launched a media network business, expanded retail foreign exchange, and grew retail money orders.

Click here to download our most recent Sure Analysis report on WU (preview of page 1 of 3 shown below):

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

Other Sure Dividend Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].

I remember it like it was yesterday.

My son was an engineering student at Stanford when one of their research teams debuted an autonomous race car named Shelley.

As a self-professed car guy, my interest was immediately piqued.

It was a modified Audi TTS – a beautiful machine with perfect handling. The students even upgraded it with ceramic brakes since they fade slower and are easier to program.

But what really caught my attention wasn’t the car.

It was what powered it.

This self-driving project was made possible by semiconductor chips from NVIDIA Corporation (NVDA).

Maybe you’ve heard of ‘em.

I say that tongue-in-cheek, of course, because practically the whole world knows NVIDIA by now.

My introduction to NVIDIA could have happened to anyone. It was one of life’s happy coincidences. But after 40-plus years in this business, I’ve learned that keeping your eyes and ears open is key if you want to be a great investor. You never know when an opportunity is right in front of you.

By that same token, NVIDIA didn’t become the household name it is today because of self-driving cars.

Instead, it took advantage of another happy coincidence – one that changed the future of computing.

Back in 2012, a PhD student named Alex Krizhevsky used NVIDIA’s graphics processing units (GPUs) to train a deep neural network called AlexNet.

This model didn’t require a single line of traditional programming. It taught itself to recognize images. And when it crushed the competition in the ImageNet challenge, it proved that GPUs were far superior to CPUs (central processing units) for AI workloads.

That’s when everything changed.

Practically overnight, NVIDIA’s chips became must-haves for AI.

The AI Revolution was on.

Fast forward to today, and NVIDIA remains at the heart of the AI Revolution. But after such a historic run, investors had one big question ahead of its latest earnings report, which was released yesterday: Can the company keep up the momentum?

Because this time, the stakes were a little different…

So, in today’s Market 360, let’s break down NVIDIA’s latest results. We’ll dive into what they mean for the AI Revolution, and more importantly – how you can take advantage of the next stage of AI investing… even if you missed the first wave.

NVIDIA achieved record results in its fourth quarter and fiscal year 2025.

Fourth-quarter revenue soared 78% year-over-year to $39.3 billion, topping estimates for $38.16 billion. Fourth-quarter data center revenue accounted for $35.6 billion, which was up 93% from the same quarter a year ago. Fourth-quarter earnings jumped 71% year-over-year to $0.89 per share, which also beat estimates for $0.85.

For fiscal year 2025, NVIDIA reported revenue of $130.5 billion, or 114% annual revenue growth. Earnings clocked in at $2.99 per share, or 130% annual growth. These results also bested analysts’ estimates for full-year revenue of $129.28 billion and earnings of $2.95 per share, respectively.

Also notable, NVIDIA revealed that the Blackwell chip accounted for $11 billion in the fourth quarter, or 28% of revenue. Company management stated it was “the fastest product ramp in our company’s history.”

Looking forward to the first quarter in fiscal year 2026, NVIDIA expects revenue of about $43 billion. That would represent roughly 65% year-over-year revenue growth.

So, once again, the company’s data center division proved to be the primary growth engine, led by the new Blackwell chip – which accounted for 50% of data center revenue. What this tells me is that demand for the latest and greatest AI-powered computing has to offer remains at an all-time high – despite recent concerns about DeepSeek or Big Tech’s AI spending.

As I’ve mentioned previously, these concerns were largely overblown. The reality is that DeepSeek has proven to have major concerns with its reliability and data security. And we can’t seem to go a week without seeing fresh news about Big Tech’s plans to spend billions on additional data centers for AI.

Company management also addressed new ways of running AI, like DeepSeek’s R1 model, which reportedly uses reasoning rather than inferencing. CEO Jensen Huang said this is not a threat, saying the next generation of AI algorithms could need millions of times more computing capacity.

What’s more, he addressed the potential threat of chips being designed in-house by Big Tech companies like Alphabet Inc. (GOOG), Microsoft Corporation (MSFT) and Amazon.com, Inc. (AMZN).

Just because the chip is designed doesn’t mean it gets deployed. And you’ve seen this over and over again. There are a lot of chips that get built, but when the time comes, a business decision has to be made… our technology is not only more advanced, more performance, it has much, much better software capability and very importantly, our ability to deploy is lightning fast.

I should also add that sales of chips for self-driving cars and robots are beginning to take off. The company reported $570 million in automotive sales during the quarter. That may be a tiny fraction of the pie, but that slice is getting bigger – it represents a 103% rise year-over-year.

Now, NVIDIA shares rose by roughly 3.5% on Wednesday prior to the earnings release. But in Thursday’s trading, the stock really took it on the chin, falling more than 5%.

So, what triggered the selloff?

There seems to be some disappointment around the fact that NVIDIA’s margins declined slightly, down to 73% from 76% in the previous year. The company also forecasted margins of 71% for the current quarter.

Since the Blackwell chips are even more complex (and expensive to make) than previous versions, this makes sense. But Wall Street fixated on the slight margin decline and forward guidance despite the company’s continued dominance.

So, while the company successfully batted down a laundry list of concerns (DeepSeek, AI spending, Blackwell delays, rising competition), Wall Street still found a reason to sell after earnings.

I don’t want you to be too concerned by this. NVIDIA’s initial action in the wake of earnings is usually not reflective of the long-term picture.

And the long-term picture is this…

The AI Revolution is the biggest technological disruption of our lifetime.

Few companies have benefited more than NVIDIA. I’ve had my fair share of winners over the years, and I can’t think of a single one that was as monopolistic as NVIDIA.

I am on record saying that NVIDIA is the Stock of the Decade.

You may know that we’ve held it in my Growth Investor service since 2019. And since then, we’re up by nearly 3,000% on my recommendation. And I don’t have any plans to sell.

However…

You should always be thinking about what’s coming next…

The folks at NVIDIA know this. In fact, they’re already preparing for it. That’s why I filmed a special presentation to discuss the next technological revolution on the horizon.

Let me be clear, folks. If you missed the boat on NVIDIA, you’re going to want to hear about this.

Because while NVIDIA is fully aware of what’s going on, the biggest gains will likely come from smaller firms on the cutting edge.

These are the ones that could become the next NVIDIA.

Go here to get the details now.

Because by the time the mainstream public hears about it, the “easy” money will have already been made.

Sincerely,

Louis Navellier

The Editor hereby discloses that as of the date of this email, the Editor, directly or indirectly, owns the following securities that are the subject of the commentary, analysis, opinions, advice, or recommendations in, or which are otherwise mentioned in, the essay set forth below:

NVIDIA Corporation (NVDA)

P.S. A quick reminder, folks…

At 8 pm ET tonight, TradeSmith CEO Keith Kaplan is going live with his full market briefing: The Last Melt-Up.

And it couldn’t be more urgent.

The S&P 500 has pulled back. Trump’s agenda is facing headwinds in Washington. Inflation looms. And the Fed seems stuck in neutral.

Is the great meltdown finally here?

Is it time to cut your losses and sell?

Join Keith tonight at 8 pm ET here and you’ll get the full answers.

Written by the Market Insights Team

Dip buyers save the day

Boris Kovacevic – Global Macro Strategist

Yesterday’s market session was split into two distinct phases, as investors began the week by selling risk assets amid growing concerns of a U.S. slowdown. Recession fears intensified following weaker-than-expected leading indicators from the Chicago and Dallas Federal Reserves. U.S. equities fell, bond yields plunged, and the dollar followed suit, pressured by deteriorating sentiment.

However, dip buyers stepped in during the U.S. session, helping equities and the Greenback recover some losses. Overall, the impact of the day’s news and data appeared to be net-neutral for markets. That said, recent growth concerns could become a bigger problem for risk assets if soft economic data persists, making secondary indicators increasingly important to monitor.

The dollar ended the day slightly lower after briefly touching its weakest level since mid-December. As we highlighted in our feature for Fortune, the dollar remains under pressure for two key reasons: the absence of new tariffs reducing safe-haven demand and the Fed’s pause being linked to rising inflation expectations rather than strong macro data. With recent data reaffirming these trends, the dollar has struggled to benefit from steady rates, currently sitting at its lowest level this year, down 3.4% from January’s peak.

For a meaningful rebound, dollar bulls will need either stronger U.S. economic data or renewed tariff enforcement by Trump. The latter could materialize today, as Trump reiterated overnight that tariffs on Canadian and Mexican goods will be implemented once the delay expires.

New government, old problems

Boris Kovacevic – Global Macro Strategist

The euro briefly climbed above $1.05, reaching its highest level in nearly a month before retreating to $1.0460. Investors see the potential for increased fiscal spending, particularly in defense, as a way to support economic activity. However, fiscal constraints may limit the impact, as political hurdles complicate efforts to boost spending. Meanwhile, business sentiment is showing cautious optimism, though immediate economic conditions remain subdued. We will continue to monitor political developments and key macro releases, as they will play a crucial role in shaping EUR/USD’s near-term direction.

Following the German election outcome, Chancellor-designate Friedrich Merz is actively engaging with the Social Democrats (SPD) to accelerate defense spending in response to escalating geopolitical tensions. However, the rise of fringe parties, securing a minority with blocking rights, has complicated efforts to amend the constitutional “debt brake”, which restricts government borrowing. To navigate these constraints, Merz is considering pushing reforms through the current parliament before the new session begins on March 24. These political maneuvers have added uncertainty to the euro’s performance, as markets assess their potential economic impact.

On the macro front, the Ifo Institute’s latest survey indicates a modest improvement in business expectations, with the index rising to 85.4 in February, up from 84.3 in January, and exceeding forecasts of 85.0. However, current conditions worsened, highlighting that while businesses are hopeful about the future, they continue to struggle with present challenges..

Pound running into resistance

Boris Kovacevic – Global Macro Strategist

The pound climbed to a nine-week high of $1.2690 before encountering resistance near $1.27. Strong UK data and persistent inflation in recent weeks continue to provide support, leaving room for further gains—especially if U.S. economic momentum slows in parallel.

However, geopolitical risks remain a key factor. Trump’s tariff agenda, while not directly targeting the UK, could disrupt global trade flows, particularly with China and the eurozone, leading to potential spillover effects for Britain. Meanwhile, elevated UK inflation still supports GBP, but a renewed rise in gilt yields—back toward January highs—could shift rate expectations from a tailwind to a headwind if fiscal concerns resurface.

This morning, the pound is trading in the lower $1.26 area, as a risk-off mood takes hold following Trump’s overnight comments. The administration is set to raise tariffs on major trading partners and is considering further restrictions on China’s access to advanced chips, adding fresh uncertainty to markets..

Dollar continues to decline

Table: 7-day currency trends and trading ranges

Key global risk events

Calendar: February 24 -28

All times are in GMT

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.

Power Corp of Canada PT Lowered to Cdn$38.50 at Scotiabank

Source link

The Central Bank of Azerbaijan (CBA) has put into circulation a new 3 qapik coin. The redesigned coin depicts the state emblem of Azerbaijan and the year of issue.

(news by Egon Conti)

(image from www.cbar.az)

Guest Post Published on February 25th, 2025 by Jacob Wolinsky

For quite some time, big tech companies have dominated the equities market, leading investors to see impressive returns.

At the same time, Wall Street remains optimistic that developments in Artificial Intelligence (AI) will further create long-term opportunities for the wider industry.

In 2024, several Silicon Valley big leagues entered the dividend space, including Meta Platform (META), Salesforce (CRM), and Google’s parent company, Alphabet (GOOG), announcing their first-ever dividend payouts.

Performance of technology shares, including those listed on the S&P 500 Technology Dividend Aristocrats Index (SPTDAUP) have continued to deliver impressive results despite investors having cold feet over wider economic and market volatility.

Since the beginning of the year, the S&P Technology Dividend Aristocrats Index has gained 5.50% compared to the broader benchmark S&P 500 which has added 4.22% during the same period.

With this in mind, Sure Dividend created a list of dividend-paying technology stocks.

You can see the full technology stocks list by clicking on the link below:

Technology companies hold an advantage over other leading sectors with the potential for long-term growth and creating attractive returns.

For instance, the 10-year return of SPTDAUP currently outpaces the S&P 500 Dividend Aristocrats Index (SPDAUDP), with a return of 14.01% compared to 7.17%.

The changing market landscape will see a growing number of companies delivering impressive results due to high exposure to artificial intelligence.

Strong market performance, driven by the rapid development of artificial intelligence, from software applications to hardware and microchips, brings a series of opportunities for dividend-focused investors.

There are several big tech firms that have a reliable dividend track record, offering investors consistency, and improved growth possibilities amid shifting market conditions.

These companies are not ordinary pure-play investment options and instead offer investors a refined balance of growth and income.

International Business Machines (IBM) has come a long way since the beginning years of commercial computer systems.

Though the company remains a strong contender in the computer hardware and Information Technology (IT) space, recent developments have been more centered around artificial intelligence, including Generative AI and Machine Learning tools.

There are numerous AI-powered projects that have been in the making for quite some time, with IBM Watson, a semantic intelligence application, being in development since 2004, and making a global appearance in 2010.

Being a trusted, and established leader in the technology industry has helped IBM retain its top position in the race for innovation and broader artificial digitization.

These long-term modifications have paid off, with IBM seeing its biggest growth in recent quarters coming from its software segment.

For Q4 2024, IBM reported software revenues of $7.9 billion, up 10.4% on a quarter-over-quarter basis, and up 11.5% on a flat currency basis. Total quarterly revenue came up 1% and totaled $17.6 billion for the period.

The company has continued to deliver impressive profitability, reporting Gross Profit Margin (GAAP) at 56.7%, and operating (non-GAAP) margins of 57.8%.

Most impressively has been the company’s growing cash stockpile. IBM generated $4.3 billion in net cash from operating activities, with a total free cash flow of $6.2 billion.

Additionally, IBM reported $1.5 billion in shareholder dividend payouts for the fourth quarter. The company recognizes the need to adjust business sentiment to leverage key market activities, boost cash flow, and remain highly competitive in a saturated market.

Qualcomm (QCOM) is another large player in the computer and technology space, and having more than 40 years of experience under its belt makes it an impressive investment choice for those looking to create a balanced portfolio with broad exposure to different corners of the industry.

To say that the company has actively been working on a handful of AI-based projects might come as an understatement.

In fact, Qualcomm has developed several native AI systems for PC, smartphones, automotive, and IoT (Internet of Things). In addition to this, projects such as Cloud AI and Edge AI Box further provide digital solutions in Gen AI and cybersecurity.

In February, Qualcomm announced Q1 2025 results, reporting a 17% increase in revenues compared to the same period in 2024. In total, for the period, reported revenues were $11.66 billion, along with $3.18 billion in net income, up 15% quarter-over-quarter, along with diluted Earnings Per Share (EPS) of $2.83, up 15%.

In October, the company announced a quarterly cash dividend of $0.85 per common share. Currently, QCOM has an annual dividend of $3.40 per share, which is in line with other market contenders.

Stock performance remains modest, seeing a 13.03% increase since the beginning of the year through February 19. For the first quarter, the company returned $2.7 billion to stockholders, including $942 million in cash dividends, with $1.8 billion through share repurchases.

Again, QCOM requires patience, and investors should keep in mind that the company continues to find its niche within a rapidly developing and changing digital environment. Still, there’s long-term upside potential, and investors who can purchase QCOM at a lower price point could benefit when the tide begins to change.

Global technology developer Broadcom (AVGO) has noticed that AI-enabled technology and software applications are rapidly approaching an inflection point. This in turn has given them an opportunity to leverage their experience to secure a spot at the top of the list of innovative digital companies that’s driving AI scalability.

At the 2024 Open Compute Project (OCP) Global Summit hosted in October last year, Charlie Kawwas, Ph. D., President of the Semiconductor Solutions Group at Broadcom shared that the company is looking to pioneer new innovative technologies, and continues to secure the necessary resources to scale its AI-infrastructure strategy.

Broadcom delivers plenty of hands-on digital solutions and has a reliable track record that has seen them deliver advancements in fiber channel networking, wired and wireless connectivity, and software applications.

2024 presented itself with a new sense of optimism for the company. Full-year revenue of $51.57 billion was an improvement of 44% compared to the previous year. Similarly, quarterly net revenue rose to $14.05 billion, a 51% increase compared to Q4 2023.

Additionally, Broadcom reported $5.6 billion in cash from operations, climbing $776 million versus the same period of 2023. The company experienced a gradual decline in capital expenditure, totaling $122 million compared to $172 million in Q3 2024.

Revenue across primary business segments delivered strong results. Semiconductor solutions revenue of $8.23 billion improved by 12% and represents roughly 59% of total company revenue.

Elsewhere, Infrastructure Software revenue climbed to $5.82 billion, which was a robust improvement of 196% compared to Q3 2024.

Last year saw the company’s stock gain 139.30% for the 12-month period, however, current year-to-date delivery is down by 1.43% with stocks making its biggest move in one day, falling by 17.40% between January 24-27.

Looking at the year ahead, Broadcom could remain a strong competitor among other market leaders, and potentially capture broader support for its semiconductor business as AI-focused demand continues to climb.

Next on the list is the Canadian-based software development company, OpenText (OTEX). The company designs and manufactures integrated information management software that provides a more seamless connection between customers and organizations.

AI development has played a key role for OpenText, with several critical projects coming to the surface in recent years. For example, the company developed OpenText™ ArcSight™ Intelligence, which is a native software protocol that makes use of artificial intelligence to detect insider risks, attacks, and cyber threats.

This is only one of several leading projects that are helping to bring OpenText to the frontlines of digital innovation. Their business model sees them partnering with major companies and organizations for critical cybersecurity solutions, enabling them to create more secure and efficient workplace systems.

OpenText completed the divestiture of Application Modernization and Connectivity (AMC) to Rocket Software for $2.27 billion. The recent sell-off means that the company can begin to focus primarily on its information management segment while using proceeds from the divestiture to reduce debt by $2.0 billion.

In addition to this, the remaining proceeds will be used to further growth in the company’s cloud security and AI market segment. The capital allocation will enable OpenText to become a frontrunner in the AI and cybersecurity space while leveraging new market opportunities to build more robust software solutions.

Fiscal Q2 2025 earnings indicate robust delivery of $1.35 billion in total revenue and is the company’s 16th consecutive quarter of cloud organic growth, which totaled $462 million and improved 2.7% year-over-year.

Similarly, the company reported a net income margin of 17% with operating cash flows of $348 million and free cash flows of $307 million. During Q3 2024 OpenText reported $1.27 billion in revenue, which was the company’s first full quarter following the AMC divestiture.

Performance on the stock market remains volatile following a year of persistent challenges, and having to navigate the divestiture of AMC. Stock performance has declined by over 10% in the last 6 months, with year-to-date delivery down 2.93% through to February 19.

While there’s a lot of room for improvement, OpenText could benefit from the rising demand for AI software and cybersecurity protocols in the coming years.

This year might’ve brought plenty of roadblocks, but the company can now look forward to building a more robust product range which in turn will help them capture a bigger share of the market.

Information management and consulting agency Accenture (ACN) may have endured a challenging summer on the stock market, seeing shares slide by more than 10% between March and September 2024 but still managed to close the year off on a high note.

In the last six months, share performance has gained 17.64% through to February 2023. Additionally, year-to-date delivery is up 10%, with shares setting their second-highest price since December 2021.

Though the company endured some challenging conditions last year, fiscal Q1 2025 results paint a more promising picture, with new bookings revenue of $18.7 billion up 1%, and the reporting $1.2 billion in Generative AI bookings.

Total revenues for the quarter were $17.7 billion, up 9% compared to Q1 2024. Accenture continues to invest in this space, deploying successful strategies to reinvent digital solutions for their clients and position them as a market leader in the space.

Last year, total new bookings revenue hit a record of $81.2 billion for the full fiscal 2024 year and represented an increase of 14% in local currency.

Accenture remains highly successful in applying a working model that allows them to stay in a flexible position. This ensures that the company has a more autonomous approach to current market conditions, while continuously delivering increased customer turnover.

Across much of its operating regions, Accenture reported strong delivery in new bookings and operating income. The Asia Pacific region witnessed the biggest improvement in operating income at 21%, followed by America up 16%, and Europe, Middle East and Africa (EMEA) up 16%.

Though tailwinds persist, perhaps there’s clear guidance in how Accenture is looking to overcome current challenges, while remaining at the forefront of digital innovation and transformation.

2025 proves to hold a new set of challenges for investors, and many will need to take a more flexible approach that would allow them to overcome roadblocks and navigate uncertainty more effectively.

Not only will 2025 be a year to see many of the biggest tech giants in the industry battling to remain at the top of the log, but wider changes in the political and economic environment could mean that companies will need to react to ensure their buoyancy.

After facing several years of hard-to-ignore market pitfalls, the technology sector remains a strong, but seemingly resilient leader that’s inviting investors to find long-term growth and reliable income in the tech companies that are pioneering the development of artificial intelligence.

Sure Dividend maintains similar databases on the following useful universes of stocks:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].

While rising costs and tariffs have consumers on edge, businesses are turning to AI to adapt.

In August 2021, Americans were on edge. The Delta variant of COVID-19 had arrived.

This caused consumers to panic a bit, and it showed in the data. The Conference Board’s Consumer Confidence Index fell to 113.8, down from 125.1 in July. That was a steep 9% drop in one month.

Now, it’s happening again – but for very different reasons.

This morning, the Conference Board’s Consumer Confidence Index for February showed a reading of 98.3. That’s down from January’s 105 reading, and economists were looking for a reading of 102.5. Not only that, but it was the third-straight monthly decline for the index.

This is its biggest drop since August 2021.

This didn’t come out of nowhere, either.

On Friday, the University of Michigan’s Consumer Sentiment Survey also plunged. The February reading came in at 64.7, down almost 10% from January’s 71.7.

This also marked a 15-month low. The last time the consumer sentiment survey was this low was in October 2023, when people were grappling with the October 7 terrorist attacks by Hamas in Israel, the U.S.’s ballooning budget deficit and elevated Treasury yields and interest rates.

Now, the reasons for the drop in consumer confidence and sentiment this time around are different. Some of the current consumer pessimism could be weather-related. But the main driver we are seeing this time around is due to tariff threats. The Conference Board noted today that “there was a sharp increase in the mentions of trade and tariffs, back to a level unseen since 2019.”

The truth is Americans are still feeling the sting of high prices. Even though inflation has cooled from its 2022 peak, it’s still sticking around. Gas, groceries, rent – they’re all more expensive than they were a year ago.

Tariffs threaten to raise the prices of imported goods and reduce consumer demand. So, consumers are on edge that these tariffs might unravel the progress made in bringing inflation down recently.

We already knew that S&P 500 companies are concerned. According to FactSet, more S&P 500 companies are citing “tariff” or “tariffs” on quarterly earnings calls than at any point since Q2 2019.

But it was Walmart Inc.’s (WMT) earnings report last week really raised the first major red flag that consumers were concerned about tariffs.

So, in today’s Market 360, we’ll take a closer look at Walmart’s earnings and what the company management had to say about tariffs. I’ll also share the important details that investors are overlooking. Not only do they bode well for Walmart’s future, but they highlight a huge shift in companies’ approach to artificial intelligence. I’ll explain what’s shifting… and how you can profit from it.

Let’s get started.

On Thursday, February 20, Walmart announced results for the fourth quarter and fiscal year of 2025. Earnings rose 10% year-over-year to $0.66 per share, besting expectations for $0.65 per share by 1.5%. Meanwhile, revenue increased 4.1% to $180.6 billion, in line with analysts’ estimates.

Walmart continued to invest heavily in its online platform, helping drive a 20% increase in U.S. e-commerce sales. The company also reported that advertising revenue surged 29%.

Still, these numbers weren’t enough for skittish traders, and shares of Walmart stumbled 6.5% last Thursday. And that’s because the company issued a lighter-than-expected forecast for sales. Specifically, the company said it expects net sales to increase 3% to 4%. That’s on the lower end of what analysts were expecting. The company also forecasted full-year adjusted earnings per share of $2.50 to $2.60, below the $2.77 consensus estimate.

“We’re one month into the year,” Walmart Chief Financial Officer John David Rainey said in prepared investor call remarks. “So, I think it’s prudent to have an outlook that is somewhat measured… we don’t want to get ahead of ourselves.”

As I mentioned earlier, tariff worries are likely the source of the tepid forecast. Walmart is the sixth-largest shipper in the world, as measured by number of shipments, and half of that comes from China. The Alliance for American Manufacturing estimates that as much as 80% of Walmart’s merchandise segment has ties to the country. That makes Walmart unusually exposed to tariffs on imported Chinese goods, which have already risen 10% since Donald Trump took office.

Now, while most people were focused on the weak outlook for Walmart, many overlooked some of the statements that CEO Doug McMillion made that will have a far greater impact on the company’s bottom line over the long run.

I’m talking about Walmart’s efforts with artificial intelligence.

During the earnings call, McMillon revealed how the company plans to accelerate its entire business with AI.

He first shared a new AI agent for its merchants to help “get to the root cause of issues related to things like out of stocks or overstocks with more accuracy and speed.”

He also highlighted tools for coding assistance that are now available for developers on Walmart’s tech team that will “help streamline deployments and deliver code faster with fewer bugs.” McMillon said these tools helped to save an estimated 4 million developer hours last year.

Now, Walmart has already been using AI to help reduce costs and boost margins. The company’s 5.2% sales growth came with a 9.4% increase in adjusted operating income, powered by higher-margin businesses like membership, third-party selling, and advertising – all businesses helped by Walmart’s AI-powered website.

It is also using its Walmart+ subscription service to help understand its shoppers. This monthly subscription service, like Amazon Prime, offers bonuses like free shipping, streaming services, returns-from-home, and fuel savings.

With this platform, Walmart can track shoppers’ spending habits and create better recommendations for future buys. In other words, Walmart is finally ready for an e-commerce fight with Amazon.

These innovations are critical for Walmart. After 50 years of expansion, the company is finally reaching the end of its physical growth runway. Analysts expect store count to remain at 4,600 through 2027, which means future expansion will have to come from an expansion of online and omnichannel offerings.

In addition, Walmart is benefiting from its recent investments in supply-chain automation. The company was an early user of warehouse robots and opened five automated distribution centers for fresh food earlier in 2024.

I bring all this up because you might not think of Walmart when you think about AI.

But mark my words… In the not-too-distant future, every company will be involved with AI to one degree or another.

And those that don’t will go the way of the Dodo bird.

Walmart gets this, and so do a handful of AI Appliers, the companies that apply AI to better optimize their businesses.

The fact is, the early adopters of AI are already becoming more efficient and profitable. And we’re only at the beginning stages of this process.

Right now, more and more “non-tech” businesses, like Walmart, are hard at work applying AI to increase revenue, make smarter capital allocation decisions and reduce costs.

Others are simply burying their heads in the proverbial sand.

As this mass adoption phase of AI plays out, we’ll begin to see a massive market rupture take place.

Those that master AI and employ fewer and fewer people and have very low-cost structures but generate huge amounts of revenue…

And companies that go out of business.

I want you to be on the right side of this, and that’s why I put together an urgent message.

Sincerely,

Louis Navellier

Editor, Market 360

The Editor hereby discloses that as of the date of this email, the Editor, directly or indirectly, owns the following securities that are the subject of the commentary, analysis, opinions, advice, or recommendations in, or which are otherwise mentioned in, the essay set forth below:

Walmart Inc. (WMT)

Consumer confidence is declining due to inflation, tariffs, and economic uncertainty.

AI is improving supply chains, reducing costs, and enhancing e-commerce efficiency.

AI could lead to lower prices and better services, but it may also impact jobs and competition.

Despite strong sales, Walmart’s cautious outlook on tariffs and inflation worried investors.

Businesses are investing in AI to streamline operations, improve decision-making, and remain competitive.

Written by the Market Insights Team

A worrying sign

Kevin Ford –FX & Macro Strategist

During a press conference yesterday, President Trump confirmed that tariffs on Canada and Mexico are ‘on time and on schedule’ to begin on March 4th, following the one-month pause. Markets are still hesitant to fully price in the threats and aren’t anticipating the tariffs will be imposed. Don’t be surprised if Trump lifts the tariff until the very last minute, as he did previously.

We’ve been trying to make sense of all the noise and commentary from President Trump. Initially, the tariffs were seen as a bargaining tool or a way to reduce the US deficit, but as time goes on, the motivation becomes clearer. Trump’s recent post on Social Truth spells trouble for Canada. It remains unclear whether the tariffs will apply only to Canada and Mexico, to steel and aluminum, to reciprocal tariffs, or to all of these. However, as the debt ceiling agreement deadline approaches on March 14th, the Trump administration is expected to push for its tax cut agenda, which includes revenue projections from tariffs and fiscal spending cuts from the newly established Department of Government Efficiency (DOGE).

The revenue projections from tariffs come from Commerce Secretary Howard Lutnick, who claimed that reciprocal tariffs could generate $700 billion annually. Also, Kevin Hassett, the director of the National Economic Council, estimated that a 10% levy on Chinese imports could yield between $500 billion and $1 trillion over 10 years. While Republicans see tariffs as a significant revenue source, these numbers alone seem far fetched from a macro point of view and will face challenges in congressional hearings.

So far, the US Senate has passed its $340 billion border bill, which excludes tax cuts. Meanwhile, the House is advocating for a single comprehensive bill that incorporates tax extensions and border spending. This bill has advanced through the Budget Committee, but only after making concessions to fiscal conservatives. The proposed bill is an extension of the 2017 tax cuts, which according to the proposed numbers, could cost $4.8 trillion over the next 10 years.

Starting the week, the Loonie began testing upward resistance levels at 1.425. In the absence of significant news, as we get closer to March 4th, it could again face upward pressure, pushing it to test the 20, 60, and 40-day SMAs resistance zone between 1.43 and 1.435.

Dip buyers save the day

Boris Kovacevic – Global Macro Strategist

Yesterday’s market session was split into two distinct phases, as investors began the week by selling risk assets amid growing concerns of a U.S. slowdown. Recession fears intensified following weaker-than-expected leading indicators from the Chicago and Dallas Federal Reserves. U.S. equities fell, bond yields plunged, and the dollar followed suit, pressured by deteriorating sentiment.

However, dip buyers stepped in during the U.S. session, helping equities and the Greenback recover some losses. Overall, the impact of the day’s news and data appeared to be net-neutral for markets. That said, recent growth concerns could become a bigger problem for risk assets if soft economic data persists, making secondary indicators increasingly important to monitor.

The dollar ended the day slightly lower after briefly touching its weakest level since mid-December. As we highlighted in our feature for Fortune, the dollar remains under pressure for two key reasons: the absence of new tariffs reducing safe-haven demand and the Fed’s pause being linked to rising inflation expectations rather than strong macro data. With recent data reaffirming these trends, the dollar has struggled to benefit from steady rates, currently sitting at its lowest level this year, down 3.4% from January’s peak.

For a meaningful rebound, dollar bulls will need either stronger U.S. economic data or renewed tariff enforcement by Trump. The latter could materialize today, as Trump reiterated overnight that tariffs on Canadian and Mexican goods will be implemented once the delay expires.

New government, old problems

Boris Kovacevic – Global Macro Strategist

The euro briefly climbed above $1.05, reaching its highest level in nearly a month before retreating to $1.0460. Investors see the potential for increased fiscal spending, particularly in defense, as a way to support economic activity. However, fiscal constraints may limit the impact, as political hurdles complicate efforts to boost spending. Meanwhile, business sentiment is showing cautious optimism, though immediate economic conditions remain subdued. We will continue to monitor political developments and key macro releases, as they will play a crucial role in shaping EUR/USD’s near-term direction.

Following the German election outcome, Chancellor-designate Friedrich Merz is actively engaging with the Social Democrats (SPD) to accelerate defense spending in response to escalating geopolitical tensions. However, the rise of fringe parties, securing a minority with blocking rights, has complicated efforts to amend the constitutional “debt brake”, which restricts government borrowing. To navigate these constraints, Merz is considering pushing reforms through the current parliament before the new session begins on March 24. These political maneuvers have added uncertainty to the euro’s performance, as markets assess their potential economic impact.

On the macro front, the Ifo Institute’s latest survey indicates a modest improvement in business expectations, with the index rising to 85.4 in February, up from 84.3 in January, and exceeding forecasts of 85.0. However, current conditions worsened, highlighting that while businesses are hopeful about the future, they continue to struggle with present challenges.

Pound running into resistance

Boris Kovacevic – Global Macro Strategist

The pound climbed to a nine-week high of $1.2690 before encountering resistance near $1.27. Strong UK data and persistent inflation in recent weeks continue to provide support, leaving room for further gains—especially if U.S. economic momentum slows in parallel.

However, geopolitical risks remain a key factor. Trump’s tariff agenda, while not directly targeting the UK, could disrupt global trade flows, particularly with China and the eurozone, leading to potential spillover effects for Britain. Meanwhile, elevated UK inflation still supports GBP, but a renewed rise in gilt yields—back toward January highs—could shift rate expectations from a tailwind to a headwind if fiscal concerns resurface.

This morning, the pound is trading in the lower $1.26 area, as a risk-off mood takes hold following Trump’s overnight comments. The administration is set to raise tariffs on major trading partners and is considering further restrictions on China’s access to advanced chips, adding fresh uncertainty to markets.

Dollar continues to decline

Table: 7-day currency trends and trading ranges

Key global risk events

Calendar: February 24-28

All times are in ET

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.