My System Is Flagging a Potential 50X Opportunity… Even in This Ugly Market

There’s no way to sugarcoat it. The market’s a disaster right now, folks.

The tariffs on Canada and Mexico, as well as the 20% tariffs on China, have sent the stock market spiraling lower in March. Even though President Trump backpedaled and postponed some of the tariffs on Canada and Mexico until April, it was too little, too late for many investors.

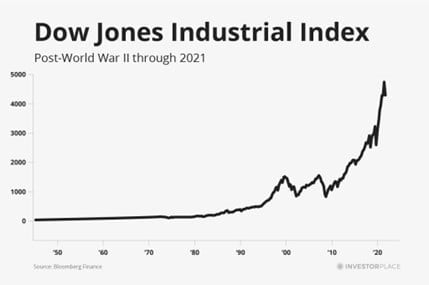

The S&P 500, Dow and NASDAQ have all erased their post-election gains. In fact, in the first six trading days of March alone, all three indices fell more than 4%.

Breaking news keeps jerking the market around, too. The markets fell this morning after President Trump announced even bigger tariffs on Canadian aluminum and steel – only to stage a rebound as news broke that Ukraine agreed to a 30-day ceasefire negotiated by the United States if Russia accepts the plan.

But believe it or not, a future billionaire is making their first move today.

George Washington once said that when you have a people who are “possessed by the spirit of Commerce,” they can achieve anything.

I don’t think our first president would realize just how true those words were.

Consider Jeff Bezos. At 30 years old, he quit a cushy Wall Street job to sell books online – at a time when most people barely used the internet.

Now, Amazon.com, Inc. (AMZN) dominates global commerce… and Bezos has a $215 billion net worth.

Or Bill Gates. He dropped out of Harvard to build software. Most people didn’t even own a computer back then.

Today, Microsoft Corporation (MSFT) is a $3 trillion giant… and Bill Gates is worth about $108 billion.

Mark Zuckerberg… Elon Musk… I could go on.

These guys weren’t lucky. They didn’t become billionaires overnight. They were talented, worked hard, and took advantage of life-changing opportunities whenever circumstances (or fate) came along.

They are the epitome of the American dream.

Now, I am no Bill Gates or Jeff Bezos. Frankly, I am also more of a “car guy” than a “rocket ship guy.”

However, I do like to say that my life story is also the embodiment of the American dream.

I wasn’t born with a silver spoon in my mouth. I’m the son of a stone mason and the first in my family to go to college. Today, I live a lavish lifestyle – and it’s all thanks to the market-beating system I created over four decades ago.

Believe it or not, I stumbled onto this system by accident when I “failed” a specific assignment at Cal State Hayward in the late ’70s.

So, in today’s Market 360, I want to tell you about the failed assignment that started it all for me. I’ll explain how it led me to create a system that would find some of the market’s biggest winners over the past few decades.

In fact, it helped me find NVIDIA Corporation (NVDA) when it was trading at just $1 (split-adjusted) in 2016. We all know what happened after that – the stock went up by more than 7,000% at its peak.

Then, I’ll wrap things up by telling you about the 50X profit opportunity my system is alerting me to today… and where you can learn more about it.

The “Failed” Assignment

Back in college at Cal State Hayward in the late ’70s, everyone believed it was impossible to beat the market without taking on excessive risk. “Sure,” many said, “some traders can be lucky for a while, but no one can consistently beat the market.”

Thankfully, an open-minded professor offered me the investing chance of a lifetime. He gave me unprecedented access to Wells Fargo’s mainframe computers to build my very own stock selection models. This was back when a computer took up the size of a room. They were prohibitively expensive for regular folks, so this was a tremendous privilege.

I spent countless hours learning how to read and research market data and built a stock selection model designed to mirror the S&P 500. But things didn’t turn out as I planned. When I ran the model, my returns came out considerably better than the S&P 500!

I had “failed” my assignment spectacularly.

I was stunned by the results. I double-checked the data, determined to get to the root of what happened.

I was able to decipher that a select group of stocks consistently outperformed the S&P 500 in my model. These were smaller, supercharged companies that all had certain factors in common: increasing sales growth, expanding operating margins, earnings growth, positive earnings momentum, positive earnings surprises, positive earnings revisions, free cash flow and return on equity.

I call these the Eight Fundamental Factors.

And it led me to build the system I use to this day: Stock Grader.

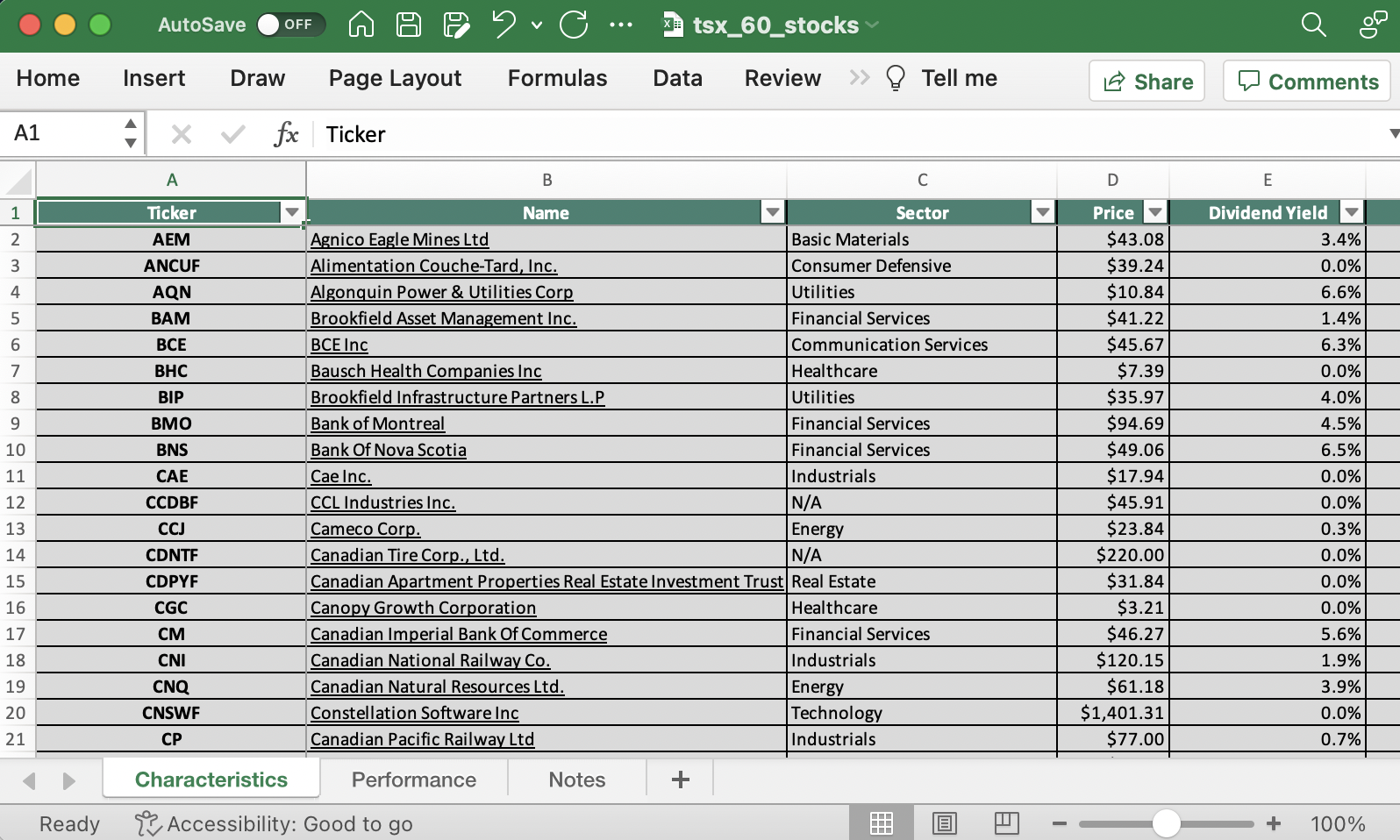

Stock Grader is my growth stock rating tool. It screens more than 6,000 stocks, interpreting reams of financial data each and every week. It’s powered by a version of the market-beating formula that I discovered more than 30 years ago.

Over the years, I’ve constantly tweaked the formula, adjusting the weighting of individual variables as needed. But the market-beating variables themselves have stayed the same.

While this system has grown much more sophisticated throughout the years, it remains the foundation of my own personal investing and my multidecade career managing money for clients and providing analysis and recommendations to individual investors.

Let me explain how it works…

Breaking Down My Ratings System

The Eight Fundamental Factors I mentioned – increasing sales growth, expanding operating margins, earnings growth, positive earnings momentum, positive earnings surprises, positive earnings revisions, free cash flow and return on equity – make up a stock’s Fundamental Grade.

The other important factor my Stock Grader tracks is institutional buying pressure, or what I call the Quantitative Grade. You can think of this as “following the money.” The more money that floods into a stock, the more momentum a stock has, and vice versa.

Stock Grader will blend the Fundamental and Quantitative Grades and give a Total Grade of A to F. You can think of these as the letter grades you’d receive in school.

A stock with the highest growth and business quality ratings gets an “A.”

A stock with miserable ratings gets an “F.”

The 50X Profit Opportunity My System Is Alerting Me to Now

With Stock Grader, I have been able to identify some of the biggest wins of my career… jumping into the stocks before they take off.

Just last year it led me to big winners, like…

- A whopping 593% gain on a partial sell of Super Micro Computer, Inc. (SMCI),

- A 159% win on a partial sell of Rambus, Inc. (RMBS) in 16 months,

- A 152% profit in CECO Environmental Corp. (CECO),

- And a 46% return on Gatos Silver, Inc. (GATO) in just one month.

But the winner I am most proud of is NVIDIA, which I recommended when it was trading at $1 (split-price adjusted) in 2016.

However, now my system is flagging another stock that I believe could be the next NVIDIA with 50X profit potential. This is a small-cap stock protected by 102 patents with close ties to NVIDIA.

And here’s why the timing couldn’t be better…

See, I think something big is about to happen.

For weeks, NVIDIA CEO Jensen Huang has been downplaying quantum computing, calling it decades away.

But now, NVIDIA is hosting an entire Quantum Day (or what I like to call “Q Day”) event on March 20.

Why?

I believe NVIDIA is about to stake its claim in the quantum computing space. And when it does, this little-known top pick could erupt overnight.

That’s why I’m hosting my own event one week before Q-Day, this Thursday, March 13, at 1 p.m. Eastern.

This is where I’ll reveal everything you need to know about Q-Day – including details on my No. 1 stock pick that could explode in the wake of NVIDIA’s announcement.

I know this market is terrible, folks. It hurts.

However, NVIDIA’s Q Day should be the catalyst that turns this market around… and I expect the stocks that rate highly in my Stock Grader (including the one that could benefit from the event) to bounce like fresh tennis balls when it does. So, hang on. There is a light at the end of the tunnel.

Click here to reserve your spot now.

I look forward to you joining me on Thursday.

Sincerely,

Louis

The Editor hereby discloses that as of the date of this email, the Editor, directly or indirectly, owns the following securities that are the subject of the commentary, analysis, opinions, advice, or recommendations in, or which are otherwise mentioned in, the essay set forth below:

CECO Environmental Corp. (CECO), NVIDIA Corporation (NVDA) and Super Micro Computer, Inc. (SMCI)