Technology’s Creepy Next Step | InvestorPlace

Technology’s spooky next step … enormous potential market size … the easiest way to invest today … nervous about a market crash? Keith Kaplan has you covered

In the pantheon of business/investing clichés, high on the list is the phrase immortalized by hockey legend Wayne Gretzky:

I skate to where the puck is going, not where it has been.

The quote has been recycled and mangled by countless investment professionals in PowerPoint presentations for years.

However, it accurately reflects how wise investors set themselves up for life-changing investment returns.

So, where is the puck going today?

Here’s a clue from Tesla CEO Elon Musk:

“[This cutting-edge technology product] will be overwhelmingly the value of the company” with “the potential to be north of $10 trillion in revenue.”

Got your guess?

Sci-Fi meets real life

Congrats if you answered “humanoids.”

Humanoids are advanced robotic machines that can mirror human movements, reasoning, and day-to-day activities. They sit at the convergence of multiple technological trends: AI, biomechanics, machine learning and sensor connectivity.

Whether you think they’re cool or creepy, they’re coming…and bringing with them a multi-trillion-dollar investment opportunity.

Let’s jump to our technology expert, Luke Lango:

These creations are finally stepping out of science fiction and into reality, possibly poised to become the most disruptive AI advancement yet.

From factory floors to elder care, these machines could easily reshape industries, redefine labor… maybe even challenge what it means to be human…

Everyone who’s anyone in the tech world is betting on humanoid robots being the next big AI breakthrough.

Tesla’s Optimus humanoid is the most visible example. And as noted earlier, Musk believes the future of Tesla isn’t in electric cars, it’s in humanoids.

Source: @Tesla

Optimus is already being used inside Tesla factories to complete a variety of tasks. Reports suggest Tesla will sell them to outside companies next year.

And after that, they’re headed to a household near you.

Here’s Luke:

We could soon have our own personal humanoid robot assistant in our homes, doing everything from unloading groceries and cleaning to safeguarding our house while we’re away.

It’s not just Tesla – all the Big Tech players are moving on humanoids

Luke points toward, Meta, Apple, Alphabet, Nvidia, and OpenAI as just a few of the companies working on aspects of humanoid technology.

Meanwhile, many private companies are involved as well. A Polish startup called Clone Robotics just released a video of “Protoclone.” This is its “faceless, anatomically accurate synthetic human.”

Source: @clonerobotics

Whether this thrills or terrifies you, some version of it is headed your way over the next 5-10 years.

Sizing the market potential

Let’s go to ETF provider and research shop, GlobalX:

The potential market opportunity for humanoids is massive, and it’s accelerating.

Tesla CEO Elon Musk and industry stakeholders believe there could be over 1 billion humanoids on Earth by the 2040s.

While adoption of single-purpose collaborative robots (cobots) is already widespread in industrial settings, the potential of general-purpose humanoid robotics remains largely untapped, with their appeal being their versatility.

Humanoids are now a tangible reality, capable of working in diverse settings like hazardous factories, and elderly homes, bringing innovative solutions to sectors like logistics, manufacturing, and healthcare.

Given the widespread potential use cases for industrial humanoids, GlobalX puts the total industrial addressable market size at nearly $2 trillion over the next decade.

But the market for household humanoids could be even bigger. GlobalX estimates 15% household penetration and a price point of $10,000 – $15,000. That results in a market size of almost $3 trillion by 2035.

So, how do you invest?

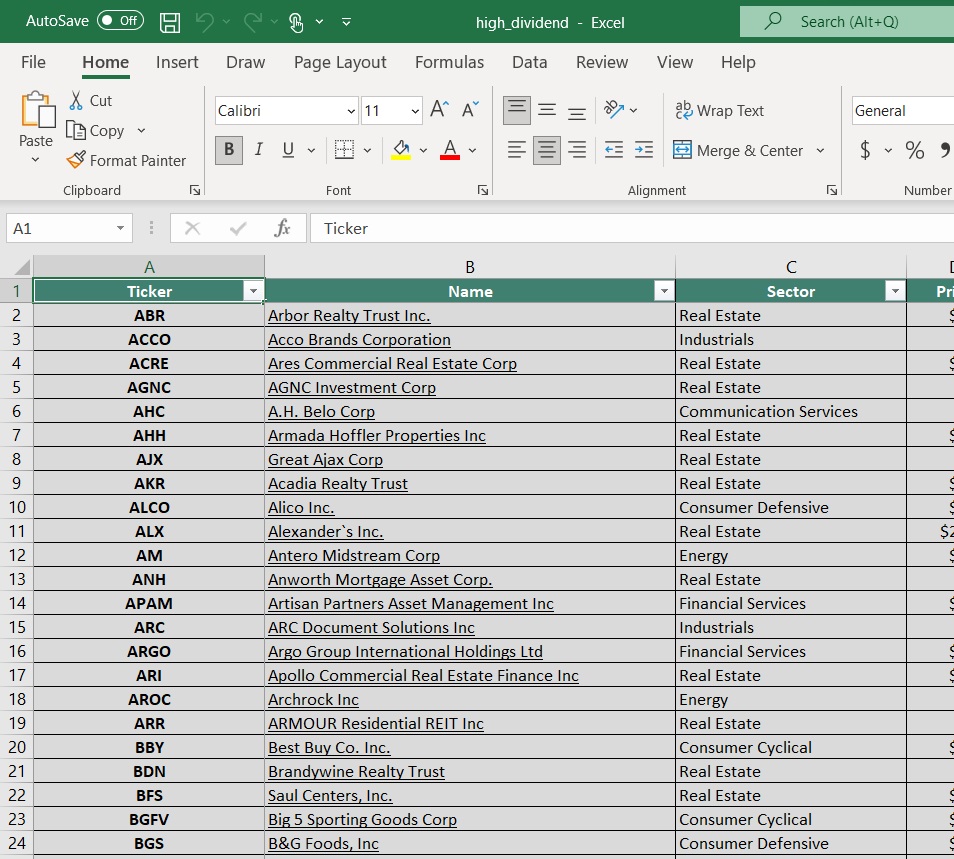

We profiled the easiest way to invest back in September.

Regular Digest readers will recall an issue in which I shared part of an internal email from InvestorPlace’s CEO Brian Hunt to a few members of our leadership team.

Brian described the technological advancements coming (like humanoids), the potential for market volatility, but the even greater potential to make enormous wealth over the next five to 10 years.

With that as our context, here’s Brian from that email with the most effortless way to ride this trend:

If you want to make it simple, easy, and powerful, just look up the five largest AI/robotics ETFs and buy them in equal parts and go to sleep for a while. Maybe throw in some QQQ.

Ignore the corrections. They will be painful but temporary.

This tailwind will blow with hurricane force.

As our experts make their single-stock humanoid recommendations over the coming quarters, we’ll highlight them for you. For now, Luke is eyeing the next step in the evolution toward humanoids – self-driving cars:

The next stage of the AI Revolution has begun.

But it’s about more than just humanoid robots unloading groceries or doing factory work. It also includes robotic driving systems – like self-driving cars.

This future may still seem many years away. But it’s already a reality… Of course, the arrival of the Age of Autonomous Vehicles also means the arrival of huge opportunities in AV stocks.

If you’d like a deeper dive into the opportunity, Luke just put together a special informational presentation focused solely on the Autonomous Vehicle Revolution. You can check it out here.

What if you can’t handle the market corrections that Brian referenced?

Not everyone has a decade-long investment horizon.

What if you’re a few years from retirement and can’t afford the type of painful pullback Brian referenced?

What if you’re saving for a downpayment on a home, or a child’s tuition, or an aging parent’s healthcare needs, and you can’t absorb a haircut of, say, 30% on your capital?

You need a tool to help you sidestep the worst of a bear market crash. And that’s where the quant-based market tools from our corporate partner, TradeSmith, come in.

Here’s a quick story from TradeSmith’s CEO Keith Kaplan to illustrate:

It was early 2020 and I had flown to Florida to meet with a group of 50 of my peers where each of us pitched our best and biggest investment ideas.

When it was my turn, I told them all “I sold almost all my stocks on Friday.”

As you would imagine, I was not the most popular person in the room.

I urged people to protect their investments and consider warning their subscribers that a bear market was rapidly approaching.

I even showed them proof of how I knew we were headed toward the fastest bear market in history — one that would catch everyone by surprise and destroy years of wealth building.

I showed them the alerts I received and then how accurate these alerts have been over the last 20 years.

I was laughed at and told not to panic. Not a single person in the room wanted to hear what I had to say.

But anyone who acted on my systems advice saved their portfolio.

Keith was using a quant-based trading tool that sent him “bear market” alerts.

Here’s an example of what he saw on Friday February 27, 2020…

…which was shortly before the S&P 500 suffered its steepest plunge in the Covid crash…

In 2020, my personal portfolio was saved a huge loss thanks to the indicators I got.

Next Thursday at 8 PM ET, Keith is holding an event to explain how this tool works, and how it could help protect your wealth from a similar crash

If protecting the money that you already have is as important as generating new investment gains, this event is for you.

That said, I’ll point out that this same tool works in reverse – notifying investors when to buy back in after a crash.

Returning to Keith, here he is describing what happened not long after those sell alerts arrived:

Just a month later, our indicators did it again, alerting me to a bullish set up in the markets.

By this time the CNN Fear and Greed Index had plummeted to extreme fear and people were nervous.

Heck, I was nervous!

But again, I trusted the math and these signals, and I took action. I started gobbling up stocks that had big pullbacks and were noted “healthy” in our system by their green designation.

Boy was that the right decision!

As you know, the S&P would go on to soar nearly 70% from its March 2020 low through the end of that year.

Source: TradingView

I’ll bring you more on TradeSmith’s market timing tool over the next few days, but to reserve your seat for next Thursday’s presentation right now, click here.

During the event, Keith will walk through how this tool helps you know:

- When to buy a stock

- How much of a stock to buy

- When to sell a stock

- And how risky that stock is – how much movement you should expect

He’s also going to unveil the biggest market prediction in his company’s 20-year history.

It’s all next Thursday at 8 PM ET.

More on this to come…

In the meantime, start looking into humanoids. It’s going to be a big one.

Have a good evening,

Jeff Remsburg