Updated on March 5th, 2025 by Bob Ciura

Monthly dividend stocks have instant appeal for many income investors. Stocks that pay their dividends each month offer more frequent payouts than traditional quarterly or semi-annual dividend payers.

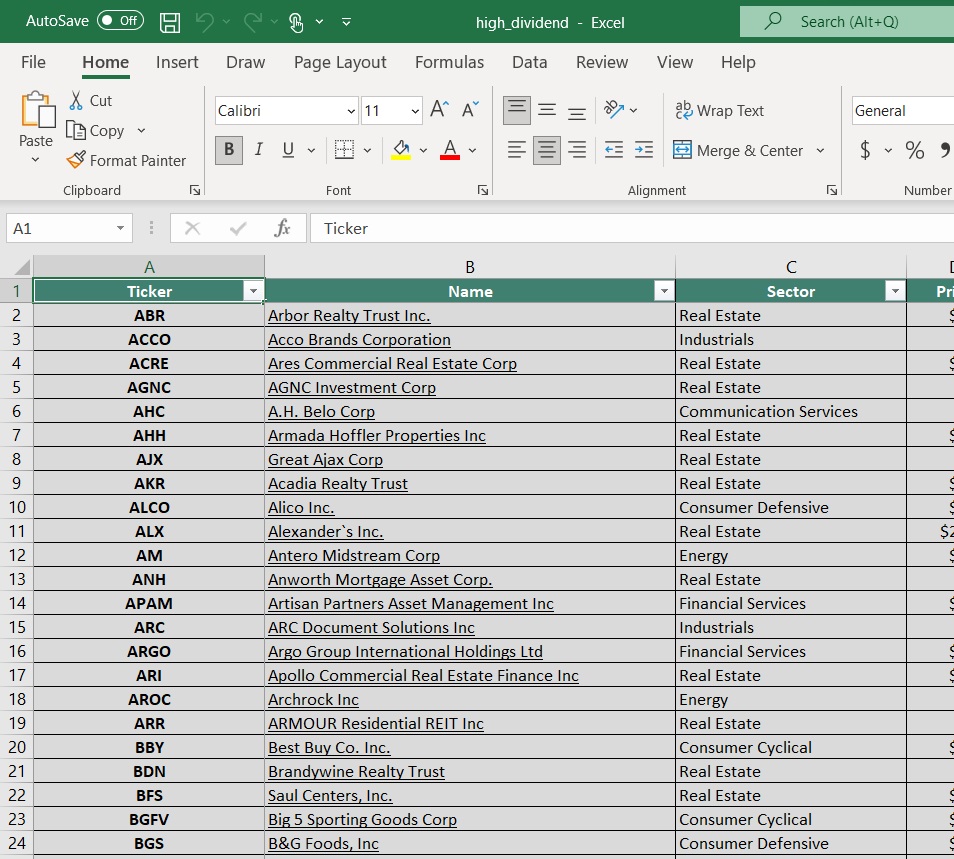

For this reason, we created a full list of ~80 monthly dividend stocks.

You can download our full Excel spreadsheet of all monthly dividend stocks (along with metrics that matter like dividend yield and payout ratio) by clicking on the link below:

In addition, stocks that have high dividend yields are also attractive for income investors.

With the average S&P 500 yield hovering around 1.3%, investors can generate much more income with high-yield stocks. Screening for monthly dividend stocks that also have high dividend yields makes for an appealing combination.

This article will list the 20 highest-yielding monthly dividend stocks.

Table Of Contents

The following 20 monthly dividend stocks have high dividend yields above 5%. Stocks are listed by their dividend yields, from lowest to highest.

The list excludes oil and gas royalty trust, which have extreme fluctuations in their dividend payouts from one quarter to the next due to the underlying volatility of commodity prices.

The list also only includes U.S.-based companies.

You can instantly jump to an individual section of the article by utilizing the links below:

High-Yield Monthly Dividend Stock #20: LTC Properties (LTC)

LTC Properties is a REIT that invests in senior housing and skilled nursing properties. Its portfolio consists of approximately 50% senior housing and 50% skilled nursing properties.

The REIT owns 194 investments in 26 states, with 31 operating partners.

Source: Investor Presentation

In late February, LTC reported (2/24/25) financial results for the fourth quarter of fiscal 2024. Funds from operations (FFO) per share dipped -8% over the prior year’s quarter, from $0.72 to $0.66, and missed the analysts’ consensus by $0.01.

The decrease in FFO per share resulted primarily from impairment losses. LTC improved its leverage ratio (Net Debt to EBITDA) from 4.7x to 4.3x thanks to various asset sales.

Click here to download our most recent Sure Analysis report on LTC (preview of page 1 of 3 shown below):

High-Yield Monthly Dividend Stock #19: EPR Properties (EPR)

EPR Properties is a specialty real estate investment trust, or REIT, that invests in properties in specific market segments that require industry knowledge to operate effectively.

It selects properties it believes have strong return potential in Entertainment, Recreation, and Education. The portfolio includes about $7 billion in investments across 340+ locations in 44 states, including over 200 tenants.

Source: Investor Presentation

EPR posted fourth quarter and full-year earnings on February 26th, 2025, and results were better than expected on both the top and bottom lines.

Funds-from-operations came to $1.23, which was a penny ahead of estimates. Revenue was up 3% to $177 million, beating estimates by $16 million.

Adjusted FFO per-share was down from $1.29 in Q3, but higher from $1.16 in the year-ago period. Revenue was also down from Q3, but higher from the year-ago period.

Property operating expenses were $15.2 million, higher from $14.6 million in Q3, and $14.8 million a year ago. Adjusted EBITDAre of $136 million was lower from $143 million in Q3, but higher from $129 million last year.

Click here to download our most recent Sure Analysis report on EPR (preview of page 1 of 3 shown below):

High-Yield Monthly Dividend Stock #19: Apple Hospitality REIT (APLE)

Apple Hospitality REIT is a hotel REIT that owns a portfolio of hotels with tens of thousands of rooms located across dozens of states.

It franchises its properties out to leading brands, including Marriottbranded hotels, Hilton-branded hotels, and Hyatt-branded hotels.

Source: Investor Presentation

Since it first began reporting FFO/share in its annual reports (2011), Apple initially generated very impressive annualized FFO/share growth thanks to its growing scale (due in large part to a merger in 2015), effective and efficient business model, and strong economic tailwinds in the United States during that period.

Typically, during a recessionary period, hotel REITs experience significant losses of income. Therefore, Apple is likely not very recession resistant.

However, its concentration in strong brand names, excellent locations, strong balance sheet, franchising model, and emphasis on value should enable it to outperform its peers in a recession.

Click here to download our most recent Sure Analysis report on APLE (preview of page 1 of 3 shown below):

High-Yield Monthly Dividend Stock #18: Gladstone Capital (GLAD)

Gladstone Capital is a business development company, or BDC, that primarily invests in small and medium businesses. These investments are made via a variety of equity (10% of portfolio) and debt instruments (90% of portfolio), generally with very high yields.

Loan size is typically in the $7 million to $30 million range and has terms up to seven years.

Gladstone posted first quarter earnings on February 12th, 2025, and results were weaker than expected. Earnings-per-share came to 50 cents, well short of the estimate for 65 cents.

Total investment income, which is akin to revenue, was down $1.8 million, or 7.4%, year-over-year. Compared to the September quarter, total investment income fell by $2.1 million.

The net increase in net assets resulting from operations was $27 million, or $1.21 per share. This was lower than the $31.8 million, or $1.46 per share, gain in the September quarter.

Gladstone noted $152 million in new fundings for the quarter, including six new portfolio companies. Exits and prepayments were $165 million, so net new funding was -$13 million. Total debt investments rose by $45 million during the quarter.

Click here to download our most recent Sure Analysis report on GLAD (preview of page 1 of 3 shown below):

High-Yield Monthly Dividend Stock #17: Gladstone Investment Corporation (GAIN)

Gladstone Investment is a business development company (BDC) that focuses on US-based small- and medium-sized companies.

Industries which Gladstone Investment targets include aerospace & defense, oil & gas, machinery, electronics, and media & communications.

Gladstone Investment reported its third quarter (Q3 2024 ended December 31) earnings results on February 13. The company generated total investment income – Gladstone Investment’s revenue equivalent – of $21.4 million during the quarter, which represents a decline of 7% compared to the prior year’s quarter.

This was a weaker performance compared to the previous quarter, when the growth rate was positive.

Gladstone Investment’s adjusted net investment income-per-share totaled $0.23 during the fiscal third quarter. That was up slightly from the previous quarter’s level.

Gladstone Investment‘s net asset value per share totaled $13.30 on a per-share basis at the end of the quarter.

Click here to download our most recent Sure Analysis report on GAIN (preview of page 1 of 3 shown below):

High-Yield Monthly Dividend Stock #16: Gladstone Commercial (GOOD)

Gladstone Commercial Corporation is a real estate investment trust, or REIT, that specializes in single-tenant and anchored multi-tenant net leased industrial and office properties across the U.S.

The trust targets primary and secondary markets that possess favorable economic growth trends, growing populations, strong employment, and robust growth trends.

The trust’s stated goal is to pay shareholders monthly distributions, which it has done for more than 17 consecutive years. Gladstone owns over 100 properties in 24 states that are leased to about 100 unique tenants.

Gladstone posted fourth quarter and full-year earnings on February 18th, 2025, and results were somewhat weak. Funds-from-operations per share came to 35 cents, which met expectations. Revenue was $37.4 million, which missed estimates by $0.66 million. The slight move up in revenue was driven by higher straight-line rents.

Same-store rents were up 5% year-over-year, which was supported by increased straight-line rent rates and recovery revenue. Operating expenses were down to $25 million from $28.1 million a year ago, partially due to reduced impairment charges.

Click here to download our most recent Sure Analysis report on GOOD (preview of page 1 of 3 shown below):

High-Yield Monthly Dividend Stock #15: Modiv Industrial (MDV)

Modiv Industrial acquires, owns, and actively manages single-tenant net-lease industrial, retail, and office properties in the United States, focusing on strategically essential and mission-critical properties with predominantly investment-grade tenants.

As of its most recent filings, the company’s portfolio comprised 43 properties that occupied 4.5 million square feet of aggregate leasable area.

On March 4th, 2025, Modiv reported its Q4 and full-year results for the period ending December 31st, 2024. For the quarter, rental income came in at $11.7 million, down 4.8% year-over-year.

This was mainly due to the elimination of some non-NNN tenant reimbursements related to the August 2023 portfolio disposition of 13 properties.

Management fee income also fell from $99 thousand to $66 thousand. Thus, total income was $11.7 million, down 5.3% from $12.4 million last year.

AFFO was $4.1 million, or $0.37 per diluted share, down from AFFO of $4.5 million, or $0.40 per diluted share last year.

For the year, AFFO per share was $1.34. For FY2025, we expect AFFO per share of $1.38 based on the company’s current leasing profile.

Click here to download our most recent Sure Analysis report on MDV (preview of page 1 of 3 shown below):

High-Yield Monthly Dividend Stock #14: Itau Unibanco (ITUB)

Itaú Unibanco Holding S.A. is headquartered in Sao Paulo, Brazil. The bank has operations across South America and other places like the United States, Portugal, Switzerland, China, Japan, etc.

On November 5th, 2024, Itaú Unibanco reported third-quarter results for 2024. The company reported recurring managerial result for the third quarter of 2024 was approximately $2.1 billion USD, reflecting a 6.0% increase from the previous quarter.

The recurring managerial return on equity stood at 22.7% on a consolidated basis and 23.8% for operations in Brazil. Total assets grew by 2.6%, surpassing $590 billion USD, while the loan portfolio increased by 1.9% globally and 2.1% in Brazil for the quarter, with year-on-year growth rates of 9.9% and 10.0%, respectively.

Key drivers included personal, vehicle, and mortgage loans, which saw quarterly growth rates of 3.1%, 3.0%, and 3.9%, respectively.

Click here to download our most recent Sure Analysis report on ITUB (preview of page 1 of 3 shown below):

High-Yield Monthly Dividend Stock #13: Fortitude Gold (FTCO)

Fortitude Gold is a junior gold producer with operations in Nevada, U.S.A, one of the world’s premier mining friendly jurisdictions. The company targets high-grade gold open pit heap leach operations averaging one gram per tonne of gold or greater.

Its property portfolio currently consists of 100% ownership in six high-grade gold properties. All six properties are within an approximate 30-mile radius of one another within the prolific Walker Lane Mineral Belt.

Source: Investor Presentation

On November 5th, 2024, Fortitude Gold released its Q3 results for the period ending September 30st, 2024. For the quarter, revenues came in at $10.2 million, 52% lower compared to last year.

The decline in revenues was primarily due to a 62% drop in gold sales volume and a 54% decrease in silver sales volume. However, these reductions were partially offset by a 26% increase in gold prices and a 23% rise in silver prices.

Click here to download our most recent Sure Analysis report on FTCO (preview of page 1 of 3 shown below):

High-Yield Monthly Dividend Stock #11: Stellus Capital (SCM)

Stellus Capital Management provides capital solutions to companies with $5 million to $50 million of EBITDA and does so with a variety of instruments, the majority of which are debt.

Stellus provides first lien, second lien, mezzanine, convertible debt, and equity investments to a diverse group of customers, generally at high yields, in the US and Canada.

Source: Investor Presentation

Stellus posted third quarter earnings on November 7th, 2024, and results were quite weak on both the top and bottom lines. Net investment income, which is similar to earnings-per-share, came to 40 cents.

This was four cents light of estimates, or about 9%. Total investment income was $26.5 million, down 2.5% year-over-year, and missing estimates by $1.34 million.

Gross operating expenses were $16.2 million, which was essentially flat year-over-year. Base management fees totaled $3.9 million for this year’s Q3 and the same period a year ago.

Click here to download our most recent Sure Analysis report on Stellus (preview of page 1 of 3 shown below):

High-Yield Monthly Dividend Stock #10: Ellington Financial (EFC)

Ellington Financial Inc. acquires and manages mortgage, consumer, corporate, and other related financial assets in the United States.

The company acquires and manages residential mortgage–backed securities (RMBS) backed by prime jumbo, Alt–A, manufactured housing, and subprime residential mortgage loans.

Source: Investor Presentation

Additionally, it manages RMBS, for which the U.S. government guarantees the principal and interest payments. It also provides collateralized loan obligations, mortgage–related and non–mortgage–related derivatives, equity investments in mortgage originators and other strategic investments.

On November 6th, 2024, Ellington Financial reported its Q3 results for the period ending September 30th, 2024. Adjusted (previously referred to as “core”) EPS came in at $0.40, seven cents higher versus Q2-2024.

The rise was driven in part by a sizeable contribution from Ellington’s proprietary reverse mortgage strategy, offset by a higher share count. Ellington’s book value per share fell from $13.92 to $13.66 during the last three months.

Click here to download our most recent Sure Analysis report on Ellington Financial (EFC) (preview of page 1 of 3 shown below):

High-Yield Monthly Dividend Stock #9: PennantPark Floating Rate Capital (PFLT)

PennantPark Floating Rate Capital Ltd. is a business development company that seeks to make secondary direct, debt, equity, and loan investments.

The fund also aims to invest through floating rate loans in private or thinly traded or small market-cap, public middle market companies, equity securities, preferred stock, common stock, warrants or options received in connection with debt investments or through direct investments.

On November 26, 2024, PennantPark Floating Rate Capital reported strong results for the fourth fiscal quarter of 2024, with core net investment income of $0.32 per share. The portfolio grew 20% quarter-over-quarter, reaching $2 billion as the firm deployed $446 million across 10 new and 50 existing companies.

Investments carried an average yield of 11%, reflecting the continued strength of the middle market lending environment. After the quarter, PFLT remained active, investing an additional $330 million at a yield of 10.2%.

Click here to download our most recent Sure Analysis report on PFLT (preview of page 1 of 3 shown below):

High-Yield Monthly Dividend Stock #8: Prospect Capital (PSEC)

Prospect Capital Corporation is a Business Development Company, or BDC, that provides private debt and private equity to middle–market companies in the U.S.

The company focuses on direct lending to owner–operated companies, as well as sponsor–backed transactions. Prospect invests primarily in first and second lien senior loans and mezzanine debt, with occasional equity investments.

Source: Investor Presentation

Prospect posted first quarter earnings on November 8th, 2024, and results were weak. However, the big news was a 25% dividend cut. Prospect reduced its payout to 54 cents per share annually, sending the stock reeling.

Net investment income was 21 cents per share in Q1, and revenue was $196 million. That was down 17% year-over-year.

The company is in the midst of rotating its strategy to emphasize first lien senior secured lending instead of real estate investments and collateralized loan obligations, or CLOs.

Click here to download our most recent Sure Analysis report on PSEC (preview of page 1 of 3 shown below):

High-Yield Monthly Dividend Stock #7: Horizon Technology (HRZN)

Horizon Technology Finance Corp. is a BDC that provides venture capital to small and medium–sized companies in the technology, life sciences, and healthcare–IT sectors.

The company has generated attractive risk–adjusted returns through directly originated senior secured loans and additional capital appreciation through warrants.

Source: Investor Presentation

On October 29th, 2024, Horizon released its Q3 results for the period ending September 30th, 2024. For the quarter, total investment income fell 15.5% year-over-year to $24.6.7 million, primarily due to lower interest income on investments from the debt investment portfolio.

More specifically, the company’s dollar-weighted annualized yield on average debt investments in Q3 of 2024 and Q3 of 2023 was 15.9% and 17.1%, respectively.

Net investment income per share (IIS) fell to $0.32, down from $0.53 compared to Q3-2023. Net asset value (NAV) per share landed at $9.06, down from $9.12 sequentially.

After paying its monthly distributions, Horizon’s undistributed spillover income as of June 30th, 2024 was $1.27 per share, indicating a considerable cash cushion.

Click here to download our most recent Sure Analysis report on HRZN (preview of page 1 of 3 shown below):

High-Yield Monthly Dividend Stock #6: AGNC Investment Corporation (AGNC)

American Capital Agency Corp is a mortgage real estate investment trust that invests primarily in agency mortgage–backed securities (or MBS) on a leveraged basis.

The firm’s asset portfolio is comprised of residential mortgage pass–through securities, collateralized mortgage obligations (or CMO), and non–agency MBS. Many of these are guaranteed by government–sponsored enterprises.

Source: Investor Presentation

AGNC Investment Corp. reported strong financial results for the third quarter ended September 30, 2024. The company achieved a comprehensive income of $0.63 per common share, driven by a net income of $0.39 and other comprehensive income of $0.24 from marked-to-market investments.

Net spread and dollar roll income contributed $0.43 per share. The tangible net book value increased by $0.42 per share to $8.82, reflecting a 5.0% growth from the previous quarter.

AGNC declared dividends of $0.36 per share, resulting in a 9.3% economic return on tangible common equity, which includes both dividends and the increase in net book value.

Click here to download our most recent Sure Analysis report on AGNC Investment Corp (AGNC) (preview of page 1 of 3 shown below):

High-Yield Monthly Dividend Stock #5: Dynex Capital (DX)

Dynex Capital invests in mortgage–backed securities (MBS) on a leveraged basis in the United States. It invests in agency and non–agency MBS consisting of residential MBS, commercial MBS (CMBS), and CMBS interest–only securities.

Source: Investor Presentation

Dynex Capital released its fourth-quarter 2024 financial results, with book value ending the quarter at $12.70 per share and an economic return of 7.4% for the year.

Leverage increased slightly to 7.9x as the company deployed capital into higher-yielding agency RMBS, particularly 30-year 4.5%, 5%, and 5.5% coupons.

The shift from treasury futures to interest rate swaps was a key strategy, enhancing portfolio returns by 200 to 300 basis points and improving net interest spread.

Click here to download our most recent Sure Analysis report on DX (preview of page 1 of 3 shown below):

High-Yield Monthly Dividend Stock #4: Oxford Square Capital (OXSQ)

Oxford Square Capital Corp. is a BDC specializing in financing early and middle–stage businesses through loans and CLOs.

The company holds an equally split portfolio of First–Lien, Second–Lien, and CLO equity assets spread across multiple industries, with the highest exposure in software and business services.

Source: Investor Presentation

On November 5th, 2024, Oxford Square reported its Q3 results for the period ending September 30th, 2024. For the quarter, the company generated about $10.3 million of total investment income, down from $11.4 million in the previous quarter.

This was due to lower interest income from its debt investments and lower income from its securitization vehicles.

Further, the weighted average yield of the company’s debt investments was 13.7% at current cost, down from 13.9% in the previous quarter.

Still, the weighted average cash distribution yield of the company’s cash income producing CLO equity investments at current rose notably from 13.7% to 14.5%.

Click here to download our most recent Sure Analysis report on OXSQ (preview of page 1 of 3 shown below):

High-Yield Monthly Dividend Stock #3: Ellington Credit Co. (EARN)

Ellington Credit Co. acquires, invests in, and manages residential mortgage and real estate related assets. Ellington focuses primarily on residential mortgage-backed securities, specifically those backed by a U.S. Government agency or U.S. government–sponsored enterprise.

Agency MBS are created and backed by government agencies or enterprises, while non-agency MBS are not guaranteed by the government.

Source: Investor Presentation

On November 12th, 2024, Ellington Residential reported its third quarter results for the period ending September 30th, 2024. The company generated net income of $5.4 million, or $0.21 per share.

Ellington achieved adjusted distributable earnings of $7.2 million in the quarter, leading to adjusted earnings of $0.28 per share, which covered the dividend paid in the period.

Net interest margin was 5.22% overall. At quarter end, Ellington had $25.7 million of cash and cash equivalents, and $96 million of other unencumbered assets.

Click here to download our most recent Sure Analysis report on EARN (preview of page 1 of 3 shown below):

High-Yield Monthly Dividend Stock #2: ARMOUR Residential REIT (ARR)

ARMOUR Residential invests in residential mortgage-backed securities that include U.S. Government-sponsored entities (GSE) such as Fannie Mae and Freddie Mac.

It also includes Ginnie Mae, the Government National Mortgage Administration’s issued or guaranteed securities backed by fixed-rate, hybrid adjustable-rate, and adjustable-rate home loans.

Unsecured notes and bonds issued by the GSE and the US Treasury, money market instruments, and non-GSE or government agency-backed securities are examples of other types of investments.

Source: Investor presentation

On October 23, 2024, ARMOUR Residential REIT announced its unaudited third-quarter 2024 financial results, reporting a GAAP net income available to common stockholders of $62.9 million, or $1.21 per common share. The company generated a net interest income of $1.8 million and distributable earnings of $52.0 million, equivalent to $1.00 per common share.

ARMOUR achieved an average interest income of 4.89% on interest-earning assets and an interest cost of 5.51% on average interest-bearing liabilities. The economic net interest spread stood at 2.00%, calculated from an economic interest income of 4.44% minus an economic interest expense of 2.44%.

During the quarter, ARMOUR raised $129.4 million by issuing 6,413,735 shares of common stock through an at-the-market offering program and paid common stock dividends of $0.72 per share for Q3.

Click here to download our most recent Sure Analysis report on ARMOUR Residential REIT Inc (ARR) (preview of page 1 of 3 shown below):

High-Yield Monthly Dividend Stock #1: Orchid Island Capital (ORC)

Orchid Island Capital is a mortgage REIT that is externally managed by Bimini Advisors LLC and focuses on investing in residential mortgage-backed securities (RMBS), including pass-through and structured agency RMBSs.

These financial instruments generate cash flow based on residential loans such as mortgages, subprime, and home-equity loans.

Source: Investor Presentation

The company reported a net income of $17.3 million, or $0.24 per common share, significantly improving from a net loss of $80.1 million in the same quarter last year. This net income comprised $0.3 million in net interest income and $4.3 million in total expenses.

Additionally, Orchid recorded net realized and unrealized gains of $21.2 million, or $0.29 per common share, from Residential Mortgage-Backed Securities (RMBS) and derivative instruments, including interest rate swaps.

Click here to download our most recent Sure Analysis report on Orchid Island Capital, Inc. (ORC) (preview of page 1 of 3 shown below):

Final Thoughts

Monthly dividend stocks could be more appealing to income investors than quarterly or semi-annual dividend stocks. This is because monthly dividend stocks make 12 dividend payments per year, instead of the usual 4 or 2.

Furthermore, monthly dividend stocks with high yields above 5% are even more attractive for income investors.

The 20 stocks on this list have not been vetted for dividend safety, meaning each investor should understand the unique risk factors of each company.

That said, these 20 dividend stocks make monthly payments to shareholders, and all have high dividend yields.

Further Reading

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

Monthly Dividend Stock Individual Security Research

Other Sure Dividend Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].