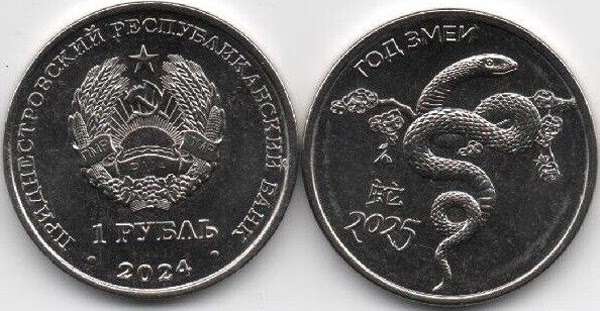

“Year of the Snake 2025“

TECHNICAL DATA

Composition: nickel plated steel

Diameter: 22.00 mm

Weight: 4.65 g

(image from eBay seller lemberg-zp)

New bimetallic commemorative:

“72nd Police Day“

TECHNICAL DATA

External ring: nickel plated steel

Center disc: brass plated steel

Diameter: 25.00 mm

Weight: 8.50 g

Thickness: 2.5 mm

(news from Eddy Reynaert)

Source link

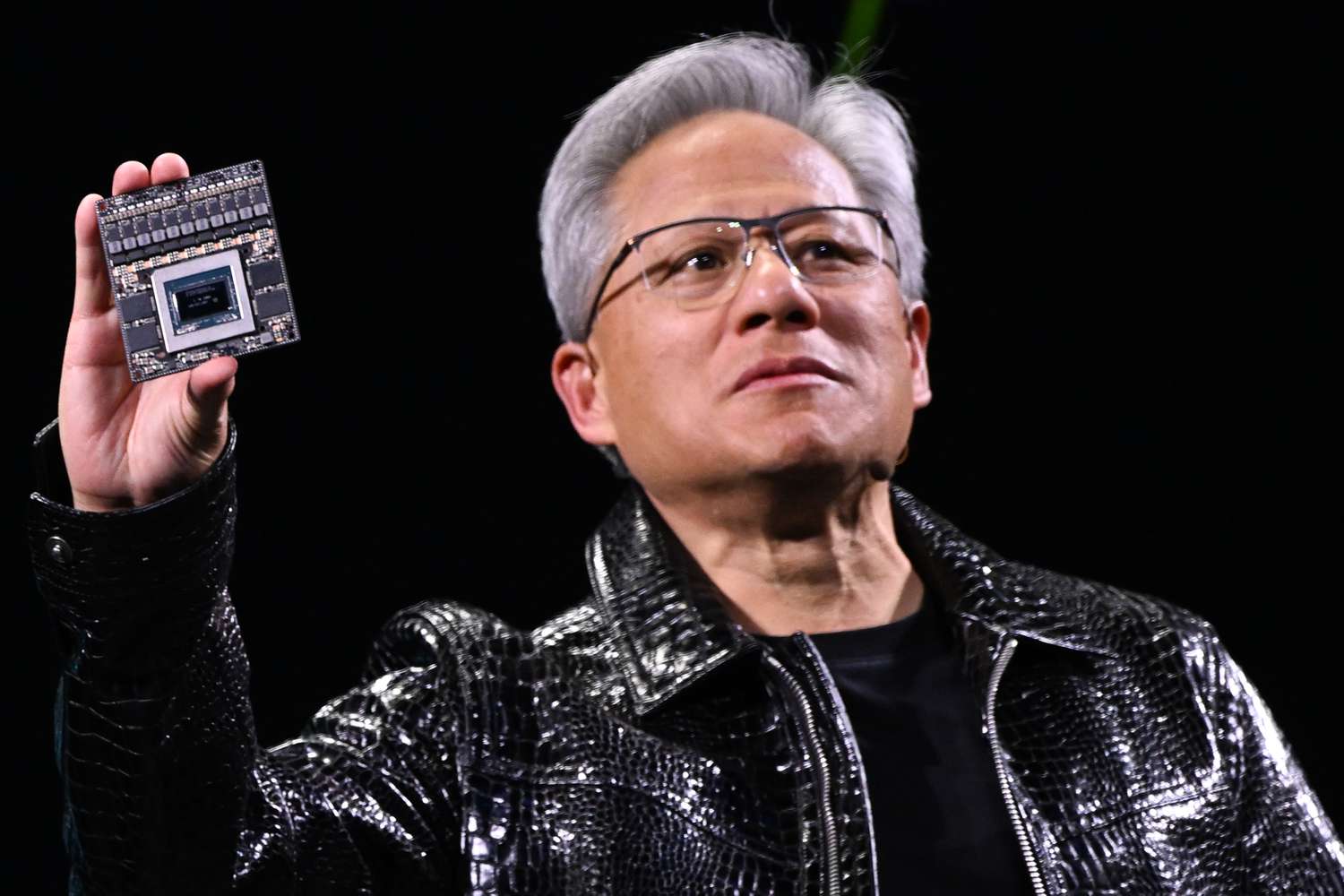

Nvidia’s (NVDA) stock has had a tough start to 2025, with this week’s post-earnings plunge dragging shares back near the January lows that came after a DeepSeek-driven selloff.

Its shares edged higher Friday as the stock found some support after plunging over 8% Thursday, but that still left the stock roughly 7% lower for the week and year. Analysts have largely remained bullish, pointing to Nvidia’s strong outlook on the back of growing AI demand.

Their optimism comes as investors appear uncertain about the path ahead for the recently highflying stock, shares of which have added about half their value over the past 12 months. Chinese startup DeepSeek‘s claims that its AI model could keep up with American rivals at a fraction of the cost and computing resources had raised worries demand for Nvidia’s most advanced chips could slow, but several analysts said they believe Nvidia stands to benefit from DeepSeek’s emergence and growing competition.

During Wednesday’s earnings call, CEO Jensen Huang said that demand for AI inference is accelerating as new AI models emerge, giving a shoutout to DeepSeek’s R1.

DeepSeek “has ignited global enthusiasm,” Huang said, adding that “nearly every AI developer” is applying R1 or adopting some of DeepSeek’s innovations into their own technology. Rather than diminishing the need for advanced chips, Huang said, next-generation AI will likely require significantly more computing power as applications become more sophisticated, leaving Nvidia poised for growth.

Citi and JPMorgan analysts said following the call that they were reassured by Huang’s comments around DeepSeek and the expected trajectory of computing needs. Wedbush analysts said they believe Nvidia will ultimately end up a “DeepSeek beneficiary.”

Analysts at Bank of America suggested competition from China could also push American firms to act with greater urgency on AI developments, rather than scale back spending. In recent earnings calls, several of Nvidia’s Big Tech buyers, including Meta (META), Microsoft (MSFT), Amazon (AMZN) and Google parent Alphabet (GOOGL), did exactly that—announcing plans to raise their capital expenditures to fuel AI ambitions.

This company must be a fraud.

This is a bold claim to make on national television in front of millions of people.

But this is how Andrew Left, CEO of Citron Research (a notorious short seller), described a technology company on CNBC in September 2017.

Fraud is a serious offense, and usually this sort of accusation does not get thrown around lightly. So, when folks hear that kind of serious claim on TV, they often believe it.

This is what Ubiquiti Inc. (UI) was up against when Andrew Left pointed his guns in its direction.

The high-growth networking technology company designs and sells wireless communications and enterprise networking solutions for service providers and businesses worldwide.

Left called Ubiquiti a fraud because he believed there were several “red flags,” including exaggerating the size of its user community, accounting irregularities and high executive leadership turnover. In the immediate aftermath of the news, Ubiquiti fell 8%.

And then, as the rumors spread, the stock tumbled.

This is exactly what Left wanted. You see, short-selling is a trading strategy where you borrow shares of a stock and sell them at the current market price. The idea is to buy them back later at a lower price to return to the lender, profiting from the decline in the stock’s value.

Simply put, short sellers want the stock to go down.

Firms like Citron, Hindenburg, Muddy Waters and others take short positions in companies and issue research reports that are critical of them. Now, sometimes there are merits to the claims, but a lot of times they simply exaggerate or throw around wild accusations, hoping to drive down the price.

Here’s how Ubiquiti’s CEO, Robert Para, initially responded:

Now, the question is: Did those claims have any merit?

Despite the short-seller attack, Ubiquiti continued to post strong earnings. In the first quarter following the Citron report, the company reported revenues of $245.9 million, a 20.1% year-over-year increase. It achieved a gross profit of $111.7 million, representing 45.4% of revenues net income of $74.9 million. Earnings per share came in at $0.92.

And in the quarters following the Citron report, the company beat analyst expectations multiple times, demonstrating resilience in both revenue growth and profitability. Ubiquiti’s robust fundamentals, including expanding margins and strong cash flow, ultimately proved that the accusations lacked substance.

I’ll put it this way. I felt comfortable enough to add the stock to my Growth Investor service back in May 2021. We ended up walking away with a 90% gain in December 2021.

More importantly, Ubiquiti is still around today.

If we look back, the Citron report in 2017 was simply a blip in the grand scheme of things.

In the chart below, the red arrow indicates the sharp drop it took when the report was released. But the stock has since recovered the losses and posted some impressive gains…

The point is the claims ultimately subsided, and the company’s fundamentals ultimately spoke for themselves.

In the end, Para had the last laugh.

But here’s the thing…

The sharp drop caused by Citron damaged the portfolios of a lot of hardworking people. I’m willing to bet that many people were scared away from this stock completely, causing them to miss out on the long-term 500%-plus gain that followed.

I have a problem with that.

These are people who were planning to retire someday. Maybe take a nice vacation with their spouse. Or pay for their daughter’s wedding.

And Left? He is currently facing both civil charges from the Securities and Exchange Commission (SEC) as well as criminal charges from the Department of Justice (DOJ).

In short, I think short sellers are scum, folks.

And I bring this up because the case with Ubiquiti shares some striking similarities to what happened to Super Micro Computer, Inc. (SMCI) last August. If you haven’t followed along, let me break it down for you in today’s Market 360. Then, I’ll review the latest developments and why I continue to believe it’s worth holding today. Plus, I’ll share where you can find strong stocks with superior fundamentals that are great buys right now.

Now, Super Micro is a leading high-performance server provider, specializing in energy-efficient, liquid-cooled hardware that’s ideal for data centers working on artificial intelligence. This made it a key player in the AI Boom since its products were best-in-class. In fact, demand for Super Micro’s products was insatiable – making it one of the hottest stocks on the market.

On August 26 last year, Super Micro fell victim to a report from another notorious short-seller, Hindenburg Research. A former employee also claimed that Super Micro was committing accounting violations and filed a whistleblower report.

The DOJ took Hindenburg Research’s allegations seriously and issued a probe to investigate. Super Micro had to delay the filing of its annual 10-K report to the SEC as a result.

Then on October 30, Super Micro dropped more than 30% after its auditor, Ernst & Young, resigned, citing concerns over the company’s controls. The stock fell another 12% the following day after CNBC’s Jim Cramer said that Super Micro might get delisted from the NASDAQ. The company did get a deficiency letter, and it had until November 16 to comply.

After hiring a new auditor, Super Micro was ultimately granted another extension to file its 10-K and 10-Q reports to the SEC. There was a three-month investigation conducted by an independent Special Committee. They found no evidence of fraud or misconduct from management or the board of directors.

Now, the new deadline was Tuesday, February 25. Now, the new deadline was Tuesday, February 25. Shares of SMCI surged by roughly 49% in anticipation of meeting the filing requirements – which it did meet this week.

But the damage was done. You can see the carnage investors experienced in the chart below.

That’s quite the wild ride, folks.

When the news of this fiasco first broke and the stock began to fall, Super Micro was downgraded to a D-rating in Stock Grader (subscription required). Normally, that means it’s an automatic sell. But I advised my Growth Investor subscribers to hold it. Many of them thought I was crazy for doing that, and I don’t blame them. Super Micro was becoming volatile, and no one likes too much volatility when their hard-earned money is on the line.

But the only thing I hate worse than volatility is a scummy short seller jerking people around, manipulating them to make a buck.

The fact is Super Micro has superior fundamentals. The numbers speak for themselves.

Its most recent update showed second-quarter fiscal 2025 sales between $5.6 billion and $5.7 billion, translating to 54% year-over-year growth. Analysts were expecting sales between $5.0 billion and $6.0 billion.

Looking to the third quarter, it expects total sales between $5.0 billion and $6.0 billion. That’s just a hair below analyst expectations for $6.09 billion. I should also add that Super Micro revised its full-year fiscal 2025 revenue forecast to a range of $23.5 billion to $25 billion, down from the previous estimate of $26 billion to $30 billion. But that still translates to nearly 60% growth on the low end.

It’s important to keep in mind that Super Micro has an extensive order backlog – as much as four to five years. I used to work in accounting, so I know that falsifying an order backlog is nearly impossible to do.

The bottom line is that fundamentals matter. Short sellers are scum and they’re just looking for ways to ruin the party.

You do not want to get me in a room with these people. In fact, I said in a CNBC International interview in February 2024 that I would fight them after they alleged that NVIDIA Corporation (NVDA) was round-tipping. Its phenomenal fourth-quarter 2024 earnings results showed that its growth was quite real, and the stock rallied about 16% in the wake of its strong numbers. There was absolutely no truth to the rumors.

I should also mention that Hindenburg Research is now out of business. On January 15, 2025, founder Nate Anderson announced that Hindenburg would be closing its doors in a personal note to his employees.

I find this very interesting.

With all of that being said, Super Micro is still not out of the woods. They have a lot of ground to make up. The stock surged as much as 23.4% on Wednesday after the company filed 10-K and 10-Q reports, but then gave up those gains after NVIDIA’s earnings triggered a tech selloff.

In the end, I think this is simply a blip in Super Micro’s history. Just like it was with Ubiquiti.

So now, you’re probably wondering where else you can find stocks with superior fundamentals like Super Micro.

Well, look no further than my Growth Investor service. My recommendations are characterized by 26% average sales growth and 556.1% annual earnings growth. Plus, the average earnings surprise during this earnings season is 43.3%.

And you couldn’t join at a better time. I just released my March Monthly Issue to my Growth Investor subscribers this afternoon with four brand-new recommendations. All four of them have positive analyst revisions, which typically precede future earnings surprises and earnings surprises mean that they’ll jump up higher, putting more money in your pocket.

Click here to join now and gain immediate access to my March Monthly Issue. You’ll also receive full access to all my Special Market Podcasts, Weekly Updates and more!

(Already a Growth Investor subscriber? Click here to log in to the members-only website.)

Sincerely,

Louis Navellier

Editor, Market 360

The Editor hereby discloses that as of the date of this email, the Editor, directly or indirectly, owns the following securities that are the subject of the commentary, analysis, opinions, advice, or recommendations in, or which are otherwise mentioned in, the essay set forth below:

NVIDIA Corporation (NVDA) and Super Micro Computer, Inc. (SMCI)

“Today, history is made,” EU chief Ursula von der Leyen declared during a ceremony held in the Lithuanian capital, Vilnius, last month: “This is freedom, freedom from threats, freedom from blackmail.”

On Feb. 9, the Baltic states of Estonia, Latvia and Lithuania officially disconnected from the Russian-controlled Brell power grid. The following day, they successfully connected to the European Union’s electricity network.

The synchronization process with Europe also marked a crucial moment for continental integration. The transition, in the works since 2007, was accelerated by Russia’s full-scale invasion of Ukraine.

“This is truly something that has been a long time coming,” notes Michael Bradshaw, professor of Global Energy at the University of Warwick. “The switch removes the Baltic states from the Soviet-era electricity grid and from exposure to Russian manipulation, giving them a greater degree of energy independence on the one hand, and closer integration into the wider European electricity grid on the other.”

A relic of the Soviet Union, the Brell—which stands for Belarus, Russia, Estonia, Latvia and Lithuania—is primarily controlled by Moscow. Estonia, Latvia and Lithuania joined the EU and NATO in 2004, and have since invested heavily in infrastructure renovations, including building new mainland and undersea power lines. Still, their energy sectors remained vulnerable and reliant on Russia.

Despite managing to entirely cut energy purchases from Russia, the three countries continued to rely on the Brell grid to control frequencies and maintain a constant power supply, which can be more easily achieved in a large-scale synchronized network than in a smaller one. With a total cost of €1.6 billion ($1.67 billion), including €1.2 billion funded by the EU, Bradshaw says the project also speaks to a growing concern about “electricity security,” a term championed by the International Energy Agency as the electrification push and plans to decarbonize Europe’s energy system gather pace. “Electricity interconnection is important to balancing national grids, but as highlighted by the recent political crisis in Norway, where local electricity prices went up as the country was exporting a growing amount of power, it is also becoming a point of contention,” he argues.

“100th anniversary of the first international sports tournament in the territory of the Slovak Republic – the Ice Hockey European Championship“

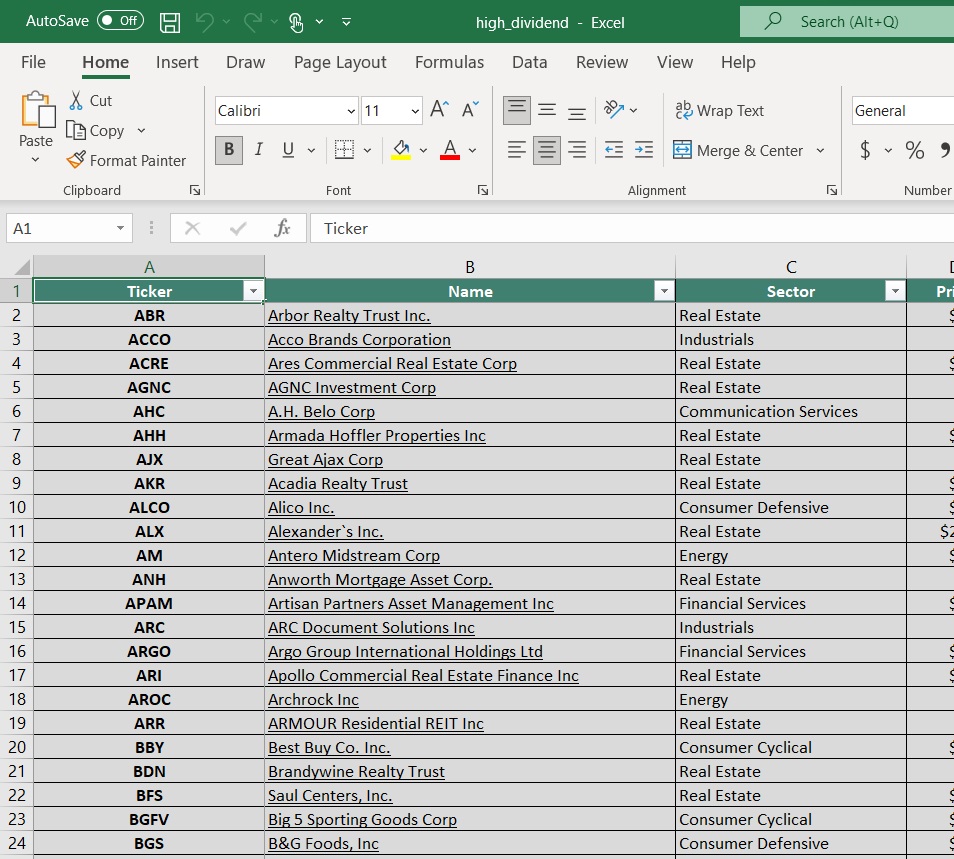

Updated on February 28th, 2025 by Bob Ciura

High dividend stocks means more income for every dollar invested. All other things equal, the higher the dividend yield, the better.

Income investors often like to find low-priced dividend stocks, as they can buy more shares than they could with higher-priced securities.

In this research report, we analyze 13 stocks trading below $10.00 per share and offering high dividend yields of 5.0% and greater.

Additionally, the free high dividend stocks list spreadsheet below has our full list of individual securities (stocks, REITs, MLPs, etc.) with with 5%+ dividend yields.

Keep reading to see analysis on these 13 high-yielding securities trading below $10.00 per share. The list is sorted by dividend yield, in ascending order.

Choice Properties Real Estate Investment Trust invests in commercial real estate properties across Canada. The company has a high-quality real estate portfolio of over 700 properties which makes up over 60 million square feet of gross leasable area (GLA).

Choice Properties’ portfolio is made up of over 700 properties, including retail, industrial, office, multi-family, and development assets. Over 500 of Choice Properties’ investments are to their largest tenant, Canada’s largest retailer, Loblaw.

Choice Properties Real Estate Investment Trust (CHP.UN) reported a net loss of $663 million for the third quarter of 2024, compared to a net income of $435.9 million for the same period in 2023.

This decline was primarily driven by a $1.26 billion unfavorable adjustment in fair value of the Trust’s Exchangeable Units, reflecting an increase in the Trust’s unit price.

However, the Trust saw positive performance in its operating metrics, with funds from operations (FFO) per unit diluted increasing by 3.2% to $0.258.

During the quarter, the Trust achieved a strong occupancy rate of 97.7%, led by retail (97.6%) and industrial (98.1%) sectors, and recorded a 3.0% year-over-year increase in Same-Asset NOI on a cash basis.

Click here to download our most recent Sure Analysis report on PPRQF (preview of page 1 of 3 shown below):

Lexington Realty Trust owns equity and debt investments in single-tenant properties and land across the United States. The trust’s portfolio is primarily industrial equity investments.

The trust grows the industrial portfolio by financing, or by acquiring new investments with long-term leases, repositioning the portfolio by recycling capital and opportunistically taking advantage of capital markets.

Additionally, the company supplies investment advisory and asset management services for investors in the single-tenant net-lease asset market.

On February 13th, 2025, Lexington reported fourth quarter 2024 results for the period ending December 31st, 2024. The trust announced adjusted funds from operations (AFFO) of $0.16 per share for the quarter, a penny short of the prior year quarter.

For Q4, the trust completed 1.0M square feet of new leases and lease extensions, which increased base and cash base rents by 66.3% and 42.6%, respectively. Lexington also invested $21 million in ongoing development projects. The trust’s stabilized industrial portfolio was 93.6% leased. At quarter end, Lexington had leverage of 5.9X net debt to adjusted EBITDA.

Click here to download our most recent Sure Analysis report on LXP (preview of page 1 of 3 shown below):

Ford Motor Company was first incorporated in 1903 and in the past 120 years, it has become one of the world’s largest automakers. It operates a large financing business as well as its core manufacturing division, which produces a popular assortment of cars, trucks, and SUVs.

Ford posted fourth quarter and full-year earnings on February 5th, 2025, and results were better than expected. Adjusted earnings-per-share came to 39 cents, which was seven cents ahead of estimates.

Revenue was up almost 5% year-over-year for the quarter to $48.2 billion, which also beat estimates by $5.37 billion. The fourth quarter was the highest revenue total the company has ever produced.

Ford Blue increased 4.2% to $27.3 billion in revenue for the fourth quarter, beating estimates of $25.9 billion. Model e revenue was down 13% year-over-year to $1.4 billion, $400 million less than expected.

Ford Pro revenue was up 5.3% to $16.2 billion, beating estimates for $15.6 billion.

For this year, Ford expects full-year adjusted EBIT of $7 to $8.5 billion, and for adjusted free cash flow of $3.5 billion to $4.5 billion, with capex of $8 to $9.5 billion.

Click here to download our most recent Sure Analysis report on Ford (preview of page 1 of 3 shown below):

Kearny Financial Corp. is a bank holding company. Headquartered in Fairfield, New Jersey, the bank operates 43 branches, primarily in New Jersey along with a couple of locations in New York City. Over the years, Kearny has evolved from being a traditional thrift institution into a full-service community bank.

Kearny had enjoyed tremendous growth over the past decade as it executed on this strategy to enlarge and diversify the bank. However, the shift in the interest rate environment and uncertainty in the commercial real estate market has provoked significant uncertainty around Kearny’s operating outlook going forward.

Kearny reported a large loss tied to one-time expenses in 2024, and the company has been hampered by falling net interest income as well.

In the company’s Q2 2025 results, reported January 30th, 2025, Kearny reported a profit of $0.11 per share. This was up sharply from a 22 cent per share loss in the same period of the prior year, though that number reflects various one-time non-recurring charges.

Click here to download our most recent Sure Analysis report on KRNY (preview of page 1 of 3 shown below):

Aegon NV is a financial holding company based in the Netherlands. The company provides a wide range of financial services to clients, including insurance, pensions, and asset management.

Aegon has five core operating segments: Americas, Europe, Asia, Asset Management Holding and Other Activities. The firm’s most widely recognized brand is Transamerica, which Aegon acquired in 1999.

On February 20th, 2024, Aegon reported results for H2-2024. Operating capital grew 14% over the prior year’s period thanks to improved performance in the U.S. As Aegon expects to be hurt by lower interest rates, it provided guidance for essentially flat operating capital of €1.2 billion in 2025.

Click here to download our most recent Sure Analysis report on AEG (preview of page 1 of 3 shown below):

GeoPark Limited (GPRK) explores and produces oil and natural gas in Colombia, Ecuador, Argentina and Brazil. It was founded in 2002, it is based in Bogota, Colombia. GeoPark is superior to other Latin American oil and gas producers in some aspects.

It has a market-leading drilling success rate of 81% and has drastically reduced its operating costs, from $19 per barrel in 2013 to $13 per barrel in 2023-2024. Approximately 90% of its production is cash flow positive even at Brent prices of $25-$30.

This means that GeoPark is a low-cost producer, which is of paramount importance in a commodity business. On the other hand, GeoPark is highly sensitive to the dramatic cycles of the prices of oil and gas. As a result, it has exhibited an extremely volatile performance record, with losses in 4 of the last 10 years.

In early November, GeoPark reported (11/6/24) financial results for the third quarter of fiscal 2024. The average daily production of oil and gas decreased -4% over the prior year’s quarter, primarily due to the divestment of the Chilean business in January.

In addition, the price of oil incurred a correction. Nevertheless, thanks to lower operating costs and lower capital expenses, earnings-per-share rose 9%, from $0.44 to $0.48.

Click here to download our most recent Sure Analysis report on GPRK (preview of page 1 of 3 shown below):

Clipper Realty is a Real Estate Investment Trust, or REIT, that was founded by the merger of four pre-existing real estate companies. The founders retain about 2/3 of the ownership and votes today, as they have never sold a share.

Clipper Properties owns commercial (primarily multifamily and office with a small sliver of retail) real estate across New York City.

Clipper Realty Inc. (CLPR) reported strong third-quarter 2024 results, with record revenues of $37.6 million, a 6.8% increase from the same period in 2023, driven largely by growth in residential leasing and higher occupancy.

Net operating income (NOI) reached a record $21.8 million, while adjusted funds from operations (AFFO) hit $7.8 million, or $0.18 per share, up from $6.3 million, or $0.15 per share, a year earlier.

Click here to download our most recent Sure Analysis report on CLPR (preview of page 1 of 3 shown below):

Itaú Unibanco Holding S.A. is headquartered in Sao Paulo, Brazil. The bank has operations across South America and other places like the United States, Portugal, Switzerland, China, Japan, etc.

On November 5th, 2024, Itaú Unibanco reported third-quarter results for 2024. The company reported recurring managerial result for the third quarter of 2024 was approximately $2.1 billion USD, reflecting a 6.0% increase from the previous quarter.

The recurring managerial return on equity stood at 22.7% on a consolidated basis and 23.8% for operations in Brazil. Total assets grew by 2.6%, surpassing $590 billion USD, while the loan portfolio increased by 1.9% globally and 2.1% in Brazil for the quarter, with year-on-year growth rates of 9.9% and 10.0%, respectively.

Key drivers included personal, vehicle, and mortgage loans, which saw quarterly growth rates of 3.1%, 3.0%, and 3.9%, respectively.

Click here to download our most recent Sure Analysis report on ITUB (preview of page 1 of 3 shown below):

Ship Finance International Ltd is an international shipping and chartering company. The company’s primary businesses include transporting crude oil and oil products, dry bulk and containerized cargos, as well as offshore drilling activities.

It owns 18 oil tankers, 15 dry bulk carriers, 38 container vessels, 7 car carriers, and 2 ultra-deep water drilling units. Ship Finance International operates primarily in Bermuda, Cyprus, Malta, Liberia, Norway, the United Kingdom, and the Marshall Islands.

On February 12th, 2025, SFL reported its Q4 and full-year results for the period ending December 31st, 2024. SFL achieved total revenues of $229.1 million during the quarter, down 10.3% compared to the previous quarter.

This figure is lower than the cash received as it excludes approximately $9.9 million of charter hire, which is not identified as operating revenues pursuant to U.S. GAAP.

Net income came in at $20.2 million, or $0.15 per share, compared to $44.5 million, or $0.34 per share, in the previous quarter. No shares were repurchased during the quarter. About $90 million remains under SFL’s share repurchase plan.

Click here to download our most recent Sure Analysis report on SFL (preview of page 1 of 3 shown below):

Prospect Capital Corporation is a Business Development Company, or BDC, that provides private debt and private equity to middle–market companies in the U.S.

The company focuses on direct lending to owner–operated companies, as well as sponsor–backed transactions. Prospect invests primarily in first and second lien senior loans and mezzanine debt, with occasional equity investments.

Source: Investor Presentation

Prospect posted second quarter earnings on February 10th, 2025, and results were somewhat weak. Net investment income per-share acme to 20 cents, while total investment income fell from $211 million to $185 million year-over-year.

NII per-share fell from 21 cents in Q1, and 24 cents from the year-ago period. Total interest income was $169 million for the quarter, down from $185 million in the prior quarter, and $195 million a year ago. It also missed estimates by about $2 million.

Total originations were $135 million, down sharply from $291 million in the previous quarter. Total payments and sales were $383 million, up from $282 million in Q1. That implies net originations at -$248 million versus a net addition of just over $8 million in Q1. Q3-to-date originations so far are a net of +$91 million.

Click here to download our most recent Sure Analysis report on PSEC (preview of page 1 of 3 shown below):

Horizon Technology Finance Corp. is a BDC that provides venture capital to small and medium–sized companies in the technology, life sciences, and healthcare–IT sectors.

The company has generated attractive risk–adjusted returns through directly originated senior secured loans and additional capital appreciation through warrants.

Source: Investor Presentation

On October 29th, 2024, Horizon released its Q3 results for the period ending September 30th, 2024. For the quarter, total investment income fell 15.5% year-over-year to $24.6.7 million, primarily due to lower interest income on investments from the debt investment portfolio.

More specifically, the company’s dollar-weighted annualized yield on average debt investments in Q3 of 2024 and Q3 of 2023 was 15.9% and 17.1%, respectively.

Net investment income per share (IIS) fell to $0.32, down from $0.53 compared to Q3-2023. Net asset value (NAV) per share landed at $9.06, down from $9.12 sequentially.

After paying its monthly distributions, Horizon’s undistributed spillover income as of June 30th, 2024 was $1.27 per share, indicating a considerable cash cushion.

Click here to download our most recent Sure Analysis report on HRZN (preview of page 1 of 3 shown below):

Ellington Credit Co. acquires, invests in, and manages residential mortgage and real estate related assets. Ellington focuses primarily on residential mortgage-backed securities, specifically those backed by a U.S. Government agency or U.S. government–sponsored enterprise.

Agency MBS are created and backed by government agencies or enterprises, while non-agency MBS are not guaranteed by the government.

On November 12th, 2024, Ellington Residential reported its third quarter results for the period ending September 30th, 2024. The company generated net income of $5.4 million, or $0.21 per share.

Ellington achieved adjusted distributable earnings of $7.2 million in the quarter, leading to adjusted earnings of $0.28 per share, which covered the dividend paid in the period.

Net interest margin was 5.22% overall. At quarter end, Ellington had $25.7 million of cash and cash equivalents, and $96 million of other unencumbered assets.

Click here to download our most recent Sure Analysis report on EARN (preview of page 1 of 3 shown below):

Orchid Island Capital is a mortgage REIT that is externally managed by Bimini Advisors LLC and focuses on investing in residential mortgage-backed securities (RMBS), including pass-through and structured agency RMBSs.

These financial instruments generate cash flow based on residential loans such as mortgages, subprime, and home-equity loans.

Source: Investor Presentation

The company reported a net income of $17.3 million, or $0.24 per common share, significantly improving from a net loss of $80.1 million in the same quarter last year. This net income comprised $0.3 million in net interest income and $4.3 million in total expenses.

Additionally, Orchid recorded net realized and unrealized gains of $21.2 million, or $0.29 per common share, from Residential Mortgage-Backed Securities (RMBS) and derivative instruments, including interest rate swaps.

Click here to download our most recent Sure Analysis report on Orchid Island Capital, Inc. (ORC) (preview of page 1 of 3 shown below):

When a stock offers an exceptionally high dividend yield, it usually signals that its dividend is at the risk of being cut. This rule certainly applies to most of the above stocks.

Nevertheless, some of the above stocks are highly attractive now thanks to their cheap valuation and still-high yield even after a potential reasonable dividend cut.

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

Other Sure Dividend Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].

Editor’s note: “An Expert Method to Overcome a Turbulent Stock Market” was previously published in January 2025 with the title, “How to Find Success Despite Wild Stock Market Volatility.” It has since been updated to include the most relevant information available.

When it comes to the stock market, it can be a bit like a hurricane at sea: powerful, unpredictable, and capable of turning calm waters into chaos in an instant.

We’ve been enduring our fair share of market chaos lately, with the S&P 500 seemingly up one week and down the next. Investors are practically begging for monotony. But wilder price action like this may be our new normal…

You see; historically speaking, the stock market averages about one bear market every five or six years. But in the past six years, we’ve had not one… not two… but three different bear markets.

There was the flash crash of late 2018, which saw stocks briefly fall into a bear market right before the holidays. There was also the COVID crash of 2020, wherein stocks plunged in the fastest market crash in history. And then there was the inflation crash of 2022, when tech stocks were obliterated by sky-high interest rates.

Three unforeseen bear markets in the past six years – that is wild.

But, of course, on the other hand, we’ve also seen some huge stock market successes, too.

On average, the stock market rises about 10% per year. But in 2024, stocks climbed 23%. They rose around 27% in 2021. And in 2019, stocks rallied about 29%.

In other words, over the past six years, the S&P 500 has achieved three different years with nearly 30% returns. As a matter of fact, of the stock market’s 10 best years since 1950, three have occurred since 2018.

Three different bear markets and three of the best years ever for stocks – all within the past six years.

So, if the stock market has felt wild to you lately, that’s because it has been.

But this wildness could be the new norm for Wall Street going forward.

We can thank technology for that – at least, that’s my opinion.

Why? Because algorithms run the market now.

These days, algorithmic trading accounts for approximately 60- to 75% of total trading volume in the U.S. stock market. That means most trades are automatic, executed by bots adhering to pre-set parameters.

And, unlike humans, robots don’t really ask why. They just do what they are programmed to.

So, when something bad happens, all the algorithmic-driven systems rush toward an exit. And when something good happens, they race to get involved. That’s why, in my view, algorithmic trading creates crowding.

As a result, we get wild swings in the market – both up and down. The algorithms drive momentum one way or the other, and the market follows.

We get flash crashes and fast recoveries; big bear markets and massive bull runs; major meltdowns and momentous melt-ups.

We get stock market volatility.

Such unpredictability can be scary. But since that turbulence drives stocks both ways, you can’t really afford to be crippled by fear, sitting on the sidelines. You need to be in the game.

But to play well, you also need to craft an investment strategy that can handle the volatility – one that can mitigate the downside while also maximizing the upside.

And we think we’ve created a strategy that could help you do just that.

That is, we’ve developed a stock screening system – dubbed Auspex – that leverages fundamental, technical, and sentimental data to find the strongest stocks in the market at any given time.

The strategy therein? Use this tool to find the best stocks in a given month. Buy and hold those stocks, then cash out at month’s end. Lather, rinse, repeat.

We’ve been executing this strategy internally, with great success, for the past several months.

Back in July, Auspex helped us score a nearly 40% gain in AnaptysBio (ANAB) and ~30% gains in Zeta Global (ZETA) in just about 30 days. In August, we locked in a ~25% paper profit on Cellebrite (CLBT) in the same timeframe.

Similarly, in September, we were able to nab ~25% returns on SiTime (SITM). Then in October, Auspex helped us put together a portfolio of five stocks – and four went on to rise that month, even while the broader market dropped.

That is the very real power Auspex can provide. And in just a few days, we’ll be running a new scan to find the best stocks to buy for March.

Click here to access those picks before we release them next week.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.

P.S. You can stay up to speed with Luke’s latest market analysis by reading our Daily Notes! Check out the latest issue on your Innovation Investor or Early Stage Investor subscriber site.

Written by the Market Insights Team

February wrap-up with unresolved tariff issues

Kevin Ford –FX & Macro Strategist

February is drawing to a close, and after five consecutive months of declines, the USD/CAD’s losing streak has eased near the 1.44 mark amidst heightened volatility and unresolved tariff issues. The Loonie has edged upward from its weekly low of 1.4182—resting just above the 20-week SMA—to a three-week high of 1.4453—a 271-pip increase. While no definitive trade policy decisions have been made, tariff risk premia keep the Loonie above 1.44. Contradictory messages about tariff plans for Canada and Mexico have heightened volatility, particularly in the USD/CAD, where implied volatility has surged with March 4th just around the corner. A last-minute extension to April 2nd isn’t ruled out, but volatility is expected until formal confirmation.

Volatility surged yesterday as equity markets grappled with escalating risk aversion. While Nvidia’s strong quarterly results initially offered a lift to markets, the optimism was short-lived. Risk aversion soon took the upper hand, driving the VIX index back above the critical 20 threshold.

Amid this month’s chaos and volatility, one clear winner has emerged: the Canadian Liberals. PM Trudeau’s decision to prorogue parliament has benefited his party, which now leads the Conservatives in polls for the first time in years. The Liberals have gained momentum by taking a strong stance against Trump’s tariff threats and increasing investment in citizen-friendly infrastructure projects. Mark Carney has overtaken Chrystia Freeland as the most likely successor, with a final decision expected on March 9th. As we enter March, Canadian politics will unfold against a backdrop of continued uncertainty and volatility.

Today, all eyes are on the US PCE, the Fed’s preferred inflation measure. Any upside surprises could further unsettle market sentiment.

The key resistance at 1.445 has proven strong for the Loonie. 1.447 is the next level to monitor. Protection against a break above 1.45 adds pressure on the Loonie. The 60-day SMA at 1.433 serves as critical support if tariffs are delayed another month.

Next week’s packed macroeconomic calendar will provide a clearer picture of the US economy, with payrolls (Friday) and ISM manufacturing (Monday) as key data points. For Canada, manufacturing (Monday) and the unemployment rate (Friday) will take center stage.

Dollar balancing tariffs, weaker growth

Boris Kovacevic – Global Macro Strategist

The trade and geopolitical news flows once again overshadowed what seemed to be a pretty important day for US macro developments. Durable goods, home sales, jobless claims and GDP data sent mixed signals about the state of the worlds largest economy. GDP grew by an annualized 2.3%, while unemployment claims rose to a 2-month high and tumbled for a second consecutive month. Overall, the data continues to point to weaker economic momentum ahead and the dollar would have depreciated against this backdrop would it not have been for the tariff news.

Markets once again reacted to fresh tariff announcements made by the US President. Donald Trump confirmed that the 25% tariffs on Canada and Mexico will go into effect, while also hinting at potential new levies on China as soon as March. This bolstered the dollar against the Canadian Dollar and Mexican peso. However, the strengthening of the Greenback broadened out to most major currencies as well.

Beyond trade, Trump’s refusal to commit to a security backstop in Ukraine added another layer of geopolitical uncertainty. Meeting with UK Prime Minister Keir Starmer, he reiterated that the focus should first be on securing a peace deal between Russia and Ukraine, rather than discussing long-term military commitments.

Still, conviction around a sustained dollar rally is fading, as tariff fatigue and growth concerns begin to weigh on sentiment. Traders remain cautious despite the elevated trade uncertainty and lack of policy clarity. For now, FX markets remain driven by trade headlines, with the dollar benefiting from renewed tariff bets—but the long-term picture remains far from clear.

The US dollar index will likely end the week higher, a feat the dollar has only achieved once in the last seven weeks. The last hurdle to overcome is the US PCE report due today. The core figure could slow on a month-on-month basis. However, personal spending is expected to remain robust.

Euro back on the defence

Boris Kovacevic – Global Macro Strategist

Fresh trade tensions are adding pressure to the euro, as President Trump confirmed 25% tariffs on Canada and Mexico and hinted at new levies on China. While the EU was not directly targeted, the risk of further escalation weighs on sentiment, especially with Trump’s criticism of European trade policies and VAT systems still lingering.

While the dollar initially rallied on the tariff news, conviction around sustained USD strength is fading, as the economic drag from higher trade barriers could outweigh short-term inflationary effects. For the euro, the uncertainty keeps upside limited, with EUR/USD hovering under $1.0400 as traders assess whether tariffs will remain a US-focused issue or expand further.

On the other hand, the ECB remains confident that policy is still restrictive, but the debate over future rate cuts is intensifying as per the meeting minutes released yesterday. A 25bp cut next week to 2.5% is expected, yet officials are divided. Some have shown worries about sticky services inflation and trade risks, while others fear weak growth and missing the 2% inflation target. The neutral rate remains a wildcard, with policymakers questioning its usefulness as a policy guide. Meanwhile, disinflation is on track, but wage growth and energy risks call for caution.

Risk sensitive or safe haven sterling?

George Vessey – Lead FX & Macro Strategist

As we explained in yesterday’s report, the pound’s high yielding status is a double-edged sword in that when the market mood is upbeat, sterling tends to appreciate, but in deteriorating global risk conditions, the pound becomes more vulnerable. Hence, the latest bout of tariff angst has sent GBP/USD tumbling from $1.27 to $1.2570 in 24 hours. GBP/USD has erased its weekly gains and more, whilst several key moving averages continue to act as hurdles to the upside.

Apart from weakening against the US dollar though, some analysts think the FX market is viewing the pound as a tariff safe-haven of sorts, driven by confidence that the UK is less economically vulnerable to tariffs compared to major exporters like the EU. This is evidenced by sterling appreciating against all G10 peers this week bar the US dollar and Swiss franc. Meanwhile, if GBP/EUR closes the week above €1.21, it will be the highest weekly closing price in almost three years. If we look at sterling more broadly though, it appreciated against less than 50% of its global peers yesterday, which contradicts this sterling safe haven theory. Moreover, sterling’s vulnerability to global risk aversion due to its reliance on foreign capital inflows would likely limit any haven demand in our view.

Nevertheless, the meeting between US President Donald Trump and UK Prime Minster Keir Starmer appeared constructive, with hopes of a trade deal boosting the odds of the UK avoiding tariffs. The UK is one of the only countries in the world to have a neutral trade relationship with the US in goods, so it’s hard to see how/why Trump would have imposed them anyway. But even if the UK does evade tariffs, a slowdown in global trade would still hurt the UK economy, which would weigh on the pro-cyclical pound.

Risk aversion drives stocks and yields lower

Table: 7-day currency trends and trading ranges

Key global risk events

Calendar: February 24-28

All times are in ET

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.

Stock futures edged higher Friday morning, rising after yesterday’s selloff driven by concerns over tech-sector strength and tariff costs; inflation is expected to decline slightly with today’s release of the Personal Consumption Expenditures price index; Dell (DELL) and HP (HPQ) shares were falling as tech stocks remained under pressure after AI stalwart Nvidia’s (NVDA) earnings weighed on markets; President Donald Trump said tariffs on Canada, China and Mexico would proceed; bitcoin (BTCUSD) dropped below $80,000 to wipe out most of the gains registered since Trump’s election in November.

Here’s what investors need to know today.

Stock futures pointed higher as investors looked to inflation data following yesterday’s selloff on tariff and tech worries. Futures trading associated with the S&P 500 was higher by around 0.3% after the benchmark index shed 1.6% in Thursday trading. Those associated with the Nasdaq were higher by a similar amount after it lost 2.8% yesterday, while Dow Jones Industrial Average-linked futures also rose after dipping yesterday. Despite the early uptick, major market indexes were poised to move lower for the month of February. Yields on the 10-year Treasury note were around 4.285%, while oil futures were lower by more than 1%. Gold futures also fell.

Market participants will be closely following the 8:30 a.m. EST planned release of the Personal Consumption Expenditures (PCE) report for January. The data is expected to show inflation came in at an annual rate of 2.5% for the month, according to a survey of economists by The Wall Street Journal and Dow Jones Newswires. That’s a tick lower than December’s rate but still above the Federal Reserve’s inflation target. The Fed cited worries over continued elevated inflation when it decided last month to not lower interest rates again.

Here’s more from Investopedia on what to expect from the report.

Following Nvidia’s plunge in trading yesterday, several technology stocks were lower in premarket trading despite some computer sellers beating quarterly earnings estimates. Shares of Dell were lower by about 4% after its earnings report showed that the PC maker had strong quarterly income on the growing demand for artificial intelligence (AI) infrastructure, but its 7% revenue improvement was lower than analysts expected. HP shares were down about 3% after it beat expectations this quarter, but its earnings outlook was lower than analysts’ forecasts. Nvidia shares were little changed in early trading after plunging by more than 8% yesterday.

Trump’s announcement that a 25% tariff on products made in Canada and Mexico will go into effect on March 4 weighed on markets yesterday. Oil products from Canada will be taxed at 10%. On top of that, Trump said he would put an additional 10% tariff on products from China, adding to a 10% tariff he imposed in early February. Stephen Miran, Trump’s nominee to chair the White House’s Council of Economic Advisors, said in a Senate hearing that the U.S. would “reindustrialize” by taxing foreign imports, reducing regulations for businesses and developing the defense industry.

Bitcoin’s (BTCUSD) price fell below $80,000 for the first time since early November, wiping out nearly all the gains that followed Trump’s reelection. The cryptocurrency’s fall coincided with the broader market selloff as investors weigh economic uncertainty. The selloff is hurting crypto-related stocks as well: Bitcoin buyer Strategy (MSTR), the company formerly called MicroStrategy, was down about 3% in premarket trading after registering a nearly 9% fall in the prior session. Shares of crypto brokerage Coinbase Global (COIN) and bitcoin mining firms Mara Holdings (MARA) and Riot Platforms (RIOT) were recently down around 3%.