Why The Department of Education Lowered Student Loan Interest Rates

Why The Department of Education Lowered Student Loan Interest Rates

Source link

Why The Department of Education Lowered Student Loan Interest Rates

Source link

The rise of cryptocurrency over the past decade has led to an explosion in the number of online casinos accepting Bitcoin and other digital assets. This new breed of crypto casinos provides players with the ability to gamble using cryptocurrency along with lucrative welcome bonuses and promotions.

In this article, we’ll be taking an in-depth look at eight of the best crypto casinos that offer new players enticing no-deposit bonus codes in 2025. But first, let’s discuss some important context around the current state of cryptocurrency and online gambling.

As the Bitcoin price continues to break records, more gamblers are discovering the benefits of using cryptocurrency for online betting and casino gaming. Unlike regular fiat deposits, crypto transactions are processed nearly instantly without pesky banking fees. Sites like the ones featured here have recognized this growing demand and adapted their platforms to support Bitcoin, Ethereum, Tron, and other leading digital assets.

Another attractive trait of crypto casinos is the generous welcome bonuses they provide. Looking to draw in new players, these virtual gaming floors offer incredibly high deposit match rates and free spins deals. Some platforms even provide no-deposit crypto bonuses that allow risk-free gambles right from sign-up. This guide unveils the finest online slot sites, awarding free bonuses to new members without requiring an initial deposit. All you need is an eligible account and the corresponding promotional code.

Read on to find out how to claim free spins and bonus funds without having to deposit anything at these leading Bitcoin and crypto gambling sites.

Jackbit holds licenses from Curacao and Malta to legally serve the European market. The site boasts a premium selection of over 2,000 games from top developers like NetEnt, Microgaming, and Play’n GO. Payments are handled through both fiat and crypto options, including Bitcoin, Ethereum, Litecoin, and Dogecoin.

Upon sign-up, Jackbit gives all new members 50 free spins to sample the action for free. No code is required, thanks to their recurring no-deposit offering. Additional perks include a four-tiered 260% match welcome package stretching to 4 BTC, plus ongoing cashback and reload bonuses. Customer support is offered around the clock via live chat and email too for any account issues. This seasoned crypto casino packs a punch.

Key features of Jackbit:

WSM Casino distinguishes itself as the home of Wall Street Memes betting, a popular subreddit on Reddit that features a bunch of finance and crypto-related memes and questionable financial advice. In addition to over 2,000 traditional casino games, the site features an innovative stock ticker plugin. This allows players to place real money bets on the direction of financial indices. Cryptocurrencies supported include Bitcoin, Ether, Litecoin, Bitcoin Cash and Doge.

New WSM members can earn 25 no-deposit free spins upon signing up. No code is needed for this recurring offer. Depositors then qualify for a 260% five-tier welcome bonus worth up to 5 BTC in total. The casino also runs lucrative weekly reloads, cashback, and VIP programs for top players. Around-the-clock support and instant crypto payouts make WSM a one-stop shop for investors and gamers alike.

Key features of WSM Casino:

Flush.com brings blockchain betting to the next level through its seamless integration of cryptocurrency and traditional gaming. Thanks to this innovative infrastructure, Flush offers near-instant coin deposits, super-fast withdrawals, and competitive game payout speeds.

New members can earn 40 free spins just by registering for an account at Flush. Depositors then qualify for perks like an initial 200% match up to 5 BTC plus further daily and weekly rewards. Flush maintains the industry’s highest standards for player verification and responsible gambling through its partnership with the leading legal firm DLA Piper. This crypto casino elevates the online slot experience.

Key features of Flush.com:

Established back in 2014, 7Bit Casino is one of the longest-running and most reputable crypto casinos online. In addition to taking major cryptocurrencies, the site has impressed with its huge game library comprising over 5,200 slots, table games, and live dealer options. The platform fully supports both desktop and mobile play through instant browser access too.

For new players, 7Bit Casino offers a very generous no-deposit bonus of 75 free spins simply by using bonus code “75BIT” upon registration. This risk-free promotion allows test drives of their high-RTP slot hits like Gonzo’s Quest and Break Da Bank Again. Depositors are then treated to a four-tiered Welcome Pack with incentives like up to 325 additional free spins and Bitcoin match bonuses of up to 1.5 BTC in total. With quick crypto payouts and 24/7 live chat support, 7Bit tops many of the best Bitcoin casino lists.

Key features of 7Bit Casino:

CoinCasino stands out with a strong focus on crypto-friendly slot gaming and a generous bonus structure. With over 2,000 casino games, a significant portion dedicated to slots, the platform caters to both casual players and high-stakes rollers. You’ll find popular reels, jackpots, and bonus buy slots from top-tier developers, all delivered through a sleek, responsive interface. Though demo mode is not available, the site offers a fast user experience and supports both crypto and fiat payments.

New players can claim a 200% bonus up to $30,000 and receive up to 50 Super Spins, which are redeemable across select slot titles. While no-deposit offers aren’t available at this time, CoinCasino still competes at the high end of the market thanks to its multi-language support, deep game library, and smooth signup process with WalletConnect compatibility.

Key Features of CoinCasino:

CryptoGames is a niche but respected crypto casino that puts provable fairness and transparency above flashy design. Its selection includes just 10 handpicked games, among them a proprietary slot title with high RTP and simple mechanics. While the site doesn’t offer hundreds of external slot providers, it does attract dedicated crypto gamblers who value clear odds and verifiable game logic. CryptoGames runs on a no-KYC policy and supports both crypto and fiat deposits.

There’s no traditional welcome bonus, but users benefit from a daily promo structure, rakeback, and VIP level-up system. Long-term players can unlock up to 600 free spins, with rakeback rates that scale to 25%. This makes CryptoGames a good option for consistent slot players looking for reward-based incentives rather than quick one-off deals.

Key Features of CryptoGames:

BC.Game positions itself as the premier crypto sportsbook and casino combo. In addition to classic RNG slots and tables, the site features over 30+ live wagering markets daily. Supported coins include Bitcoin, Bitcoin Cash, Ether, Litecoin, Doge, and Tether. BC.Game is licensed by both the UK Gambling Commission and Curacao authorities.

Upon registration, BC.Game gives all new players 50 free spins to enjoy popular slots free of risk. Depositors then qualify for boosted match rates on football, horse racing, and slot action. The site also runs exclusive tournaments and VIP rewards throughout football’s biggest tournaments. With its all-in-one global focus, BC.Game sets the standard in crypto betting.

Key features of BC.Game:

As one of the original crypto casinos, FortuneJack has stood the test of time since 2014. The site boasts a truly global focus by accepting eighteen different currencies, including all major crypto coins. Their gaming library features over 3,000 casino games and a world-class live dealer room from Evolution Gaming.

New players can earn 100 free spins immediately upon registration using no code. This allows spin samples of mega-hits like Starburst, Dead or Alive 2, and Gonzo’s Quest. Depositors then access a very generous match bonus of 200% up to 5 BTC. FortuneJack also runs generous weekly tournaments for slots and tables with cash prizes reaching $10,000 at times. Secure crypto payouts are generally processed in under an hour, too, making this a prime online crypto destination.

Key features of FortuneJack:

JustBit prioritizes fast and seamless crypto betting through its web-based instant play platform. The site takes nine digital coins like Bitcoin Cash, Dogecoin, and Tether and guarantees no hidden fees. Their content library includes over 2,000 classics and new releases from pioneers like Microgaming.

No deposit players at JustBit receive 20 free spins upon registration to sample games risk-free. Depositors then get perks like a four-tier welcome package totaling 500% match up to 5 BTC plus 100 additional free spins. Customer service is on call 24/7 and payouts take a maximum of one business day for quick funds. With its lightning-fast crypto functionality, JustBit sets the bar high.

Key features of JustBit:

Winz.io stands apart through its sleek web-based instant play casino. The site boasts lightning-quick coin deposits via Coinpayments and high-quality games from leaders like Belatra, EGT, and Pragmatic Play. Supported currencies are Bitcoin, Ether, Litecoin, Doge, and Tether.

For all new members, Winz awards 30 no deposit free spins upon sign-up, with no code required. Depositors then get a 300% five-tier welcome package worth 4 BTC total. The casino also dishes out generous daily and weekly cash prizes plus hot new slot tournaments. Outstanding customer assistance via live chat supports players worldwide 24/7 too. For sheer speed and smooth gaming, Winz.io takes the cake.

Key features of Winz.io:

As cryptocurrency gains wider appeal and adoption, expect to see more innovative casinos launch that leverage blockchain’s speed, security, and transparency. The casino platforms featured in this article highlight that crypto gambling can offer players an overall experience that’s in many ways superior to traditional online casinos.

By providing lucrative no-deposit bonuses and top-tier service, they invite all gamers to enjoy the emerging benefits of blockchain betting. Make sure to check each platform and only play within your personal risk tolerance.

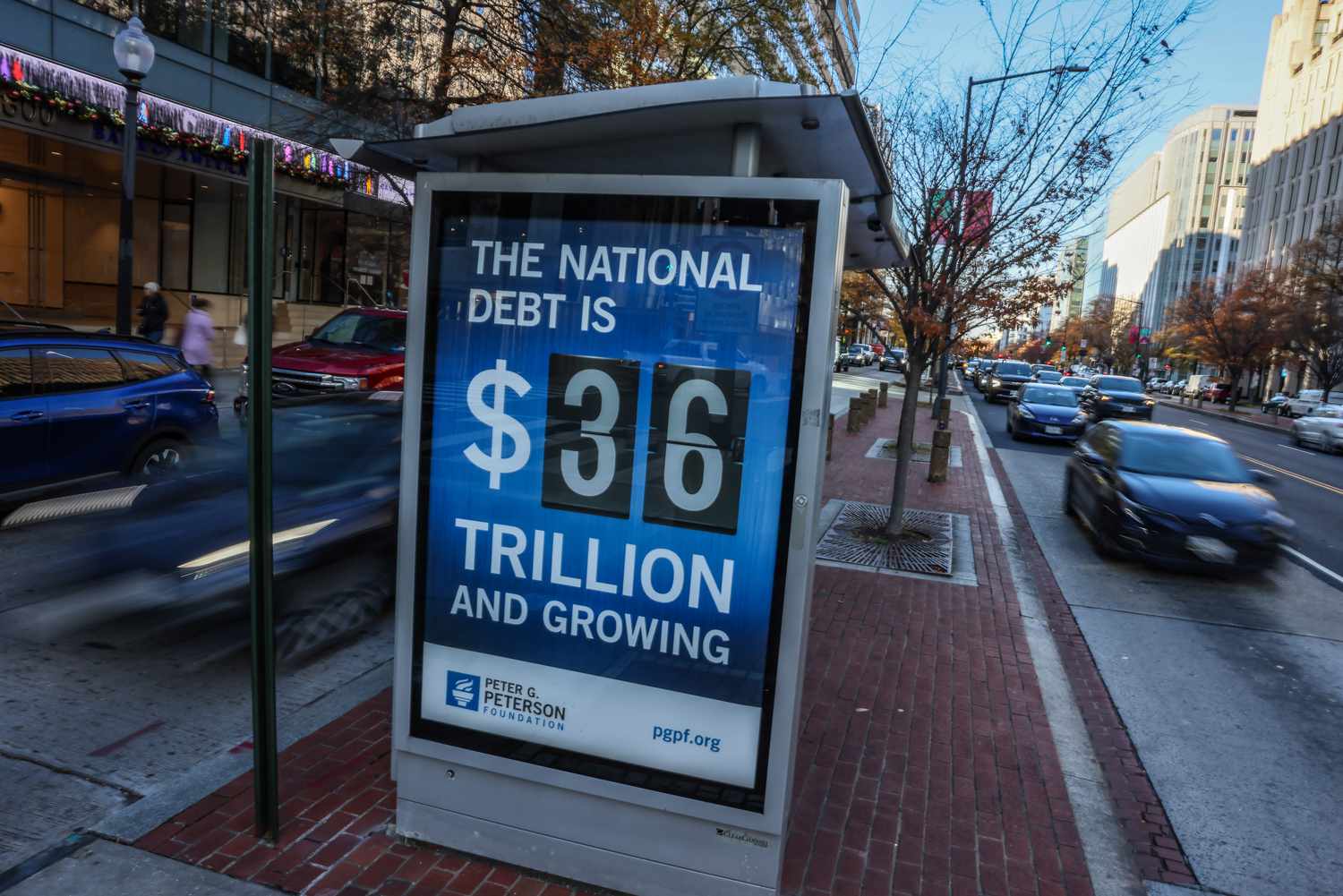

The U.S. national debt just cleared a record $36.2 trillion—more than the annual output of China, Japan, Germany, the U.K., and India combined. That’s also roughly $106,000 per American.

The government will pay about $684 billion in interest this fiscal year alone—roughly 16% of every federal dollar spent—then roll maturing debt into a steady stream of new Treasury securities.

While the debt has grown steadily over decades, warning lights are flashing brighter than ever: in May 2025, Moody’s stripped Washington of its last triple-A rating, bluntly warning that successive administrations have failed to rein in spiraling deficits.

It is the first time that all three major agencies—S&P (2011), Fitch (2023), and now Moody’s—rate America’s debt below the top tier. If investor confidence wavers, borrowing costs would climb just as trillions in Treasuries hit a “maturity wall” in 2026, testing demand on a scale never seen before.

The government takes on debt to cover the gap between what it spends and what it collects in taxes—so it can keep funding programs, services, and investments even when current revenues fall short.

The U.S. national debt is a mix of government bonds that trade daily and non-marketable securities that sit exclusively on federal ledgers. This “intragovernmental” debt is money owed by one arm of the government to another—mostly for programs like Social Security and Medicare.

War spending drove early leaps in the debt, from $75 million after the Revolution to upwards of $3 billion after the Civil War. However, modern surges following the Great Recession pushed the debt-to-GDP ratio above 100% in 2013, and the COVID-19 stimulus to more than 120% today.

Unlike households, which must pay off their debts or risk bankruptcy, the federal government can roll debt indefinitely. Washington can raise taxes and, through the Fed, create more dollars. That is one reason U.S. Treasurys remain the closest thing to a “risk-free” asset and why Washington can keep borrowing year after year.

In effect, the Treasury acts like a giant bond-fund manager: it pays out interest from current tax receipts, then issues fresh bonds to replace those that mature. This process involves regular auctions where Treasury securities are sold to investors, providing the government with the necessary funds to cover expenditures.

Foreign investors still hold about $9 trillion, led by Japan ($1.13 trillion), the U.K. ($779 billion), and China ($765 billion). Domestic pension funds and mutual funds own a growing share.

Despite mounting debt, Congress has raised the debt ceiling 78 times since 1960, using “extraordinary measures” to avoid default when the cap is reached.

There have, of course, been efforts to reduce the size of the debt, but these have often been undermined by political gridlock, unrealistic assumptions, or voter-friendly policies. Elon Musk’s so-called Department of Government Efficiency (DOGE) initially claimed $160+ billion in savings, but watchdogs say it simply shifted or delayed costs and cost taxpayers billions instead.

Meanwhile, annual net-interest outlays are expected to reach $1.8 trillion by 2035, as President Trump’s recent budget proposal, dubbed the “Big, Beautiful Bill,” is projected to add $3+ trillion to the national debt over the next decade, with further tax cuts increasing the burden by another $3.8 trillion.

The U.S. doesn’t so much “pay off” its national debt as manages it, relying on continued investor confidence, a flexible debt ceiling, and economic growth. Credit downgrades and rising costs, however. highlight growing risks—but the depth of Treasury markets and America’s unique fiscal standing still give policymakers room to act for now—if they choose to.

Call it a centennial celebration … of a centennial celebration.

The Restauration – a Norwegian ship carrying 45 immigrants, many of whom settled in Minnesota and became an integral part of the community – arrived in America in 1825. One hundred years later, the U.S. Mint in Philadelphia celebrated the arrival of the Restauration and the launch of the Norse-American community with the striking of a series of medals.

Now, a century after the centennial celebration, a selection of the rarest of those medals, from the collection of David F. Schmidt, will be offered in the ANA US Coins Signature® Auction August 26-31. Heritage Auctions is an ANA Event Auctioneer Partner.

“This is a very important collection of medals and die trials. David Schmidt spent more than 50 years building what might be the finest and most complete collection of these medals ever assembled,” says Greg Rohan, President of Heritage Auctions. “They were made to celebrate an important date in Norwegian and American history, and in the relationship between the two countries. They help cast a spotlight on the strong relationship between the countries, and have even inspired the creation of organizations designed to collect, curate and preserve the history of this important international relationship.

“Some of them are exceptionally rare, and will become important additions to new collections.”

Among the top lots, all of which come from a single consignor, that will be up for grabs is a 1925 Norse-American Centennial Gold Medal, PR65 with the No. 1 Stamped on the Edge, PR65 NGC. The edge stamp suggests that it likely was the first struck Norse-American Centennial gold medal. In June 1982, Anthony Swiatek wrote in The Numismatist that “First strikings of the silver and gold medals were retained by the Centennial Commission.” Gold medal No. 2, he wrote, was presented to Congressman O.J. Kvale, and gold medals No. 3, 4 and 5 were presented to George L Croker, W.J. Clark and J. Carmichael, respectively.

The group includes two other gold medals: one that carries a grade of PR65 PCGS. CAC and is one of about 30 surviving examples, and another that is graded PR65 PCGS.

The Norse-American treasures in the auction feature several silver medals, including a 1925 Medal Norse, Thin Planchet, MS66 PCGS. CAC from a thin planchet and three from thick planchets, as well as a Copper Die Trial, MS63 Brown PCGS and a Brass Uniface Die Trial, MS64 PCGS.

Several rare Large Format pieces also are represented, among them a nickel strike in MS65 NGC and a second nickel strike on a spectacular oversized planchet.

Information for the entire ANA US Coins auction can be found at HA.com/1385.

About Heritage Auctions

Heritage Auctions is the largest fine art and collectibles auction house founded in the United States, and the world’s largest collectibles auctioneer. Heritage maintains offices in New York, Dallas, Beverly Hills, Chicago, Palm Beach, London, Paris, Amsterdam, Brussels, Munich, Hong Kong and Tokyo.

Heritage also enjoys the highest Online traffic and dollar volume of any auction house on earth (source: SimilarWeb and Hiscox Report). The Internet’s most popular auction-house website, HA.com, has more than 1,960,000 registered bidder-members and searchable free archives of more than 7,000,000 past auction records with prices realized, descriptions and enlargeable photos. Reproduction rights routinely granted to media for photo credit.

In May 2025, an Italian crypto millionaire was allegedly tortured for weeks in a luxury Manhattan townhouse, hung from a roof ledge and attacked with a chain saw as his captors demanded his bitcoin password. Just months earlier, another crypto executive had his finger severed by kidnappers demanding millions in digital currency.

Crypto investors are waking up to how these aren’t isolated incidents—they’re part of a terrifying new wave of violent crimes that many worry has put a target on their backs. As Bitcoin and other digital assets have reached record highs, criminals are shifting from laborious online hacking to brutal, real-world extortion.

Criminals are increasingly professional in their approach, leveraging a mix of digital sleuthing and real-world surveillance. Many victims are identified after flaunting their crypto wealth on social media or in public forums, despite the lessons many learned after the Kim Kardashian kidnapping saga.

Others are exposed through data breaches at exchanges. Each passing week, it seems, more of the private information of cryptocurrency users is leaked. For example, in May 2025, Coinbase Global Inc. (COIN) announced that hackers had accessed home addresses and account balances of almost 70k customers in the previous months, putting thousands at risk of targeted extortion and physical threats.

Besides hacks, criminals have bribed insiders at crypto exchanges to leak sensitive customer data. This information can then be used to select and find high-value targets for kidnapping or home invasion.

The luxury SoHo townhouse rented for up to $40,000 per month seemed like the perfect backdrop for crypto success. Instead, it became a torture chamber where 28-year-old Italian entrepreneur Michael Valentino Teofrasto Carturan was allegedly held for 17 days, his captors using increasingly brutal methods to crack his bitcoin wallet.

According to police, John Woeltz and William Duplessie, both of whom have a history in the crypto world, didn’t just threaten their victim—they hung him off the building’s roof ledge, shocked him with electrical wires, and menaced him with a chain saw. When all that failed, they allegedly forced him to smoke crack cocaine and took Polaroid photos of his bound and bloodied body as trophies of their work.

In the United States, a violent gang orchestrated a series of home invasions involving $3.5 million in stolen crypto between September 2022 and July 2023. Victims were threatened, tortured, and forced to transfer their digital assets under duress. The ringleader, Remy Ra St. Felix, was sentenced to 47 years in prison in 2024 after court documents revealed the gang’s use of extreme violence, including inserting sharp objects under fingernails. “The victims in this case suffered a horrible, painful experience that no citizen should have to endure,” said U.S. Attorney Sandra J. Hairston for the Middle District of North Carolina in a prepared statement. “The defendant and his co-conspirators acted purely out of greed and callously terrorized those they targeted.”

The attacks span continents. In France, the crypto world recoiled in early 2025 when attackers didn’t just kidnap the father of a prominent entrepreneur, but filmed themselves severing his finger and sent the video to his son, demanding €5 million (about $5.7 million) in crypto ransom.

David Balland, a co-founder of Ledger, the crypto security firm, endured similarly gruesome attacks during his January 2025 kidnapping. Balland’s finger, too, was cut off—a bloody calling card to prove the kidnappers’ seriousness to anyone considering non-payment.

Canada and Australia have also seen high-profile kidnappings, with crypto executives and traders abducted and forced to pay ransoms ranging from $40,000 to $1 million in digital assets.

Tom Masson/Getty Images

For crypto holders, the message is clear: visibility is a liability. Security experts urge investors to avoid sharing details of their holdings online, even with friends, and to use pseudonyms and fresh digital wallet addresses for each transaction. Physical safety measures are just as important—avoid posting geotagged photos, flaunting luxury items, or revealing travel plans that could signal wealth.

Technical defenses matter, too. Store the bulk of your assets in multi-signature or cold wallets, which require multiple keys or are kept offline, making immediate transfers under duress impossible. Consider setting up decoy wallets with small amounts of crypto to surrender if threatened, while keeping the majority of your funds inaccessible in an emergency.

Finally, stay informed about the latest scams and extortion tactics.

The rise of crypto extortion is a stark reminder that digital wealth can bring very real-world dangers. As criminals become more brazen and sophisticated, crypto holders must balance the pursuit of financial freedom with a heightened sense of caution. Protecting your assets and, more importantly, yourself means you’ll need to give much more thought to security because in the new world of crypto riches, the risks are no longer just virtual.

Just a few days into June, the United States Mint launches its first products of the month, all featuring the new 2025 Dr. Vera Rubin quarter. Struck in circulation quality, the new coin is offered in 100-coin bags, two-roll sets, and three-roll sets, with options including quarters from the Philadelphia, Denver, and San Francisco Mints.

|

|

The Dr. Vera Rubin quarter is the eighteenth release in the U.S. Mint’s American Women Quarters™ Program. Launched in 2022, the series honors notable women in American history, with four new designs issued each year. It will conclude later this year with the twentieth and final coin.

Dr. Vera Rubin was an American astronomer born on July 23, 1928. Fascinated by astronomy from a young age, she earned her bachelor’s degree from Vassar College in 1948, a master’s from Cornell in 1951, and a Ph.D. from Georgetown University in 1954. Among her many contributions to science, Rubin is best known for her groundbreaking research on the rotation curves of spiral galaxies. She observed that stars at the edges of galaxies were moving just as quickly as those near the center – a discovery that could not be explained by the visible matter alone. Her work provided compelling evidence for the existence of dark matter, reshaping our understanding of the universe.

Dr. Vera Rubin Quarter Designs

United States Mint Artistic Infusion Program artist Christina Hess designed the likeness of Dr. Vera Rubin that appears on the reverse (tails side) of each new quarter. Rubin is shown gazing upward, smiling as she contemplates the cosmos, surrounded by a spiral galaxy and other celestial bodies. Inscriptions on the reverse include “DR. VERA RUBIN,” “QUARTER DOLLAR,” “E PLURIBUS UNUM,” and “UNITED STATES OF AMERICA.” The phrase “DARK MATTER” – referencing the invisible mass believed to hold galaxies together – appears at the bottom. The design was sculpted by Mint Medallic Artist John P. McGraw.

All coins in the series feature a portrait of George Washington on the obverse (heads side). This image of the first U.S. president was originally created by artist Laura Gardin Fraser to commemorate Washington’s 200th birthday in 1932, and includes the inscriptions “LIBERTY,” “IN GOD WE TRUST,” and “2025.”

Coin Specifications

| Denomination: | Quarter |

| Finish: | Uncirculated |

| Composition: | 8.33% nickel, balance copper |

| Weight: | 5.670 grams |

| Diameter: | 0.955 inch (24.26 mm) |

| Edge: | Reeded |

| Mint and Mint Mark: | Philadelphia – P Denver – D San Francisco – S |

| Privy Mark: | None |

Quarter Products, Prices and Ordering

The Dr. Vera Rubin quarter is available in the following product options and prices:

Product limits are set at 7,000 for the Two-Roll Sets, 18,625 for the Three-Roll Sets, and 8,250 for each of the 100-Coin Bags. Additionally, initial household order limits are three for any of the rolls and ten for the bags.

Of note, the Mint stated that “because of overwhelming demand, much of the production of the three-roll sets is accounted for through subscription,” with only “a limited quantity available for purchase beginning June 3 at noon ET.”

Quarter products may be ordered directly from the U.S. Mint’s online catalog.

American Women Quarters Program

Authorized by Congress under Public Law 116-330, the Mint’s American Women Quarters series launched in 2022 and will conclude this year with a total of twenty coins, each honoring the achievements and contributions of women in United States history.

2025 quarters recognize:

In addition to rolls and bags of circulation-quality coins, American Women quarters will also be included in U.S. Mint clad proof sets, silver proof sets, holiday ornaments, and uncirculated sets.

Dr. Vera Rubin quarters entered circulation on Monday, June 2, through the Federal Reserve Bank System. Only the Philadelphia and Denver Mint strikes were released, as San Francisco–minted quarters are produced exclusively for numismatic products.

The states with the cheapest 30-year new purchase mortgage rates Monday were New York, California, Hawaii, and Tennessee, followed by a large multi-state tie that includes Georgia, Pennsylvania, and Texas. The lowest-rate states registered averages between 6.86% and 6.97%.

Meanwhile, the states with Monday’s most expensive 30-year rates were Alaska, West Virginia, Mississippi, Montana, Maryland, South Dakota, and Vermont. The range of averages for these pricier states was 7.05% to 7.22%.

Mortgage rates vary by the state where they originate. Different lenders operate in different regions, and rates can be influenced by state-level variations in credit score, average loan size, and regulations. Lenders also have varying risk management strategies that influence the rates they offer.

Since rates vary widely across lenders, it’s always smart to shop around for your best mortgage option and compare rates regularly, no matter the type of home loan you seek.

The rates we publish won’t compare directly with teaser rates you see advertised online since those rates are cherry-picked as the most attractive vs. the averages you see here. Teaser rates may involve paying points in advance or may be based on a hypothetical borrower with an ultra-high credit score or for a smaller-than-typical loan. The rate you ultimately secure will be based on factors like your credit score, income, and more, so it can vary from the averages you see here.

Rates on 30-year new purchase mortgages have been mildly bobbing after a multi-day decline of 16 points. The current 7.00% average is an improvement vs. the May 22 reading of 7.15%, which was the flagship average’s highest level in a year.

In March, however, 30-year rates sank to 6.50%, their cheapest average of 2025. And in September, 30-year rates plunged to a two-year low of 5.89%.

| National Averages of Lenders’ Best Mortgage Rates | |

|---|---|

| Loan Type | New Purchase |

| 30-Year Fixed | 7.00% |

| FHA 30-Year Fixed | 7.37% |

| 15-Year Fixed | 6.04% |

| Jumbo 30-Year Fixed | 7.03% |

| 5/6 ARM | 7.03% |

| Provided via the Zillow Mortgage API | |

Calculate monthly payments for different loan scenarios with our Mortgage Calculator.

Mortgage rates are determined by a complex interaction of macroeconomic and industry factors, such as:

Because any number of these can cause fluctuations simultaneously, it’s generally difficult to attribute any change to any one factor.

Macroeconomic factors kept the mortgage market relatively low for much of 2021. In particular, the Federal Reserve had been buying billions of dollars of bonds in response to the pandemic’s economic pressures. This bond-buying policy is a major influencer of mortgage rates.

But starting in November 2021, the Fed began tapering its bond purchases downward, making sizable monthly reductions until reaching net zero in March 2022.

Between that time and July 2023, the Fed aggressively raised the federal funds rate to fight decades-high inflation. While the fed funds rate can influence mortgage rates, it doesn’t directly do so. In fact, the fed funds rate and mortgage rates can move in opposite directions.

But given the historic speed and magnitude of the Fed’s 2022 and 2023 rate increases—raising the benchmark rate 5.25 percentage points over 16 months—even the indirect influence of the fed funds rate has resulted in a dramatic upward impact on mortgage rates over the last two years.

The Fed maintained the federal funds rate at its peak level for almost 14 months, beginning in July 2023. But in September, the central bank announced a first rate cut of 0.50 percentage points, and then followed that with quarter-point reductions in November and December.

For its third meeting of the new year, however, the Fed opted to hold rates steady—and it’s possible the central bank may not make another rate cut for months. With a total of eight rate-setting meetings scheduled per year, that means we could see multiple rate-hold announcements in 2025.

The national and state averages cited above are provided as is via the Zillow Mortgage API, assuming a loan-to-value (LTV) ratio of 80% (i.e., a down payment of at least 20%) and an applicant credit score in the 680–739 range. The resulting rates represent what borrowers should expect when receiving quotes from lenders based on their qualifications, which may vary from advertised teaser rates. © Zillow, Inc., 2025. Use is subject to the Zillow Terms of Use.

Editor’s Note: Every time the markets have plunged into chaos over the last 25 years – 2008, 2020, 2022, even 2025’s tariff shock – veteran trader Jeff Clark was one of the few to sound the alarm before it happened… and each time, he was right.

Now Jeff is issuing another urgent warning: A fresh wave of market volatility could be just weeks away. But here’s what most investors usually miss – volatility isn’t just risk. It’s also opportunity. And nobody has turned chaos into consistent profits quite like Jeff.

He’s closed over 1,000 winning trades amid turbulent markets using his proprietary “chaos pattern” strategy, a method based on divergence and mean reversion.

Together with TradeSmith, Jeff is debuting a groundbreaking tool that scans the market daily for these chaos patterns. It’s the same system Jeff already uses; but now, for the first time, you’ll be able to access it, too.

He’ll reveal all next week, Wednesday, June 11 at 10 am ET during his Countdown to Chaos event, including 10 real-time opportunities the screener is flagging right now.

Don’t miss this. If Jeff is right again – and history says he probably is – this could be your best shot to profit while others panic. Reserve your seat now.

Today, we’ve invited Jeff to share some insights about what’s building behind the scenes right now to help prepare you for what’s ahead.

If you’re looking for financial advice, seek out someone with wrinkles and gray hair.

Most folks under 50 years old have no idea what’s coming next. They’ve never experienced a rising interest rate environment.

Look at this chart of 30-year interest rates…

Long-term interest rates peaked in 1982, with the 30-year Treasury Bond yielding 14%.

Rates then declined for the next 40 years – hitting as low as 0.4% during the COVID crisis in 2020.

But, look at what has happened in the last three years. The 30-year Treasury yield broke out above a 40-year declining resistance line.

Interest rates entered a new, long term bull market – meaning Treasury Bonds entered a bear market. Rates are 60% higher today than they were in 2022.

They’re 1,100% higher than they were at the bottom in 2020.

In other words, the cost of borrowing money is 11 times greater today than it was five years ago.

Most folks, most companies, and most governments manage their debt by taking out new loans to pay off older debt as it matures. And, for the past 40 years we’ve been able to do this at perpetually lower interest rates. This allowed us to borrow even more money without incurring larger debt payments.

People could buy bigger homes. Companies could pay premium prices to buy out competitors or buy back their own shares. Governments could spend money recklessly without feeling the pinch of fiscal budget restraints.

There were no consequences to borrowing money. Deficits didn’t matter.

Now though, with long-term interest rates recently hitting the highest level in 20 years, it costs more to borrow money. Any maturing debt must be refinanced at higher rates.

Nobody is refinancing their mortgage anymore and taking out a pile of cash to spend on their lavish lifestyles. Companies can’t borrow cheap money to buy back expensive shares.

And the U.S. government – with $9 trillion of its $36 trillion national debt due to mature in 2025 – for lack of a better word… is screwed. All of that debt will be refinanced at higher interest rates.

Some of us wrinkled, gray-haired, old folks remember what it was like living in the 1970s. We’ve seen how financial assets perform in a rising interest rate environment.

And, we’ve frequently been mocked for pointing to the ever-growing, massive mountains of consumer, corporate, and government debt and suggesting caution.

“Deficits don’t matter,” the younger folks shout at us. “The national debt has grown from less than $1 trillion in 1982 to almost $37 trillion today, and nothing bad has happened.”

They ask, “What’s different this time?”

Take another look at the chart above. This time, you’ll see the difference…

And it could hit like a freight train.

That’s why I’m hosting a special event next Wednesday, June 11 at 10 am ET – Countdown to Chaos – to walk you through exactly what’s coming next… and how you can position yourself not just to survive but to profit in spades.

I’ll reveal 10 compelling opportunities flashing right now, as well as the powerful new tool I’ve built with TradeSmith to find them daily.

If you’ve ever wanted to turn volatility into your biggest advantage, join us for the Countdown to Chaos.

U.S. equities rose at midday as the markets continued to wait for more information about possible U.S. trade deals. The Dow Jones Industrial Average, S&P 500, and Nasdaq were slightly higher.

Dollar General (DG) was the best-performing stock in the S&P 500 after the discount retailer beat profit and sales estimates and boosted its guidance as shoppers worried about economic uncertainty flocked to its stores.

Shares of Constellation Energy (CEG) gained when Meta Platforms (META) signed a 20-year deal to buy nuclear power from the firm to power its artificial intelligence (AI) data centers.

Hims & Hers Health (HIMS) shares rose when the health and wellness site purchased London-based digital healthcare provider ZAVA to expand its reach in Europe. The price of the all-cash deal was not disclosed.

FactSet Research Systems (FDS) shares fell when the financial data firm announced that CEO Phil Snow would be retiring in September. Snow will be replaced by former JPMorgan Chase (JPM) executive Sanoke Viswanathan.

After a big jump yesterday on President Trump’s announcement of 50% tariffs on imported steel, shares of Nucor (NUE) and rival steelmakers fell on concerns the new duties will lead to higher costs, supply chain issues, and retaliation.

Bumble (BMBL) shares tumbled on a downgrade from JPMorgan, which said the dating app is losing market share to competitor Hinge.

Oil futures climbed. Gold prices declined. The yield on the 10-year Treasury note ticked higher. The U.S. dollar was up on the euro, pound, and yen. Most major cryptocurrencies traded higher.

TradingView

The Central Bank of Kenya (CBK) plans to lift its 10-year ban on issuing new banking licenses on July 1.

This change will open the market to fintechs and digital banks, which is expected to increase market competition and, possibly, bank consolidations as small banks are forced to merge or exit the industry.

“Fintechs will drive innovation in the sector, prompting traditional banks to adopt new technologies to stay competitive,” says Anne Kibisu, a banking analyst at Deloitte Kenya.

New and existing banks will face new capital requirements enacted in December 2024 under the Business Laws (Amendment) Act 2024. By 2026, banks will be required to maintain KES10 billion ($77 million) in capital.

This development follows a similar capital increase in 2009, when the requirement was raised from KES250 million to KES1 billion. That change prompted mergers, including KCB’s acquisition of National Bank in 2019. Analysts predict a similar wave of consolidation as smaller banks struggle to meet the new capital targets.

The central bank reports that 12 banks face a combined capital shortfall of KES11.8 billion. To comply with the new requirements, these banks needed to raise KES3 billion by December 2024, KES6 billion this year, and eventually KES10 billion by 2026.

“These increased capital thresholds are designed to help banks absorb economic shocks and continue supporting sustainable growth,” said CBK Governor Kamau Thugge.

Since December 2023, 27 of Kenya’s 39 licensed banks have met the new capital requirement. The remaining 12, primarily smaller banks with limited branch networks, now face significant pressure to recapitalize or merge with larger institutions.

“We are actively exploring strategic partnerships to meet the new capital requirements,” said an executive from an affected bank. “Mergers are also being considered.”

The CBK is expected to guide the consolidation process, as it did during the 2015-2016 banking crisis, which saw the collapse of Imperial Bank and Chase Bank. By 2027, Kenya’s banking sector is expected to be more robust and consolidated.