This ‘Trump 2.0’ Stock Is Tied to Energy, Infrastructure… and AI

While the media scrambles to explain the rally, he’s been tracking this economic shift for months…

Editor’s Note: While the market reels from President Trump’s “Liberation Day” tariffs, legendary investor Louis Navellier says something much bigger is happening just beneath the surface.

He’s calling it Liberation Day 2.0 – and according to his research, it could unleash up to $10 trillion in new stimulus, create millions of high-paying jobs, and spark the next phase of a generational bull market. But only if you know where to look.

What’s driving it all? A three-pronged strategy the president is already rolling out – Tax Liberation, Tech Liberation, and Energy Liberation – each one designed to jolt different corners of the U.S. economy.

In a brand-new presentation called The Liberation Day Summit, Louis lays out a detailed plan for how he’s preparing his readers to profit from this unprecedented shift. He even gives away the name and ticker of one A-rated stock he believes could hand investors a $5,000–$15,000 payday in the coming months – and it’s completely free to watch.

Reserve your seat to the summit now, and tune in Wednesday, May 28 at 1 p.m. ET to hear all about Louis’ blueprint.

To help prepare you for this event, Louis is joining us today to share a bit more about what he sees coming down the pike.

After the big “Liberation Day” selloff on April 3, I made a bold prediction.

I told everyone that we would see a huge rally soon – we just needed to wait for the dust to settle first.

And that’s exactly what happened.

The folks at Bespoke pointed out that the S&P 500 was down more than 15% year-to-date on April 8. But in the next 25 trading days, the S&P 500 erased these losses.

The media is acting like this spectacular rally came out of nowhere – a sudden, unexpected development that no one could have predicted.

But that’s not true.

Over the past two years, I’ve made three big predictions that all came true – from Joe Biden’s departure from the presidential election to Donald Trump’s return to the White House to the trade pivot we’re seeing now.

So, today, I want to show you why I made these predictions and how they unfolded.

More importantly, I’ll make my next big prediction.

And I’ll show you one stock that will benefit from what’s coming next.

Three Big Predictions

1. Biden’s Dropout: Back in December 2023, I said President Biden wouldn’t make it to the 2024 general election. I’ve been around the markets and politics for over four decades. So, I’ve learned a thing or two about how things work behind closed doors. And I knew party insiders wouldn’t risk running a candidate they couldn’t prop up through the finish line. I also said a Democrat from California would likely replace him. I picked the wrong one – I expected Gavin Newsom, but it turned out to be Kamala Harris. Still, the pattern played out exactly as I said it would.

2. Trump 2.0: Next, throughout 2024, I told my premium readers that Donald Trump would win the presidential election. When most analysts were still hedging their bets, I was explicit: A second Trump term was coming – and investors needed to prepare. And after Trump won the election, I further prepared readers for what to expect from Trump 2.0.

I said that Trump would 1) aim to end the “manufacturing recession” and lay the groundwork for a true “Made in America” revival… 2) roll back environmental restrictions and unleash American fossil fuel production… and 3) go “all-in” on AI by removing bureaucratic hurdles and launch a full-scale effort to ensure the U.S. leads the global race. Since then, we’ve seen these forecasts begin to play out in real time.

3. The Trade Panic – and the Pivot: Then, when Trump took office, I said that tariffs were coming. And when they came in April 2025, I warned that the media would panic and that volatility was likely. But I also said this was Step 1 in a broader strategy to reroute global trade, bring critical industries back onshore, and realign the tax code to favor working- and middle-class Americans. I predicted that most countries would come to the negotiating table and said investors shouldn’t worry. I said that most of the “reciprocal” tariffs would go away for major U.S. trading partners – so long as they agreed to play fair. Sure enough, by May, trade truces started piling up. Markets rallied. And the so-called crisis began to fade.

If you think this rally is the end of the story – you’re missing the bigger picture.

Here’s What’s Next on the Trump 2.0 Agenda

What we’re seeing now is the rollout of a much bigger framework I’ve been tracking for months. I call it Liberation Day 2.0.

Here’s what it includes:

1. Tax Liberation

President Trump’s proposal to use tariff revenue to cut income taxes for Americans earning under $150,000 could unleash a wave of consumer spending. If history is any guide, these cuts could lift wages, fuel business investment, and add trillions to GDP over the next decade.

2. Tech Liberation

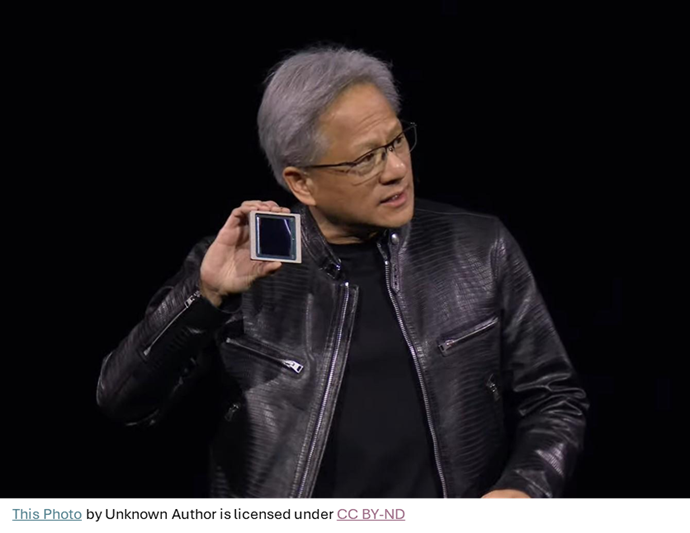

Big Tech, the U.S., and foreign governments have committed more than $2 trillion to AI, crypto, and cloud infrastructure since the election. Get ready for more. The White House is reversing regulatory choke points. Innovation-first policy is back – and the smart money knows it.

3. Energy Liberation

The U.S. is sitting on more than $100 trillion in untapped energy and mineral resources. New executive orders are clearing red tape on mining and drilling projects nationwide. This may be the beginning of a generational boom in strategic materials, rare earths, and domestic energy.

The question now is simple: How do you position your portfolio to capture this wealth-creation opportunity?

One way is to buy a stock in the “crosshairs” of the Liberation 2.0 policies.

One Trump 2.0 Stock to Buy Now

I recommended Powell Industries Inc. (POWL) to my premium members in December 2023 because of its “history of posting big earnings surprises.”

Over the previous five quarters, this Houston-based developer and manufacturer of equipment and systems for electrical infrastructure had posted earnings surprises of 305.6%, 400%, 233.3%, 130.3%, and 62.5%.

Since then, Powell has skyrocketed for peak gains of 300%.

Now, earnings surprises – even big ones – tend not to produce that much profit.

However, exposure to the exploding artificial intelligence market does.

While I didn’t mention “AI” once in my original “buy” alert, in the months after I recommended Powell, it became clear that its products and services were crucial components in the giant AI data centers known as “hyperscalers.”

Indeed, we started talking about Powell as an AI data center beneficiary as early as June 2024… and the stock went on to double in the months after that.

You see, as AI grows, so does the demand for reliable, scalable data centers – essential infrastructure for AI workloads. These facilities require customized, fully integrated electrical solutions to ensure reliability, efficiency and performance.

Powell’s other major clients include petrochemical plants, pulp and paper mills, oil and gas producers, utilities, and transportation facilities. That makes it uniquely positioned to benefit from the trifecta of Trump 2.0’s Tax, Tech, and Energy Liberation policies.

The company has already laid the groundwork to support this growth, building relationships with hyperscaler operators and the companies that rent space within those giant data centers (known as “co-locators”).

And this groundwork is already paying off.

During its second quarter in fiscal year 2025, Powell reported new orders totaling $249 million, and its backlog remained at $1.3 billion. Second-quarter revenue rose 9% year-over-year to $279 million, just shy of estimates for $282.68 million.

Earnings increased 38% year-over-year to $46 million, or $3.81 per share, compared to $33.5 million, or $2.75 per share, in the second quarter of 2024. Analysts expected earnings of $3.44 per share, so Powell Industries posted a 10.8% earnings surprise.

While Powell has pulled back from its all-time highs from earlier this year, it remains on a solid growth trajectory. For 2025, analysts expect Powell to post $1.12 billion in revenue, up from $1.01 billion in the previous year. Earnings are expected to climb to $14.17 per share, up from $12.29 a year ago.

Right now, Powell earns a “B” rating in my Stock Grader system… and I think it’s a good “buy” under $227.

But buying Powell Industries is just a start…

The Final Word: Highlighting the Next Winners of This Economic Reset

More ambitious investors will want to join me on Wednesday, May 28, at 1 p.m. Eastern. That’s when I’ll be doing a free broadcast where I’ll walk you through the full Liberation Day 2.0 blueprint.

I’ll also share some details on three stocks my Stock Grader system has flagged with even higher “buy” ratings than Powell’s – companies I believe could double or triple as these policies unfold. (Register here now.)

This system is the same quantitative engine I’ve been using for nearly five decades – the system that helped me identify winners like Apple Inc. (AAPL) and Amazon.com, Inc. (AMZN) long before they became household names.

And that, in 2024 alone, showed my premium members how to take a $7,500 investment… and walk away with:

- A $2,093 gain on Novo Nordisk A/S (NVO)…

- A $5,500 gain on Axcelis Technologies Inc. (ACLS)…

- A $14,000 gain on YPF SA (YPF)…

- And even a whopping $45,360 gain on Vista Energy (VIST).

That’s without using options, penny stocks, or any other high-risk strategies.

While the media and Wall Street are still catching up to what’s happening, my system is already highlighting the next winners of this economic reset.

I’ll explain everything on May 28. But I suggest you take a moment now and get your name on the list. That way you won’t miss a word.

Click here to register for my Liberation 2.0 summit now.

Louis Navellier hereby discloses that as of the date of this email, that he, directly or indirectly, owns the following securities that are the subject of the commentary, analysis, opinions, advice, or recommendations in, or which are otherwise mentioned in, the essay set forth below:

Powell Industries Inc. (POWL).