3 Certainties for a New American Prosperity… and One Stock Set to Profit

Liberation Day 2.0 Summit begins today in less than an hour, at 1 p.m. Eastern.

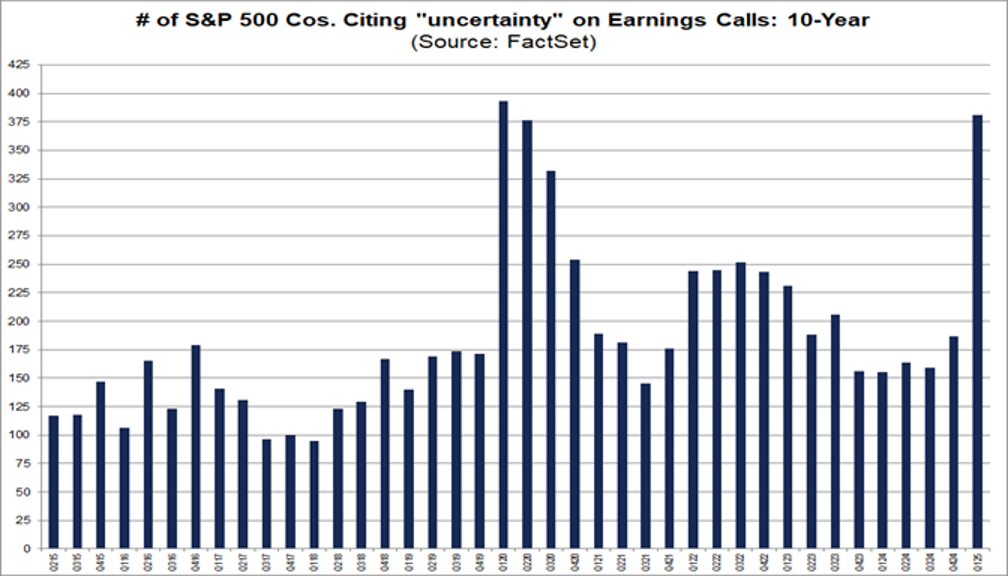

Editor’s Note: Uncertainty is everywhere. Just look at the fact that more than 350 S&P 500 companies cited the word “uncertainty” on their latest earnings calls, the highest in years.

But legendary investor Louis Navellier says the real story isn’t about what’s unclear — it’s about three major economic shifts that are already happening with full clarity.

He calls it Liberation Day 2.0 — a sweeping trifecta of Tax Liberation, Tech Liberation, and Energy Liberation, powered by President Trump’s latest policies.

Louis believes this plan could unlock up to $10 trillion in new stimulus, create millions of jobs, and trigger a generational bull market.

In less than an hour, Louis is going live with a brand-new briefing — The Liberation Day Summit — where he’ll reveal:

- A stock he believes could hand investors $5,000–$15,000 in gains

- Three sectors set to dominate under Trump 2.0

- Ten stocks he says to sell immediately

- And the strategy he’s using to help readers capture big paydays

The summit begins today at 1 p.m. ET — and there’s still time to claim your free spot.

Don’t miss Louis’ full blueprint for turning today’s so-called “uncertainty” into tomorrow’s opportunity.

Now, take it away, Louis…

In the very first Sesame Street episode, in November 1969, Kermit the Frog attempts to describe the letter “W.” A hungry Cookie Monster chomps away at the subject matter, forcing Kermit to change his prepared speech to talk about “N”… then “V”… as sections of the letter disappear.

The segment proved so memorable that Sesame Street has continued to run some version of its “letter of the day” to the present.

Fast forward to today, and the American economy is now being brought to you by the letter “U.”

Indeed, uncertainty has become the fixation of media and Wall Street alike.

Eighty-four percent of the S&P 500 companies used the term “uncertainty” in their most recent earnings calls. Moody’s used it as a reason for their recent downgrade of U.S. debt.

In fact, this word has become so prevalent that the Federal Reserve’s April 2025 “Beige Book” (its twice-a-quarter commentary on current economic conditions) used it 80 times without people really noticing. (The April 2024 version mentioned the word only 11 times.)

Now, I want to acknowledge the word is useful in some cases.

But the word “uncertainty” gives many the excuse to be a bit lazy:

- It lets the media create an invisible enemy to focus readership anger…

- It causes financial analysts and investors to throw up their hands and say nothing’s for sure….

- It allows CEOs of S&P 500 companies to blame something else if their performance falls short…

And it also hides some facts that are absolutely crystal clear to me.

So, in today’s Market 360, let’s review three items that are actually quite certain… what they has to do with President Trump’s three-part economic plan… why this plan matters to investors…

And one stock investors can buy right now to profit off of the president’s latest pro-business moves.

Certainty No. 1: Tax Liberation

Last week, President Trump’s “Big, Beautiful Bill,” a sweeping legislative tax proposal, passed the House. Here are three key reforms it includes…

- Permanent middle-class tax cuts. It lowers the individual income tax rate. For example, the 15% bracket is dropped to 12% and 25% is lowered to 22%. There are also no taxes on tips or overtime – one of President Trump’s campaign promises.

- Expanded family and child benefits. The child tax credit is permanently set at $2,000 per child. It also includes new MAGA savings accounts, with a $1,000 federal contribution for newborns.

- Health and wellness savings expansion. Health savings accounts (HSAs) can be used on more than just doctor’s visits and medications. Americans can apply them toward things like fitness memberships, direct primary care and spousal flexibility.

However, President Trump isn’t stopping there… he also wants to use the revenues the U.S. makes from tariffs to cut income taxes for people making $150,000 or less. This would be the biggest change to the tax code since Trump’s first term, when he passed the Tax Cuts and Jobs Act.

These tax changes would be a huge boost for the middle class and economy. According to the House Ways and Means Committee, the Tax Cuts and Jobs Act drove wages higher, grew business investment by 20% and boosted GDP by a full percent. This could lead to trillions of dollars in additional growth over a decade.

All we need now is for the Senate to get on board, and then the Big, Beautiful Bill will become law.

Certainty No. 2: Tech Liberation

Artificial intelligence will continue to gobble up ever more electricity this year. Here’s why I’m so confident:

Last November, NVIDIA Corporation (NVDA) released its Blackwell chip, an AI platform that’s 3X to 4X faster than its predecessor. It’s also a power hog, with each B200 GPU unit consuming 1,200 watts, roughly what a household toaster needs. (Its predecessor used 700 watts.)

However, this 70% increase in power consumption doesn’t translate to 70% more electricity demand overnight. Blackwell chips can only be produced so quickly, and even the top cloud computing firms like Oracle Corporation (ORCL) and Microsoft Corporation (MSFT) have been forced to wait in line for supply.

During its first-quarter earnings call, Microsoft CEO Satya Nadella noted that profits at his firm would have been even higher if only they had the hardware.

That will change through mid-2026 as more Blackwell chips roll off the assembly line. Older generations of Nvidia’s Hopper chips will be replaced by these power-hungry Blackwell ones, and additional sites will be built to house all-new sets. More of these chips means more power will be consumed, straining an already tight U.S. energy grid further.

In addition, AI developers show no sign of lifting off the gas pedal.

Last month, OpenAI launched its latest GPT-4.1 model, an AI that’s roughly 20% better at coding than its predecessor GPT-4o. The firm followed up this month with a new AI coding agent, Codex, a powerful tool that can write code, fix bugs, run tests, and answer questions.

Not to be outdone, Alphabet Inc. (GOOG) unveiled a suite of AI-powered products at its I/O developer conference last Tuesday, May 20. This included a new series of AI models, AI-generated movies, next-generation smart glasses, and AI-powered wearable devices.

Perhaps most importantly, Alphabet revealed a new AI model, code-named “Deep Think,” that is more than twice as accurate as OpenAI’s best models at certain tasks.

This AI arms race will continue, driving up demand for power-intensive Blackwell chips. No AI company can afford to get left behind, and so we expect power-generation firms will continue to see strong demand.

Certainty No. 3: Energy Liberation

On President Trump’s first day in office, he signed three new energy executive orders that would “unleash America’s affordable and reliable energy and natural resources”:

- Executive Order 14154, “Unleashing American Energy”: This order boosts energy independence and economic growth. It prioritizes expanding energy production on federal lands and offshore, increasing domestic mining of critical minerals, and ending the electric vehicle (EV) mandate to promote consumer choice. It also demands a review of regulations that hinder energy development.

- Executive Order 14156, “Declaring a National Energy Emergency”: This order declares a national energy emergency and directs federal agencies to use emergency powers to increase energy development. This includes identifying and utilizing domestic energy resources, streamlining leases and permitting processes, and expanding energy infrastructure. The goal is to make the U.S. more energy independent.

- Executive Order 14153, “Unleashing Alaska’s Extraordinary Resource Potential”: This order is to expand resource development in Alaska. It focuses on boosting energy production, streamlining permits, and advancing infrastructure like pipelines and liquified natural gas (LNG) exports. It also restores oil and gas leasing in the Arctic National Wildlife Refuge and directs agencies to remove regulations that hinder development.

These three initiatives, I believe, may have the largest long-term impact on this country’s wealth and prosperity. The reality is we’re sitting on over $100 trillion worth of energy and natural resources right here in America.

That’s almost four times larger than our annual GDP and three times larger than our national debt. That means we can wipe out the national debt three times over just by tapping into the assets we have buried in our own backyard. This would be a game-changer for our economy.

All Part of President Trump’s Liberation Day 2.0

The reason why I believe tax liberation, tech liberation and energy liberation are certainties is because they fall under President Trump’s three-part economic plan. I like to call it Liberation Day 2.0.

Investors looking for a place to buy may want to investigate the president’s latest “liberation.”

On Friday, he signed a series of executive orders with the goal of “re-establishing the United States as the global leader in nuclear energy.” The orders slash regulations, with the aim to increase American nuclear energy capacity from 100 gigawatts to 400GW by 2050 and to “have 10 new large reactors with complete designs under construction by 2030.”

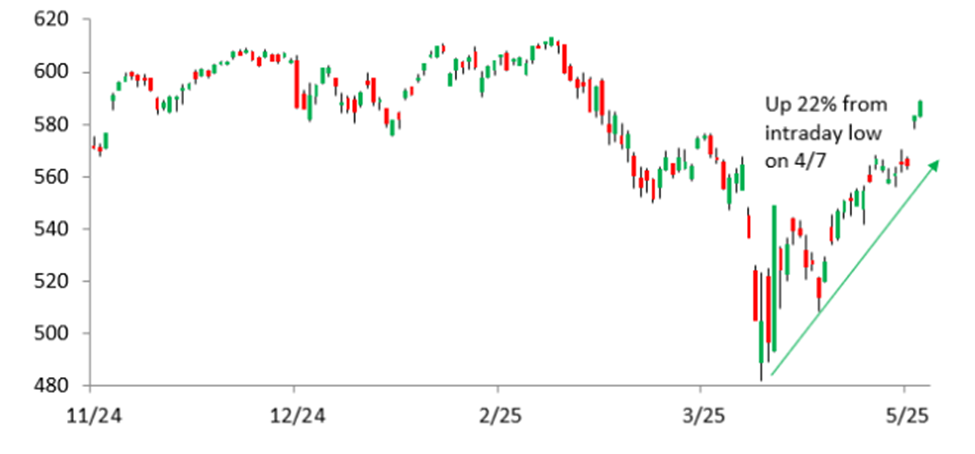

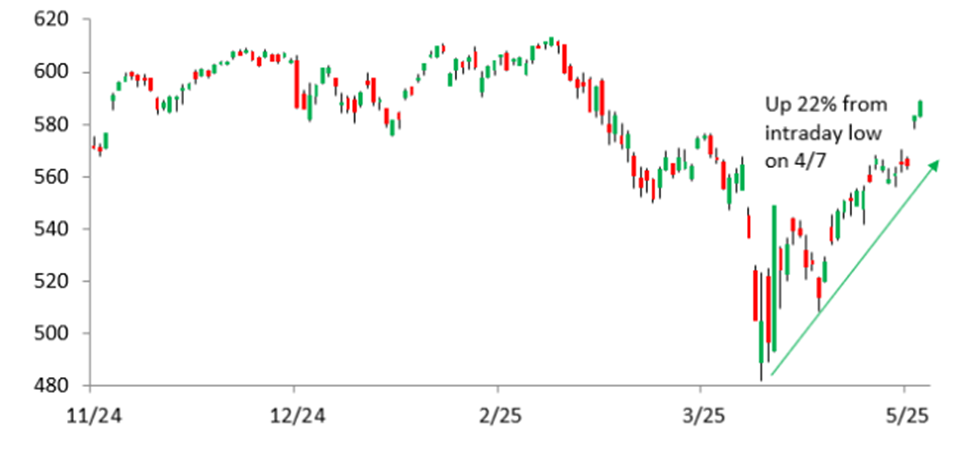

Nuclear stocks jumped on the news… but they still have plenty of room to run as AI’s need for power continues to soar. One of my favorite nuclear stocks at the moment is Vistra Corp. (VST).

This Irving, Texas-based company is one of the biggest power generators in the United States, with about 37,000 megawatts of power generated from natural gas, nuclear, solar and battery storage facilities. The company offers reliable and efficient power solutions to approximately 4 million customers – residential, commercial and industrial – in 20 states, and Washington, D.C.

And in March 2024, Vistra completed a $3.4 billion deal to acquire Energy Harbor, making it the second-largest American nuclear power provider.

It rates a “B” in my Stock Grader system, and I recommend it in several of my paid services. Investors curious about nuclear energy “liberation” should take a closer look at VST.

Of course, that’s not the only way to profit from Liberation Day 2.0.

And I’ll talk about some more ideas during my Liberation 2.0 summit today in less than an hour! It starts at 1 p.m. Eastern, but you still have some time left to reserve your spot. Click here and do so now.

During this summit, I’ll also discuss:

- The three sectors I expect to dominate during the next phase of Trump 2.0 – and a top-ranked “buy” pick for each sector.

- The sectors I believe will suffer the most as we transition to the new Trump economy – and 10 stocks my Stock Grader system and I say to avoid and/or sell now.

- The strategy I’m using to help my readers target $2,500… $5,000… even $10,000 paydays.

- And details on the Stock Grader system that’s helped me beat Wall Street at its own game for nearly five decades.