10 Best Dividend Aristocrats You’ve Never Heard Of

Updated on February 26th, 2025 by Bob Ciura

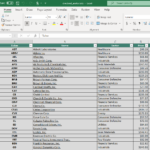

Spreadsheet data updated daily

We recommend long-term investors focus on high-quality dividend stocks. To that end, we view the Dividend Aristocrats as among the best dividend stocks to buy-and-hold for the long run.

The Dividend Aristocrats have a long history of outperforming the market when it comes to risk-adjusted returns. There are currently 69 Dividend Aristocrats.

You can download an Excel spreadsheet of all 69 Dividend Aristocrats (with metrics that matter such as dividend yields and price-to-earnings ratios) by clicking the link below:

Disclaimer: Sure Dividend is not affiliated with S&P Global in any way. S&P Global owns and maintains The Dividend Aristocrats Index. The information in this article and downloadable spreadsheet is based on Sure Dividend’s own review, summary, and analysis of the S&P 500 Dividend Aristocrats ETF (NOBL) and other sources, and is meant to help individual investors better understand this ETF and the index upon which it is based. None of the information in this article or spreadsheet is official data from S&P Global. Consult S&P Global for official information.

This article begins with an overview of the Dividend Aristocrats list. Then, we list our top 10 Dividend Aristocrats you’ve never heard of.

The list is comprised of 10 Dividend Aristocrats, all of which have raised their dividends for over 25 years in a row, and are included in the S&P 500 Index.

In addition, these 10 Dividend Aristocrats tend to get much less coverage in the financial media, and have smaller followings than the largest Dividend Aristocrats.

Table of Contents

Dividend Aristocrats Overview

The requirements to be a Dividend Aristocrat are:

- Be in the S&P 500

- Have 25+ consecutive years of dividend increases

- Meet certain minimum size & liquidity requirements

All Dividend Aristocrats are high-quality businesses based on their long dividend histories. A company cannot pay rising dividends for 25+ years without having a strong and durable competitive advantage.

But not all Dividend Aristocrats make equally good investments today. That’s where the spreadsheet in this article comes into play. You can use the Dividend Aristocrats spreadsheet to quickly find quality dividend investment ideas.

The list of all 69 Dividend Aristocrats is valuable because it gives you a concise list of all S&P 500 stocks with 25+ consecutive years of dividend increases (that also meet certain minimum size and liquidity requirements).

A sector breakdown of the Dividend Aristocrats Index is shown below:

The top 2 sectors by weight in the Dividend Aristocrats are Industrials and Consumer Staples. The Dividend Aristocrats Index is tilted toward Consumer Staples and Industrials relative to the S&P 500.

These 2 sectors make up over 40% of the Dividend Aristocrats Index, but less than 20% of the S&P 500.

The Dividend Aristocrats Index is also significantly underweight the Information Technology sector, with a ~3.5% allocation compared with over 20% allocation within the S&P 500.

The Dividend Aristocrat Index is filled with stable industry giants with market caps above $200 billion, such as Coca-Cola (KO), ExxonMobil (XOM), and Johnson & Johnson (JNJ).

However, there are smaller Dividend Aristocrats that are worth paying attention to. The following 10 Dividend Aristocrats have strong business models, durable competitive advantages, and long-term dividend growth potential.

Dividend Aristocrat You’ve Never Heard Of: FactSet Research Systems (FDS)

FactSet Research Systems is a financial data and analytics firm founded in 1978. It provides integrated financial information and analytical tools to the investment community in the Americas, Europe, the Middle East, Africa, and Asia-Pacific.

The company provides insight and information through research, analytics, trading workflow solutions, content and technology solutions, and wealth management.

Source: Investor Presentation

On December 19th, 2024, FactSet Research Systems announced Q1 2025 results, reporting non-GAAP EPS of $4.37 for the period, beating market consensus by $0.09 while revenue rose 4.9% to $568.7 million.

FactSet Research Systems kicked off fiscal 2025 with solid, yet measured growth in Q1, reporting GAAP revenues of $568.7 million, a 4.9% year-over-year increase.

The revenue boost was driven by strong performance across its wealth management, asset owner, and institutional client segments.

Organic Annual Subscription Value (ASV), a key performance metric, rose 4.5% to $2.25 billion, reflecting sustained demand for FactSet’s financial data and analytics solutions.

FactSet has grown its earnings-per-share by an average compound growth rate of 10.3% over the last 10 years. Its investments and improved product offerings could lead to significant margin expansion in the following years.

We have increased our EPS estimate for 2025 to $17.10, matching the midpoint of the management’s guidance, but we have maintained our 8.5% annual earnings growth forecast for the next five years.

Click here to download our most recent Sure Analysis report on FDS (preview of page 1 of 3 shown below):

Dividend Aristocrat You’ve Never Heard Of: Erie Indemnity (ERIE)

Erie Indemnity is an insurance company that has established itself in life insurance, auto, home, and commercial insurance. The company’s history dates to the 1920s.

Erie Indemnity reported its third quarter earnings results on October 31. Revenue totaled $999 million during the quarter, up 16% year-over-year.

Revenue growth was driven by higher management fee revenues (for policy issuance and renewal services), which rose by 19% year-over-year. Administrative services fee revenue grew 6%.

Erie Indemnity’s investment income was up substantially on a year-over-year basis during the quarter, which can be explained by tailwinds from higher interest rates.

Erie Indemnity generated GAAP earnings-per-share of $3.06 during the third quarter, which was up by 20% year-over-year.

Like other insurance companies, Erie Indemnity has a sizable float–cash that it has received through premiums that it invests. Therefore, its financial results are somewhat dependent on market rates.

We believe that Erie Indemnity should be able to grow its profits at a mid-single-digit rate over the next five years.

Growth will be driven by higher premium revenue, while further increases in investment income could have a positive impact on EPS growth as well.

Click here to download our most recent Sure Analysis report on ERIE (preview of page 1 of 3 shown below):

Dividend Aristocrat You’ve Never Heard Of: Eversource Energy (ES)

Eversource Energy is a diversified holding company with subsidiaries that provide regulated electric, gas, and water distribution service in the Northeast U.S.

FactSet, Erie Indemnity, and Eversource Energy are the three new Dividend Aristocrats for 2025.

The company’s utilities serve more than 4 million customers after acquiring NStar’s Massachusetts utilities in 2012, Aquarion in 2017, and Columbia Gas in 2020.

Eversource has delivered steady growth to shareholders for many years.

Source: Investor Presentation

On February 11th, 2025, Eversource Energy released its fourth-quarter and full-year 2024 results. For the quarter, the company reported net earnings of $72.5 million, a significant improvement from a net loss of $(1,288.5) million in the same quarter of last year, which reflected the impact of the company’s exit from offshore wind investments.

The company reported earnings per share of $0.20, compared with a loss per share of $(3.68) in the prior year. For the full year 2024, Eversource reported GAAP earnings of $811.7 million, or $2.27 per share, compared with a full-year 2023 loss of $(442.2) million, or $(1.26) per share.

On a non-GAAP recurring basis, the company earned $1,634.0 million, or $4.57 per share, representing a 5.3% increase from 2023.

Click here to download our most recent Sure Analysis report on ES (preview of page 1 of 3 shown below):

Dividend Aristocrat You’ve Never Heard Of: Air Products & Chemicals (ADP)

Air Products & Chemicals is one of the world’s largest producers and distributors of atmospheric and process gases, serving other businesses in the industrial, technology, energy, and materials sectors.

Air Products & Chemicals operates through three main business units: Industrial Gases – Americas, Industrial Gases EMEA, and Industrial Gases – Asia.

The company has a long track record of generating consistent growth.

Source: Investor Presentation

Air Products & Chemicals reported financial results for the fourth quarter of fiscal 2024 on November 7. The company generated revenues of $3.19 billion during the quarter, which was up 0.3% year-over-year, missing the analyst consensus estimate by $30 million.

Air Products & Chemicals was able to generate earnings-per-share of $3.56 during the fourth quarter, which was up 13% compared to the previous year’s period.

Click here to download our most recent Sure Analysis report on APD (preview of page 1 of 3 shown below):

Dividend Aristocrat You’ve Never Heard Of: Fastenal Co. (FAST)

Fastenal began in 1967 when Bob Kierlin and four friends pooled together $30,000 to open the first store. The original intent was to dispense nuts and bolts via vending machine, but that idea got off the ground after 20 years.

The company went public in 1987 and today provides fasteners, tools and supplies to its customers via 1,597 public branches, 1,986 active Onsite locations and over 123,000 managed inventory devices.

Source: Investor Presentation

In mid-January, Fastenal reported (1/17/25) results for the fourth quarter of fiscal 2024. It grew its net sales 4% over the prior year’s quarter thanks to growth in Onsite locations while prices remained flat.

Earnings-per-share remained flat at $0.46, missing the analysts’ consensus by $0.02. Fastenal has missed the analysts’ estimates only twice in the last 21 quarters.

It posted record earnings-per-share in 2022 and 2023 and remained close to its record earnings last year, as an increase in Onsite locations almost offset the effect of a soft manufacturing environment.

Click here to download our most recent Sure Analysis report on FAST (preview of page 1 of 3 shown below):

Dividend Aristocrat You’ve Never Heard Of: Brown & Brown (BRO)

Brown & Brown Inc. is a leading insurance brokerage firm that provides risk management solutions to both individuals and businesses, with a focus on property & casualty insurance. Brown & Brown has a notably high level of insider ownership.

Brown & Brown posted fourth quarter and full-year earnings on January 27th, 2025, and results were better than expected on both the top and bottom lines.

The company posted adjusted earnings-per-share of 86 cents for the quarter, beating estimates by nine cents. Revenue soared 15% year-over-year to $1.18 billion, besting expectations by $60 million.

Revenue was up 15.4% year-over-year, with 13.8% of that being organic revenue growth and the balance from acquisitions. Income before taxes came to $275 million, falling 23% year-over-year as margin fell from 23.2% from 34.7% of revenue.

Its competitive advantage comes from its willingness to execute small and frequent acquisitions. This growth-by-acquisition strategy gives the company an enduring opportunity to continue growing its business for the foreseeable future.

Click here to download our most recent Sure Analysis report on BRO (preview of page 1 of 3 shown below):

Dividend Aristocrat You’ve Never Heard Of: C.H. Robinson Worldwide (CHRW)

Charles Henry Robinson founded C.H. Robinson Worldwide in the early 1900s. The company is now an American Fortune 500 provider of multimodal transportation services and third-party logistics.

The company’s services are freight transportation, transportation management, brokerage, and warehousing. CHRW also offers truckload, air freight, intermodal, and ocean transportation.

On October 30st, 2024, C.H. Robinson Worldwide reported results for the third quarter for Fiscal Year (FY)2024. The company reported strong financial results for the third quarter of 2024, ending September 30.

The company achieved a significant 15.5% increase in gross profits, totaling $723.8 million, and a 58.7% rise in income from operations to $180.1 million.

Adjusted operating margin grew by 660 basis points to 24.5%, with adjusted earnings per share increasing 45.5% to $1.28. These results were driven by disciplined volume growth, improvements in operating leverage, and enhanced profitability across divisions.

Click here to download our most recent Sure Analysis report on CHRW (preview of page 1 of 3 shown below):

Dividend Aristocrat You’ve Never Heard Of: Albemarle (ALB)

Albemarle is the largest producer of lithium and second largest producer of bromine in the world. The two products account for nearly two-thirds of annual sales. Albemarle produces lithium from its salt brine deposits in the U.S. and Chile.

The company has two joint ventures in Australia that also produce lithium. Albemarle’s Chile assets offer a very low-cost source of lithium. The company operates in nearly 100 countries.

On February 12th, 2025, Albemarle announced fourth quarter and full year results. For the quarter, revenue fell 48% to $1.23 billion and was $110 million less than expected.

Source: Investor Presentation

Adjusted earnings-per-share of -$1.09 compared very unfavorably to $1.85 in the prior year and was $0.42 below estimates.

For the year, revenue declined 44% to $5.4 billion while adjusted earnings-per-share was -$2.34.

Results were impacted by asset write-offs and weaker average prices for lithium. For the quarter, revenue for Energy Storage was down 63.2% to $616.8 million.

This segment was impact by weaker volumes (-10%) and lower prices (-53%). Revenues for Specialties were lower by 2.0% to $332.9 million as volume (+3%) was offset by a decrease in pricing (-5%).

Click here to download our most recent Sure Analysis report on ALB (preview of page 1 of 3 shown below):

Dividend Aristocrat You’ve Never Heard Of: Nordson Corporation (NDSN)

Nordson was founded in 1954 in Amherst, Ohio by brothers Eric and Evan Nord, but the company can trace its roots back to 1909 with the U.S. Automatic Company.

Today the company has operations in over 35 countries and engineers, manufactures, and markets products used for dispensing adhesives, coatings, sealants, biomaterials, plastics, and other materials, with applications ranging from diapers and straws to cell phones and aerospace.

Source: Investor Presentation

On August 14th, 2024, Nordson increased its dividend by 15% to $0.78 per share quarterly, marking 61 years of increases.

On December 11th, 2024, Nordson reported fourth quarter results for the period ending October 31st, 2024. For the quarter, the company reported sales of $744 million, 4% higher compared to $719 million in Q4 2023, which was driven by a positive acquisition impact, and offset by organic decrease of 3%.

Industrial Precision saw sales decrease by 3%, while the Medical and Fluid Solutions and Advanced Technology Solutions segments had sales increases of 19% and 5%, respectively. The company generated adjusted earnings per share of $2.78, a 3% increase compared to the same prior-year quarter.

Click here to download our most recent Sure Analysis report on NDSN (preview of page 1 of 3 shown below):

Dividend Aristocrat You’ve Never Heard Of: Expeditors International of Washington (EXPD)

Expeditors is a global logistics company headquartered in Seattle, Washington. The company was founded in 1979 as a single-office ocean forwarder in Seattle.

Its services include the consolidation or forwarding of air and ocean freight, customs brokerage, vendor consolidation, cargo insurance, time definite transportation services, order management, warehousing and distribution, and customized logistics solutions.

Currently, the company has over 250 locations and ~17,500 employees worldwide. In 2023, the company reported $17.1 billion in revenue. The company has increased its dividend for 29 consecutive years.

On November 5th, 2024, EXPD reported third-quarter results for Fiscal Year (FY)2024. The company reported strong third-quarter 2024 results, with earnings per share (EPS) rising 41% to $1.63, and net earnings increasing 34% to $230 million compared to Q3 2023.

Operating income grew 40% to $302 million, supported by a 37% revenue increase to $3 billion. The company achieved significant growth in airfreight tonnage (+19%) and ocean container volumes (+12%), driven by proactive freight handling amid geopolitical disruptions and holiday shipping preparation.

Click here to download our most recent Sure Analysis report on EXPD (preview of page 1 of 3 shown below):

Additional Reading

The Dividend Aristocrats are among the best dividend growth stocks to buy and hold for the long run. But the Dividend Aristocrats list is not the only way to quickly screen for stocks that regularly pay rising dividends.

We have compiled a reading list for additional dividend growth stock investing ideas:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].