Shares of Tesla Inc. (TSLA) have long confounded Elon Musk’s critics: while sales have collapsed in some key markets, retail investors remain remarkably devoted to the firm.

For example, after news broke that Tesla’s European sales had plummeted 40% year-over-year in January 2025, even as the wider electric vehicle (EV) market grew 26%, retail investors poured $7.3 billion into Tesla stock over the next 12 days, the most of any “buying streak” over a decade, according to JPMorgan’s “Retail Radar.”

The report suggested this was more money chasing after bad: Noting that Tesla’s retail investors were down 7% in the year to date versus 3.3% for the broader S&P 500 index, JPMorgan analysts pointed out, “Most of the drawdown came…as they increased their holdings.”

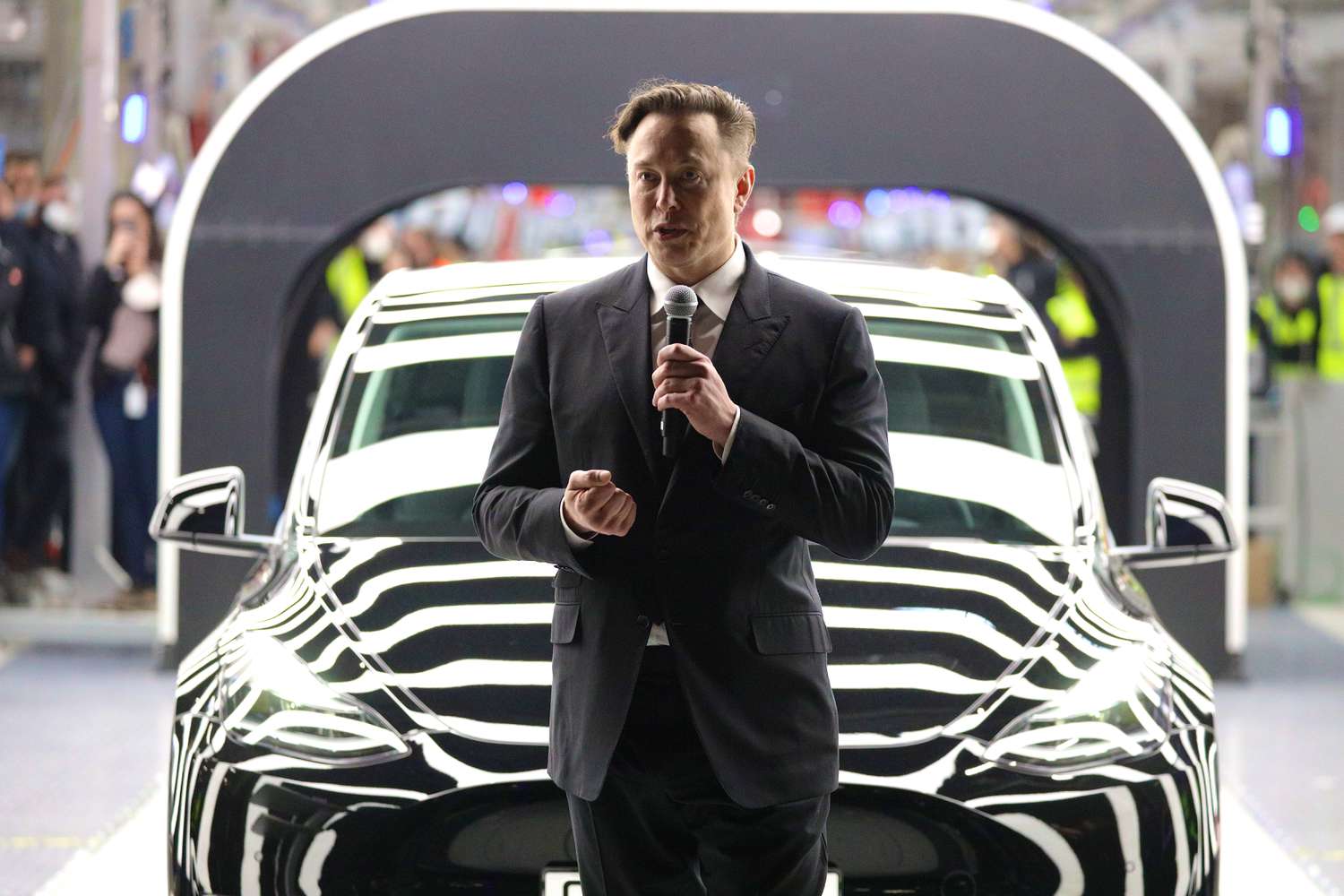

What gives? “Core investors” have an “undying faith in and love of Elon Musk,” Steve Sosnick, chief strategist at Interactive Brokers, told Investopedia. “In fact, I’ve frequently referred to it as a ‘faith-based’ stock.” But, he added, “that faith is well-earned after making many long-term investors quite rich.”

Key Takeaways

- For retail investors, Tesla’s value proposition extends well beyond its sales figures.

- Elon Musk‘s promises of Tesla’s transition from car manufacturer to AI-driven mobility company continues to fuel investor enthusiasm even as traditional automotive metrics falter.

It’s Not About Tesla’s Past or Present, But Its Future

“Tesla’s electric vehicle business is under pressure from pricing challenges and fierce competition, with 2024 marking its first-ever annual delivery decline,” John Blank, chief equity strategist at Zacks Investment Research, told Investopedia. “Musk’s divided attention and growing political controversies have investors questioning whether Tesla is still his top priority.”

However, it’s Tesla’s long-term prospects that count most. “Musk wants the company to be primarily viewed through the lens of AI and robotics rather than solely as an automotive company,” Blank said.

Among the CEOs of automakers, “only Musk is perceived as an avatar of the future,” Sosnick said.

Hence, investors’ “faith is based less on corporate fundamentals than futurism—robotaxis, etc.—which is why the stock’s valuation is way above that of a conventional auto company,” Sosnick said. “Thus, if you’ve already decided that the stock is all about the future, you can overlook some pesky details about the present.”

That’s borne out in interviews. “To be honest, I’m not a huge fan of Tesla’s EVs,” a retail investor who snapped up more shares of TSLA as its price fell in March 2025 told Business Insider. “My bullish outlook is more on the AI and autonomous side of the business.”

Tip

“It is tempting to blame Elon Musk’s political activities for becoming a headwind” for Tesla’s stock underperformance, wrote Sheraz Mian, research director for Zacks Equity Research, in a late-March 2025 report. “But there is no shortage of fundamental issues related to the company’s China exposure, trade/tariff vulnerabilities, and the evolving EV competitive landscape that has to also be at play here.”

Tesla’s Next Chapter

Instead of the usual “dumb money” derision one might expect, analysts we spoke to don’t think these investors are irrationally following market sentiment.

For several years, Tesla has been making a strategic pivot beyond its core automotive business. “Tesla’s long-term growth prospects still remain strong, driven by its thriving energy generation and storage segment, expansive supercharger network, and AI advancements,” Blank said. The company is sitting on a massive cash pile to help make that happen—about $37 billion at year-end 2024.

“Pretty much all” of Tesla’s market cap is based upon future expectations, and that has always been the case, Sosnick said, noting that General Motors Company (GM), Ford Motor Co. (F), and other automakers all have single-digit price-to-earnings ratios, which means investors are valuing them based almost wholly on where they are now, not where they are likely to be in the future.

For core investors, the numbers are compelling: While automotive operations still accounted for 78.9% of Tesla’s total sales in 2024, its Energy Generation/Storage segment showed remarkable growth, with revenues rocketing 113% year over year in the fourth quarter and its energy storage deployment reaching 11 gigawatt-hours, Blank noted. In addition, “the charging business has the potential to evolve into a substantial revenue stream for the company,” he said, especially as major automakers are forced to adopt Tesla’s charging standard.

However, major challenges remain. Sales of the Cybertruck, launched in 2024, sputtered and the vehicles were recalled for significant problems. In addition, most investors surveyed think Musk’s political activities have damaged the company—they’ve sparked mass protests and acts of vandalism against the EVs and dealerships worldwide. Meanwhile, General Motors, Ford, emerging players like Rivian Automotive, Inc. (RIVN) and Lucid Group, Inc. (LCID), and Chinese competitors like BYD are gaining ground fast as Tesla’s overseas sales drop precipitously.

The Bottom Line

The question is whether Tesla’s ambitious expansion into energy, AI, and autonomous driving can offset the significant challenges in its automotive business. Given the headwinds the company faces, the execution of this transformation becomes all the more crucial if the faith of retail investors is to be justified.