What To Expect in the Markets This Week

Key Takeaways

- President Donald Trump is expected to address a joint session of Congress on Tuesday.

- Tariffs against products from Canada and Mexico are also set to go into effect Tuesday, Trump announced last week, along with the doubling of the existing tariff on goods from China.

- The latest jobs report for February is due for release Friday, as officials watch for softness in the labor market.

- Broadcom is set to report earnings this week, along with Costco, Target, and others.

- Reports on consumer credit levels, the U.S. trade balance, factory orders, and industry PMI survey results are also expected.

President Donald Trump on Tuesday is set to give what will be his first address to a joint session of Congress since he was reelected. Tariffs against products from Canada and Mexico are also set to go into effect Tuesday, Trump announced last week, along with the doubling of the existing tariff on goods from China.

Market participants may look forward to comments this week from Federal Reserve Governor Michelle Bowman and New York Fed President John Williams ahead of the blackout period. The latest jobs report for February, due Friday, could be in the spotlight as well, amid concerns about emerging weakness in the labor market.

Updates to consumer credit levels, the U.S. trade balance, factory orders, and manufacturing and Purchasing Managers’ Index (PMI) surveys are also expected, along with scheduled earnings from Broadcom (AVGO), Costco (COST), Target (TGT), and others.

Monday, March 3

- S&P manufacturing PMI (February)

- ISM manufacturing PMI (February)

- Construction spending (January)

- St. Louis Fed President Alberto Musalem is scheduled to deliver remarks

- Okta (OKTA) and GitLab (GTLB) are scheduled to report earnings

Tuesday, March 4

- President Donald Trump is scheduled to address joint session of Congress

- New York Fed President John Williams is scheduled to deliver remarks

- CrowdStrike (CRWD), Target, AutoZone (AZO), Ross Stores (ROST), Best Buy (BBY), and Nordstrom (JWN) are scheduled to report earnings

Wednesday, March 5

- ADP employment (February)

- S&P services PMI (February)

- ISM services PMI (February)

- Factory orders (January)

- Federal Reserve Beige Book

- Marvell Technology (MRVL), Veeva Systems (VEEV), Zscaler (ZS), MongoDB (MDB), Campbell’s (CPB), Brown-Forman (BF.A), and Abercrombie & Fitch (ANF) are scheduled to report earnings

Thursday, March 6

- Initial jobless claims (Week ending March 1)

- U.S. trade deficit (January)

- U.S. productivity – final (Q4)

- Wholesale inventories (January)

- Atlanta Fed President Raphael Bostic is scheduled to deliver remarks

- Broadcom, Costco, Kroger (KR), Hewlett Packard Enterprise (HPE), Burlington Stores (BURL), Gap (GAP), and Macy’s (M) are scheduled to report earnings

Friday, March 7

- U.S. employment report (February)

- Consumer credit (January)

- Fed Reserve Governor Michelle Bowman and New York Fed President John Williams are scheduled to deliver remarks

- Final day before Federal Reserve blackout period ahead of March 18-19 meeting

Trump To Address Congress as Tariffs Take Effect

President Trump is set to address a joint session of Congress at 8 p.m. EST on Tuesday, March 4. The address could offer an opportunity for Trump to lay out his agenda and highlight his administration’s early actions, including the tariffs scheduled to take effect the same day.

Fresh Jobs Report To Come Amid Focus on Labor Market

The February jobs report scheduled for Friday comes after employers added fewer positions than expected last month, raising worries the labor market may be softening. Those concerns were reinforced last week when jobless claims came in higher than expected.

Reports on weekly initial jobless claims and private sector hiring in February are due earlier in the week. Federal Reserve officials have pointed to strength in the labor market as helping influence their recent decision not to lower interest rates at their January meeting.

Fed Officials To Speak Ahead of Blackout Period

It’s the last week for Federal Reserve officials to deliver remarks before the start of the blackout period ahead of the March 18-19 meeting of the Federal Open Market Committee. Fed Governor Michelle Bowman, New York Fed President John Williams, and Atlanta Fed President Raphael Bostic are scheduled to give remarks. The Fed’s latest Beige Book is also due for release Wednesday, offering a qualitative review of economic conditions.

Several economic indicators this week could provide updates on the health of the manufacturing and services sectors, including PMI survey results for February, wholesale inventories data, U.S. fourth quarter productivity, and factory orders. January consumer credit data could also provide insight into the strength of consumers, coming as retailers like Walmart (WMT) have projected lower-than-expected sales growth in coming quarters.

Earnings Due From Broadcom, Target, Costco and More

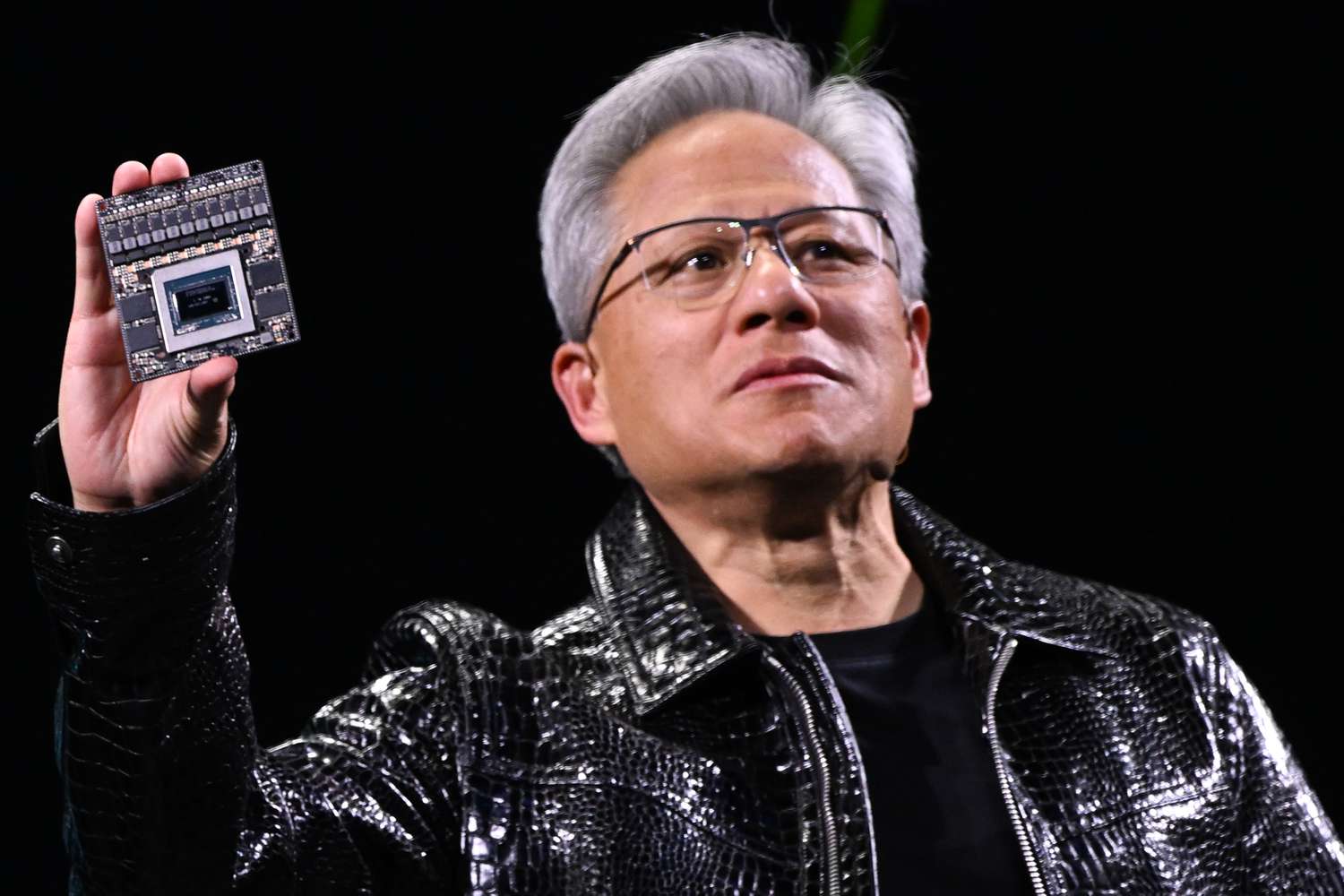

Broadcom is set to report earnings Thursday, after chip stocks sold off last week in the wake of Nvidia’s (NVDA) earnings. Nvidia’s results surpassed Street estimates, but they may not have been good enough for investors amid some concerns about AI spending and economic uncertainty. Analysts have so far largely remained bullish on Nvidia’s stock as well as Broadcom’s, pointing to the chipmakers’ potential to benefit from growing AI demand.

Other tech companies scheduled to report this week include Marvell Technology, HP Enterprise, MongoDB, GitLab, CrowdStrike, Zscaler, and Okta. Several big retailers are also scheduled to release quarterly results, with Ross Stores, Best Buy, and Target reporting Tuesday, with Costco set to follow on Thursday.

Kroger’s report Thursday follows the grocery chain’s weak report last quarter and represents the first since its failed efforts to merge with Albertsons (ACI).