Updated on March 21st, 2025 by Bob Ciura

Air Products & Chemicals (APD) may not be the most well-known company. It is primarily a business-to-business manufacturer and distributor of industrial gases.

However, Air Products & Chemicals is an elite dividend stock as a member of the Dividend Aristocrats, a group of reliable dividend stocks with 25+ years of consecutive dividend increases.

We believe the Dividend Aristocrats are among the best dividend growth stocks to buy for the long run.

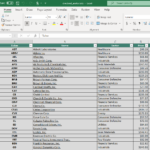

With that in mind, we created a list of all 69 Dividend Aristocrats, along with important metrics like price-to-earnings and dividend yields.

You can download a copy of our Dividend Aristocrats list by clicking on the link below:

Disclaimer: Sure Dividend is not affiliated with S&P Global in any way. S&P Global owns and maintains The Dividend Aristocrats Index. The information in this article and downloadable spreadsheet is based on Sure Dividend’s own review, summary, and analysis of the S&P 500 Dividend Aristocrats ETF (NOBL) and other sources, and is meant to help individual investors better understand this ETF and the index upon which it is based. None of the information in this article or spreadsheet is official data from S&P Global. Consult S&P Global for official information.

Air Products & Chemicals’ dividend history – 43 years of consecutive dividend increases – indicates that the company is a model of consistency.

The company has reinvented itself in recent years. A spinoff and a separate significant divestiture were implemented with the goal of streamlining the company’s business model and focusing on its core industrial gas operations.

Air Products & Chemicals appears poised to continue raising its dividend for many years to come.

Business Overview

Air Products & Chemicals is one of the largest producers and distributors of atmospheric and process gasses in the world. Its customers include other businesses in the industrial, technology, energy, and materials sectors.

Air Products & Chemicals was founded in 1940 and has a current market capitalization of ~$65 billion.

It also has a significant international presence. Roughly 40% of the company’s annual sales are generated in the U.S. and Canada, with the remainder spread across Latin America, Europe, and Asia.

Air Products & Chemicals reported financial results for the first quarter of fiscal 2025 in February. Revenue of $2.93 billion during the quarter, declined 2.3% year-over-year, missing the analyst consensus estimate by $10 million.

Source: Investor Presentation

The company’s costs declined even more than revenues, which still allowed for some earnings growth compared to the previous year’s quarter.

Air Products & Chemicals was able to generate earnings-per-share of $2.86 during the first quarter, which was up 1% compared to the previous year’s period. EBITDA was up 1% as well during the period.

Following a record year in 2024, Air Products & Chemicals is guiding for another record profit in fiscal 2025, with earnings-per-share seen at $12.70 to $13.00. The guidance implies an earnings-per-share growth rate of around 3% this year.

Growth Prospects

The streamlining initiatives undertaken by Air Products & Chemicals in the past several years have led to significant profitability improvements for the industrial gas giant. The company’s EBITDA margin trend over the last several years can be seen below:

Air Products & Chemicals has expanded its adjusted EBITDA margin by ~1400 basis points since the second quarter of 2014 – a significant improvement, which has combined with growing adjusted EBITDA to drive higher earnings-per-share and dividends.

It will also grow due to international expansion, as the company’s Gases Asia business has delivered the highest growth rate in the recent past, although its American business remains the largest segment.

Air Products & Chemicals has a number of growth projects either recently completed or scheduled to be completed in the coming months.

Source: Investor Presentation

Investments in NEOM will drive its green energy exposure and expand its presence in Saudi Arabia, while Air Products & Chemicals is also is expanding its hydrogen footprint in several markets, investing heavily in recent years and for the foreseeable future in this industry in order to benefit from the expected market growth in the coming years.

These investments, coupled with margin growth initiatives, should lead to meaningful earnings growth for the company over the coming years. We expect 6% annualized EPS growth over the next five years.

Competitive Advantages & Recession Performance

Air Products & Chemicals has a number of competitive advantages. The first and primary advantage the company has is its size and market share.

Moreover, the industrial gas distribution business benefits from high switching costs. These costs may not necessarily be financial – instead, customers are unlikely to switch once their gas needs are being met by a particular supplier because it would be difficult to find a competitor that offers identical services in a particular geographic region.

To that end, Air Products & Chemicals’ size also benefits the company.

The company’s recent divestitures and asset sales have given it an infusion of cash, bolstering its corporate finances in a way that should help it endure any upcoming economic downturns. Moreover, Air Products & Chemicals has a track record of performing reasonably well during past recessions.

Consider the company’s performance during the 2007-2009 financial crisis for evidence of this:

- 2007 adjusted earnings-per-share: $4.40

- 2008 adjusted earnings-per-share: $4.97 (13% increase)

- 2009 adjusted earnings-per-share: $4.06 (18.3% decline)

- 2010 adjusted earnings-per-share: $5.02 (23.6% increase)

Air Products & Chemicals experienced an 18.3% decline in adjusted earnings-per-share in 2009 during the financial crisis, but the company’s bottom line surged to a new high by 2010.

The company also remained highly profitable in 2020, a difficult year for the global economy due to the coronavirus pandemic.

The U.S. economy entered a recession as a result of the pandemic, but Air Products & Chemicals experienced only a mild dip in earnings, which allowed it to continue raising its dividend.

Valuation & Expected Total Returns

With a 6% expected EPS growth rate, in addition to a 2.4% dividend yield, one might anticipate high single-digit annual returns from the security.

However, it is imperative to consider how valuation can impact future returns.

Using $12.85 as the expected fiscal 2025 adjusted earnings-per-share, and a share price of $291, the security is currently trading hands at 22.6 times expected earnings.

For context, the stock has traded at an average earnings multiple closer to 19 over the last 10 years.

We believe that 20 times earnings is a fair valuation estimate for Air Products & Chemicals, meaning shares are slightly overvalued. Mean reversion to a price-to-earnings ratio of 20 could lower annualized returns by -2.4% over a 5-year time horizon.

As such, we expect total annual returns to consist of the following:

- 6% earnings-per-share growth

- 2.4% dividend yield

- -2.4% P/E multiple compression

We expect total annual returns of 6.0% per year through 2029.

Final Thoughts

Air Products & Chemicals is a strong dividend growth stock, having raised its dividend each year for the past 43 years.

The company has de-risked its business model and that business transformation allows it to focus on its core business of industrial gases.

Moreover, it has a large slate of new projects to help stay on track for growth in the coming years. This should benefit shareholders in the form of continued dividend increases on an annual basis.

With expected annual returns of 6%, we rate the stock as a hold right now.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].