TECHNICAL DATA

Composition: copper-nickel

Diameter: 27.30 mm

Weight: 8.00 g

(image from eBay seller numista_gibraltar_pormayor)

LINK: Gibraltar Stamps

Proposed designs for the United States Mint’s 2026 American Innovation dollar for California have been unveiled, revealing it will feature Steve Jobs.

Raised in Los Altos, California, Jobs was a visionary entrepreneur who revolutionized the technology industry with innovations in personal computing, smartphones, and digital media.

“Steve Jobs transformed society’s relationship with technology by integrating it into our daily lives through user-friendly, accessible, and aesthetically pleasing design,” the U.S. Mint’s design narrative states.

“Jobs’ relentless pursuit of his vision not only revolutionized personal computing but also laid the foundation for the digital age, cementing his legacy as one of the most influential innovators of the modern era,” the narrative concluded.

The U.S. Mint’s American Innovation $1 Coin Program celebrates innovation and pioneering achievements from each of the 50 states, the District of Columbia, and the five U.S. territories. Launched in 2018, the program features annually released coins, with four unique reverse designs per year, each honoring a significant innovation or innovator.

Design Recommendations for California Innovation Dollar

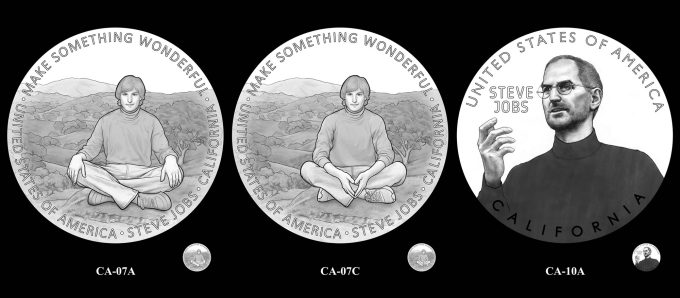

Six candidate designs for the California Innovation dollar were presented to the Citizens Coinage Advisory Committee (CCAC) on Feb. 18 and the Commission of Fine Arts (CFA) on Feb. 20. Liaisons from the state and both advisory bodies provided their recommendations.

Stakeholders, represented by Dee Dee Myers, senior advisor to Gov. Newsom and director of the Governor’s Office of Business and Economic Development, favored 7C overall, with 07A as a secondary choice. Both designs depict a young Steve Jobs seated before Northern California’s oak-covered rolling hills.

The CCAC recommended 10A, highlighting his iconic speeches and ability to connect with audiences.

Meanwhile, the CFA did not strongly favor any single design but acknowledged that 01B offered a clearer link between Jobs and his innovations. Ultimately, however, they supported any selection made by the stakeholders or CCAC, recommending the use of a proportional font and ensuring the inscription “Make Something Wonderful” was included if not already present.

In the end, the Secretary of the Treasury will make the final design selection after considering recommendations from the advisory panels and stakeholders.

Design Images and Design Descriptions

The U.S. Mint’s line art images and design descriptions for all the candidate designs follow.

CA-01B captures Steve Jobs in his characteristic speaking pose, evoking his famous product presentations and visionary speeches. It incorporates circuit patterns emerging from his hands and flowing around his figure, symbolizing his innovative spirit. Through his emphasis on design, usability, and consumer appeal, Jobs helped reshape how people interact with technology in their daily lives. As Jobs remarked about his purpose, “There’s lots of ways to be, as a person. And some people express their deep appreciation for their species in different ways. But one of the ways that I believe people express their appreciation to the rest of humanity is to make something wonderful and put it out there. And you never meet the people, you never shake their hands, you never hear their story or tell yours – but, somehow, in the act of making something with a great deal of care and love, something’s transmitted there.” The additional inscriptions are “STEVE JOBS” and “MAKE SOMETHING WONDERFUL.”

CA-04A depicts a tree with branches that blend with computer circuitry, symbolizing how Steve Jobs drew inspiration from California’s natural landscapes to shape his technological vision. The intertwining circuits and branches reflect the intuitive and organic user experience he would champion, reflecting the harmony he found in the natural world. A falling leaf draws attention to his name, representing how his influence continues to resonate even after his passing. The additional inscription is “STEVE JOBS.”

CA-05A displays Steve Jobs within a computer screen and a keyboard below, conveying Jobs’ early implementation of the personal computer for public use. His name appears on the screen in a font evoking early computers. The monitor contrasts with the textured surrounding to mimic light emanating from a computer screen. The additional inscription is “STEVE JOBS.”

CA-07A and CA-07C present a young Steve Jobs sitting in front of a quintessentially Northern California landscape of oak-covered rolling hills. Captured in a moment of reflection, his posture and expression reflect how this environment inspired his vision to transform complex technology into something as intuitive and organic to us as nature itself. CA-07A shows Jobs with his hands on his knees, while CA-07C renders his hands in front of his lap. The additional inscriptions are “STEVE JOBS” and “MAKE SOMETHING WONDERFUL.”

CA-10A features Steve Jobs speaking, recalling his legendary speeches and emphasizing his ability to connect with audiences. The minimalistic fonts honor his aesthetic vision and approach to design. The additional inscription is “STEVE JOBS.”

Thousands of Americans carrying student loan debt are turning to their communities for help footing the bills. In many cases, those communities are showing up.

Nearly 40,000 individuals and organizations got help funding tuition costs and loan repayment expenses from GoFundMe fundraisers in 2024, according to the crowdfunding platform. While many fundraisers were started by the people with the need themselves, according to GoFundMe, others were launched by parent-teacher organizations, sports teams, clubs or other groups.

One fundraiser was started by a friend of a Santa Fe nursing student and single mom of two who said she maxed out on her Pell Grant and opportunity scholarship during her last semester. “I am reaching out in the hopes that my community, who knows how hard I have worked and how far I have come, may be able to help me in this time of need,” she wrote.

The campaigns come as federal student loan borrowers face rising tuition costs and unexpected lawsuits challenging repayment plans.

“Everyone is in school in order to accomplish something professionally, and people are inspired to support those dreams and [to help people avoid] being burdened or prevented from [accomplishing] those dreams because of their debt,” said Margaret Richardson, chief corporate affairs officer at GoFundMe. “There is a real innate human desire to show up for people in those moments.”

There are 42.7 million federal student loan borrowers who have debt totaling almost $1.64 trillion, according to Federal Student Aid.

Among those borrowers, surveys indicate, are people who worry that their educations might not pay off: More than two-thirds of student loan borrowers said their education wasn’t worth the burden they now feel from their debt, according to a survey conducted by The Harris Poll on behalf of childcare and education provider Bright Horizons.

Student loans have typically been considered “good debt” that offers a return on the investment due to the higher incomes that a college degree can provide. However, as tuition costs have increased over the years, more borrowers have been wary of student loan debt and turned to donation platforms to receive help with tuition, Richardson said.

Many borrowers also asked for tuition support because an outside circumstance, such as the loss of a job or a car accident, made it harder to pay back the debt, according to GoFundMe.

“While I hate asking for things, I know I’m too close to finishing this journey to give up now,”one student at the Berklee College of Music wrote. “Thus, I’m putting aside my pride and asking for help from anyone who feels it in their heart to give.”

Many borrowers have faced uncertainty with their repayment plans. Many federal student loan borrowers were pushed into forbearance, which made it impossible to work toward loan forgiveness after President Joe Biden’s Saving on a Valuable Education repayment plan and greater student loan forgiveness were struck down by federal courts.

“To be able to share this need, in some cases, an unexpected need with their community is something that is a real gift for people,” Richardson said. “To be able to say, ‘I need help,’ and for their community to show up for them, and be able to say, ‘We’ve got your back’.”

There’s always a bull market happening somewhere… and we’ve found it

Last week, I (Tom Yeung) introduced you to two cyclical stocks to buy immediately.

These promising firms couldn’t have been more different, at least from a business perspective:

Yet, these two companies are both riding cyclical waves. The AI Boom is driving Digital Realty’s business to new heights, while a turnaround in cattle production is powering Tyson to a strong recovery.

That pair joins another eight recommendations from January that also focused on riding cyclical trends. These 10 high-quality firms have now risen 7% on average – outperforming the weighted S&P 500 return (-3%) and trouncing the -6% decline in the Nasdaq Composite over the same period.

That’s because cyclical effects can often overwhelm broader market negativity. Commodity prices surged during the 2008 financial crisis while everything else was plummeting… airline stocks boomed in the mid-2010s as oil prices collapsed… and chipmaking stocks surged in 2020 on a global shortage despite the broader Covid-19 selloff.

Today, the cycle is pointing upward for power-producing companies… financial exchanges… meatpackers… and more. That’s happening even as the rest of the market goes in reverse.

Nevertheless, these wonderful up-cycles are incredibly short to Keith Kaplan, CEO of TradeSmith. He’s helping his software firm’s investor customers find cycles across decades… if not longer.

That’s why I encourage you to watch Keith’s latest presentation while it’s still available. During this free broadcast, he reveals what he calls “the pattern,” a cyclical effect that’s only happened every 49.5 years on average.

When this patten appears, Keith says, it can send a specific class of stocks soaring. In fact, back-tests show the last time this pattern appeared under these conditions, it led to historic gains over the long haul, such as 9,731% from a leading software company… and 28,894% from a computer-driven hardware firm.

For long-term investors, it’s an event you don’t want to miss.

Click here to watch that presentation.

And in the meantime, I’d like to introduce two final cyclical stocks to buy this year.

In 2015, New England faced “Snowmageddon,” an epic winter season that dumped nearly 8 feet of snow in Boston alone. The city would spend over $40 million responding to the storms – more than twice its annual snow-removal budget. One massive snow pile in South Boston’s Seaport district took until mid-July to fully melt.

Construction of Boston’s city monument to Winter ’15

The following period would prove a windfall for Douglas Dynamics Inc. (PLOW), America’s largest producer of snowplow attachments and ice management tools. Over the next three years, revenues would surge 56% as customers scrambled to replace their aging plows and salt-spreading equipment.

PLOW’s stock more than doubled.

A down-cycle then began in 2020 after a series of dry winters eviscerated demand. Northern regions from the Midwest to New England saw unusually low amounts of snow, and Douglas’s stock dropped to within striking distance of its pre-2015 levels.

2025 could mark a turnaround year for the Wisconsin-based firm.

In January, an unusual Gulf Coast snowstorm dumped as much as 10 inches of snow on parts of New Orleans. The city only had 14 rented plows to clear the streets. The same storm would also expose enormous snow-clearing equipment shortages from Texas to the Carolinas.

Many parts of America are also seeing their first “average” winters in several years. That same month, Boston saw 4 inches or more of snow for the first time in 1,000 days.

That should provide a new up-cycle for this high-quality firm. Douglas Dynamics owns some of the best-known brands in the business, including Fisher, Henderson, and SnowEx, and has a history of making solid bolt-on acquisitions. The company has generated positive cash flows every year since it began publishing records in 2006.

In addition, shares trade at a significant discount. PLOW is currently valued at under 10 times earnings and eight times cash flow – less than half of historical levels.

Please note that much of the Midwest is still seeing an unusually dry winter, so Douglas’s up-cycle could take until 2026 to fully play out. But given the Northeast’s sudden return to an “average” winter (and the South’s recent snowstorm), that should be enough to jumpstart a new upward cycle for PLOW’s beaten-down shares.

In January, I said CME Group Inc. (CME) and Cboe Global Markets Inc. (CBOE) were two wide-moat cyclical companies to buy. These firms have virtual monopolies in the options and futures markets, and profits tend to spike when volatility rises.

Donald Trump’s second term in office is providing a compelling catalyst for gains.

Shares of the two companies have since risen 7% each on a spike in the market’s VIX “fear” index (a ticker ironically owned by CBOE). Further gains are likely as the threat of tariffs materialize.

This week, I’d like to add one more financial firm to our list of high-quality cyclical stocks:

Charles Schwab Corp. (SCHW). The world’s largest brokerage firmscores a solid “B” based on InvestorPlace Senior Analyst Louis Navellier’s proprietary Stock Grader scores, and has generated positive net income every year since going public in 1987.

Schwab’s management has also been relatively quick to recognize trends in both institutional and retail trading. In 2019, the firm shocked the industry by offering zero-commission online trades, reasoning it could earn enough interest income from cash deposits to make up the difference. The following year, Schwab acquired TD Ameritrade, giving it a strong presence in the online trading boom.

Together, that’s turned Schwab into a money-printing machine. The firm now supports over $8 trillion of client assets and generates $9 billion of net interest revenue annually – almost half of total revenues.

Still, the trading business is highly cyclical. Trump’s first year in office in2017 saw a flurry of stock trading, boosting Schwab’s revenues by 17% and its share price by 35%. Rising interest rates the following year then created a down-cycle by causing customers to reduce cash balances and cutting into Schwab’s interest revenues.

A similar cycle played out in the years following the Covid-19 pandemic. Retail traders flush with pandemic stimulus money powered Schwab’s business to record heights. Then, rising rates from 2022 through 2023 created a down-cycle for the blue-chip firm. Wall Street’s rollercoaster rides are even wilder for trading firms.

2025 marks the beginning of a new cycle. Donald Trump is back in office, and according to Nasdaq data, trading in equity volumes surged 14% in January. Interest rates are also on the decline, making cash more attractive.

Both should benefit Schwab greatly. Analysts now expect earnings per share to surge 34% this year and 26% in 2026. For conservative investors seeking a safer way to play the market, Schwab offers an incredible deal.

I must emphasize that the 12 cyclical stocks I’ve shown you so far this year all have relatively short time horizons. Douglas Dynamics could reach its peak within two years. Kimberly-Clark Corp. (KMB), a cyclical firm I recommended in January, took just a month to come within 5% of its target price.

That’s why I urge you to check out Keith’s free special briefing while it’s still available.

During that event, he’ll demo his company’s new tech breakthrough that revealed “the pattern.”

He’ll show you the pattern in full.

Keith will even reveal the names and tickers for 10 tech stocks poised to soar as the pattern begins to play out in 2025.

Based on what happened last time, the long-term gains could get legendary.

Just go here to watch Keith’s free broadcast.

I’ll see you back here next week,

Regards,

Thomas Yeung

Markets Analyst, InvestorPlace

After more than three years, CIBC Caribbean wrapped up its segment of a groupwide efficiency drive last month with the successful transfer of its Saint Maarten operations to Orco Bank. The divestment drive began in October 2021; since then, CIBC has sold operations in Aruba, Curaçao, Dominica, Grenada, and St. Vincent and the Grenadines, as well.

“Our country divestment program is now over,” said CIBC Caribbean’s CEO Mark St. Hill, in a statement. “These were some very complex transactions, and it is a credit to [CIBC’s team’s and buyer banks’] expertise and professionalism that we were able to complete all of them within the timeframe that we set out and with relative ease.”

Operating as CIBC FirstCaribbean in the Dutch Caribbean, the bank’s reduced regional footprint has resulted in a modern, slimmed-down bank, St. Hill added. Changes included centralizing key functions, including digital sales through LoanStore; launching an agile work plan; and revamping its call centers into contact centers.

Parent CIBC has been refocusing on its core markets to accelerate growth. The ownership changes are subject to local banking regulatory approval, which is expected in the forthcoming months.

“Acquiring CIBC FirstCaribbean’s banking assets presents an excellent opportunity for Orco Bank,” says Edward Pietersz, Orco managing director and CEO. “With an expanded reach, we are well positioned to fulfill our mission of being the preferred partner, offering innovative, customer-driven solutions that enable financial freedom in a responsible and sustainable manner while creating shared value for our communities.”

A similar effort to de-risk the region by National Commercial Bank Jamaica with the sale of its Cayman Islands subsidiary NCB Cayman has fallen through. The transaction failed to be completed within the agreed timeframe, parent NCB Financial Group revealed. But rumors persist that other international banks are considering selling some of their Caribbean assets due to poor performance and high compliance costs in the region.

President Donald Trump on Tuesday is set to give what will be his first address to a joint session of Congress since he was reelected. Tariffs against products from Canada and Mexico are also set to go into effect Tuesday, Trump announced last week, along with the doubling of the existing tariff on goods from China.

Market participants may look forward to comments this week from Federal Reserve Governor Michelle Bowman and New York Fed President John Williams ahead of the blackout period. The latest jobs report for February, due Friday, could be in the spotlight as well, amid concerns about emerging weakness in the labor market.

Updates to consumer credit levels, the U.S. trade balance, factory orders, and manufacturing and Purchasing Managers’ Index (PMI) surveys are also expected, along with scheduled earnings from Broadcom (AVGO), Costco (COST), Target (TGT), and others.

Monday, March 3

Tuesday, March 4

Wednesday, March 5

Thursday, March 6

Friday, March 7

President Trump is set to address a joint session of Congress at 8 p.m. EST on Tuesday, March 4. The address could offer an opportunity for Trump to lay out his agenda and highlight his administration’s early actions, including the tariffs scheduled to take effect the same day.

The February jobs report scheduled for Friday comes after employers added fewer positions than expected last month, raising worries the labor market may be softening. Those concerns were reinforced last week when jobless claims came in higher than expected.

Reports on weekly initial jobless claims and private sector hiring in February are due earlier in the week. Federal Reserve officials have pointed to strength in the labor market as helping influence their recent decision not to lower interest rates at their January meeting.

It’s the last week for Federal Reserve officials to deliver remarks before the start of the blackout period ahead of the March 18-19 meeting of the Federal Open Market Committee. Fed Governor Michelle Bowman, New York Fed President John Williams, and Atlanta Fed President Raphael Bostic are scheduled to give remarks. The Fed’s latest Beige Book is also due for release Wednesday, offering a qualitative review of economic conditions.

Several economic indicators this week could provide updates on the health of the manufacturing and services sectors, including PMI survey results for February, wholesale inventories data, U.S. fourth quarter productivity, and factory orders. January consumer credit data could also provide insight into the strength of consumers, coming as retailers like Walmart (WMT) have projected lower-than-expected sales growth in coming quarters.

Broadcom is set to report earnings Thursday, after chip stocks sold off last week in the wake of Nvidia’s (NVDA) earnings. Nvidia’s results surpassed Street estimates, but they may not have been good enough for investors amid some concerns about AI spending and economic uncertainty. Analysts have so far largely remained bullish on Nvidia’s stock as well as Broadcom’s, pointing to the chipmakers’ potential to benefit from growing AI demand.

Other tech companies scheduled to report this week include Marvell Technology, HP Enterprise, MongoDB, GitLab, CrowdStrike, Zscaler, and Okta. Several big retailers are also scheduled to release quarterly results, with Ross Stores, Best Buy, and Target reporting Tuesday, with Costco set to follow on Thursday.

Kroger’s report Thursday follows the grocery chain’s weak report last quarter and represents the first since its failed efforts to merge with Albertsons (ACI).

This tool signaled the perfect time to sell before the crash—and the ideal moment to buy back in. Now, it’s flashing another critical alert.

Editor’s Note: As any investor knows, it can be difficult to know when to buy or sell a stock. That’s why I’m such an admirer of TradeSmith CEO Keith Kaplan.

To improve his own investing, Keith developed software to help him identify the best times to buy and sell a stock.

In a guest essay today, Keith shares an amazing story about how the system he helped develop saved his portfolio before the Covid crash of 2020, and how it helped him to grow his wealth in the historic run that followed.

After you read this, you’ll want to sign up for Keith’s event on Thursday, February 27 at 8 p.m. Eastern. He’s calling it The Last Melt-Up – and in this special event, you’ll learn how Keith’s system works and why it’s so accurate. You’ll also learn why he’s got his eye on an ultra-rare pattern that has only appeared in the markets three times going back 125 years. You can click here to sign up for your free spot now.

In the meantime, I’ll let Keith share his story and tell you more about the alert that saved his portfolio…

It was one of the most difficult moments of my professional life … but I had saved my portfolio!

It was early 2020 and I had flown to Florida to meet with a group of 50 of my peers where each of us pitched our best and biggest investment ideas.

Person after person was pitching greedy parts of the market that they believed were ready to soar.

When it was my turn, I told them all “I sold almost all my stocks on Friday.”

As you would imagine, I was not the most popular person in the room.

I urged people to protect their investments and consider warning their subscribers that a bear market was rapidly approaching.

I even showed them proof of how I knew we were headed toward the fastest bear market in history — one that would catch everyone by surprise and destroy years of wealth building.

I showed them the alerts I received and then how accurate these alerts have been over the last 20 years.

I was laughed at and told not to panic. Not a single person in the room wanted to hear what I had to say. And I understand why; the CNN Fear and Greed Index at the time was nearing extreme greed levels.

Why would they want to hear a bearish alarm?

But anyone who acted on my systems advice saved their portfolio … and then made even more money when the system signaled it was time to get back in.

In the last 20 years, we’ve only made the system better…

And we are on the verge of another change in the market’s direction. One that you can be ahead of, while everyone else depends on outdated indicators.

I remember it like yesterday.

On a Friday, Feb. 27, I had received a big, bearish alert from our system.

It basically said, “Run for the hills and sell your stocks.”

At the time I knew almost nothing about COVID-19 and I didn’t know how markets would react to what was coming.

But I did know that I trust our system, so the very next day, I sold nearly all my stocks.

Over the weekend, a quick stop into Target with my family gave us an early glimpse into the world of panic buying and hoarding we can all remember. We noticed a woman with a cart FULL of nothing but Clorox wipes.

Clearly, there was panic in the air, and we were just starting to see and feel it for the first time.

But I knew I didn’t have to panic about my portfolio.

Our system’s alerts are based on proprietary algorithms we created years ago and that routinely test and update. They’re based on momentum and short- and long-term trends. And they’re eerily accurate!

Here are the five most recent drawdowns prior to that day…

Obviously, a lot has changed since then. Indeed, we experienced the fastest bear market onset in history.

But we also experienced one of the fastest recoveries in the history of markets. We haven’t looked back, except for a few small setbacks.

In 2020, my personal portfolio was saved a huge loss thanks to the indicators I got.

And, just a month later, our indicators did it again, alerting me to a bullish set up in the markets.

This signal has been almost always right over 40 years of use and testing:

By this time the CNN Fear and Greed Index had plummeted to extreme fear and people were nervous.

Heck, I was nervous!

But again, I trusted the math and these signals, and I took action. I started gobbling up stocks that had big pullbacks and were noted “healthy” in our system by their green designation.

Boy was that the right decision!

Look what the market did the rest of the year!

As you can tell, I love our products and can’t wait to reveal more to you over the next few days.

In fact, it all started for us years ago when we invented what I call the “single most important number in investing.” And next week, on Feb. 27 at 8 p.m. Eastern, I’ll be unveiling the prediction in TradeSmith’s 20-year history. You can register to hear this prediction for free right here.

Thank you and all the best.

Warm regards,

Keith Kaplan

CEO, TradeSmith

Hong Kong’s Securities and Futures Commission and Hong Kong Exchanges and Clearing Ltd. (HKEX) are considering whether to ease initial public offering rules for mainland Chinese companies.

Christopher Hui, the territory’s secretary for financial services and the treasury, said at a recent conference in Shenzhen that the bourse pledged to ease listing requirements for Chinese firms. The mainland regards the Special Administrative Region’s (SAR) capital markets as a valuable source of funding in realizing their wider global expansion goals.

Observers expect local markets watchdog and HKEX to propose amendments by the end of the year. Regulators conducting comprehensive studies are expected to showcase proposed measures to better the current fundraising system, Hui said at a meeting of the Shenzhen-Hong Kong Financial Cooperation Committee in mid-February.

Hong Kong’s IPO market is still shaking off a multi-year slump as more mainland Chinese-listed firms seek dual listings on the SEHK.

Mainland firms are keen to learn the degree to which the territory’s regulators will streamline application procedures and lower listing requirements. HKEX figures indicate that, in January, the exchange received 30 IPO applications in January, including seven A+H applications for firms already possessing mainland-listed (A) shares that wanted to add Hong Kong (H) shares, or H shares.

According to Bonnie Chan, HKEX’s CEO, nearly 100 companies were in the city’s IPO pipeline as of January.

In February, electric vehicle battery maker Contemporary Amperex Technology (CATL) submitted listing documents to HKEX. The Ningde-based company will likely raise $5 billion—potentially the SAR’s biggest IPO in more than four years. Proceeds from the proposed IPO will help enhance mainland EV supply chain dominance.

In recent years, Hong Kong regulators have emphasized the importance of closer links between capital markets to uplift the mainland economy. They also stressed the SAR’s role as a bridge between mainland Chinese and global markets, while promising to create more cross-border investment mechanisms to facilitate increased capital flows. CATL, the world’s largest producer of batteries for electric vehicles, said proceeds from the proposed IPO would reinforce its global expansion, which would enhance China’s dominance in the EV supply chain.

“2nd coin from the new Pre-Columbian ceramics series: Moche culture“

Stocks hit a rough patch in February as the AI rally’s momentum waned and Wall Street grew antsier about an increasingly uncertain economic outlook.

The S&P 500 fell 1.4% last month, giving back a big chunk of its January gains, while the tech-heavy Nasdaq fell 4% to post its worst month since April as investors sold off some of last year’s favorite AI stocks.

Fourth-quarter earnings season will completely wind down in March, leaving Wall Street with far less to distract from this month’s economic data and the likely torrent of headlines out of Washington. Below, we look at stocks investors should keep an eye on this month.

Nvidia (NVDA) will host its annual GPU Technology Conference (GTC), which analysts have dubbed the “Woodstock of AI,” between March 17 to 21, with CEO Jensen Huang set to deliver a keynote address at 10 a.m. PT on March 18.

“We have some really exciting things to share with you guys at GTC,” CEO Jensen Huang said on Nvidia’s earnings call on Wednesday. He promised updates on its new Blackwell Ultra chip, expected to roll out later this year, and its next-generation Vera Rubin architecture.

Nvidia shares have been under pressure all year after a massive run-up following ChatGPT’s November 2022 release. The company lost nearly $600 billion in market value after Chinese start-up DeepSeek released an open-source AI model that required far fewer Nvidia chips than comparable American models.

Some on Wall Street argued the sell-off was a buying opportunity, and that DeepSeek’s efficiency was likely to benefit Nvidia in the long run. Huang echoed those sentiments on Wednesday, telling analysts that DeepSeek’s R1 had “ignited global enthusiasm” and driven innovation in reasoning models, which, Huang said, “can require 100x more compute per task compared to one-shot inferences.”

Nvidia shares gained 4% in February but are down 7% so far in 2025.

Tesla (TSLA) shares fell 28% in February as investors grew increasingly concerned about the time CEO Elon Musk is spending culling the federal workforce.

Musk has become deeply involved with President Donald Trump’s administration as the unofficial leader of the Department of Government Efficiency’s campaign against government spending. He has even held a press conference in the Oval Office and attended Trump’s first cabinet meeting, despite not being a Senate-confirmed cabinet member.

Some investors have expressed fears that Musk’s government work will distract him from leading Tesla at a critical juncture for the EV maker. Musk has said he’s aiming to roll out full self-driving software and a Cybercab this year, a lofty goal that underpins Musk’s ambition to make Tesla a leader in not just electric vehicles, but in AI and autonomous vehicles.

Besides possibly distracting him, Musk’s DOGE work has risked tarnishing the Tesla brand. European registrations, a proxy for sales, were down 45% in January from the prior year, a precipitous drop that may be linked to public blowback against Musk’s controversial support for far-right politics on both sides of the Atlantic.

Investors will be watching this month to see if pushback against DOGE from Congressional Democrats, federal workers, and courts makes Musk even more consumed by his work in Washington.

Target (TGT) is set to report earnings for the three months through January before markets open on March 4.

The report comes just a couple of weeks after Walmart (WMT), Target’s largest competitor, spooked Wall Street with a conservative full-year outlook. Walmart estimated net sales growth and operating income growth would slow this year. Its earnings forecast also fell short of Wall Street’s estimates.

Walmart’s report came a week after data showed Americans significantly reined in their spending in January after a strong holiday shopping season. That data, along with signs of stubborn inflation and uncertainty around President Trump’s ever-changing tariff plans, has helped cloud the economic outlook, putting market participants on edge.

Discretionary purchases make up a higher share of sales at Target than at Walmart or Costco (COST), which makes its sales slightly more sensitive to shifts in consumer preference and sentiment. Its January results and near-term outlook could clarify or add color to Walmart’s tepid forecast.

Target shares fell 9% last month, putting the stock down 8.1% year-to-date.

Investors showed signs of souring on the AI trade last month, dealing a big blow to the market’s highest-flying stocks.

Palantir (PLTR), Applovin (APP), and Vistra (VST), three of the year’s best-performing stocks were among the worst performers in the second half of February. Palantir shares finished February 32% off their mid-month high. Applovin fell 38% from its all-time high in the last two weeks of the month. Vistra, despite topping earnings estimates late in the month, has lost a third of its value since hitting a record in late January.

The stocks, all of which more than tripled in value last year, had at times appeared unstoppable in their ascent. Applovin soared nearly 50% in a single day last November when it handily topped earnings estimates. Palantir stock jumped more than 20% after each of its two most recent earnings reports.

That changed last month as economic uncertainty and moderating growth at AI bellwether Nvidia bridled the optimism fueling the AI rally. Investors will be eyeing these and other momentum stocks closely for signs of a bottom or acceleration of last month’s slump.

Homebuilder Lennar (LEN) is scheduled to report quarterly results on March 12. Investors will be paying special attention to executives’ comments on Trump’s protectionist trade policies.

Lennar will be the first major homebuilder to post results after Trump’s 25% tariffs on Canadian and Mexican imports, which as scheduled to go into effect on March 4. CoreLogic estimates Trump’s North American tariffs would raise homebuilding costs by 4% to 6% within 12 months of being implemented. Canadian lumber, Chinese steel, Mexican and Canadian concrete, and appliances are all imports that could cost more under Trump’s tariffs.

Executives are likely to be asked about the potential costs of tariffs on Lennar’s earnings call. They may also be asked if Trump’s vow to carry out mass deportations has affected the availability of construction workers, a disproportionate number of whom are immigrants.

Lennar shares fell nearly 9% last month as investors looked ahead to another year of elevated interest and mortgage rates.