US-Canada trade war intensifies – United States

Written by the Market Insights Team

Half a day twists and turns

Kevin Ford –FX & Macro Strategist

Yesterday, the USD/CAD experienced significant intraday volatility due to escalating trade tensions initiated by President Trump and subsequent de-escalation by Ontario Premier Doug Ford. Initially, Trump raised tariffs to 50% on all aluminum and steel imports from Canada, following Ford’s refusal to withdraw a 25% electricity tariff on US exports. This tariff particularly would have impacted electricity sales to 1.5 million homes and businesses across Michigan, Minnesota, and New York. Later, Ford announced on social media that the 25% electricity surcharge would be scrapped.

Despite this half a day trade war spat, uncertainty lingers over the tariff situation. Markets are awaiting confirmation on whether steel and aluminum tariffs will be postponed, and/or if some countries will be exempted, especially given President Trump’s recurring tariff pattern of impose and delay. For now, the 25% tariffs on steel and aluminum are in effect as of today. Aluminum and steel, critical materials, have far-reaching economic implications. With US industry capacity exceeding 75% for both metals and heavy reliance on Canadian imports, (imports made up 23% of the U.S. steel market in 2024 and 44% of U.S. aluminum market, and half of those imports coming from Canada), tariff hikes are likely to drive up prices and the impact might be felt beyond aluminum and steel. Tariffs ripple through supply chains, increasing costs across various industries and items such as housing, household appliances, construction equipment, farm machinery, batteries, and vehicles, as many specialty steel products for the automotive industry are unavailable domestically. Also, increasing internal capacity would take years for some companies. If history serves as an example, during 2018, when then President Trump imposed 25% steel and aluminum tariffs, metal prices increased and there was little sector job creation during the time.

The USD/CAD has attempted to break above the 1.454 level four times in the past six days without success. Prices holding above 1.447 signal CAD bearishness, shifting risks to the upside. The coming days will be crucial in assessing whether Trump proceeds with metals tariffs. Also, today we’ll see how markets respond to the US CPI data, the BoC’s rate decision and Governor Tiff Macklem press conference. As mentioned previously, US CPI is expected to come at 2.9% YoY and markets are expecting BoC to cut rates 25 bps to 2.75%.

Dollar not profiting from tariff angst

Boris Kovacevic – Global Macro Strategist

The US dollar fell against most major currencies yesterday, despite another wave of risk aversion gripping global markets. Traditionally, escalating trade tensions would drive demand for the dollar as a safe-haven asset, but investors are now looking beyond short-term flows and focusing on the economic damage these tariffs could inflict. The market reaction suggests that concerns over weaker US growth and corporate profitability are beginning to outweigh the immediate defensive bid for the dollar. The Greenback has fallen for seven consecutive days and is down 6.5% from its 2025 peak.

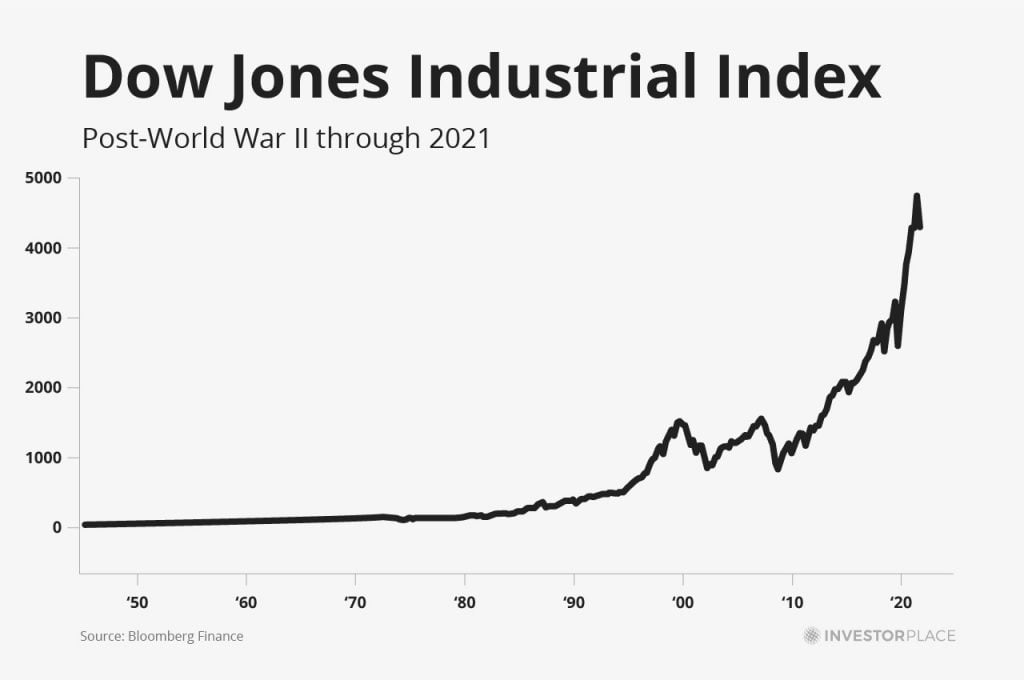

President Trump’s latest tariff escalation has further rattled financial markets. Just days after imposing broad duties on Canadian and Mexican imports, Trump announced he would double planned steel and aluminum tariffs on Canada to 50% in response to Ontario’s tax hike on electricity exports. This move has sent shockwaves through equities, with the S&P 500 extending its three-week decline to nearly 10%, while Wall Street’s fear gauge (VIX) surged toward its highest level since last August. The Canadian dollar tumbled to a weekly low, highlighting the over proportional impact of trade tensions on American (North & Central) currencies.

Beyond tariffs, yesterday’s macro data reinforced mixed signals about the US economy. The NFIB Small Business Optimism Index fell to 100.7, its weakest level since October 2024, as uncertainty among business owners surged to near-record highs. Small firms are growing increasingly concerned about inflation and labor quality, while their confidence in future economic conditions has deteriorated sharply. At the same time, however, the JOLTS report showed job openings climbing to 7.74 million, suggesting that labor demand remains resilient in key sectors like retail, finance, and healthcare.

Looking ahead, the focus remains on US inflation data, central bank commentary, and geopolitical risks. The dollar’s recent weakness could persist if trade concerns continue to weigh on economic sentiment and corporate outlooks, particularly as investors reassess the balance between short-term positioning and longer-term fundamentals.

Euro continues its surge

Boris Kovacevic – Global Macro Strategist

The euro continued its remarkable surge against the dollar, breaking through the $1.09 barrier for the first time since Trump’s election. The currency is up more than 5.5% this month as investor sentiment shifts away from the US, weighed down by recession fears and continued trade policy uncertainty.

The latest catalyst for the euro’s rally comes from Germany, where negotiations over a historic fiscal expansion are progressing. Franziska Brantner, co-leader of the Greens, signaled a willingness to negotiate a deal on increased state borrowing to finance defence spending and economic revival. While the details remain unclear, markets welcomed the prospect of higher fiscal stimulus, which, when combined with ECB rate cuts, creates a rare case of simultaneous monetary and fiscal support for the eurozone economy.

The political backdrop in Europe is fueling this divergence between the euro and the dollar. Germany’s debt policy overhaul remains the focal point, with expectations of a spending package that could significantly raise borrowing and boost investment over the next decade. However, political hurdles remain, with the Greens still opposing broader reforms to debt rules and a €500 billion infrastructure fund. Markets will be closely watching for any deal before the weekend, as its approval could provide another leg higher for the euro.

The combination of US economic weakness, ongoing tariff uncertainty, and a growing policy divergence between the Fed and ECB is eroding confidence in the greenback. For now, euro bulls are in control, with traders looking for confirmation of a German fiscal deal and further signs that the US economy is cooling.

Look over your shoulder sterling

George Vessey – Lead FX & Macro Strategist

Since the start of 2023, GBP/USD has mostly been in positive territory, clocking up to 11% gains by September 2024. The same can’t be said for EUR/USD, which only reached 5% gains, significantly underperforming in comparison. Historically the two currency pairs have exhibited a high correlation, explained by the interconnective relationship between the euro area and UK economies. The correlation remains strong, but the euro is now playing catch up.

Aside from recent US dollar weakness driven by the fading US exceptionalism narrative, the pound has likely been dragged higher by the fiscal re-rating of Europe. But of course, it’s the euro that’s benefited most from Germany’s historic stimulus package that includes a debt-brake reform to boost spending on defence and infrastructure. After last week’s seismic shift in euro sentiment, EUR/USD now stands over 5% higher this month alone compared to GBP/USD’s less than 3% gain.

Looking back over the last two years, the pound has enjoyed a high yield advantage over many peers, supporting GBP/USD’s outperformance relative to EUR/USD. It’s also spurred GBP/EUR on to scale 2-year peaks recently. But the tables seem to be turning. The euro could be primed for a continued spell of outperformance versus its major peers like sterling as Europe’s growth outlook looks set to improve whilst German yields surge higher.

GBP/EUR is already down 2.2% this month and has broken below its 50-week moving average support level for the first time in a year, which could open the door to an extended slide towards €1.17. Moreover, whilst the strong positive correlation between EUR/USD and GBP/USD will hold, we think the euro has more scope to run higher than sterling does against the dollar.

Euro dominates across the board

Table: 7-day currency trends and trading ranges

Key global risk events

Calendar: March 10-14

All times are in ET

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.