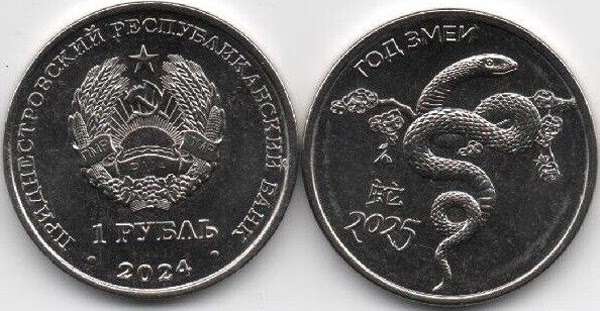

“Year of the Snake 2025“

TECHNICAL DATA

Composition: nickel plated steel

Diameter: 22.00 mm

Weight: 4.65 g

(image from eBay seller lemberg-zp)

Editor’s note: “An Expert Method to Overcome a Turbulent Stock Market” was previously published in January 2025 with the title, “How to Find Success Despite Wild Stock Market Volatility.” It has since been updated to include the most relevant information available.

When it comes to the stock market, it can be a bit like a hurricane at sea: powerful, unpredictable, and capable of turning calm waters into chaos in an instant.

We’ve been enduring our fair share of market chaos lately, with the S&P 500 seemingly up one week and down the next. Investors are practically begging for monotony. But wilder price action like this may be our new normal…

You see; historically speaking, the stock market averages about one bear market every five or six years. But in the past six years, we’ve had not one… not two… but three different bear markets.

There was the flash crash of late 2018, which saw stocks briefly fall into a bear market right before the holidays. There was also the COVID crash of 2020, wherein stocks plunged in the fastest market crash in history. And then there was the inflation crash of 2022, when tech stocks were obliterated by sky-high interest rates.

Three unforeseen bear markets in the past six years – that is wild.

But, of course, on the other hand, we’ve also seen some huge stock market successes, too.

On average, the stock market rises about 10% per year. But in 2024, stocks climbed 23%. They rose around 27% in 2021. And in 2019, stocks rallied about 29%.

In other words, over the past six years, the S&P 500 has achieved three different years with nearly 30% returns. As a matter of fact, of the stock market’s 10 best years since 1950, three have occurred since 2018.

Three different bear markets and three of the best years ever for stocks – all within the past six years.

So, if the stock market has felt wild to you lately, that’s because it has been.

But this wildness could be the new norm for Wall Street going forward.

We can thank technology for that – at least, that’s my opinion.

Why? Because algorithms run the market now.

These days, algorithmic trading accounts for approximately 60- to 75% of total trading volume in the U.S. stock market. That means most trades are automatic, executed by bots adhering to pre-set parameters.

And, unlike humans, robots don’t really ask why. They just do what they are programmed to.

So, when something bad happens, all the algorithmic-driven systems rush toward an exit. And when something good happens, they race to get involved. That’s why, in my view, algorithmic trading creates crowding.

As a result, we get wild swings in the market – both up and down. The algorithms drive momentum one way or the other, and the market follows.

We get flash crashes and fast recoveries; big bear markets and massive bull runs; major meltdowns and momentous melt-ups.

We get stock market volatility.

Such unpredictability can be scary. But since that turbulence drives stocks both ways, you can’t really afford to be crippled by fear, sitting on the sidelines. You need to be in the game.

But to play well, you also need to craft an investment strategy that can handle the volatility – one that can mitigate the downside while also maximizing the upside.

And we think we’ve created a strategy that could help you do just that.

That is, we’ve developed a stock screening system – dubbed Auspex – that leverages fundamental, technical, and sentimental data to find the strongest stocks in the market at any given time.

The strategy therein? Use this tool to find the best stocks in a given month. Buy and hold those stocks, then cash out at month’s end. Lather, rinse, repeat.

We’ve been executing this strategy internally, with great success, for the past several months.

Back in July, Auspex helped us score a nearly 40% gain in AnaptysBio (ANAB) and ~30% gains in Zeta Global (ZETA) in just about 30 days. In August, we locked in a ~25% paper profit on Cellebrite (CLBT) in the same timeframe.

Similarly, in September, we were able to nab ~25% returns on SiTime (SITM). Then in October, Auspex helped us put together a portfolio of five stocks – and four went on to rise that month, even while the broader market dropped.

That is the very real power Auspex can provide. And in just a few days, we’ll be running a new scan to find the best stocks to buy for March.

Click here to access those picks before we release them next week.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.

P.S. You can stay up to speed with Luke’s latest market analysis by reading our Daily Notes! Check out the latest issue on your Innovation Investor or Early Stage Investor subscriber site.

Written by the Market Insights Team

February wrap-up with unresolved tariff issues

Kevin Ford –FX & Macro Strategist

February is drawing to a close, and after five consecutive months of declines, the USD/CAD’s losing streak has eased near the 1.44 mark amidst heightened volatility and unresolved tariff issues. The Loonie has edged upward from its weekly low of 1.4182—resting just above the 20-week SMA—to a three-week high of 1.4453—a 271-pip increase. While no definitive trade policy decisions have been made, tariff risk premia keep the Loonie above 1.44. Contradictory messages about tariff plans for Canada and Mexico have heightened volatility, particularly in the USD/CAD, where implied volatility has surged with March 4th just around the corner. A last-minute extension to April 2nd isn’t ruled out, but volatility is expected until formal confirmation.

Volatility surged yesterday as equity markets grappled with escalating risk aversion. While Nvidia’s strong quarterly results initially offered a lift to markets, the optimism was short-lived. Risk aversion soon took the upper hand, driving the VIX index back above the critical 20 threshold.

Amid this month’s chaos and volatility, one clear winner has emerged: the Canadian Liberals. PM Trudeau’s decision to prorogue parliament has benefited his party, which now leads the Conservatives in polls for the first time in years. The Liberals have gained momentum by taking a strong stance against Trump’s tariff threats and increasing investment in citizen-friendly infrastructure projects. Mark Carney has overtaken Chrystia Freeland as the most likely successor, with a final decision expected on March 9th. As we enter March, Canadian politics will unfold against a backdrop of continued uncertainty and volatility.

Today, all eyes are on the US PCE, the Fed’s preferred inflation measure. Any upside surprises could further unsettle market sentiment.

The key resistance at 1.445 has proven strong for the Loonie. 1.447 is the next level to monitor. Protection against a break above 1.45 adds pressure on the Loonie. The 60-day SMA at 1.433 serves as critical support if tariffs are delayed another month.

Next week’s packed macroeconomic calendar will provide a clearer picture of the US economy, with payrolls (Friday) and ISM manufacturing (Monday) as key data points. For Canada, manufacturing (Monday) and the unemployment rate (Friday) will take center stage.

Dollar balancing tariffs, weaker growth

Boris Kovacevic – Global Macro Strategist

The trade and geopolitical news flows once again overshadowed what seemed to be a pretty important day for US macro developments. Durable goods, home sales, jobless claims and GDP data sent mixed signals about the state of the worlds largest economy. GDP grew by an annualized 2.3%, while unemployment claims rose to a 2-month high and tumbled for a second consecutive month. Overall, the data continues to point to weaker economic momentum ahead and the dollar would have depreciated against this backdrop would it not have been for the tariff news.

Markets once again reacted to fresh tariff announcements made by the US President. Donald Trump confirmed that the 25% tariffs on Canada and Mexico will go into effect, while also hinting at potential new levies on China as soon as March. This bolstered the dollar against the Canadian Dollar and Mexican peso. However, the strengthening of the Greenback broadened out to most major currencies as well.

Beyond trade, Trump’s refusal to commit to a security backstop in Ukraine added another layer of geopolitical uncertainty. Meeting with UK Prime Minister Keir Starmer, he reiterated that the focus should first be on securing a peace deal between Russia and Ukraine, rather than discussing long-term military commitments.

Still, conviction around a sustained dollar rally is fading, as tariff fatigue and growth concerns begin to weigh on sentiment. Traders remain cautious despite the elevated trade uncertainty and lack of policy clarity. For now, FX markets remain driven by trade headlines, with the dollar benefiting from renewed tariff bets—but the long-term picture remains far from clear.

The US dollar index will likely end the week higher, a feat the dollar has only achieved once in the last seven weeks. The last hurdle to overcome is the US PCE report due today. The core figure could slow on a month-on-month basis. However, personal spending is expected to remain robust.

Euro back on the defence

Boris Kovacevic – Global Macro Strategist

Fresh trade tensions are adding pressure to the euro, as President Trump confirmed 25% tariffs on Canada and Mexico and hinted at new levies on China. While the EU was not directly targeted, the risk of further escalation weighs on sentiment, especially with Trump’s criticism of European trade policies and VAT systems still lingering.

While the dollar initially rallied on the tariff news, conviction around sustained USD strength is fading, as the economic drag from higher trade barriers could outweigh short-term inflationary effects. For the euro, the uncertainty keeps upside limited, with EUR/USD hovering under $1.0400 as traders assess whether tariffs will remain a US-focused issue or expand further.

On the other hand, the ECB remains confident that policy is still restrictive, but the debate over future rate cuts is intensifying as per the meeting minutes released yesterday. A 25bp cut next week to 2.5% is expected, yet officials are divided. Some have shown worries about sticky services inflation and trade risks, while others fear weak growth and missing the 2% inflation target. The neutral rate remains a wildcard, with policymakers questioning its usefulness as a policy guide. Meanwhile, disinflation is on track, but wage growth and energy risks call for caution.

Risk sensitive or safe haven sterling?

George Vessey – Lead FX & Macro Strategist

As we explained in yesterday’s report, the pound’s high yielding status is a double-edged sword in that when the market mood is upbeat, sterling tends to appreciate, but in deteriorating global risk conditions, the pound becomes more vulnerable. Hence, the latest bout of tariff angst has sent GBP/USD tumbling from $1.27 to $1.2570 in 24 hours. GBP/USD has erased its weekly gains and more, whilst several key moving averages continue to act as hurdles to the upside.

Apart from weakening against the US dollar though, some analysts think the FX market is viewing the pound as a tariff safe-haven of sorts, driven by confidence that the UK is less economically vulnerable to tariffs compared to major exporters like the EU. This is evidenced by sterling appreciating against all G10 peers this week bar the US dollar and Swiss franc. Meanwhile, if GBP/EUR closes the week above €1.21, it will be the highest weekly closing price in almost three years. If we look at sterling more broadly though, it appreciated against less than 50% of its global peers yesterday, which contradicts this sterling safe haven theory. Moreover, sterling’s vulnerability to global risk aversion due to its reliance on foreign capital inflows would likely limit any haven demand in our view.

Nevertheless, the meeting between US President Donald Trump and UK Prime Minster Keir Starmer appeared constructive, with hopes of a trade deal boosting the odds of the UK avoiding tariffs. The UK is one of the only countries in the world to have a neutral trade relationship with the US in goods, so it’s hard to see how/why Trump would have imposed them anyway. But even if the UK does evade tariffs, a slowdown in global trade would still hurt the UK economy, which would weigh on the pro-cyclical pound.

Risk aversion drives stocks and yields lower

Table: 7-day currency trends and trading ranges

Key global risk events

Calendar: February 24-28

All times are in ET

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.

Stock futures edged higher Friday morning, rising after yesterday’s selloff driven by concerns over tech-sector strength and tariff costs; inflation is expected to decline slightly with today’s release of the Personal Consumption Expenditures price index; Dell (DELL) and HP (HPQ) shares were falling as tech stocks remained under pressure after AI stalwart Nvidia’s (NVDA) earnings weighed on markets; President Donald Trump said tariffs on Canada, China and Mexico would proceed; bitcoin (BTCUSD) dropped below $80,000 to wipe out most of the gains registered since Trump’s election in November.

Here’s what investors need to know today.

Stock futures pointed higher as investors looked to inflation data following yesterday’s selloff on tariff and tech worries. Futures trading associated with the S&P 500 was higher by around 0.3% after the benchmark index shed 1.6% in Thursday trading. Those associated with the Nasdaq were higher by a similar amount after it lost 2.8% yesterday, while Dow Jones Industrial Average-linked futures also rose after dipping yesterday. Despite the early uptick, major market indexes were poised to move lower for the month of February. Yields on the 10-year Treasury note were around 4.285%, while oil futures were lower by more than 1%. Gold futures also fell.

Market participants will be closely following the 8:30 a.m. EST planned release of the Personal Consumption Expenditures (PCE) report for January. The data is expected to show inflation came in at an annual rate of 2.5% for the month, according to a survey of economists by The Wall Street Journal and Dow Jones Newswires. That’s a tick lower than December’s rate but still above the Federal Reserve’s inflation target. The Fed cited worries over continued elevated inflation when it decided last month to not lower interest rates again.

Here’s more from Investopedia on what to expect from the report.

Following Nvidia’s plunge in trading yesterday, several technology stocks were lower in premarket trading despite some computer sellers beating quarterly earnings estimates. Shares of Dell were lower by about 4% after its earnings report showed that the PC maker had strong quarterly income on the growing demand for artificial intelligence (AI) infrastructure, but its 7% revenue improvement was lower than analysts expected. HP shares were down about 3% after it beat expectations this quarter, but its earnings outlook was lower than analysts’ forecasts. Nvidia shares were little changed in early trading after plunging by more than 8% yesterday.

Trump’s announcement that a 25% tariff on products made in Canada and Mexico will go into effect on March 4 weighed on markets yesterday. Oil products from Canada will be taxed at 10%. On top of that, Trump said he would put an additional 10% tariff on products from China, adding to a 10% tariff he imposed in early February. Stephen Miran, Trump’s nominee to chair the White House’s Council of Economic Advisors, said in a Senate hearing that the U.S. would “reindustrialize” by taxing foreign imports, reducing regulations for businesses and developing the defense industry.

Bitcoin’s (BTCUSD) price fell below $80,000 for the first time since early November, wiping out nearly all the gains that followed Trump’s reelection. The cryptocurrency’s fall coincided with the broader market selloff as investors weigh economic uncertainty. The selloff is hurting crypto-related stocks as well: Bitcoin buyer Strategy (MSTR), the company formerly called MicroStrategy, was down about 3% in premarket trading after registering a nearly 9% fall in the prior session. Shares of crypto brokerage Coinbase Global (COIN) and bitcoin mining firms Mara Holdings (MARA) and Riot Platforms (RIOT) were recently down around 3%.

Are your holdings on the move? See my updated ratings for 137 big blue chips.

Source: iQoncept/Shutterstock.com

During these busy times, it pays to stay on top of the latest profit opportunities. And today’s blog post should be a great place to start. After taking a close look at the latest data on institutional buying pressure and each company’s fundamental health, I decided to revise my Stock Grader recommendations for 137 big blue chips. Chances are that you have at least one of these stocks in your portfolio, so you may want to give this list a skim and act accordingly.

| Symbol | Company Name | Quantitative Grade | Fundamental Grade | Total Grade |

|---|---|---|---|---|

| BABA | Alibaba Group Holding Limited Sponsored ADR | A | B | A |

| CART | Maplebear Inc. | A | B | A |

| CHWY | Chewy, Inc. Class A | A | C | A |

| CMS | CMS Energy Corporation | A | C | A |

| EPD | Enterprise Products Partners L.P. | A | C | A |

| GRAB | Grab Holdings Limited Class A | A | C | A |

| HLN | Haleon PLC Sponsored ADR | A | C | A |

| LNG | Cheniere Energy, Inc. | A | C | A |

| LYG | Lloyds Banking Group plc Sponsored ADR | A | C | A |

| MAA | Mid-America Apartment Communities, Inc. | A | C | A |

| MELI | MercadoLibre, Inc. | A | B | A |

| REG | Regency Centers Corporation | A | C | A |

| WPM | Wheaton Precious Metals Corp | A | B | A |

| Symbol | Company Name | Quantitative Grade | Fundamental Grade | Total Grade |

|---|---|---|---|---|

| AFL | Aflac Incorporated | A | B | B |

| AUR | Aurora Innovation, Inc. Class A | A | C | B |

| CASY | Casey’s General Stores, Inc. | A | C | B |

| COST | Costco Wholesale Corporation | A | C | B |

| DAL | Delta Air Lines, Inc. | A | C | B |

| DASH | DoorDash, Inc. Class A | A | C | B |

| EQH | Equitable Holdings, Inc. | A | B | B |

| FTI | TechnipFMC plc | B | B | B |

| LYV | Live Nation Entertainment, Inc. | A | B | B |

| NFLX | Netflix, Inc. | A | B | B |

| SAP | SAP SE Sponsored ADR | A | C | B |

| TCOM | Trip.com Group Ltd. Sponsored ADR | B | B | B |

| TRP | TC Energy Corporation | A | C | B |

| WFC | Wells Fargo & Company | A | B | B |

| Symbol | Company Name | Quantitative Grade | Fundamental Grade | Total Grade |

|---|---|---|---|---|

| AWK | American Water Works Company, Inc. | B | C | B |

| BEPC | Brookfield Renewable Holdings Corporation Class A | B | C | B |

| BKNG | Booking Holdings Inc. | B | C | B |

| CLX | Clorox Company | B | C | B |

| CNA | CNA Financial Corporation | B | C | B |

| DOC | Healthpeak Properties, Inc. | B | C | B |

| EOG | EOG Resources, Inc. | B | C | B |

| ERIE | Erie Indemnity Company Class A | B | C | B |

| FMS | Fresenius Medical Care AG Sponsored ADR | B | B | B |

| FNF | Fidelity National Financial, Inc. – FNF Group | B | C | B |

| GLPI | Gaming and Leisure Properties, Inc. | B | C | B |

| GOLD | Barrick Gold Corporation | B | B | B |

| JNJ | Johnson & Johnson | B | C | B |

| KB | KB Financial Group Inc. Sponsored ADR | B | B | B |

| KDP | Keurig Dr Pepper Inc. | B | C | B |

| KIM | Kimco Realty Corporation | B | B | B |

| MET | MetLife, Inc. | B | C | B |

| NVS | Novartis AG Sponsored ADR | B | C | B |

| PANW | Palo Alto Networks, Inc. | B | C | B |

| PEN | Penumbra, Inc. | B | C | B |

| RIVN | Rivian Automotive, Inc. Class A | B | C | B |

| SRE | Sempra | B | D | B |

| SW | Smurfit Westrock PLC | B | C | B |

| TSLA | Tesla, Inc. | B | D | B |

| UDR | UDR, Inc. | B | C | B |

| UL | Unilever PLC Sponsored ADR | B | C | B |

| WPC | W. P. Carey Inc. | B | D | B |

| Symbol | Company Name | Quantitative Grade | Fundamental Grade | Total Grade |

|---|---|---|---|---|

| AIZ | Assurant, Inc. | C | C | C |

| AMZN | Amazon.com, Inc. | C | B | C |

| BAP | Credicorp Ltd. | C | C | C |

| CF | CF Industries Holdings, Inc. | C | C | C |

| CPAY | Corpay, Inc. | B | C | C |

| CTSH | Cognizant Technology Solutions Corporation Class A | C | C | C |

| DVA | DaVita Inc. | C | B | C |

| EMN | Eastman Chemical Company | C | C | C |

| EXE | Expand Energy Corporation | B | C | C |

| FLUT | Flutter Entertainment Plc | B | C | C |

| HDB | HDFC Bank Limited Sponsored ADR | B | C | C |

| IBN | ICICI Bank Limited Sponsored ADR | C | C | C |

| IHG | InterContinental Hotels Group PLC Sponsored ADR | C | C | C |

| KSPI | Kaspi.kz Joint Stock Company Sponsored ADR RegS | C | C | C |

| LAMR | Lamar Advertising Company Class A | C | D | C |

| NU | Nu Holdings Ltd. Class A | D | B | C |

| NWS | News Corporation Class B | C | B | C |

| PCTY | Paylocity Holding Corp. | C | C | C |

| RELX | RELX PLC Sponsored ADR | C | C | C |

| SCCO | Southern Copper Corporation | C | B | C |

| TS | Tenaris S.A. Sponsored ADR | C | C | C |

| UNH | UnitedHealth Group Incorporated | C | C | C |

| YUMC | Yum China Holdings, Inc. | C | C | C |

| Symbol | Company Name | Quantitative Grade | Fundamental Grade | Total Grade |

|---|---|---|---|---|

| A | Agilent Technologies, Inc. | C | C | C |

| ADI | Analog Devices, Inc. | B | C | C |

| ADM | Archer-Daniels-Midland Company | C | C | C |

| AME | AMETEK, Inc. | C | C | C |

| ASX | ASE Technology Holding Co., Ltd. Sponsored ADR | C | C | C |

| CARR | Carrier Global Corp. | C | C | C |

| EXPD | Expeditors International of Washington, Inc. | D | B | C |

| FDS | FactSet Research Systems Inc. | C | C | C |

| GMAB | Genmab A/S Sponsored ADR | D | A | C |

| HSY | Hershey Company | C | C | C |

| JKHY | Jack Henry & Associates, Inc. | C | C | C |

| MDLZ | Mondelez International, Inc. Class A | D | C | C |

| MNST | Monster Beverage Corporation | C | C | C |

| MT | ArcelorMittal SA ADR | C | C | C |

| NBIX | Neurocrine Biosciences, Inc. | C | C | C |

| PBR.A | Petroleo Brasileiro SA Sponsored ADR Pfd | C | C | C |

| PCG | PG&E Corporation | C | C | C |

| PFG | Principal Financial Group, Inc. | C | C | C |

| ROK | Rockwell Automation, Inc. | C | C | C |

| SWK | Stanley Black & Decker, Inc. | C | C | C |

| SYY | Sysco Corporation | D | C | C |

| TAK | Takeda Pharmaceutical Co. Ltd. Sponsored ADR | C | C | C |

| TECK | Teck Resources Limited Class B | D | C | C |

| TRMB | Trimble Inc. | D | C | C |

| U | Unity Software, Inc. | C | C | C |

| VRTX | Vertex Pharmaceuticals Incorporated | C | C | C |

| WPP | WPP Plc Sponsored ADR | C | C | C |

| WTRG | Essential Utilities, Inc. | C | C | C |

| Symbol | Company Name | Quantitative Grade | Fundamental Grade | Total Grade |

|---|---|---|---|---|

| AFG | American Financial Group, Inc. | D | C | D |

| ALLE | Allegion Public Limited Company | D | C | D |

| BBD | Banco Bradesco SA Sponsored ADR Pfd | D | B | D |

| CNQ | Canadian Natural Resources Limited | D | C | D |

| COO | Cooper Companies, Inc. | D | B | D |

| EPAM | EPAM Systems, Inc. | D | C | D |

| EW | Edwards Lifesciences Corporation | D | C | D |

| GIB | CGI Inc. Class A | D | C | D |

| HD | Home Depot, Inc. | D | C | D |

| LIN | Linde plc | D | C | D |

| LOW | Lowe’s Companies, Inc. | D | C | D |

| NVR | NVR, Inc. | D | C | D |

| PFGC | Performance Food Group Co | D | D | D |

| RDY | Dr. Reddy’s Laboratories Ltd. Sponsored ADR | D | C | D |

| SHW | Sherwin-Williams Company | D | C | D |

| SLF | Sun Life Financial Inc. | D | D | D |

| STE | STERIS plc | D | C | D |

| STLD | Steel Dynamics, Inc. | D | D | D |

| TGT | Target Corporation | D | C | D |

| TMO | Thermo Fisher Scientific Inc. | D | C | D |

| TOL | Toll Brothers, Inc. | D | D | D |

| VIV | Telefonica Brasil S.A. Sponsored ADR | D | C | D |

| XYZ | Block, Inc. Class A | D | C | D |

| Symbol | Company Name | Quantitative Grade | Fundamental Grade | Total Grade |

|---|---|---|---|---|

| DG | Dollar General Corporation | F | D | D |

| FMX | Fomento Economico Mexicano SAB de CV Sponsored ADR Class B | F | C | D |

| ICLR | ICON Plc | F | C | D |

| STZ | Constellation Brands, Inc. Class A | F | C | D |

| SWKS | Skyworks Solutions, Inc. | F | D | D |

| ZBH | Zimmer Biomet Holdings, Inc. | F | D | D |

| Symbol | Company Name | Quantitative Grade | Fundamental Grade | Total Grade |

|---|---|---|---|---|

| CSX | CSX Corporation | F | C | F |

| NVT | nVent Electric plc | F | D | F |

| WDS | Woodside Energy Group Ltd Sponsored ADR | F | C | F |

To stay on top of my latest stock ratings, plug your holdings into Stock Grader, my proprietary stock screening tool. But, you must be a subscriber to one of my premium services. Or, if you are a member of one of my premium services, you can go here to get started.

Sincerely,

Louis Navellier

Editor, Market 360

Article printed from InvestorPlace Media, https://investorplace.com/market360/2025/02/20250225-blue-chip-upgrades-downgrades/.

©2025 InvestorPlace Media, LLC

Global Macro

Risk-off across the board

The global equity selloff continues, the US dollar’s rebound is gaining traction and Treasury yields are suffering their worst weekly slide since September. Investors are avoiding risky bets due to Donald Trump ratcheting up tariff threats, which has seen the euro pull back sharply from 2-month highs versus the dollar. Meanwhile, the pound is outperforming most G10 peers bar the dollar and franc this week and is eyeing its highest weekly close in over three years versus the euro.

Weaker data. The trade and geopolitical news flows once again overshadowed what seemed to be a pretty important week for US macro developments. Durable goods, home sales, jobless claims and GDP data sent mixed signals about the state of the world’s largest economy. GDP grew by an annualized 2.3%, while unemployment claims rose to a 2-month high and tumbled for a second consecutive month. Overall, the data continues to point to weaker economic momentum ahead and the dollar would have depreciated against this backdrop would it not have been for the tariff news.

Tariff uncertainty. Markets once again reacted to fresh tariff announcements made by the US President. Donald Trump confirmed that the 25% tariffs on Canada and Mexico will go into effect, while also hinting at potential new levies on China as soon as March. This bolstered the dollar against the Canadian Dollar and Mexican peso. However, the strengthening of the Greenback broadened out to most major currencies as well.

Ukraine in focus. Beyond trade, Trump’s refusal to commit to a security backstop in Ukraine added another layer of geopolitical uncertainty. Meeting with UK Prime Minister Keir Starmer, he reiterated that the focus should first be on securing a peace deal between Russia and Ukraine, rather than discussing long-term military commitments.

Commodities lower for now. In the commodities space, oil prices are trading a multi-month lows having lost around 4% this month as Trump’s aggressive moves on trade triggered anxiety at a time when oil traders were already concerned about lackluster consumption in China. Moreover, hopes for a potential Russia-Ukraine peace deal weighed on the market, as lifting Russian sanctions could increase global oil supply. Commodity FX thus remains under pressure with the Aussie and Canadian dollars trading softer.

Trump’s new target. Trump stated he intends to impose duties of 25% on the European Union without giving any further details on whether those would affect all exports from the bloc or only certain products or sectors. Meanwhile, Germany’s incoming chancellor, Friedrich Merz, ruled out a swift reform of the country’s borrowing limits and said it was too early to determine whether the outgoing parliament could approve a major military spending increase.

Cautiously dovish. The ECB remains confident that policy is still restrictive, but the debate over future rate cuts is intensifying as per the meeting minutes released yesterday. A 25bp cut next week to 2.5% is expected, yet officials are divided. Some have shown worries about sticky services inflation and trade risks, while others fear weak growth and missing the 2% inflation target. The neutral rate remains a wildcard, with policymakers questioning its usefulness as a policy guide. Meanwhile, disinflation is on track, but wage growth and energy risks call for caution.

Week ahead

Litmus test for the US economy

This week brings a crucial mix of central bank decisions, inflation data, and labor market reports that will shape market sentiment and dictate currency movements. The ECB meeting takes center stage, as investors assess whether policymakers will hint at a timeline for rate cuts. Meanwhile, in the US, the February jobs report will provide key insights into the strength of the labor market and its implications for the Federal Reserve’s policy path.

US. ISM PMI data will provide key insights into US economic momentum. A weak manufacturing print could raise growth concerns, while the services sector remains crucial for inflation trends. The ADP Employment report will serve as a preview of Friday’s payrolls release, with markets watching closely for any signs of labor market softening. The most critical release of the week, however, will be Nonfarm Payrolls and Unemployment. If job growth slows from the previously weak 143k, expectations for a Fed rate cut could accelerate, putting pressure on the dollar.

Eurozone. The spotlight in the Eurozone will be on the European Central Bank’s policy decision, with markets expecting a rate cut that would bring the deposit facility rate down to 2.5% from 2.75%. However, the outlook beyond this move remains uncertain. Policymakers are divided between concerns over sticky services inflation, higher energy costs, and potential U.S. trade tariffs on one side, and sluggish economic growth alongside the risk of missing the 2% inflation target on the other. The latest GDP figures will also provide insight into the region’s economic trajectory.

FX Views

Back to havens as uncertainty prevails

USD Balancing tariffs and weaker growth. The US dollar index will likely end the week higher, a feat the dollar has only achieved once in the last seven weeks. Overall, US macro data continues to point to weaker economic momentum ahead and the dollar would have depreciated against this backdrop would it not have been for the tariff news boosting the safe haven buck. Conviction around a sustained dollar rally is fading though, as tariff fatigue and growth concerns begin to weigh on sentiment. In fact, the dollar has suffered its biggest monthly loss (-1%) since August 2024 and is negative against most G10 peers year-to-date. Traders remain cautious amidst elevated trade uncertainty and lack of policy clarity and FX markets will remain driven by trade headlines, with the dollar benefiting from renewed tariff bet. But the long-term picture remains far from clear. For a meaningful rebound, dollar bulls will need either stronger US economic data or an escalation in the global trade war. The upcoming Nonfarm Payrolls report will be critical. If job growth slows, expectations for a Fed rate cut could accelerate, pressuring the dollar.

EUR Topped out in short term. The euro has staged a modest appreciation against the US dollar in February, despite having fallen to an over 2-year low earlier in the month. EUR/USD has risen around 4% from near $1.01 to testing the key psychological (and resistance) handle of $1.05, though still six cents below its 5-year average. A cyclically-driven turn in the US dollar has been noteworthy, with soft US economic data disappointing, helping EUR/USD rebound, but hard data remains robust for now. Reports of a possible peace agreement in Ukraine is also seen as providing a modest boost to EU economies, mainly due to higher military spending prompted by increased security fears, plus lower gas prices alleviating energy cost concerns and providing further support to the euro. However, the latest bout of tariff risks in the latter stages of this week saw the euro slide back under $1.04 after failing to break above its 100-day moving average multiple times. Next week, all eyes are on the ECB rate decision. A 25bps cut is expected so attention will be on forward guidance and how officials view the weak growth outlook versus reflation fears.

GBP Snaps 4-month losing streak. After appreciating against just 6% of its global peers in January, the pound’s good fortunes returned as it appreciated against over 70% of its peers in February. This was thanks to some more upbeat UK data, hawkish BoE commentary and the fact the UK is seen as less exposed to Trump’s tariff threats. Due to higher interest rates in the UK relative to other G10 peers though, the pound’s elevated carry status increases its exposure to equity market fluctuations. Hence, this week’s risk aversion has dragged GBP/USD from a fresh 2-month high of $1.27 to under $1.26. However, sterling has also appreciated against all other G10 peers this week bar the franc, in a sign that it may be deemed a tariff-haven of sorts. Indeed, against the euro, the pound has edged up above the €1.21 resistance level and a weekly close above here would be the highest in three years, with €1.22 the next upside target. Against the dollar, despite the slide this week, the pound is still primed for an over 1% rise this month, snapping a 4-month losing streak.

CHF Turning to havens. The Swiss franc appreciated against 70% of its global peers in February, up from the mere 20% it rose against the month prior. FX traders are seeking safety in traditional havens like CHF as they look to hedge against potential shocks from trade policy, geopolitics and political uncertainty. This is further evidenced by the fact one-month implied-realized volatility spreads show only franc and yen options are overpriced amongst the G10. However, the franc is vulnerable against the yen as the prospect of a positive carry on the latter currency looms large. Still, CHF/JPY has gained a whopping 55% over the past six years, so a correction lower is long overdue. Against the euro and the pound, the franc is also historically overvalued and has appreciated for two weeks on the trot against the former. However, if talks to end the war in Ukraine show signs of bearing fruit, the franc could come under selling pressure if it spurs risk appetite, though tariff policy remains a key source of uncertainty.

CAD On edge until the last minute? The USD/CAD has rebounded from its weekly low of 1.4182, just above its 20-weekly SMA, reaching a 3-week high of 1.4443—a 261 pips increase—as tariff risk premia rise amidst uncertain trade policy decisions. Contradictory messages about plans to enact tariffs on Canada and Mexico have heightened volatility, especially in the USD/CAD pair, with implied volatility surging as March 4th approaches. A last-minute deadline extension to April 2nd remains possible, but we expect volatility to remain elevated until a formal confirmation is made. The Loonie is targeting important resistance at 1.445 and may maintain upward momentum as nervousness increases and protection against a break above 1.45 puts pressure on it. The 60-day SMA at 1.433 is a crucial support level if tariffs are postponed for another month.

Next week will be filled with macroeconomic data that will provide a better gauge of the US economy, featuring payrolls (Fri) and ISM manufacturing (Mon) as key data points. In Canada, manufacturing (Mon) and the unemployment rate (Fri) will be in focus.

AUD RBA’s communication shift bolsters Aussie resilience. The RBA may stop naming dissenting board members under its new monetary policy committee regime to limit “noise” around rate decisions. Deputy Governor Hauser expects further positive inflation news but remains cautious given Australia’s tight labor market. The committee will likely present unified views in public speeches moving forward. Technically, AUD/USD shows mixed signals after Cloud rejection on February 21 with easing upward momentum suggesting a potential near-term pullback. However, the broader outlook remains positive with price closed within the Cloud and the falling wedge pattern resolved after reaching 93% of its 0.6421 target. Any pullback should find support at the lower Cloud (around 0.6200). A breakout above the Cloud would expose moves to 0.6545, then 0.6688. Market focus shifts to upcoming current account, retail sales, and GDP data for further directional cues.

JPY Wage demands fuel Yen’s technical breakout. Japan Metal Worker Unions are demanding record pay increases of 14% year-on-year, adding to wage growth momentum that could support BOJ policy normalization. Market pricing for a May BOJ rate increase remains modest at 5.375bp, supported by recent increases in underlying inflation measures. The rising wedge pattern in USD/JPY remains valid with a technical target at 145.50. A head and shoulders top formation on the weekly chart reinforces the negative outlook. Rebounds to Cloud resistance (around 153.74) would be tolerated before reconsidering this view. Chart shows USD/JPY performance over the years from 1975 onwards. USD/JPY returned circa -5% YTD. Markets will closely monitor upcoming unemployment rate, capital spending, monetary base, and household confidence data for additional clues on BOJ policy direction.

CNY Diplomatic tones accelerate Yuan strength. President Xi urged officials to respond calmly to challenges while expanding economic opening, signaling a measured approach to Trump policies. Trump indicated the US-China relationship will be “a very good one,” encouraging bilateral investment, though decoupling concerns persist with looming tariffs and his America First Investment Policy. USD/CNH displays increasing downside bias after closing below the Cloud, though overnight downside exhaustion candlestick with softer downward momentum suggests a potential near-term corrective rebound. The pair remains technically negative below the Cloud with 7.1475 as the next target. Any upside should be rejected around Cloud resistance (approximately 7.3000). A break above the Cloud would weaken negative conviction and expose 7.3682. No significant economic data releases are scheduled, keeping focus on geopolitical developments.

MXN 50bps cuts will continue

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.

Americold Realty Trust PT Raised to $31 at RBC Capital

Source link

Updated on February 20th, 2025 by Felix Martinez

Chevron Corporation (CVX) is one of the world’s largest and most well-known energy stocks. It is also one of the energy sector’s most stable dividend growth companies, having grown its dividend for 38 consecutive years.

As a result, Chevron is a member of the exclusive Dividend Aristocrats – a group of 69 elite dividend stocks with 25+ years of consecutive dividend increases.

We believe the Dividend Aristocrats are some of the highest-quality dividend stocks in the entire stock market. With this in mind, we created a full list of all 69 Dividend Aristocrats, along with important financial metrics such as dividend yields and P/E ratios.

You can download a copy of our full Dividend Aristocrats list by clicking on the link below:

Due to the industry’s reliance on high commodity prices for profitability, only two oil stocks are on the list of Dividend Aristocrats: Chevron and Exxon Mobil (XOM).

Chevron’s dividend consistency and stability help it stand out in the otherwise volatile energy industry. This article will analyze Chevron’s intermediate-term investment prospects.

Chevron is one of 6 integrated oil and gas super-majors, along with:

Like the other integrated supermajors, Chevron engages in upstream oil and gas production and downstream refining businesses. In 2023, Chevron generated 74% of its earnings from its upstream segment. Therefore, it is highly sensitive to the underlying commodity price.

Global oil demand has continued to increase in the years since the coronavirus pandemic steadily. Separately, oil and gas prices have been elevated due to the war in Ukraine and resulting sanctions on Russia. Before the sanctions, Russia was producing about 10% of global oil output and one-third of natural gas consumed in Europe.

The benefit from these exceptionally favorable conditions was evident in Chevron’s performance in 2022, although conditions softened in 2023 and 2024 as oil and gas prices moderated off their peaks.

Still, Chevron is posting strong financial results. At the end of January, Chevron reported (1/31/25) earnings for the fourth quarter and full year. The company fourth-quarter 2024 earnings of $3.2 billion ($1.84 per share), up from $2.3 billion in 2023, with adjusted earnings at $3.6 billion. The company returned a record $27 billion to shareholders, including $15.2 billion in buybacks and $11.8 billion in dividends. The board approved a 5% dividend increase to $1.71 per share. Full-year earnings totaled $17.7 billion, though lower refining margins and asset retirement costs impacted cash flow.

Chevron is one of the largest publicly traded energy corporations in the world and stands to benefit tremendously from elevated prices of oil and gas.

Chevron invested heavily in growth projects for years but failed to grow its output for an entire decade, as oil projects take several years to start bearing fruit. However, Chevron is now in the positive phase of its investing cycle.

Source: Investor Presentation

In addition, thanks to the high-grading of its asset portfolio, Chevron can fund its dividend even at an oil price of $40.

Another long-term growth catalyst is Chevron’s major acquisition. On October 23rd, 2023, Chevron agreed to Acquire Hess (HES) for $53 billion in an all-stock deal. Thanks to this deal, Chevron will purchase the highly profitable Stabroek block in Guyana and Bakken assets, greatly enhancing its production and free cash flow.

Nevertheless, given the nearly all-time high earnings-per-share expected this year, we expect an -5 % average annual decrease over the next five years.

Chevron’s competitive advantage in the highly cyclical energy sector comes primarily from its size and financial strength. The company’s operational expertise allowed it to navigate the 2020 coronavirus pandemic successfully.

As a commodity producer, Chevron is vulnerable to any oil price downturn, particularly given that it is the most leveraged oil major to the oil price. However, thanks to its strong balance sheet, the company is likely to endure the next downturn, just like it has done in all the previous downturns.

Chevron’s aggressive cost-cutting efforts have helped the company become more efficient. Chevron has continued to reduce drilling costs, significantly reducing its break-even expense.

Chevron stacks up well among its peers in the energy sector. However, the company is certainly not the most recession-resistant Dividend Aristocrat, as evidenced by its performance during the 2007-2009 financial crisis:

Chevron’s adjusted earnings per share declined by more than 50% during the 2007-2009 financial crisis, but the company managed to remain profitable during a bear market that drove many of its competitors out of business.

This allowed Chevron to continue raising its dividend payment throughout the Great Recession. Chevron’s dividend safety is far above the average company in the energy sector.

Chevron’s expected total returns are more difficult to assess than those of many other companies. This is primarily due to the company’s highly volatile results, which result from the dramatic swings in oil and gas prices.

With a share price near $158, the price-to-earnings ratio presently sits 14.8 times based on 2025 expected earnings of $10.70 per share.

If the stock reverted to our fair value estimate of 14 times earnings, this would imply a fractional valuation headwind over the next five years.

Moreover, the stock offers a 4.4% dividend yield. However, the valuation tailwind and the dividend are likely to be offset by the expected 5% average annual decline in earnings per share.

Overall, the stock could generate a -0.5% average annual return over the next five years off its nearly all-time high current stock price.

Chevron is one of the rare oil and gas companies that was able to navigate through the Great Recession of 2007-2009, the oil downturn of 2014-2016, and the COVID-19 pandemic without cutting its dividend.

Chevron’s lower cost structure allows it to handle a much lower average oil price. Furthermore, new projects in the U.S. and international markets will help the company continue to grow.

Nevertheless, as we are nearing the peak of the oil industry’s cycle, which is infamous for its dramatic swings, Chevron should probably be avoided around its current stock price.

Additionally, the following Sure Dividend databases contain the most reliable dividend growers in our investment universe:

If you’re looking for stocks with unique dividend characteristics, consider the following Sure Dividend databases:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].

Editor’s note: “An Outperforming Investment Tool to Help You Game the Market” was previously published in January 2025 with the title, “Introducing: An Outperforming Investment Tool to Help You Game the Market.” It has since been updated to include the most relevant information available.

For the past several months, since it became clear that Donald Trump won the U.S. presidential election, the stock market has been highly volatile.

The S&P 500 rallied 4% in the week after the election – only to crash 3% the following week. Then stocks rose 4% into December just to sink 5% by the month’s end… popped 6% higher in mid-January before dropping 3% after the inauguration. And here in February, stocks gained 4% in the first few weeks of the month, then flopped about 4% over the past week.

Wall Street has been stuck on a roller-coaster ride since early November.

With all this volatility, investors are dying to know what the next four years will look like for stocks under “Trump 2.0.” Is this unpredictability the new normal?

Possibly…

I have six words of advice for this era: embrace the boom, beware the bust.

Thanks in large part to the AI investment megatrend and long-awaited rate cuts from the Federal Reserve, the U.S. stock market has been booming for the past two years.

That is, the craze around artificial intelligence has sparked an exceptional surge in investment. Companies have been racing to create the infrastructure necessary to support next-gen AI. Indeed, Meta (META), Microsoft (MSFT), Amazon (AMZN), Alphabet (GOOGL) – pretty much all the world’s major tech companies continue to spend billions upon billions of dollars to build new AI data centers, create new applications, hire more engineers, etc. And all that investment has created a major economic boom.

Meanwhile, throughout 2022 – after embarking on the most aggressive rate-hiking cycle in nearly 50 years – the Federal Reserve finally slowed its pace of hikes. And here in 2024, the central bank actually started to cut rates. This has provided much-needed relief to consumers looking to finance big purchases and businesses looking to make new investments. This relief has also helped support an economic boom.

The result? Stocks have been soaring for two years.

Since hitting its lows in October 2022 – just over two years ago – the S&P has surged more than 70% higher. In fact, it just posted its second consecutive year of 20%-plus gains.

The index rose 24% in 2023. It popped another 23% in ’24. That is just the fourth time since the Great Depression – nearly 100 years ago – that the S&P 500 rallied more than 20% in back-to-back years.

We are unequivocally in a stock market boom.

And in our view, this boom is about to get even ‘boomier.’

Thanks to Donald Trump’s victory and Republicans’ newfound control of Congress, a wave of deregulation, pro-business policies, and tax cuts are likely to sweep the nation over the next few years. Those dynamics will only add to the current economic boom.

Indeed, this is already happening. In his first month in office, President Trump has already signed executive orders to deregulate the energy industry, announced big new growth initiatives like Stargate (which will pour $500 billion into AI infrastructure over the next four years), and talked about enacting more tax cuts.

Sounds great, doesn’t it?

Sure does – so long as you remember that all market booms inevitably end with busts. It is not a question of “if.” It is simply a question of “when.”

As we mentioned before, the stock market just notched back-to-back years of 20%-plus gains. It has only done that three times before: in 1935/36, 1954/55, and 1995/96.

After the two boom years in 1935 and ‘36, stocks immediately crashed about 40% in 1937. That boom turned into a bust almost immediately.

Following the market boom in 1954 and ‘55, stocks went flat in ‘56, then dropped 15% in 1957. The boom turned into a bust after about a year.

Similarly, post-1995/96, stocks kept partying throughout 1997, ‘98, and ‘99 – only to crash about 50% throughout 2000, ‘01, and ‘02. After about three years, that era’s big boom turned into a big bust as well.

All booms of this nature turn into busts. It is simply a matter of timing.

Does that mean you should get out of stocks and run for the hills now to avoid the inevitable meltdown?

Usually, the last 30 minutes of a movie is the best part of the film. The last episode of a TV show is almost always the best one, just as the last few minutes of a ballgame are normally the most exciting.

Similarly, the last few years of a stock market boom can often be the most profitable.

Just consider the Dot Com Boom of the 1990s.

Tech stocks had some amazing years therein. The Nasdaq Composite rallied 40% in 1995, about 20% in ‘96, another 20% in ‘97, and then 40% again in ‘98. But tech stocks saved their best for last, with the Nasdaq soaring almost 90% for its best year ever in 1999.

Then the bust started in 2000.

Point being: The best year for tech stocks in the ‘90s was the final year of the Dot Com Boom.

That’s why you don’t want to leave a stock market party early. But you also don’t want to leave too late.

So, what’s an investor to do?

Embrace the boom. Beware the bust. Ride stocks higher, then head for the exits when the warning signs appear.

Of course, that’s much easier said than done, I know.

That’s why we created Auspex: a stock screener that scans about ~14,000 stocks every time we run the model. It’s designed to help us uncover the stocks most likely to rise over the next 30 days, highlighting only those with favorable fundamental, technical, and optical characteristics. And typically, only a few make each final cut.

After a manual evaluation from my team, those stocks become our “Auspex picks” for that month. Then, we do it all over again the next month.

In fact, in just a few days, we’ll be running our next scan to identify the top stocks to buy for March.

Click here to gain access to those picks before we release them on Monday.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.

P.S. You can stay up to speed with Luke’s latest market analysis by reading our Daily Notes! Check out the latest issue on your Innovation Investor or Early Stage Investor subscriber site.