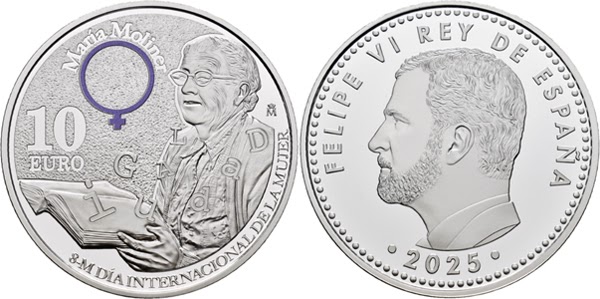

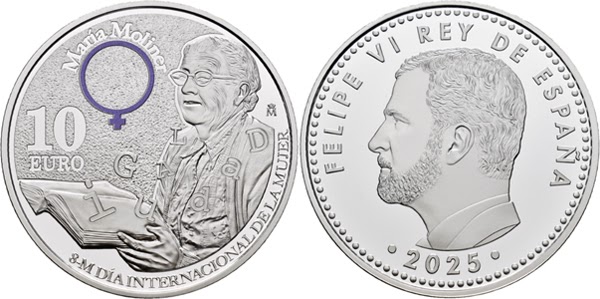

World Coin News: Spain 10 euro 2025

“International Women’s Day / María Moliner“

TECHNICAL DATA

Composition: silver .925

Diameter: 40.00 mm

Weight: 27.00 g

Mint: Fábrica Nacional de Moneda y Timbre (Spain)

Mintage: 4,000

(image from www.fnmt.es)

“International Women’s Day / María Moliner“

Chipmaking giant Taiwan Semiconductor Manufacturing Company (TSM) plans to invest $100 billion in U.S.-based chip manufacturing facilities, CEO C.C. Wei announced alongside President Trump on Monday.

The company said it will build three new chip fabrication plants, two advanced packaging facilities, and a research and development center at its complex in Arizona, growing the company’s total investment at the site to $165 billion.

“The most powerful AI chips in the world will be made right here in America,” Trump said at a televised press conference. “It’s a matter of economic security, it’s also a matter of national security,” he added.

TSMC is the world’s largest semiconductor manufacturer, and expanding its U.S. production aligns with the Trump administration’s stated goal of ensuring AI chips are designed and manufactured domestically. Trump reiterated Monday plans to announce tariffs of 25% or more on semiconductors and other imports on April 2. Tariffs on goods from Canada and Mexico will begin Tuesday, Trump said.

The first factory at TSMC’s Arizona complex began production in the fourth quarter of 2024 and was recently in talks to produce Nvidia (NVDA) Blackwell chips. Two plants currently under construction are expected to begin production in 2028 and “by the end of the decade,” according to the company’s website.

The complex was awarded $6.6 billion in federal funding in 2024 through the CHIPS and Science Act, a 2022 piece of legislation supported by then-President Biden that earmarked over $50 billion for investment in semiconductor research and manufacturing facilities in the U.S.

U.S.-listed shares of TSMC fell 4% Monday as Nvidia and other AI and chip stocks lost ground amid concerns about policies on tariffs and chip export curbs.

Hello, Reader.

Geopolitical uncertainty abounds… tariffs are on the menu… earnings results are mixed… price action has stalled out… and so much more is throwing a wrench into the works.

But our partners at TradeSmith couldn’t be more certain about what’s coming.

And what’s coming is not a crash or a bear market.

What’s coming is the continuation of an epic melt-up that officially began in April of last year… and will likely only accelerate over the next 12 months.

Today, I’d like to share a special conversation between TradeSmith CEO Keith Kaplan and Michael Salvatore, the editor of TradeSmith Daily. In the video, Keith and Michael share exactly how the research team at TradeSmith reached that conclusion. (Hint: They did so by looking at the data – not the headlines.)

The conditions we’re seeing today, they say, mirror the biggest melt-ups in history… the kind that come around once or twice every 100 years. So, when they occur during your lifetime – you might not see another one again.

And when the TradeSmith team realized the gravity of this opportunity, they knew they had to develop something you could use to profit on the way up… and avoid the inevitable meltdown.

What they created is a strategy with an 80% win rate and 16% average returns over a 21-day hold time on hundreds of backtested trades.

Click here or on the video below to watch the conversation between Keith and Michael to see how they built it – and take a look at a fresh signal that flashed just seven trading days ago, on a stock you might not hear about anywhere else.

Plus, last Thursday, Keith hosted a research presentation that covers all this in much greater detail. You can watch a replay of the event here.

As part of his demonstration, he shared 10 stocks he thinks will dominate through the melt-up… and 10 more that are destined for the bargain bin.

By the end, he shared everything you need to understand just how bullish the next year will be.

Once again, you can watch a replay of the Keith’s special broadcast here.

Now, let’s take a look back at what we covered here at Smart Money last week…

By targeting quality stocks in sudden, steep downtrends, the folks at TradeSmith have learned you can bank on a quick reversion to the mean that sends shares much higher from your entry. But why talk about it now? Read on as Keith Kaplan discusses the ultra-rare bullish signal his team is picking up… and the strategy perfectly suited to give you monumental gains.

A sky-high utility bill may have more to do with your portfolio’s potential profits than you think. And it has all to do with the solar industry. In last Thursday’s issue, Tom Yeung dives deeper into solar’s coming revolution, why we could see an uptick in solar spending, and how you can profit from it.

Nvidia’srocky start to the year reminds us that investors should start considering companies that will eventually inherit the chip king’s momentum – the AI Appliers. Some of these companies use AI to enhance businesses, while others provide the energy AI needs to run. Continue reading to learn about under-the-radar AI plays set to produce strong investment gains in the coming years.

Between Chinese AI breakthroughs, radical shifts in trade policy, the Federal Reserve’s rate-cutting cycle, and now a surge in inflation expectations, the headlines have been all over the place. All this chaos can’t help but make you wonder if we’re heading for a crash. Keith Kaplan is here to tell you how this isn’t the beginning of a bear market, but the setup for one of the biggest opportunities of your lifetime.

Regards,

Eric Fry

India’s Shapoorji Pallonji (SP) Group, a construction and real estate conglomerate, is negotiating with global private credit funds to raise $3.3 billion, marking the country’s largest local currency private debt deal. The funds will be used to refinance existing debt.

The group is controlled by billionaire Shapoor Pallonji Mistry, whose family ranks as the 13th richest in India, according to Forbes.

The group’s debt hit $5.2 billion in March 2020 due to high construction costs and working capital shortages during the pandemic. It utilized a one-time resolution (OTR) from the Reserve Bank of India, repaid $1.4 billion to lenders, and exited the plan by March 2022, becoming the largest and first fully repaid OTR in the country within a year.

Further, the group sold its assets, including Eureka Forbes, Gopalpur Port, and Dharamtar Port. The company’s debt decreased to $2.2 billion on March 31, 2024.

However, the maturing debt of $3.8 billion between March 2025 and April 2026 is a problem.

In 2021, Sterling Investments, linked to SP Group promoters, raised $2.2 billion from Ares SSG, a capital market company, and Farallon Capital Management LLC, pledging a 9.1% stake in Tata Sons and real estate assets, maturing in March 2025.

In June 2023, Cyrus Investments, a subsidiary of SP Group’s promoter entity Goswami Infratech, raised $1.6 billion at an interest rate of 18.75% against a 9.18% stake in Tata Sons as collateral, which will mature in April 2026.

The group is negotiating with several investors, including Cerberus Capital Management, Davidson Kempner Capital Management, Varde Partners, Farallon Capital Management, Ares Management, and EAAA India Alternatives, to refinance its debt. Deutsche Bank is the sole arranger for the deal.

The SP deal would deepen India’s private credit industry, which is expanding as the Budget 2025-2026 allocates $129 billion for the infrastructure sector and encourages private sector participation.

Indian corporations raised $6.77 billion in private credit deals in 2024. In 2025, the market anticipates key deals, including the second $500 million tranche for Reliance Capital by the Hinduja Group and the $212 million fundraising by TVS Mobility Group.

To mark 25 years since the Sacagawea dollar’s release, the United States Mint may issue a 24K gold coin in 2025 featuring its original design. The U.S. Mint presented the possibility today to the Citizens Coinage Advisory Committee (CCAC) for feedback.

The $1 coin, often called the Sacagawea “golden dollar” due to its composition that gives it a distinctive gold color, entered circulation in 2000 as part of an effort to establish a widely used dollar coin. That effort continued until 2002, when production was scaled back, and the coins were struck exclusively for collectors. In 2009, the Mint introduced its Native American $1 Coin Program, which features the same Sacagawea obverse design but annually changing reverse designs.

As proposed, the 2025 Sacagawea 25th Anniversary Gold Coin would be struck in a half-ounce of gold, with a diameter just 20 thousandths of an inch larger than the original dollar.

The obverse design features Sacagawea in a three-quarter profile with her infant son, Jean Baptiste, on her back. Inscriptions include “LIBERTY,” “IN GOD WE TRUST,” and “2025.” As U.S. Mint gold coins are produced at its West Point facility, the anniversary dollar would carry a “W” mint mark.

The reverse depicts a soaring eagle encircled by 17 stars, representing the number of states in the Union during the 1804 Lewis and Clark expedition. Its tail feathers match those of the coins released into circulation in 2000, rather than the more highly detailed diagonal tail feathers seen on the much scarcer promotional 2000 Sacagawea “Cheerios” dollars. Inscriptions read “UNITED STATES OF AMERICA,” “E PLURIBUS UNUM,” and “ONE DOLLAR.”

The anniversary edition, as proposed, omits the half-ounce weight and .9999 fineness inscriptions. From a technical standpoint, these details could be added to the coin’s surface or edge. CCAC members expressed mixed opinions on whether to include them. Ultimately, the committee approved a motion recommending both designs as presented.

Other details, such as whether the coin will be issued in an uncirculated or proof finish, remain undecided or unannounced.

Updated on March 3rd, 2025 by Bob Ciura

Investors looking to generate higher income levels from their investment portfolios should look at Real Estate Investment Trusts or REITs.

These are companies that own real estate properties and lease them to tenants, or invest in real estate backed loans, both of which generate a steady stream of income.

The bulk of their income is then passed on to shareholders through dividends.

You can see all 200+ REITs here.

You can download our full list of REITs, along with important metrics such as dividend yields and market capitalizations, by clicking on the link below:

The beauty of REITs for income investors is that they are required to distribute 90% of their taxable income to shareholders annually in the form of dividends. In return, REITs typically do not pay corporate taxes.

As a result, many of the 200+ REITs we track offer high dividend yields of 5%+.

But not all high-yielding stocks are automatic buys. Investors should carefully assess the fundamentals to ensure that high yields are sustainable.

Note that while the securities in this article have very high yields, a high yield alone does not make for a solid investment. Dividend safety, valuation, management, balance sheet health, and growth are also very important factors.

We urge investors to use the analysis below as informative but to do significant due diligence before buying into any security – especially high-yield securities.

Many (but not all) high-yield securities have a significant risk of a dividend reduction and/or deteriorating business results.

You can instantly jump to any specific section of the article by using the links below:

Community Healthcare Trust is an REIT which owns income-producing real estate properties linked to the healthcare sector, such as physician offices, specialty centers, behavioral facilities, inpatient rehabilitation facilities, and medical office buildings.

The trust has investments in 197 properties in 35 states, totaling 4.4 million square feet.

Source: Investor Presentation

On February 18th, 2025, Community Healthcare Trust reported fourth quarter results for the period ending December 31st, 2024.

Funds from operations (FFO) per share dipped 16% to $0.48 from $0.57 in the prior year quarter. Adjusted FFO per share, however, declined by 10% to $0.55.

During the quarter, Community Healthcare acquired three properties for $8.2 million. These properties were 100% leased with lease expirations through 2029.

The trust also has seven properties under definitive purchase agreements, with a combined purchase price of roughly $170 million, expected to close from 2025 through 2027.

Click here to download our most recent Sure Analysis report on CHCT (preview of page 1 of 3 shown below):

Chimera Investment Corporation is a real estate investment trust (REIT) that is a specialty finance company. The company’s primary business is in investing through subsidiaries in a diversified portfolio of mortgage assets, including residential mortgage loans, Non-Agency RMBS, Agency CMBS, and other real estate related securities.

Chimera’s income is predominantly obtained by the difference between the income the company earns on its assets and financing and hedging costs.

The company funds the purchase of assets through several funding sources: asset securitization, repurchase agreements (repo), warehouse lines, and equity capital.

On May 21st, 2024, Chimera executed a 1-for-3 reverse stock split due to its depressed stock price, which resulted from the impact of high interest rates. This was a negative development.

In mid-February, Chimera released (2/12/25) results for the fourth quarter of fiscal 2024. Its core earnings-per-share edged up sequentially, from $0.36 to $0.37, thanks to lower provisions for credit losses. Chimera missed the analysts’ consensus by $0.01.

Click here to download our most recent Sure Analysis report on CIM (preview of page 1 of 3 shown below):

Innovative Industrial Properties, Inc. is a single-use “specialty REIT” that exclusively focuses on owning properties used for the cultivation and production of cannabis.

As of the end of 2024, IIPR had 109 properties, with a weighted average lease length of 13.7 years. Approximately 92% of IIPR’s properties are industrial, with retail comprising 2% and blended properties the remaining 6%.

Source: Investor Presentation

On February 19th, 2025, IIPR released its Q4 and full-year results for the period ending December 31st, 2024. For the quarter, revenues and normalized AFFO/share were $76.7 million and $2.22, down 3% and 2.6% year-over-year, respectively.

The decline in revenues was due to lost rent and fees from properties repossessed or sold since 2023, lease amendments that adjusted and deferred rent on certain properties, and (iii) partial rent payments from some tenants, along with reclassified sales-type leases starting January 2024.

These factors were offset by $3.9 million from a disposition-contingent lease termination fee, revenue from new acquisitions, and contractual rent escalations.

Click here to download our most recent Sure Analysis report on IIPR (preview of page 1 of 3 shown below):

PennyMac Mortgage Investment Trust invests in residential mortgage loans and mortgage-related assets. PMT has three segments: credit sensitive strategies, interest rate sensitive strategies and correspondent production.

PennyMac Mortgage began its operations in 2009 with $324 million of assets, which has grown to $13.1 billion as of September 30th, 2024. PMT is externally managed by PNMAC Capital Management, which itself is a wholly owned subsidiary of PennyMac Financial Services (PFSI).

PennyMac Mortgage Investment Trust reported fourth quarter 2024 results on January 30th, 2025, for the period ending December 31st, 2024. PMT reported net investment income of $107.9 million, which was a 27% jump from NII of $84.8 million in the prior year quarter.

The trust generated $0.41 per share profit in the quarter, which was a 7% decrease from the year-ago quarter.

The book value per share increased from $15.85 on September 30th, 2024 to $15.87 on December 31st, 2024. In the fourth quarter, the company added $60 million in new mortgage servicing rights (MSRs).

Click here to download our most recent Sure Analysis report on PMT (preview of page 1 of 3 shown below):

American Capital Agency Corp is a mortgage real estate investment trust that invests primarily in agency mortgage–backed securities (or MBS) on a leveraged basis.

The firm’s asset portfolio is comprised of residential mortgage pass–through securities, collateralized mortgage obligations (or CMO), and non–agency MBS. Many of these are guaranteed by government–sponsored enterprises.

AGNC Investment Corp. reported strong financial results for the third quarter ended September 30, 2024. The company achieved a comprehensive income of $0.63 per common share, driven by a net income of $0.39 and other comprehensive income of $0.24 from marked-to-market investments.

Net spread and dollar roll income contributed $0.43 per share.

Click here to download our most recent Sure Analysis report on AGNC Investment Corp (AGNC) (preview of page 1 of 3 shown below):

Arbor Realty Trust is a nationwide mortgage real estate investment trust (REIT) that acts as a direct lender and operates in two reporting segments: Agency Business and Structured Business. The trust provides loan origination and servicing for multifamily, seniors housing, healthcare, and other diverse commercial real estate assets.

Arbor Realty’s specific focus is government-sponsored enterprise products, although its platform also includes commercial mortgage backed securities (CMBS), bridge and mezzanine loans, and preferred equity issuances.

Arbor Realty Trust, Inc. (ABR) reported third-quarter 2024 results with net income of $0.31 per diluted common share, matching expectations, and distributable earnings of $0.43 per share. Revenue reached $88.81 million, a 17.23% year-over-year decrease but still beating estimates by $3.10 million.

The company declared a cash dividend of $0.43 per share and announced agency loan originations totaling $1.1 billion, supporting a $33.01 billion servicing portfolio, which grew 10% year-over-year. Structured loan originations reached $258.5 million, contributing to a $11.57 billion portfolio.

Click here to download our most recent Sure Analysis report on ABR (preview of page 1 of 3 shown below):

Dynex Capital invests in mortgage–backed securities (MBS) on a leveraged basis in the United States. It invests in agency and non–agency MBS consisting of residential MBS, commercial MBS (CMBS), and CMBS interest–only securities.

Source: Investor Presentation

Dynex Capital released its fourth-quarter 2024 financial results, with book value ending the quarter at $12.70 per share and an economic return of 7.4% for the year.

Leverage increased slightly to 7.9x as the company deployed capital into higher-yielding agency RMBS, particularly 30-year 4.5%, 5%, and 5.5% coupons.

The shift from treasury futures to interest rate swaps was a key strategy, enhancing portfolio returns by 200 to 300 basis points and improving net interest spread.

Click here to download our most recent Sure Analysis report on DX (preview of page 1 of 3 shown below):

Ellington Credit Co. acquires, invests in, and manages residential mortgage and real estate related assets. Ellington focuses primarily on residential mortgage-backed securities, specifically those backed by a U.S. Government agency or U.S. government–sponsored enterprise.

Agency MBS are created and backed by government agencies or enterprises, while non-agency MBS are not guaranteed by the government.

Source: Investor Presentation

On November 12th, 2024, Ellington Residential reported its third quarter results for the period ending September 30th, 2024. The company generated net income of $5.4 million, or $0.21 per share.

Ellington achieved adjusted distributable earnings of $7.2 million in the quarter, leading to adjusted earnings of $0.28 per share, which covered the dividend paid in the period. Ellington’s net interest margin was 5.22% overall.

Click here to download our most recent Sure Analysis report on EARN (preview of page 1 of 3 shown below):

ARMOUR Residential invests in residential mortgage-backed securities that include U.S. Government-sponsored entities (GSE) such as Fannie Mae and Freddie Mac.

It also includes Ginnie Mae, the Government National Mortgage Administration’s issued or guaranteed securities backed by fixed-rate, hybrid adjustable-rate, and adjustable-rate home loans.

Unsecured notes and bonds issued by the GSE and the US Treasury, money market instruments, and non-GSE or government agency-backed securities are examples of other types of investments.

Source: Investor presentation

On October 23, 2024, ARMOUR Residential REIT announced its unaudited third-quarter 2024 financial results, reporting a GAAP net income available to common stockholders of $62.9 million, or $1.21 per common share. The company generated a net interest income of $1.8 million and distributable earnings of $52.0 million, equivalent to $1.00 per common share.

ARMOUR achieved an average interest income of 4.89% on interest-earning assets and an interest cost of 5.51% on average interest-bearing liabilities. The economic net interest spread stood at 2.00%, calculated from an economic interest income of 4.44% minus an economic interest expense of 2.44%.

During the quarter, ARMOUR raised $129.4 million by issuing 6,413,735 shares of common stock through an at-the-market offering program and paid common stock dividends of $0.72 per share for Q3.

Click here to download our most recent Sure Analysis report on ARMOUR Residential REIT Inc (ARR) (preview of page 1 of 3 shown below):

Orchid Island Capital is a mortgage REIT that is externally managed by Bimini Advisors LLC and focuses on investing in residential mortgage-backed securities (RMBS), including pass-through and structured agency RMBSs.

These financial instruments generate cash flow based on residential loans such as mortgages, subprime, and home-equity loans.

Source: Investor Presentation

The company reported a net income of $17.3 million, or $0.24 per common share, significantly improving from a net loss of $80.1 million in the same quarter last year. This net income comprised $0.3 million in net interest income and $4.3 million in total expenses.

Additionally, Orchid recorded net realized and unrealized gains of $21.2 million, or $0.29 per common share, from Residential Mortgage-Backed Securities (RMBS) and derivative instruments, including interest rate swaps.

Click here to download our most recent Sure Analysis report on Orchid Island Capital, Inc. (ORC) (preview of page 1 of 3 shown below):

REITs have significant appeal for income investors due to their high yields. These 10 extremely high-yielding REITs are especially attractive on the surface, although investors should be aware that abnormally high yields are often accompanied by elevated risks.

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

Other Sure Dividend Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].

Are your holdings on the move? See my updated ratings for 164 stocks.

Source: iQoncept/Shutterstock.com

During these busy times, it pays to stay on top of the latest profit opportunities. And today’s blog post should be a great place to start. After taking a close look at the latest data on institutional buying pressure and each company’s fundamental health, I decided to revise my Stock Grader recommendations for 164 big blue chips. Chances are that you have at least one of these stocks in your portfolio, so you may want to give this list a skim and act accordingly.

| Symbol | Company Name | Quantitative Grade | Fundamental Grade | Total Grade |

|---|---|---|---|---|

| ADP | Automatic Data Processing, Inc. | A | C | A |

| AFL | Aflac Incorporated | A | B | A |

| AON | Aon Plc Class A | A | B | A |

| BRO | Brown & Brown, Inc. | A | C | A |

| COST | Costco Wholesale Corporation | A | C | A |

| CQP | Cheniere Energy Partners, L.P. | A | C | A |

| ED | Consolidated Edison, Inc. | A | C | A |

| EQH | Equitable Holdings, Inc. | A | B | A |

| KO | Coca-Cola Company | A | C | A |

| MKC | McCormick & Company, Incorporated | A | C | A |

| NRG | NRG Energy, Inc. | A | B | A |

| PODD | Insulet Corporation | A | B | A |

| RSG | Republic Services, Inc. | A | C | A |

| SAN | Banco Santander S.A. Sponsored ADR | A | B | A |

| V | Visa Inc. Class A | A | C | A |

| WTW | Willis Towers Watson Public Limited Company | A | C | A |

| XPEV | XPeng, Inc. ADR Sponsored Class A | A | C | A |

| Symbol | Company Name | Quantitative Grade | Fundamental Grade | Total Grade |

|---|---|---|---|---|

| AU | Anglogold Ashanti PLC | A | C | B |

| CAVA | CAVA Group, Inc. | B | B | B |

| CHWY | Chewy, Inc. Class A | A | C | B |

| CPNG | Coupang, Inc. Class A | A | C | B |

| DOCU | DocuSign, Inc. | B | B | B |

| FWONK | Liberty Media Corp. Series C Liberty Formula One | A | D | B |

| JD | JD.com, Inc. Sponsored ADR Class A | A | B | B |

| MELI | MercadoLibre, Inc. | B | B | B |

| MS | Morgan Stanley | A | B | B |

| NTRA | Natera, Inc. | A | C | B |

| NTRS | Northern Trust Corporation | A | B | B |

| PEG | Public Service Enterprise Group Inc | A | C | B |

| SO | Southern Company | A | C | B |

| UTHR | United Therapeutics Corporation | A | C | B |

| VST | Vistra Corp. | A | B | B |

| Symbol | Company Name | Quantitative Grade | Fundamental Grade | Total Grade |

|---|---|---|---|---|

| AIG | American International Group, Inc. | B | C | B |

| AIZ | Assurant, Inc. | B | C | B |

| AMGN | Amgen Inc. | B | C | B |

| BAP | Credicorp Ltd. | B | C | B |

| BMO | Bank of Montreal | B | B | B |

| BSAC | Banco Santander-Chile Sponsored ADR | C | B | B |

| BURL | Burlington Stores, Inc. | B | B | B |

| BX | Blackstone Inc. | B | B | B |

| CB | Chubb Limited | B | C | B |

| CL | Colgate-Palmolive Company | B | C | B |

| COR | Cencora, Inc. | B | C | B |

| CPAY | Corpay, Inc. | B | C | B |

| CTVA | Corteva Inc | B | C | B |

| ELS | Equity LifeStyle Properties, Inc. | B | C | B |

| FICO | Fair Isaac Corporation | B | C | B |

| HDB | HDFC Bank Limited Sponsored ADR | B | C | B |

| HEI | HEICO Corporation | A | B | B |

| IHG | InterContinental Hotels Group PLC Sponsored ADR | B | C | B |

| L | Loews Corporation | B | C | B |

| LLY | Eli Lilly and Company | B | B | B |

| MCK | McKesson Corporation | B | C | B |

| NTNX | Nutanix, Inc. Class A | B | B | B |

| NWS | News Corporation Class B | B | B | B |

| PAYC | Paycom Software, Inc. | B | B | B |

| PCTY | Paylocity Holding Corp. | B | C | B |

| PFE | Pfizer Inc. | B | B | B |

| SCI | Service Corporation International | B | C | B |

| SNA | Snap-on Incorporated | B | C | B |

| SNN | Smith & Nephew plc Sponsored ADR | B | C | B |

| TDY | Teledyne Technologies Incorporated | B | C | B |

| TRI | Thomson Reuters Corporation | B | C | B |

| TRV | Travelers Companies, Inc. | B | C | B |

| VICI | VICI Properties Inc | B | C | B |

| VLTO | Veralto Corporation | B | C | B |

| VZ | Verizon Communications Inc. | B | C | B |

| WBD | Warner Bros. Discovery, Inc. Series A | B | D | B |

| WCN | Waste Connections, Inc. | B | D | B |

| WTRG | Essential Utilities, Inc. | B | C | B |

| YUM | Yum! Brands, Inc. | B | C | B |

| YUMC | Yum China Holdings, Inc. | B | C | B |

| Symbol | Company Name | Quantitative Grade | Fundamental Grade | Total Grade |

|---|---|---|---|---|

| ANET | Arista Networks, Inc. | C | B | C |

| AVGO | Broadcom Inc. | C | C | C |

| BCH | Banco de Chile Sponsored ADR | B | C | C |

| CART | Maplebear Inc. | C | B | C |

| COIN | Coinbase Global, Inc. Class A | C | B | C |

| DLR | Digital Realty Trust, Inc. | C | B | C |

| DUOL | Duolingo, Inc. Class A | B | C | C |

| EME | EMCOR Group, Inc. | C | B | C |

| EOG | EOG Resources, Inc. | C | C | C |

| FIS | Fidelity National Information Services, Inc. | C | C | C |

| FLEX | Flex Ltd | C | B | C |

| HUBS | HubSpot, Inc. | C | C | C |

| KB | KB Financial Group Inc. Sponsored ADR | C | B | C |

| PYPL | PayPal Holdings, Inc. | C | C | C |

| RACE | Ferrari NV | C | B | C |

| RIVN | Rivian Automotive, Inc. Class A | C | C | C |

| SRE | Sempra | C | D | C |

| SU | Suncor Energy Inc. | B | C | C |

| SW | Smurfit Westrock PLC | B | C | C |

| TSLA | Tesla, Inc. | B | D | C |

| WAT | Waters Corporation | C | C | C |

| ZM | Zoom Communications, Inc. Class A | C | C | C |

| ZTO | ZTO Express (Cayman), Inc. Sponsored ADR Class A | C | C | C |

| Symbol | Company Name | Quantitative Grade | Fundamental Grade | Total Grade |

|---|---|---|---|---|

| ABEV | Ambev SA Sponsored ADR | D | B | C |

| AFG | American Financial Group, Inc. | C | C | C |

| ALLE | Allegion Public Limited Company | D | C | C |

| BIDU | Baidu, Inc. Sponsored ADR Class A | D | B | C |

| BMRN | BioMarin Pharmaceutical Inc. | D | B | C |

| BUD | Anheuser-Busch InBev SA/NV Sponsored ADR | C | C | C |

| CVS | CVS Health Corporation | C | C | C |

| EA | Electronic Arts Inc. | C | C | C |

| ESTC | Elastic NV | C | C | C |

| EW | Edwards Lifesciences Corporation | D | C | C |

| FAST | Fastenal Company | C | C | C |

| GSK | GSK plc Sponsored ADR | D | B | C |

| HD | Home Depot, Inc. | D | C | C |

| INTU | Intuit Inc. | D | B | C |

| INVH | Invitation Homes, Inc. | C | C | C |

| ITW | Illinois Tool Works Inc. | C | C | C |

| LHX | L3Harris Technologies Inc | D | C | C |

| LIN | Linde plc | C | C | C |

| LOW | Lowe’s Companies, Inc. | C | C | C |

| MSCI | MSCI Inc. Class A | C | D | C |

| NOC | Northrop Grumman Corp. | C | C | C |

| PEP | PepsiCo, Inc. | C | C | C |

| PFGC | Performance Food Group Co | C | D | C |

| PLD | Prologis, Inc. | D | B | C |

| PRU | Prudential Financial, Inc. | C | D | C |

| ROP | Roper Technologies, Inc. | C | C | C |

| RYAAY | Ryanair Holdings PLC Sponsored ADR | C | B | C |

| SHW | Sherwin-Williams Company | C | C | C |

| SJM | J.M. Smucker Company | C | D | C |

| SLF | Sun Life Financial Inc. | C | D | C |

| SNOW | Snowflake, Inc. Class A | D | B | C |

| SRPT | Sarepta Therapeutics, Inc. | D | C | C |

| STE | STERIS plc | C | C | C |

| STLD | Steel Dynamics, Inc. | C | D | C |

| TEL | TE Connectivity plc | C | C | C |

| XYL | Xylem Inc. | D | C | C |

| ZTS | Zoetis, Inc. Class A | D | C | C |

| Symbol | Company Name | Quantitative Grade | Fundamental Grade | Total Grade |

|---|---|---|---|---|

| A | Agilent Technologies, Inc. | D | C | D |

| ADM | Archer-Daniels-Midland Company | D | C | D |

| ASX | ASE Technology Holding Co., Ltd. Sponsored ADR | D | C | D |

| DELL | Dell Technologies, Inc. Class C | D | C | D |

| DKNG | DraftKings, Inc. Class A | D | C | D |

| DXCM | DexCom, Inc. | D | C | D |

| HRL | Hormel Foods Corporation | D | C | D |

| MNST | Monster Beverage Corporation | D | C | D |

| NTAP | NetApp, Inc. | D | C | D |

| OC | Owens Corning | D | D | D |

| OKTA | Okta, Inc. Class A | D | C | D |

| OVV | Ovintiv Inc | D | D | D |

| PBR.A | Petroleo Brasileiro SA Sponsored ADR Pfd | D | D | D |

| PSTG | Pure Storage, Inc. Class A | D | C | D |

| QCOM | QUALCOMM Incorporated | D | B | D |

| ROK | Rockwell Automation, Inc. | D | C | D |

| SUZ | Suzano SA Sponsored ADR | D | D | D |

| TECK | Teck Resources Limited Class B | D | C | D |

| WDC | Western Digital Corporation | D | C | D |

| Symbol | Company Name | Quantitative Grade | Fundamental Grade | Total Grade |

|---|---|---|---|---|

| ARE | Alexandria Real Estate Equities, Inc. | F | C | D |

| AVY | Avery Dennison Corporation | F | C | D |

| JBHT | J.B. Hunt Transport Services, Inc. | F | C | D |

| MRK | Merck & Co., Inc. | F | C | D |

| NDSN | Nordson Corporation | F | C | D |

| NUE | Nucor Corporation | F | C | D |

| TXT | Textron Inc. | F | C | D |

| WDS | Woodside Energy Group Ltd Sponsored ADR | F | C | D |

| WLK | Westlake Corporation | F | C | D |

| Symbol | Company Name | Quantitative Grade | Fundamental Grade | Total Grade |

|---|---|---|---|---|

| DG | Dollar General Corporation | F | C | F |

| ICLR | ICON Plc | F | C | F |

| SNPS | Synopsys, Inc. | F | C | F |

To stay on top of my latest stock ratings, plug your holdings into Stock Grader, my proprietary stock screening tool. But, you must be a subscriber to one of my premium services. Or, if you are a member of one of my premium services, you can go here to get started.

Sincerely,

Louis Navellier

Editor, Market 360

Article printed from InvestorPlace Media, https://investorplace.com/market360/2025/03/20250303-blue-chip-upgrades-downgrades/.

©2025 InvestorPlace Media, LLC

It used to be tough investing in private market assets. Typically, at least a couple of hundred thousand dollars was required, and you had to commit the money for up to 10 years or more. You had to be an accredited investor (sophisticated and experienced), and you had to be ready to fork over more capital in the future depending on the terms.

Not anymore. The development of open-ended, “evergreen” funds that allow investors to periodically redeem shares—typically, monthly or quarterly—and carry relatively low investment minimums have made private market investing accessible to just about everyone. The new funds’ investing strategies run the gamut. Some focus on specific sectors of the market while others are more diversified.

“Anyone can get exposure to private investments now,” says William Whitt, analyst with Datos Insights. “New fund structures are generating a lot of interest with retail investors.”

Evergreen funds are intended to attract investors further down the wealth spectrum from the traditional buyers of private equity and debt stakes. High-net-worth (HNW) investors, with more than $1 million in liquid assets, and the mass affluent, with less than $1 million, have virtually no holdings in private markets. En masse, they represent a huge new source of potential capital for private equity and debt managers to tap. A survey of alternative fund managers by Ernst & Young last year found that accessing private client capital was the top strategic priority for managers.

The number of funds being floated, largely by the biggest financial sponsors like Blackstone, KKR, and Apollo, is growing rapidly. According to FS Investments and Prequin data, more than 500 evergreen funds held over $400 billion in assets in 2023. Last October, KKR and mutual fund giant Capital Group filed to launch two hybrid fixed-income funds investing in public and private debt.

The filings underscore an effort to make private markets more accessible to a broader client base, the firms touted in a press release.

“The product structures are much more client-friendly and they’re bringing a lot more investors to the table,” says Mark Sutterlin, head of alternative investments at Bank of America and Merrill Lynch. “You need discipline to put together a diversified portfolio, but advisors can implement a plan in a more turnkey manner now.”

The development of the secondary market in private investments has also opened up opportunities for new buyers in the private space. Secondaries are existing stakes in private asset funds that are sold to other investors. The buyer gets into the fund later in the investment lifecycle but is still obligated to meet any further contracted capital calls from the general partner.

Some secondaries are simply the stakes of existing limited partners in the fund while others are transactions led by the general partner. The GP can use the money either to continue holding assets in the fund or to cash out existing investors. In some cases, investors can get discounts on secondary offerings, which will have a shorter time horizon than primary fund investments.

“Secondaries can be a good way to start an allocation,” says Trish Halper, CIO in the family office practice at Northern Trust. “They’re further along in the investment cycle and investors can get distributions quicker.”

Alternatives research firm Preqin is forecasting that secondaries will be the fastest growing segment of the alternatives market over the next five years.

The proliferation of new fund structures and the development of the secondaries market is bringing new investors to the private asset markets. Some close observers, however, are skeptical of this “democratization” of the market. “It feels like the latest fad,” Whitt says. “Everyone is running after it because everyone else is without really thinking about why.”

Wrapping up a four-year series of proof sets featuring coins honoring women’s contributions to U.S. history, the United States Mint releases its 2025 American Women Quarters Proof Set today at noon ET.

The clad set includes five San Francisco Mint-struck quarters, marking the final issues in the Mint’s American Women Quarters™ Program. Each coin is in proof finish, featuring frosted design elements and mirror-like backgrounds – achieved through multiple strikes on polished planchets using specially prepared dies.

The set’s 2025 quarters honor:

The individuals celebrated appear on the reverse (tails side) of their respective quarters, accompanied by inscriptions reading “UNITED STATES OF AMERICA,” “E PLURIBUS UNUM,” and “QUARTER DOLLAR,” along with additional inscriptions specific to each honoree.

The obverse (heads side) of each quarter shares Laura Gardin Fraser’s portrait of George Washington, originally designed in 1932 to commemorate his 200th birthday. Inscriptions include “LIBERTY,” “IN GOD WE TRUST,” and “2025.”

The American Women Quarters Program launched in 2022, with five releases issued each year as part of the series.

Price, Ordering and Limits

The 2025 American Women Quarters Proof Set is priced at $26.50. It is available directly from the U.S. Mint through its online store for quarter products.

All five coins are packaged in a single protective lens. The set has a product limit of 60,060, with a household order limit of five for the first 24 hours.

American Women Quarters are also included in other upcoming U.S. Mint products, such as rolls and bags of each quarter, other annual numismatic sets – including uncirculated sets, standard and silver proof sets – and holiday ornaments.

After nearly two years of lackluster production, the U.S. factory sector’s efforts to mount a comeback slowed in February, with a closely-watched industry survey showing that tariff worries were making manufacturers nervous.

The Institute of Supply Management’s manufacturing Purchasing Managers Index (PMI) survey showed that the factory sector expanded in February with a 50.3% reading. It’s the second month in a row the index has registered above 50, indicating an expanding manufacturing sector, after 26 straight months of contraction.

However, the February survey reading was down from the month before and came lower than economists surveyed by The Wall Street Journal and Dow Jones Newswires expected.

The report weighed on market sentiment Monday as investors have grown increasingly concerned about the health of the economy and the impact of policies being pursued by the Trump administration.

Selected commentary from the factory managers answering the survey pointed to worries over President Donald Trump’s tariff policy, which includes 25% levies on Canada and Mexico set to go into effect tomorrow.

“New orders plunged into contraction in February as tariff uncertainty caused many downstream consumers to take a wait-and-see approach to expenses in 2025,” wrote Nationwide Senior Economist Ben Ayers.

The potential impact of the tariffs was already causing some real price increases for manufacturers, as the prices paid index rose by 7.5 percentage points to hit 62.4% in February.

“Prices growth accelerated due to tariffs, causing new order placement backlogs, supplier delivery stoppages and manufacturing inventory impacts,” said Timothy Fiore, chair of the ISM Manufacturing Business Survey Committee.