Humans are hardwired to pay close attention to potential dangers.

A hundred thousand years ago, it’s how we survived. Constantly worrying that a tiger or bear might be around the corner was a valuable instinct.

We may not encounter bears or tigers anymore, but our instincts remain a part of who we are. We still pay close attention to potential dangers.

A recession may be the potential danger that most frightens investors like us.

Recessions usually inflict some damage on portfolios, and at times they can be downright destructive. The economy and stock market always recover, but it can take some investors years or even decades to get back on track.

If you study the history of economic recessions in the United States, you see that almost all of them up until the Great Depression in 1929 were referred to as “panics.”

The Panic of 1873… the Panic of 1893… the Panic of 1907.

Those all resulted in runs on banks, because depositors feared their financial institutions would not be able to fulfill withdrawal requests. These panics led to the formation of a national bank in 1913, which we know today as the Federal Reserve System.

Bank runs are not much of a thing anymore, but we do see panic selling in the market whenever fear overcomes investors:

- Fear of inflation.

- Fear of rising interest rates.

- Fear of war, trade disputes, and other global socioeconomic events.

- And, ultimately, fear of a recession.

Even hints or speculation of a recession looming on the horizon are enough to scare the wits out of investors. The result is often uncertainty to the point of gridlock. Investors don’t know whether to stuff their money under the mattress, back up the truck and buy, or do something in between.

As I write this in the second quarter of 2022, signs and speculation of a possible recession have increased, so you are in good company if you’re more worried and confused than just a few months ago.

A recent Bank of America monthly fund manager survey showed that investors are more concerned about the global economy than they have been since the financial crisis of 2007-’08.

Deutsche Bank became the first major bank to predict the United States will enter a “mild” recession later in 2022 into early 2023. Moody’s Analytics put the chances of a recession at 33%, and Goldman Sachs is in the same ballpark at 35%.

JPMorgan Chase CEO Jamie Dimon, arguably the most powerful person in banking, wrote to shareholders in early April 2022 that the global economy will slow, and that “it could easily get worse.”

InvestorPlace’s advisors all agree that a recession is indeed possible. The odds have increased as the war in Ukraine further ignited already hot inflation at 40-year highs. They are all watching carefully.

Still, this is where our survival instinct can be helpful. If those potential dangers help us invest smarter and fortify our portfolios, we can be better prepared to avoid those catastrophic losses that are so difficult to recover from.

Now is the perfect time to consider how you’ll manage your portfolio during a recession. Even if we don’t get one, it’s still a worthwhile exercise to consider ways to protect your portfolio from painful losses that cost money and time.

Recessions Hurt

The simplest definition of a recession is two or more consecutive quarters in which the economy contracts. The National Bureau of Economic Research (NEBR) makes the “official” call on recessions, and it considers many more factors than that. (If you’re interested, you can dive into the details here.)

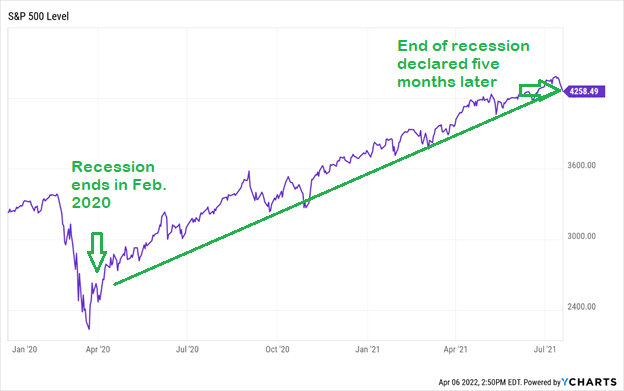

NEBR uses trailing data, so keep in mind that recessions can only be declared looking in the rearview mirror. By the time a recession is identified, both the economy and the stock market may have already been through the worst of it and could even be turning around.

That said, economists, investors, business owners, and consumers alike can often “feel” when they’re in a recession due to what they see in the world, in the news, and on their balance sheets.

Consumers tend to cut back on discretionary spending, corporate revenues slow down, companies cut back on manufacturing, and unemployment rises as more people find themselves out of work.

Recessions have lasted anywhere from a grueling 65 months (in very different times in 1873) to a quick two months. That two-month recession, the shortest in U.S. history, is also very recent. It hit in early 2020 as COVID-19 emerged and much of the nation – and the world – shut down.

The NEBR said that recession lasted from February 2020 to April 2020, and they made that announcement on July 19, 2021… more than a year after the fact. Anyone waiting for official word to get back into the stock market missed one heck of a rally, as you can see in the S&P 500 level chart below.

Recessions over the last 80 years, since World War II ended, lasted 11.1 months on average. That makes very short and long recessions the exception rather than the rule, but investors ignore any recession at their own risk.

Believe it or not, stocks can actually go up during recessions. In fact, they often do. The market looks forward, so as we just saw in 2020, stocks often turn higher even as a recession is ongoing. This chart from Hartford Funds shows that stocks gained during seven of the 13 recessions since 1945.

Source: InvestorPlace

The overall average for all 13 recessions was +3.7%. Of the seven recessions when stocks were up, the average gain was 16%. And of the six when stocks lost ground, the average loss was 10.7%.

So this may come as a surprise: Recessions aren’t necessarily catastrophic for stocks. At the same time, they can be costly in terms of both money and time.

The most recent recession discussed above was an outlier in how quickly stocks recovered to new highs. Stocks took much longer to recover from the prior recession that occurred from December 2007 to June 2009 – the so-called “Great Recession” sparked by the subprime mortgage and financial crises. You can see the sharp rally off the March 6, 2009, bottom, but then it took almost another four years for the S&P 500 to get back to where it was before the recession.

We see a similar pattern in the 2001 recession from March to November, which was when the whole dot-com bubble burst. The S&P 500 rallied in late 2001 as the recession was ending, but then fell to new lows in 2002. It took until fall of 2005 for the S&P 500 to fully recover.

The Nasdaq Composite got hit even worse, taking a full 15 years to top the all-time highs from 2000 prior to the recession.

In this report, we’ll show you five ways to invest in a recession. But like we said before, we don’t officially know about recessions until after the fact.

So first, let’s look at a few recession “indicators” that can tell us about the economy’s status well before the NBER makes its official call.

The #1 Recession Indicator

The NBER doesn’t make the official determination of a recession until after the fact, but there are indicators that can point to the possibility. Perhaps the most frequently watched recession indicator – because it’s the most accurate – is what’s called the “yield curve.”

As I write this in mid-2022, it’s understandable why investors are so nervous. The bond market has been flashing plenty of warning signs lately, with the Treasury yield curve briefly inverting for the first time since 2019 and the end of March and in early April.

The yield curve refers to the relationship between short-term interest rates and long-term interest rates, specifically as paid out by bonds. In a normal market, long-term bonds pay a higher rate – or yield – than short-term bonds. This makes sense, as investors expect a higher return for tying their money up for a longer period of time.

You can see a normal yield curve in the chart below, which John Jagerson and Wade Hansen shared with their Strategic Trader readers in early April. The black line is the long-term yield (10 years), and red line shows the short-term yield (two years).

Source: InvestorPlace

The yield curve “flattens” when long-term and short-term rates are about the same, and it “inverts” when short-term yields pay more than long-term yields. An inverted yield curve is concerning because it affects banks’ profits and is often a precursor to a recession.

The most important and closely watched yield curve is the spread between 10-year and 2-year Treasury bond yields. This spread, when it goes negative, has correctly predicted every recession over the past 50 years.

That’s what happened at the very end of the first quarter. At the beginning of 2022, the 2-year and 10-year yields started coming closer together until the 2-year yield (purple line) briefly popped above the 10-year (orange line).

Timing is critical to note here because an inverted yield doesn’t historically signal an immediate recession. In fact, it is usually an opportunity for a period of time.

Luke Lango, InvestorPlace’s Chief Investment Strategist, highlighted the data for his subscribers:

The last three 10-2 inversions didn’t happen at stock market tops – they happenedbefore stock market booms.

In 1988, the 10-2 spread went negative. Stocks rallied 33% over the next 20 months. A decade later, the 10-2 spread inverted again. Stocks rallied 40% over the next 22 months. In 2006, the 10-2 spread also inverted. And over the next 20 months, stocks rallied 22%.

Source: InvestorPlace

In other words, yield curve inversions do predict recessions – but they’re really early in doing so. And, in the time between when the yield curve inverts and the U.S. economy dips into a recession, the stock market tends to party in a big way.

Other Recession Indicators

The yield curve may get the most attention, but it isn’t the only sign of a possible recession on the horizon.

There is also what’s called “stagflation” – a time of high inflation, slowing economic growth, and low unemployment. This is the situation now. The concern here is that the Federal Reserve needs to raise rates to combat inflation, but higher rates make it difficult for businesses to borrow money, which can result in hiring and keeping fewer employees.

Successfully navigating this balance results in the “soft landing” you hear so much about, but investors often turn cautious – sometimes overly cautious – before it’s known whether the landing will be hard or soft.

Consumer confidence is also another indicator economists and investors watch closely when assessing the odds of a recession. The logic here is simple: Consumer spending accounts for roughly 70% of the economy. If confidence wanes and spending drops, the economy can slow or even shrink.

There are also multiple factors that influence consumer confidence and spending, like how many people have jobs and how many are out of work. Real income measures essentially the purchasing power of consumers by adjusting personal income for inflation. Employment may be high currently, but wages have lagged inflation since early 2021.

Wholesale and retail sales tell us about demand for goods, as does manufacturing. If you want a less scientific indicator, you can check men’s underwear sales. Former Fed Chairman Alan Greenspan said many years ago that underwear is the last piece of clothing men buy, so if sales of those are down, it may mean people are holding on to more of their money.

Now that we’ve gone over a few ways we can tell if a recession may be on the way or not, let’s get to what you can do about it – the opportunities that can be found during a recession…

The first thing to know about investing during recessions is that they always end. The track record is without blemish. As we discussed earlier, the bigger question is how long they will last, and how much money and time they will they cost investors.

There are multiple strategies to consider when investing in a recession:

Strategy #1: A Stash of Cash

Cash is not the most exciting thing to think about when it comes to investing, but don’t underestimate its importance – especially in recessionary times.

Cash provides a ballast for your portfolio and dampens overall volatility. It is as low risk as you can get. It won’t grow, unless you can get a good interest rate on a savings or money market account, but $1,000 in cash today will still be $1,000 in cash tomorrow no matter how much the stock market falls (even if its purchasing power declines a little due to inflation).

Cash is also the proverbial “dry powder” that enables you to pounce on opportunities. And as we’ll talk more about in a moment, there will be opportunities. Even good stocks trade at bargain prices during tough economic times and market selloffs.

At the same time, you don’t want to overestimate the importance of cash either by getting out of the market completely. This can happen when investors panic and emotions take over. Too often, investors end up taking bigger losses than they needed to.

To be clear, we are talking here about cash in your investment portfolio. From a personal finance perspective, you also want to have some cash on hand for emergencies like loss of a job or an unexpected repair to your car or home. And from a financial planning perspective, you want little if any of the cash you need right now or will need in the very near future invested in stocks. It’s just too unpredictable.

Strategy #2: Stocks That Typically Do Well in a Recession

There are several tried-and-true investments that typically outperform during a recession. That is, they gain more and/or lose less than many other stocks. As you would expect, these are industries that can maintain demand levels or even increase demand during tough economic times as well as some of the biggest companies in those industries…

- Healthcare/Pharmaceuticals: Our need for healthcare and medicines doesn’t change just because the economy does. Examples include pharmaceutical companies like Johnson & Johnson (JNJ) and Pfizer Inc. (PFE), biotech companies like Abbvie Inc. (ABBV) and Amgen Inc. (AMGN), medical equipment companies like Abbott Laboratories (ABT) and Medtronic PLC (MDT), and healthcare services and providers like Unitedhealth Group Inc. (UNH) and CVS Health Corp. (CVS). We also have medical software and technology companies such as Cerner Corp. (CERN) and Veeva Systems Inc. (VEEV) that help healthcare providers do more for less cost.

- Utilities: We still need water, electricity, and gas to live, so demand tends to remain steady, even during tough economic times. Many utility stocks also pay solid dividends, which investors seek in down markets and times of inflation. (See below.) Among the biggest are Nextera Energy Inc. (NEE), Dominion Energy Inc. (D), Atmos Energy Corp. (ATO), and American Water Works Company Inc. (AWK).

- Home and auto maintenance: If consumers cut back spending, they will likely delay major purchases like new homes and cars. That means spending money to maintain current homes and cars. Hardware stores like Home Depot Inc. (HD) and Lowe’s Companies Inc. (LOW) stores often see an uptick in sales during recessions, as do auto supply stores such as O’Reilly Automotive Inc. (ORLY) and Autozone Inc. (AZO).

- Consumer staples: People may not go to restaurants as much when money is tight, but that doesn’t mean they stop eating. They may not go to the movies as much, but that doesn’t mean they don’t need entertainment. Demand for food, beverages, cleaning supplies, personal products, and the like usually remains fairly steady. Some of the biggest consumer staples companies include Procter & Gamble Co. (PG), Coca-Cola Co. (KO) and Pepsico Inc. (PEP), and Unilever PLC (UL).

- Discount stores: Makes sense, doesn’t it? You still need things when times are tough, so might as well get them at the lowest prices you can find. That means discount retailers can benefit. Think dollar stores, warehouse clubs, and even just big chains with lower prices – stores like Walmart Inc. (WMT), Target Corp. (TGT), Costco Wholesale Corp. (COST), and Dollar General Corp. (DG).

Many investors like to put their money into dividend-paying stocks when they fear a recession. History would say it is worth investing some of your portfolio in dividend stocks in good times and in bad.

According to S&P Global, dividends account for 32% of the S&P 500’s total returns since 1926. Fidelity says that in the 90 years from 1930 to 2020, dividends constituted nearly 40% of total returns.

Source: Fidelity

Let that sink in. Somewhere around one-third of the market’s total returns going back nearly a century come from dividends.

A solid dividend also tends to make the payer’s stock less volatile, and the income from the dividend helps counter any drops in the share price. Wall Street sees such stocks as safer investments, and investors seek safety in turbulent markets and economies.

Dividends are not guaranteed. They can be cut by the company if need be, so you want to look for a strong dividend history and strong company cash flow to minimize the chances of dividends being slashed.

Strategy #3: Long-Term Buying Opportunities

In times of recession, stocks can fall because their underlying businesses are not doing as well. That’s understandable.

But stocks often fall too much as fear takes over, and making investment decisions based on any emotion can lead to shortsighted thinking and costly mistakes.

The term “panic selling” is accurate, and when investors sell out of fear, they don’t care what price they are getting back. They simply want out. As with selling anything from a stock to a home, you’re going to get a lower price if you’re desperate to get rid of it.

The buyer, on the other hand, walks away with a real bargain.

Stocks usually move based on a company’s earnings and revenue growth. Every once in a while, especially during times of economic unease like a recession, war, or unexpected scare, that pattern breaks down. As a result, companies still growing their earnings and revenues see their share prices diverge from the underlying fundamentals. Smart investors can sometimes buy a dollar of earnings growth for mere pennies.

Luke Lango has done some fascinating research on what he calls “divergence” and the resulting opportunities:

In my early years as an investor, I remember reading book after book, studying lecture after lecture, and talking to hedge fund manager after hedge fund manager to figure out what type of investment style fit me best.

And by “fit me best” I mean to say I was trying to figure out what investment style would make me the most money.

My questions were answered when I came across an earlier version of the following chart. It graphs the earnings per share of the S&P 500 alongside the price of the S&P 500 from 1988 to 2022.

Source: InvestorPlace

As you can see, the blue line (earnings per share) lines up almost perfectly with the orange line (price). Indeed, the mathematical correlation between the two is 0.93, which is about as close as it gets.

I was convinced after seeing that chart. Clearly, earnings drive stock prices. Forget the Fed. Forget inflation. Forget geopolitics. Forget trade wars, recessions, depressions, and financial crises.

We’ve seen all of that over the past 30 years – and yet, through it all, the correlation between earnings and stock prices never broke or even faltered very much.

But at certain times in history, including here in the first part of 2022, earnings and revenues have not driven stock prices. This divergence is due to macroeconomic fears.

When people get fearful in the stock market, they sell first and ask questions second. They don’t care about fundamentals. Fear on Wall Street sparks a mad dash for the exits.

One period of great divergence Luke identified was 2001 when the dot-com bubble burst and the economy tumbled into a recession. His research shows how that turned out to be one of the best opportunities to buy internet stocks, and he cited Amazon as a prime example:

From December 1999 to September 2001, Amazon dropped a mind-boggling 92%. During that stretch, revenues rose 82%. This was a massive divergence the market had never seen before.

The result? A rally like the market hadn’t seen yet, either.

Within a year, Amazon stock had soared 166%. Within two years, it had risen 707%. Two decades later, it is up 52,860%.

Source: InvestorPlace

Of course, taking advantage of undervalued stocks requires a willingness to tolerate volatility and a long-term investment horizon. As a recession gathers steam, it’s impossible to know for sure when investors will get past their fears and start focusing again on fundamentals.

But when they do, quality companies with growing businesses in transformative megatrends can rally further and faster than the market.

Strategy #4: Hedging and Shorting

If you want to take a more active approach to managing your portfolio during recessions and tough markets, you can consider both hedging to dampen downside risk and shorting to profit from stocks that go down.

InvestorPlace macro expert Eric Fry, a former hedge fund manager, says that hedging is really about making money no matter what the market does…

It is a return that is not dependent upon, or relative to, market direction. It does not require nourishment from a bull-market trend.

Over the decades since [A.W.] Jones launched his new-fangled fund, a wide variety of hedge-fund strategies have emerged. Although many of them still focus on buying and selling short stocks, others utilize some combination of bonds, currencies, futures, private equity investments, derivatives, and what-have-yous.

No matter the exact tactics, most hedge funds attempt to construct some type of “market-neutral” portfolio that can generate a positive absolute – no matter if the stock market is rising or falling.

In theory, therefore, “market-neutral” strategies are the fat-free ice cream of investing. They deliver at least some of the good stuff while eliminating almost all the bad stuff.

In its simplest form, a market-neutral trade would feature two halves: one half that bets on some sort of up move, paired against a second half that bets on some sort of down move.

But of course, a perfectly market-neutral trade would never produce a profit or a loss; it would only produce a breakeven result because the gain on one half would perfectly offset the loss on the other half.

Obviously, the goal is not to be that neutral.

Instead, a market-neutral trade attempts to profit when the two halves of the trade combine to produce a profit. Importantly, however, both sides of a market-neutral trade do not need to produce a profit, in order for the entire trade to produce one.

The most direct way to bet on a down move is through shorting a stock. Be aware, though, that shorting is risky and more complicated than buying shares. It also requires you to have a margin account, which allows you to borrow from your broker. Like any other type of loan, you need to pay interest, and you need to pay back what you’ve borrowed.

Shorting a stock means selling it first. If that sounds impossible, here’s how it works: When you identify a stock you believe will go down, you “borrow” shares from your broker and sell them on the open market. The goal is to then buy those shares back at a lower price, return them to your broker, and keep the difference as profit.

You still hope to buy low and sell high, but just in reverse order.

Say you borrow shares of XYZ stock and sell them right away for $20 a share. XYZ then dips to $15, so you buy them back and return them to your broker, keeping the $5 a share as your profit (minus any interest and fees).

The risk, of course, is that the stock you shorted goes higher, and then your losses can mount quickly. Mathematically speaking, the most you can make shorting a stock is 100% if the stock goes to $0, but your downside risk is theoretically infinite if the stock price keeps going higher and higher.

That’s when short-sellers “cover” by buying shares back and taking the loss. You can also be forced to cover if the brokerage issues a “margin call” and essentially demands that you return the shares you borrowed.

You can hedge your portfolio without directly shorting a stock by concentrating on investments that tend to zig when the market zags. We talked above about types of stocks that often outperform during recessions when the market falls.

You can also hedge by investing in inverse exchange-traded funds (ETFs), which are basically short ETFs that are built to move in the opposite direction to the market or a specific index. For example, if the S&P 500 is down 1.5% on a given day, the ProShares Short S&P 500 ETF (SH) would be up 1.5%. You can find inverse ETFs on most any investment index, sector, or theme.

We’ll let Eric have the last word on hedging and how to think about it:

We investors do not need to swing for the fences every time we step the plate. Sometimes, it’s a good idea to shorten our swings and try to hit singles. Heck, it’s even good to get hit by a pitch.

And when times get really tough, select short sales or other portfolio hedges can help a portfolio “score runs” when most typical investment strategies are striking out completely.

Because short sales produce profits from falling stock prices, they can provide a valuable “hedge” to your conventional portfolio. To be sure, short sales can be risky, even when they are part of a market-neutral trade. But so can owning stocks during a bear market.

Therefore, for those folks who are eager to investigate the mysterious, alluring (and risky) world of hedges that can profit directly from falling stock prices, take a look at the final story in this month’s issue.

On the other hand, if you have no interest in advanced “Hedging 2.0” strategies, no problem. Most of us don’t like betting against companies, or the idea that we will lose money if a stock increases in value.

I get it. There are other, less scary forms of hedging, like gold stocks, oil stocks, and “inverse funds” like the ProShares Short 20+ Year Treasury ETF (TBF).

Although “indirect hedges” like these do not automatically rise when the overall is falling, the last few weeks have demonstrated that they can deliver big gains amid market turmoil.

Strategy #5: Built a Crisis-Proof Portfolio in Advance

If the past 30 years of history have taught us anything, it’s that smart investors need to “harden” their financial lives and investment portfolios.

We’ve talked about many of these crises already, from the worst pandemic in a century to the Great Recession of 2007-’08 and the bursting of the 2000 tech bubble.

Moreover, we live in a world rife with cybercrime and financial scams and wars.

And we live in a world where stock market drops occur with disturbing regularity, whether they are from a recession or wars or pandemics or any number of other causes.

For these reasons, building and maintaining a “hardened” financial life to grow your wealth safely is one of the smartest moves you can make for yourself and your family.

As one of the world’s largest investment research firms, InvestorPlace hand selects and recommends many stocks and other investments each year. However, the world’s best investment ideas aren’t worth much if they don’t fit inside a robust all-weather portfolio that can make you money during good times and keep you safe during the bad times.

In fact, asset allocation is arguably more important than stock picking when it comes to successful investments and building wealth safely,.

Asset allocation is the part of your investment strategy that dictates how much of your wealth you place in broad asset classes like stocks, bonds, cash, commodities, precious metals, and real estate. Ideally, you want a diversified mix of assets that greatly limits your exposure to a big decline in one asset class.

There’s no “one size fits all” asset allocation strategy that is right for everyone.

When you (possibly with the help of a financial advisor) think about your right “mix,” you must consider your age, your risk tolerance, and your goals. A 50-year-old who is paying college tuition for three children will think about asset allocation much differently than a 32-year-old with no family.

However, most of us have a similar goals. We want to own a diversified collection of assets that throws off income… even when we are not actively working. We want to buy high-quality assets for bargain prices. We want to keep the financial damage a recession inflicts on us to a minimum.

Having all that means being diversified across private businesses, stocks, bonds, real estate, cash, precious metals, and insurance.

While deciding what allocation works best for you, consider some of these factors:

If you’re younger and more comfortable with the volatility involved in stocks, you can keep a stock exposure to somewhere around 50%-75% of your portfolio. A young person who can place a significant chunk of their wealth into stocks and hold them for decades stands to do very well. But they will have to go through some volatile times.

If you’re older and/or can’t stand risk or volatility, consider keeping a significant portion of your wealth in cash and bonds, perhaps even as much as a 75%-85% weighting.

Near the end of your career as an investor, you’ll likely be more concerned with preserving wealth than growing it, so you’ll in turn likely want to be very conservative.

Whatever mix you choose, just make sure you’re not overexposed to an unforeseen crash in one particular asset. This will make your hardened wealth plan as “crisis proof” and “inflation proof” as possible.

Rely on the Proven Basics

Preparing your portfolio for a recession can mean incorporating strategies specific to the market and the economy at that time.

But it also means sticking to the basics that have proven their worth through recessions, bear markets, and just every other situation.

Have some cash to live on and for emergencies.

Try to minimize big hits to your portfolio by diversifying among asset classes. You never want to be too dependent on any single asset class or even one investment within an asset class.

Dividends can provide both income and stability to your portfolio.

When investing in stocks, stay focused on the long term. The short term is too unpredictable.

Keep emotions out of it. The market is famous for panic selloffs, and it can be tempting to join the crowd when you see your stocks falling. Selling out of fear is rarely the right decision, especially if the long-term outlook for your stocks hasn’t changed.

Most of all, remember that recessions end and bear markets end. They can be painful and stressful when they are happening, but the market and the economy always recover. The bias of capitalism is growth, which makes the bias of the market higher.

Build a smart portfolio.

Avoid the catastrophic losses.

Stay patient.

If you can do those, you’ll be in the best position possible to weather a recession – and other negative market events – and continue on the path to wealth and financial freedom.