Published on March 24th, 2025 by Bob Ciura

The average dividend yield in the S&P 500 Index remains low at just 1.3%. As a result, income investors should focus on higher-yielding securities, if they want additional income from their stock portfolios.

Even better, investors can buy high dividend stocks when they are also undervalued, which could lead to high total returns in the coming years.

After all, the goal of rational investors is to maximize total return under a given set of constraints. High dividend stocks can contribute a significant portion of a stock’s total return.

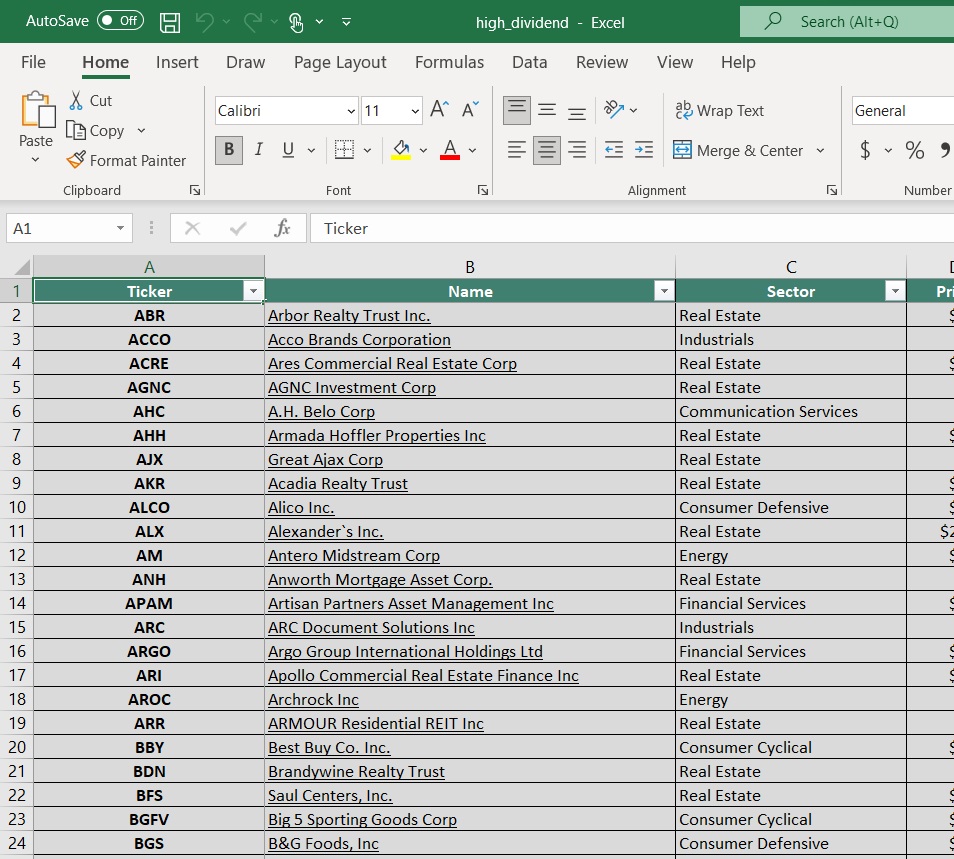

With this in mind, we compiled a list of high dividend stocks with dividend yields above 5%. You can download your free copy of the high dividend stocks list by clicking on the link below:

Note: The spreadsheet uses the Wilshire 5000 as the universe of securities from which to select, plus a few additional securities we screen for with 5%+ dividend yields.

The free high dividend stocks list spreadsheet has our full list of ~170 individual securities (stocks, REITs, MLPs, etc.) with 5%+ dividend yields.

Interestingly, all returns come from only three sources:

- Dividends (or distributions, interest, etc.)

- Growth on a per share basis (typically measured as earnings-per-share)

- Valuation multiple changes (typically measured as a change in the price-to-earnings ratio)

Combined, these three sources make up total return.

Historical total return, while interesting, is not what matters in investing. It’s expected future returns that we care about.

And since total returns can only come from the three sources mentioned above, you can use the expected total return framework to clarify your thinking on where you expect total returns to come from.

The following list represents the 10 most undervalued stocks in the Sure Analysis Research Database that also have yields above 5%.

The list excludes MLPs, BDCs, and REITs, and also excludes international stocks. The 10 undervalued hidden gems below are sorted by expected return from valuation changes, from lowest to highest.

Table of Contents

You can instantly jump to any specific section of the article by using the links below:

Undervalued Hidden Gem #10: Pfizer Inc. (PFE)

- Annual Valuation Return: 6.1%

- Dividend Yield: 6.6%

Pfizer Inc. is a global pharmaceutical company focusing on prescription drugs and vaccines. Pfizer formed the GSK Consumer Healthcare Joint Venture in 2019 with GlaxoSmithKline plc, which includes its over-the-counter business.

Pfizer owns 32% of the JV, but is exiting the company, now known as Haleon. Pfizer spun off its Upjohn segment and merged it with Mylan forming Viatris for its off patent, branded and generic medicines in 2020.

Pfizer’s top products are Eliquis, Ibrance, Prevnar family, Vyndaqel family, Abrysvo, Xeljanz, and Comirnaty.

Source: Investor Presentation

Pfizer’s current product line is expected to produce top line and bottom-line growth because of significant R&D and acquisitions.

Pfizer reported solid Q4 2024 results on February 4th, 2025. Company-wide revenue grew 21% operationally and adjusted diluted earnings per share climbed to $0.63 versus $0.10 on a year-over-year basis because of stabilizing COVID-19 related sales, growing revenue from the existing portfolio, and lower expenses.

Global Biopharmaceuticals sales gained 22% to $17,413M from $14,186M led by gains in Primary Care (+27%), Specialty Care (+12%), and Oncology (+27%). Pfizer Centerone saw 11% lower sales to $325M, while Ignite revenue was $26M.

Of the top selling drugs, sales increased for Eliquis (+14%), Prevnar (-4%), Plaxlovid (flat), Cominraty (-37%), Vyndaqel/ Vyndamax (+61%), Ibrance (-2%), and Xtandi (+24).

Click here to download our most recent Sure Analysis report on PFE (preview of page 1 of 3 shown below):

Undervalued Hidden Gem #9: T. Rowe Price Group (TROW)

- Annual Valuation Return: 6.8%

- Dividend Yield: 5.5%

T. Rowe Price Group, founded in 1937 and headquartered in Baltimore, MD, is one of the largest publicly traded asset managers.

The company provides a broad array of mutual funds, sub-advisory services, and separate account management for individual and institutional investors, retirement plans and financial intermediaries.

Source: Investor Presentation

On February 5th, 2025, T. Rowe Price announced fourth quarter and full year results for the period December 31st, 2024.

For the quarter, revenue increased 11% to $1.82 billion, though this was $50 million less than expected. Adjusted earnings-per-share of $2.12 compared favorably to $1.72 in the prior year, but missed estimates by $0.08. For the year, revenue grew 9.8% to $7.1 billion while adjusted earnings-per-share of $9.33 compared to $7.59 in 2023.

During the quarter, AUMs of $1.639 billion were up 19.2% year-over-year and 3.1% sequentially. Market appreciation of $205.3 billion was partially offset by $43.2 billion of net client outflows. Operating expenses of $1.26 billion increased 0.1% year-over-year and 6.4% quarter-over-quarter.

Click here to download our most recent Sure Analysis report on TROW (preview of page 1 of 3 shown below):

Undervalued Hidden Gem #8: Canandaigua National Corporation (CNND)

- Annual Valuation Return: 6.9%

- Dividend Yield: 5.1%

Canandaigua National Corporation (CNC) is the parent company of The Canandaigua National Bank & Trust Company (CNB) and Canandaigua National Trust Company of Florida (CNTF).

The company offers a wide range of financial services, including banking, lending, mortgage services, trust, investment management, and insurance.

With 23 branches across its service areas, CNC is focus on serving local communities by providing personalized financial solutions to individuals, businesses, and municipalities. CNC emphasizes community banking, focusing on reinvesting in the local economy through a diverse lending portfolio.

Moving forward, we expect CNC’s EPS to grow at a CAGR of 5%. Note that the company has increased its dividend every year since 2002, marking 22 years of consecutive annual dividend increases.

Click here to download our most recent Sure Analysis report on CNND (preview of page 1 of 3 shown below):

Undervalued Hidden Gem #7: Midland States Bancorp (MSBI)

- Annual Valuation Return: 7.8%

- Dividend Yield: 7.0%

Midland States Bancorp (MSBI) is the holding company of Midland States Bank, a community bank that was founded in 1881 and is headquartered in Effingham, Illinois.

It operates 53 branches in Illinois and Missouri and provides a wide range of banking products and services to individuals, businesses, municipalities and other entities. Midland States Bancorp has total assets of $7.5 billion.

In late January, Midland States Bancorp reported (1/23/25) results for the fourth quarter of fiscal 2024. Its net interest margin expand sequentially from 3.10% to 3.19% and its net interest income grew 2%.

However, the bank incurred massive charge-offs on loans ($103 million) and provisions for loan losses ($93.5 million).

As a result, it switched from earnings-per-share of $0.74 to an excessive loss per share of -$2.52, missing the analysts’ consensus by $3.19.

Midland States Bancorp has acquired seven smaller banks since 2009. As a result, it grew its asset base by 12% per year on average over the last nine years.

It had also grown its earnings-per-share by 6.9% per year on average during 2015-2023 but it incurred a loss in 2024 due to massive loan charge-offs and high deposit costs, which resulted from high interest rates.

Click here to download our most recent Sure Analysis report on MSBI (preview of page 1 of 3 shown below):

Undervalued Hidden Gem #6: Western Union Company (WU)

- Annual Valuation Return: 8.5%

- Dividend Yield: 8.8%

The Western Union Company is the world leader in the business of domestic and international money transfers. The company has a network of approximately 550,000 agents globally and operates in more than 200 countries.

About 90% of agents are outside of the US. Western Union operates two business segments, Consumer-to-Consumer (C2C) and Other (bill payments in the US and Argentina).

Western Union reported mixed Q4 2024 results on February 4th, 2025. Revenue increased 1% and diluted GAAP earnings per share increased to $1.14 in the quarter, compared to $0.35 in the prior year on higher revenue and a $0.75 tax benefit on reorganizing the international operations.

Revenue rose, despite challenges in Iraq on higher Banded Digital transactions and Consumer Services volumes.

CMT revenue fell 4% year-over-year even with 3% higher transaction volumes. Branded Digital Money Transfer CMT revenues increased 7% as transactions rose 13%. Digital revenue is now 25% of total CMT revenue and 32% of transactions.

Consumer Services revenue rose 56% on new products and expansion of retail foreign exchange offerings. The firm launched a media network business, expanded retail foreign exchange, and grew retail money orders.

Click here to download our most recent Sure Analysis report on WU (preview of page 1 of 3 shown below):

Undervalued Hidden Gem #5: Hooker Furnishings Company (HOFT)

- Annual Valuation Return: 9.1%

- Dividend Yield: 7.9%

Hooker Furnishings is a designer, marketer and importer of casegoods (wooden and metal furniture), leather furniture, fabric-upholstered furniture, lighting, accessories and home décor for residential, hospitality and contract markets.

The company also domestically manufactures premium residential custom leather and fabric-upholstered furniture.

Hooker Furnishings is the largest supplier of casegoods and upholstery in the U.S. and has access to more than 75% of all retail furniture distribution.

Source: Investor Presentation

In early December, Hooker Furnishings reported (12/5/24) financial results for the third quarter of fiscal 2025. Net sales decreased -11% over the prior year’s quarter due to sustained headwinds in the housing market and loss of sales due to the bankruptcy of a customer.

The combination of high interest rates and high home prices have been exerting pressure on the business of Home Furnishings over the last two years.

As a result, the company switched from earnings-per-share of $0.65 to a loss per share of -$0.39 and missed the analysts’ consensus by a massive $0.67.

Click here to download our most recent Sure Analysis report on HOFT (preview of page 1 of 3 shown below):

Undervalued Hidden Gem #4: Peoples Financial Services (PFIS)

- Annual Valuation Return: 10.5%

- Dividend Yield: 5.5%

Peoples Financial Services (PFIS) is the holding company of Peoples Security Bank and Trust Company, a community bank that was founded in 1905 and is headquartered in Scranton, Pennsylvania.

It operates 44 branches in Pennsylvania and provides various banking products and services to consumers, municipalities and businesses.

On July 1st, 2024, Peoples Financial Services completed its acquisition of FNCB Bancorp in an all-stock deal. As per the terms of the deal, the shareholders of FNCB now own ~29% of the combined entity.

Thanks to the merger, the bank grew its total assets from $3.7 billion to $5.5 billion and thus it became the 5th largest community bank in Pennsylvania.

In early February, Peoples Financial Services reported (2/6/24) financial results for the fourth quarter of fiscal 2024. Loans and deposits grew 40% and 28%, respectively, over the prior year’s quarter, thanks to the acquisition of FNCB Bancorp.

Net interest margin expanded impressively, from 2.30% in the prior year’s quarter to 3.25% thanks to the much higher net interest margin of the acquired bank.

Click here to download our most recent Sure Analysis report on PFIS (preview of page 1 of 3 shown below):

Undervalued Hidden Gem #3: AES Corp. (AES)

- Annual Valuation Return: 11.0%

- Dividend Yield: 5.4%

The AES (Applied Energy Services) Corporation was founded in 1981 as an energy consulting company. It now has businesses in 14 countries and a portfolio of approximately 160 generation facilities.

AES produces power through various fuel types, such as gas, renewables, coal, and oil/diesel. The company has more than 36,000 Gross MW in operation.

Source: Investor Presentation

AES Corporation reported fourth quarter results on February 28th, 2025, for the period ending December 31, 2024. Adjusted EPS decreased 26% to $0.54 for Q4 2024, but this still beat analyst estimates by $0.19.

For the full year, AES’ adjusted EPS rose 22% to $2.14 from $1.76 in 2023. The company constructed and acquired 3 GW of renewable energy in 2024, as well as constructed a 670 MW combined cycle gas plant in Panama.

Leadership initiated its 2025 guidance, expecting adjusted EPS of $2.10 to $2.26 for the full fiscal year.

Additionally, the company reaffirms its expectation it can grow EPS on average 7% to 9% through 2025 from a base year of 2020. It also expects annual EPS growth of 7% to 9% from 2023 through 2027.

Click here to download our most recent Sure Analysis report on AES (preview of page 1 of 3 shown below):

Undervalued Hidden Gem #2: Virtus Investment Partners (VRTS)

- Annual Valuation Return: 11.8%

- Dividend Yield: 5.1%

Virtus Investment Partners, Inc. is a distinctive partnership of boutique investment managers, singularly committed to the long-term success of individual and institutional investors.

The firm offers a diverse range of investment strategies across asset classes, including equity, fixed income, multi-asset, as well as alternative investments.

These strategies are available in multiple product forms, such as open-end mutual funds, closed-end funds, ETFs, retail separate accounts, and institutional accounts.

Virtus operates through a multi-manager model, partnering with affiliated managers and select unaffiliated sub-advisers, each maintaining distinct investment philosophies and processes.

This structure allows Virtus to offer clients access to specialized expertise and a broad array of solutions tailored to meet various financial objectives.

On January 31st, 2025, Virtus reported its Q4 and full-year results for the period ending December 31st, 2024. Total AUM fell by 5% sequentially to $175.0 billion due to net outflows in institutional accounts and U.S. retail funds, and negative market performance, partially offset by inflows in ETFs, global funds, and retail separate accounts.

Net outflows of ($4.8) billion worsened from ($1.7) billion in Q3, primarily due to a $3.3 billion lower-fee partial redemption of an institutional mandate.

However, adjusted EPS rose 8% to $7.50, driven by higher investment management fees and a soft increase in operating expenses. For FY2025, we expect adjusted EPS of $26.81.

Click here to download our most recent Sure Analysis report on VRTS (preview of page 1 of 3 shown below):

Undervalued Hidden Gem #1: Shutterstock Inc. (SSTK)

- Annual Valuation Return: 14.8%

- Dividend Yield: 6.7%

Shutterstock sells high-quality creative content for brands, digital media and marketing companies through its global creative platform.

Its platform hosts the most extensive and diverse collection of high-quality 3D models, videos, music, photographs, vectors and illustrations for licensing. The company reported $935 million in revenues last year.

On January 7th, 2025, Shutterstock announced it entered a merger agreement with Getty Images through a merger of equals. The combined company will retain the name Getty Images Holdings, Inc and trade on the NYSE under ticker GETY.

Getty Images shareholders will own roughly 54.6% of the entity and Shutterstock shareholders will own the remaining 45.3%. Shareholders of SSTK will receive $28.84870 of cash, or 9.17 shares of Getty Images plus $9.50 in cash per share.

The combined company would have revenue between $1,979 million and $1,993 million, 46% of it being subscription revenue. About $175 million of annual cost savings is forecast by the third year, with most of this expected after 1 to 2 years.

On January 27th, 2025, Shutterstock announced a $0.33 quarterly dividend, a 10% increase over the prior year.

On February 25th, 2025, Shutterstock published its fourth quarter results for the period ending December 31, 2024. While quarterly revenue grew by a solid 15% year-on-year, it missed analyst estimates by nearly $4 million.

Adjusted EPS of $0.67 decreased by 7%, and also missed analyst estimates by $0.18.

Click here to download our most recent Sure Analysis report on SSTK (preview of page 1 of 3 shown below):

Final Thoughts & Additional Reading

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

Other Sure Dividend Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].