Published on February 25th, 2025 by Bob Ciura

High dividend stocks means more income for every dollar invested. All other things equal, the higher the dividend yield, the better.

In this research report, we analyze 10 dividend dynamos offering high dividend yields of 5.0% and greater.

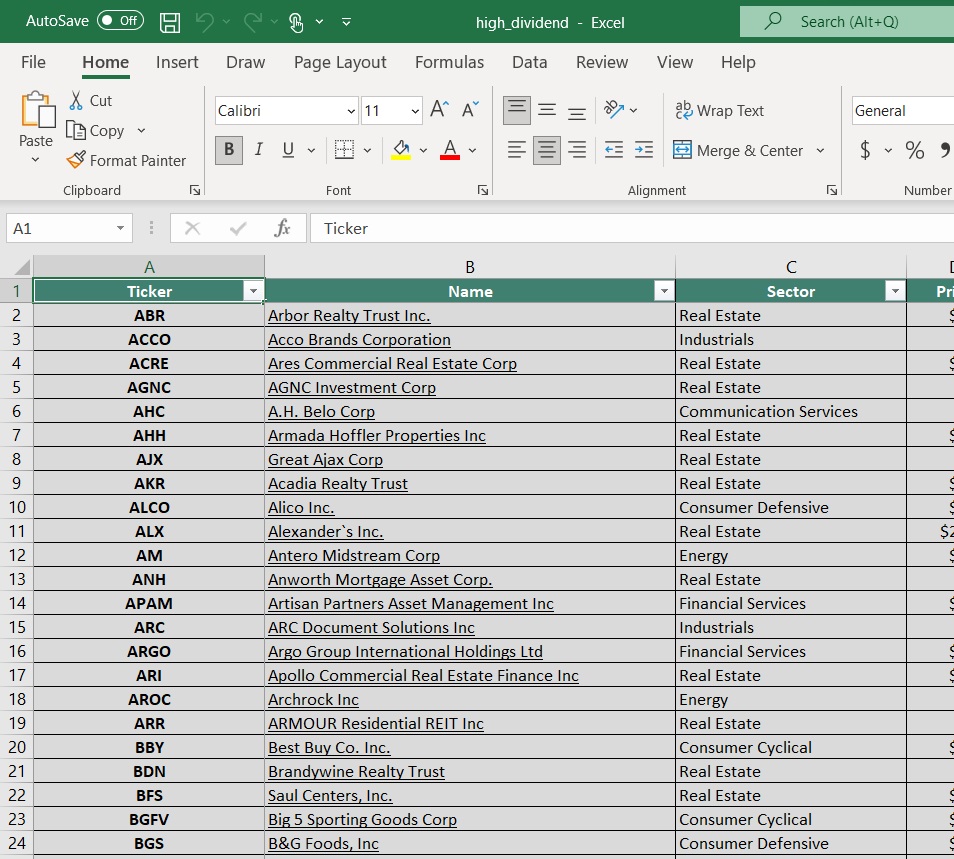

The free high dividend stocks list spreadsheet below has our full list of individual securities (stocks, REITs, MLPs, etc.) with with 5%+ dividend yields.

You can download a free copy by clicking on the link below:

Not only do the stocks in this article have high yields above 5%, they are also generating strong growth.

The combination of a high starting yield, plus long-term growth, could produce strong total returns in the years ahead.

To qualify for this list, we screened out any high-yield stocks with our lowest Dividend Risk Score of ‘F’, to try to filter out stocks in danger of cutting their dividends.

The 10 stocks are sorted by five-year expected underlying business growth, from lowest to highest.

Table of Contents

Dividend Dynamo #10: Bank of Nova Scotia (BNS)

- 5-year annual expected business growth: 5.0%

Bank of Nova Scotia (often called Scotiabank) is the fourth-largest financial institution in Canada behind the Royal Bank of Canada, the Toronto-Dominion Bank and Bank of Montreal.

Scotiabank reports in four core business segments – Canadian Banking, International Banking, Global Wealth Management, and Global Banking & Markets.

Scotiabank reported fiscal Q4 and full-year 2024 results on 12/03/24. For the quarter, revenue rose 3.1% to C$8.5 billion, while non-interest expenses fell 4.2% to C$5.3 billion. Provision for credit losses (“PCL”) declined by 18% year over year (“YOY”) to C$1.0 billion, weighing less on earnings compared to a year ago.

As a result, net income rose 25% to C$1.7 billion and diluted earnings per share (“EPS”) rose 23% to C$1.22. The bank’s PCL as a percentage of average net loans & acceptances was 0.54%, down from 0.65% a year ago, whereas the PCL on impaired loans as a percentage of average net loans & acceptances was 0.55%, up from 0.42% a year ago.

The fiscal year saw revenue rising 4.5% to C$33.7 billion. Non-interest expenses increased by 3.0% to C$19.7 billion, while PCL rose 18% to C$4.1 billion.

The PCL as a percentage of average net loans & acceptances was 0.53%, up from 0.44% a year ago, whereas the PCL on impaired loans as a percentage of average net loans & acceptances was 0.46%, up from 0.32% a year ago.

Click here to download our most recent Sure Analysis report on BNS (preview of page 1 of 3 shown below):

Dividend Dynamo #9: Canandaigua National Corporation (CNND)

- 5-year annual expected business growth: 5.0%

Canandaigua National Corporation (CNC) is the parent company of The Canandaigua National Bank & Trust Company (CNB) and Canandaigua National Trust Company of Florida (CNTF), offering a wide range of financial services, including banking, lending, mortgage services, trust, investment management, and insurance.

With 23 branches across its service areas, CNC is focus on serving local communities by providing personalized financial solutions to individuals, businesses, and municipalities. CNC emphasizes community banking, focusing on reinvesting in the local economy through a diverse lending portfolio.

Moving forward, we expect CNC’s EPS to grow at a CAGR of 5%. Note that the company has increased its dividend every year since 2002, marking 22 years of consecutive annual dividend increases.

Click here to download our most recent Sure Analysis report on CNND (preview of page 1 of 3 shown below):

Dividend Dynamo #8: United Bancorp, Inc. (UBCP)

- 5-year annual expected business growth: 6.0%

United Bancorp a financial holding company based in the United States, operating primarily through its wholly-owned subsidiary, United Bank.

The company offers a wide range of banking services including retail and commercial banking, mortgage lending, and investment services.

Some of its other solutions include checking and savings accounts, personal and business loans, as well as wealth management.

On August 22nd, 2024, United Bancorp raised its dividend by 1.4% to a quarterly rate of $0.1775. On a year-over-year basis, this was a 4.4% increase.

On November 6th, 2024, United Bancorp posted its Q3 results for the period ending September 30th, 2024. The company reported total interest income of $9.94 million, which was up 3.0% year-over-year.

This growth was primarily driven by a 13.9% rise in interest income on loans, despite a 32.9% decline in loan fee income and a 15.2% decrease in interest income from securities.

However, total interest expenses increased by about 23.4%, leading to a 6.5% decline in net interest income, which fell to $6.1 million.

Click here to download our most recent Sure Analysis report on UBCP (preview of page 1 of 3 shown below):

Dividend Dynamo #7: Edison International (EIX)

- 5-year annual expected business growth: 6.7%

Edison International is a renewable energy company that is active in energy generation and distribution. It also operates an energy services and a technologies business. The company was founded in 1987 and is headquartered in Rosemead, CA.

On October 29, 2024, Edison International reported its financial results for the third quarter ended September 30, 2024.

The company delivered a GAAP net income of $516 million, or $1.33 per diluted share, marking a substantial increase from $155 million, or $0.40 per diluted share, in the same quarter last year.

On an adjusted basis, Edison achieved core earnings of $582 million, or $1.51 per diluted share, up from $531 million, or $1.38 per diluted share, in Q3 2023.

Revenue for the quarter was $5.20 billion, reflecting a 10.61% year-over-year growth and surpassing expectations by $192.39 million.

Click here to download our most recent Sure Analysis report on Edison International (EIX) (preview of page 1 of 3 shown below):

Dividend Dynamo #6: Magna International Inc. (MGA)

- 5-year annual expected business growth: 7.0%

Magna International Inc. is dual-listed on the New York Stock Exchange and the Toronto Stock Exchange. The company began working with General Motors (GM) back in 1957.

Since then, it has become the largest automotive supplier in North America and the fourth-largest in the world. Magna has increased its dividend every year since 2010.

Magna reported its Q4 and full-year 2024 results on 02/14/2025. For the quarter, its sales were $10.6 billion – 2.0% higher versus a year ago – in-line with the global light vehicle production. Magna’s income from operations before income taxes rose 23% to $381 million.

Adjusted earnings before interest and taxes (“EBIT”) rose 23% to $689 million and adjusted earnings per share (“EPS”) of $1.69 rose 27% year over year (“YOY”).

The full-year results provide a bigger picture. Sales were essentially flat at $42.8 billion. Adjusted EBIT rose 4.1% to $2.3 billion. And the adjusted EPS declined 1.5% to $5.41. Magna increased its quarterly dividend by 2.1%, equating an annualized payout of $1.94.

Magna initiated its 2025 sales forecast at $38.6-$40.2 billion and adjusted EBIT margin at 5.3-5.8%.

Click here to download our most recent Sure Analysis report on MGA (preview of page 1 of 3 shown below):

Dividend Dynamo #5: AES Corp. (AES)

- 5-year annual expected business growth: 7.0%

The AES (Applied Energy Services) Corporation was founded in 1981 as an energy consulting company. It now has businesses in 14 countries and a portfolio of approximately 160 generation facilities.

AES produces power through various fuel types, such as gas, renewables, coal, and oil/diesel. The company has more than 36,000 Gross MW in operation.

AES Corporation reported third quarter results on October 31st, 2024, for the period ending September 30th, 2024. Adjusted EPS rose 18% to $0.71 for Q3 2024.

The company constructed and acquired 2.8 GW of renewable energy year-to-date, and is on course to add 3.6 GW of new projects online in 2024.

Source: Investor Presentation

Leadership expects to achieve the high end of its 2024 guidance for adjusted EPS of $1.87 to $1.97 for the full fiscal year. Additionally, the company reaffirms it also still expects annual EPS growth of 7% to 9% from 2023 through 2027.

The company is actively engaged in developing and acquiring new energy projects.

It currently has a backlog of 12.7 GW of renewables. AES expects to complete the majority of these projects through 2027.

Click here to download our most recent Sure Analysis report on AES (preview of page 1 of 3 shown below):

Dividend Dynamo #4: Brookfield Infrastructure Partners LP (BIP)

- 5-year annual expected business growth: 7.0%

Brookfield Infrastructure Partners L.P. is one of the largest global owners and operators of infrastructure networks, which includes operations in sectors such as energy, water, freight, passengers, and data.

Brookfield Infrastructure Partners is one of four publicly-traded listed partnerships that is operated by Brookfield Asset Management (BAM).

BIP has delivered 8% compound annual distribution growth over the past 10 years.

Source: Investor Presentation

BIP reported resilient results for Q4 2024 on 01/30/25. The diversified utility reported funds from operations of $646 million, up 3.9% year over year. FFO per unit was $0.82, up 3.8%.

For the full year, FFO per unit was $3.12, up 5.8% from the previous year. Normalized for the impact of foreign exchange, the FFOPU growth would have been 10%, which better reflects the business’s operational strength.

For the year, it achieved its target of $2 billion capital recycling proceeds. It also deployed +$1.1 billion across its backlog of organic growth projects and three tuck-in acquisitions, which should help contribute to growth. It also added ~$1.8 billion of new projects to its capital backlog.

Click here to download our most recent Sure Analysis report on Brookfield Infrastructure Partners (preview of page 1 of 3 shown below):

Dividend Dynamo #3: United Parcel Service (UPS)

- 5-year annual expected business growth: 8.0%

United Parcel Service is a logistics and package delivery company that offers services including transportation, distribution, ground freight, ocean freight, insurance, and financing.

Its operations are split into three segments: US Domestic Package, International Package, and Supply Chain & Freight.

On January 30th, 2025, UPS reported fourth quarter 2024 results for the period ending December 31st, 2024. For the quarter, the company generated revenue of $25.3 billion, a 1.5% year-over-year increase.

Source: Investor Presentation

The U.S. Domestic segment (making up 68% of sales) saw a 2.2% revenue increase, with International also posting a 6.9% revenue increase, while Supply Chain Solutions saw a 9.1% decrease. Adjusted net income equaled $2.75 per share, up 11.3% year-over-year.

The company announced it is reducing its largest customer’s volume by over 50% by H2 2026, insourced 100% of its UPS SurePost product, and is redesigning its end-to-end process to deliver $1 billion in savings.

Click here to download our most recent Sure Analysis report on UPS (preview of page 1 of 3 shown below):

Dividend Dynamo #2: HA Sustainable Infrastructure Capital (HASI)

- 5-year annual expected business growth: 9.0%

Hannon Armstrong is a U.S. public company that invests in climate change solutions, providing capital to leading companies in energy efficiency, renewable energy, and other sustainable infrastructure markets.

The company’s portfolio of assets is worth around $13.1 billion and is split between three market segments: Its Behind the Meter business (46% of assets) focuses on the installation of solar power, electric storage, and other heat and power systems.

The Grid-Connected segment (30% of assets) involves investments in grid-connected renewable energy projects, such as solar and off/on-shore wind projects, whose generated yield the company then sells on the wholesale energy markets.

Finally, occupying the rest of its portfolio (24% of assets), are the company’s Fuels, Transport, & Nature projects, enabling the use of natural resources, such as its projects to slow pollution runoff across the Chesapeake Bay region.

Source: Investor Presentation

On November 7th, 2024, Hannon Armstrong reported its Q3 results for the period ending September 30th, 2024. For the quarter, total revenues fell by 8.5% year-over-year to about $82 million.

The drop in revenues was mainly due to lower rental income due to asset sales as well as lower gains on assets sold compared to last year.

Adjusted EPS fell by 16% to $0.52 compared to the prior-year period. The drop was mainly due to lower revenues, offset partially by growth in adjusted net investment income due to a larger portfolio.

The company’s pipeline remained robust, including $5.5 billion of asset opportunities. Management affirmed its prior outlook, expecting to deliver adjusted EPS CAGR between 8% and 10% through 2026.

Click here to download our most recent Sure Analysis report on HASI (preview of page 1 of 3 shown below):

Dividend Dynamo #1: Whirlpool Corp. (WHR)

- 5-year annual expected business growth: 11.0%

Whirlpool Corporation, founded in 1955 and headquartered in Benton Harbor, MI, is a leading home appliance company with top brands Whirlpool, KitchenAid, and Maytag.

Roughly half of the company’s sales are in North America, but Whirlpool does business around the world under twelve principal brand names. The company, which employs about 44,000 people, generated nearly $17 billion in sales in 2024.

Source: Investor Presentation

On January 29th, 2025, Whirpool reported fourth quarter 2024 results. Sales for the quarter totaled $4.14 billion, down 18.7% from fourth quarter 2023. Ongoing earnings per diluted share was $4.57 for the quarter, 19% higher than the previous year’s $3.85 per share.

Whirlpool issued its 2025 guidance, seeing ongoing earnings-per-share coming in at approximately $10.00 on revenue of $15.8 billion. Additionally, Whirlpool expects cash provided by operating activities to total roughly $1 billion, with $500 to $600 million in free cash flow.

Click here to download our most recent Sure Analysis report on WHR (preview of page 1 of 3 shown below):

Final Thoughts

High dividend stocks are naturally appealing to income investors, especially when the S&P 500 Index is only yielding roughly 1.3% on average.

Even better, these 10 dividend dynamos combine a high current yield, with the potential for long-term business growth. In this way, they could provide strong total returns through the combination of growth and yield.

Investors should continue to monitor each stock to make sure their fundamentals and growth remain on track, particularly among stocks with extremely high dividend yields.

Additional Reading

If you are interested in finding other high-yield securities, the following Sure Dividend resources may be useful:

High-Yield Individual Security Research

Other Sure Dividend Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].