What To Expect in the Markets This Week

Key Takeaways

- The Michigan Consumer Sentiment Index for May is expected Friday as investors watch inflation data amid international trade tensions.

- Weekend meetings between U.S. and China trade officials are scheduled to continue on Sunday.

- Federal Reserve Chair Jerome Powell and other Fed officials are scheduled to deliver remarks.

- Earnings reports are expected this week for Walmart, Cisco, Deere, Alibaba, and Take-Two Interactive.

- Retail sales data will be released Thursday, along with consumer and small business sentiment surveys and homebuilder and manufacturing sector data during the week.

Inflation data, scheduled for Tuesday, may claim the spotlight early this week. But investors will also be evaluating the outcome of the weekend meetings between U.S. and Chinese trade officials after a quiet Friday session that left stocks down for the week.

Traders will also follow Thursday’s remarks from Fed Chair Jerome Powell as he comes under pressure from President Donald Trump over the Fed’s interest rate policy. And retail sales data will be closely watched on Thursday, the same day as retailer Walmart (WMT) reports earnings.

Earnings releases from Cisco Systems (CSCO), Alibaba Group (BABA), Deere & Co. (DE), Applied Materials (AMAT), and video game maker Take-Two Interactive (TTWO) are among the week’s other top scheduled results.

Consumer and small business sentiment surveys, along with homebuilder and manufacturing sector data, could also attract attention.

Monday, May 12

- Monthly federal budget (April)

- Federal Reserve Gov. Adriana Kugler is scheduled to deliver remarks

- Simon Property Group (SPG), NRG Energy (NRG), Fox Corp. (FOX), and Monday.com (MNDY)

Tuesday, May 13

- NFIB Small Business Optimism Index (April)

- Consumer Price Index (April)

- JD.com (JD), On Holding (ONON), Tencent Music Entertainment (TME), and Oklo (OKLO)

Wednesday, May 14

- Federal Reserve Vice Chair Philip Jefferson, Federal Reserve Gov. Christopher Waller and San Francisco Fed President Mary Daly are scheduled to speak

- Sony Group (SONY), Cisco Systems, CoreWeave (CRWV), Dynatrace (DT), and Alcon (ALC)

Thursday, May 15

- Initial jobless claims (Week ending May 10)

- U.S. retail sales (April)

- Producer Price Index (April)

- Industrial production (April)

- Capacity utilization (April)

- Business inventories (March)

- Homebuilder confidence (May)

- Federal Reserve Chair Jerome Powell and Gov. Michael Barr are scheduled to speak

- Walmart, Alibaba, Deere & Co., Applied Materials, Mizuho Financial Group (MFG), Take-Two Interactive, and Cava Group (CAVA)

Friday, May 16

- Import/export price index (April)

- Housing starts (April)

- Building permits (April)

- Consumer sentiment – preliminary (May)

- Richmond Fed President Tom Barkin is scheduled to speak

Inflation, Retail Sales Reports Come As Investors Watch Data Amid Tariff Developments

The weekend meetings on trade between U.S. and Chinese officials are likely to capture market watchers’ attention to start the week, with investors hopeful that trade tensions between the two nations could be easing.

Inflation will be in focus as investors get their first look at April prices with the Tuesday release of the Consumer Price Index (CPI). At last week’s Federal Reserve meeting, officials said they were looking for more improvement on inflation before moving to lower interest rates from their current levels.

Federal Reserve Chair Jerome Powell is scheduled to speak on Thursday; last week, President Trump was critical of the Fed for failing to act on interest rates. Federal Reserve Vice Chair Philip Jefferson, Federal Reserve Gov. Christopher Waller, and San Francisco Fed President Mary Daly are among the other officials expected to deliver remarks this week.

March’s CPI report indicated that inflation dropped unexpectedly to a rise of 2.4%, while other recent indicators have shown that price increases are slowing. Investors are also expecting updates on import and export prices, as well as April’s Producer Price Index, which shows inflation at the wholesale level.

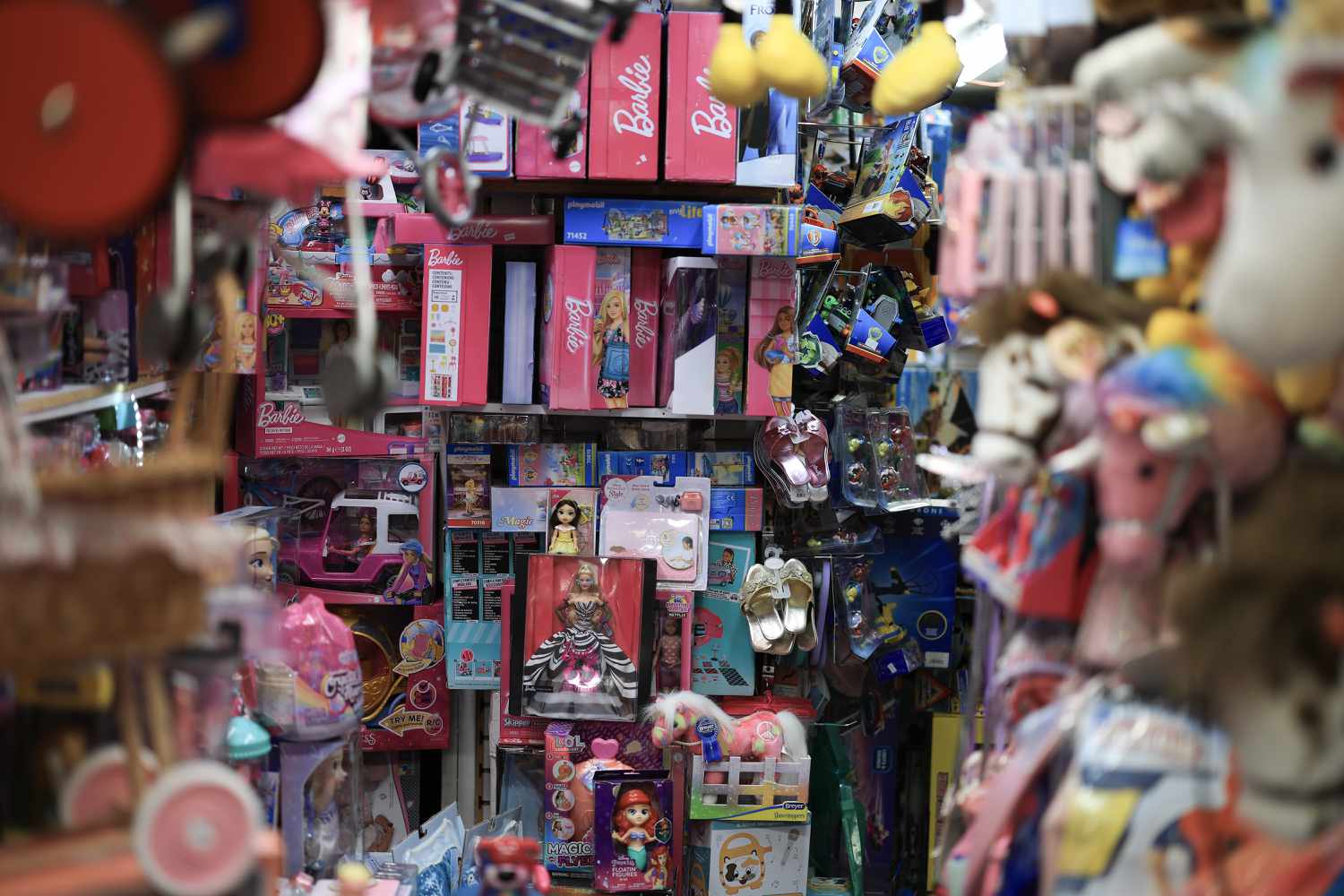

Retail sales data, scheduled for Thursday, comes as consumer spending has been strong while shoppers rush to buy items before tariffs take hold. Economists are looking for signs of change in spending levels, with recent consumer sentiment surveys showing that feelings about the economy are worsening.

On Friday, the latest sentiment report is expected to offer May’s first look at how consumers feel about current and future economic conditions. The survey offers insights into spending patterns that can help support the economy. It follows several months of surveys showing declining consumer sentiment amid worries over the administration’s tariffs’ impact on prices. Tuesday’s expected small business sentiment report could further signal the economy’s direction.

The homebuilders’ confidence survey, scheduled for Thursday, and Friday’s expected housing starts data, will highlight inventory supply trends during a period in which housing scarcity is helping drive affordability problems.

Investors will also be looking at Thursday’s scheduled industrial productivity report for data on the manufacturing sector. Monday’s planned release of the monthly federal budget for April will provide an update on government debt levels.

Walmart Earnings Come as Investors Watch for Consumer Spending Trends

Walmart’s scheduled quarterly report on Thursday leads the weekly earnings calendar, as market watchers seek information on consumer spending and economic conditions amid uncertain U.S. trade policy.

The retail giant reported prior-quarter earnings per share and revenue that came in ahead of analyst expectations, but its outlook was weaker than expected as the company said it was evaluating the impact of tariffs on its business.

Cisco is expected to report on Wednesday after the network infrastructure provider posted higher revenue in the prior quarter on increased AI orders and approved a $15 billion increase to the company’s stock repurchase program. Semiconductor maker Applied Materials’ report scheduled for Thursday comes after it said in its previous quarterly earnings report in February that sales could be negatively affected by recent limitations on chip exports.

Take-Two Interactive’s Thursday earnings report will drop as the video game maker builds excitement for its latest release in the Grand Theft Auto game franchise. Deere’s report on the same day will provide a look at the agricultural sector.

Nuclear power startup Oklo’s report on Tuesday comes after it recently reported that its losses widened in 2024. Investors in the power provider include OpenAI’s Sam Altman, which has raised investor optimism that the company’s services could be used to meet energy demand for AI infrastructure projects.

Investors will also be following scheduled earnings reports from Chinese e-commerce companies Alibaba, JD.com, and Tencent Music Entertainment.