Key Takeaways

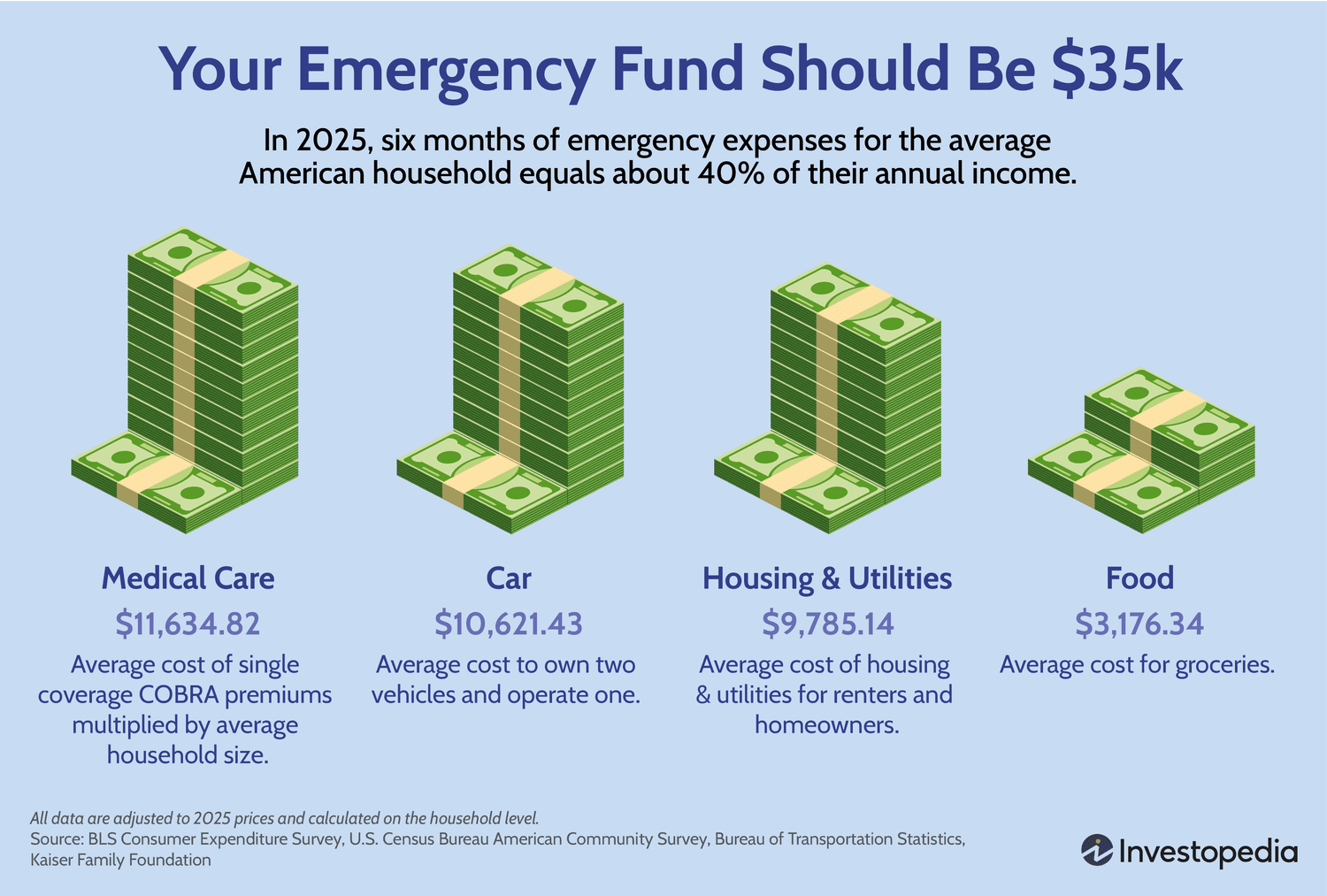

- Your emergency fund should total about $35,000, according to an analysis by Investopedia.

- That’s six months of emergency expenses for the average American household, and equals about 40% of their annual income.

- The median account balance in all transaction accounts for U.S. households with at least one account was only about $8,742, according to Federal Reserve data.

Do you have $35,000 in cash? You should, according to an Investopedia analysis.

That might seem like a lot of money—and it may strike you as higher than other recommended emergency fund figures. (It’s about 40% of the average US household’s annual income, according to Census Bureau data.) But that’s the estimated cost of six months’ expenses for the average household, which is what experts recommend you aim to save.

An emergency fund can help account for all types of unexpected costs—from a surprise home or car repair to a potential job or health insurance loss. To illustrate that point, Investopedia analyzed the average cost of six months of the household expenses you’d need to pay if you lost a job.

We calculated the cost of six months of housing, utilities, food, medical care, and car payments for an average U.S. household of at least two people, ending up with a total of $35,217.73—about $2,000 more than last year, and much more than most households have in their savings. (Our full methodology is at the bottom of this article.) Much of that is associated with healthcare and automotive expenses.

“Given the recent increase in economic uncertainty and a realistic calculation of what our ‘needs’ actually cost on a monthly basis, $35,217 sounds like a lot, and is a lot of money for most households,” says Investopedia Editor-in-Chief Caleb Silver. “But having that emergency cushion could help prevent you and your family from falling deep into debt due to unforeseen circumstances,”

The median balance in all transaction accounts for US households with at least one account was about $8,742 in 2025 dollars, according to Federal Reserve data. That’s enough to cover about a month and a half of expenses for the average American household.

This year, concerns regarding tariffs, market volatility, stubborn inflation, a potential recession and falling consumer confidence have signaled economic uncertainty, which could mean you’re more likely to need your emergency fund.

Most people plan to rely on savings in an emergency. About 43% said they would dip into their savings account in a hypothetical financial emergency, according to a 2022 survey by the Federal Reserve. That’s far larger than the amount who said they would work more, borrow money, postpone payments or cut spending.

What’s My Own Emergency Fund Total?

The exact amount you’d need depends on the number of people in and specific needs of your household. Financial experts recommend keeping enough cash to cover at least three, and preferably six, months of money to cover:

- Rent or Mortgage

- Utilities

- Food

- Transportation (car payment, gas, other necessary transportation fees)

- Medical costs

The cost of medical care, transportation, and housing for six months made up the bulk of the expenses in Investopedia’s analysis, costing $11,634, $10,621, and $9,785, respectively. Medical care was the highest expense, costing the average American household $11,634 for six months, followed by the cost of owning two cars, and housing at $10,621 and $9,785, respectively.

Where Should I Keep My Emergency Fund?

While the cost of an emergency fund keeps getting higher, it’s an essential part of your financial plan. There are ways to maximize savings beyond stashing it in a regular savings account. Investopedia’s Silver suggests a a high-yield savings or money market account,

“Your emergency fund needs to be liquid and accessible immediately, but you should try to keep it in a higher interest earning type of account,” says Silver.

Methodology

Medical care was calculated by multiplying the average annual premium cost for single-coverage employer sponsored health insurance (KFF Employer Health Benefits Survey, 2024) by 2.5 to reflect the average number of people in both households and consumer units, and increased by 2% to reflect COBRA administrative costs.

Car costs are calculated by adding together the annual fixed (owning) costs for two vehicles and the annual variable (operating costs) for one vehicle (Bureau of Transportation Statistics, 2024).

Housing and utilities are calculated by adding together the median monthly housing costs for both owners and renters (American Communities Survey, 2023) along with the annual consumer expenditures on trash and garbage collection, telephone and internet services to cover utilities not included in the former (Consumer Expenditure Survey, 2023).

The cost of groceries is sourced from annual expenditures on food at home (Consumer Expenditure Survey, 2023).

All figures are adjusted for inflation to reflect March 2025 dollars, and to reflect 6 months worth of expenditures.