How Big Tech’s AI Layoffs Are Creating the Next Great Wealth Wave

Let’s not kid ourselves. This isn’t about efficiency; It’s about replacement.

Something strange is happening in Big Tech.

HR departments are being gutted. Customer support teams are vanishing. Writers, recruiters, analysts — all shown the door.

And just days later?

The same companies unveil shiny new AI tools that “boost productivity,” “streamline operations,” and “enhance customer experience.”

But let’s not kid ourselves.

This isn’t about efficiency. It’s about replacement.

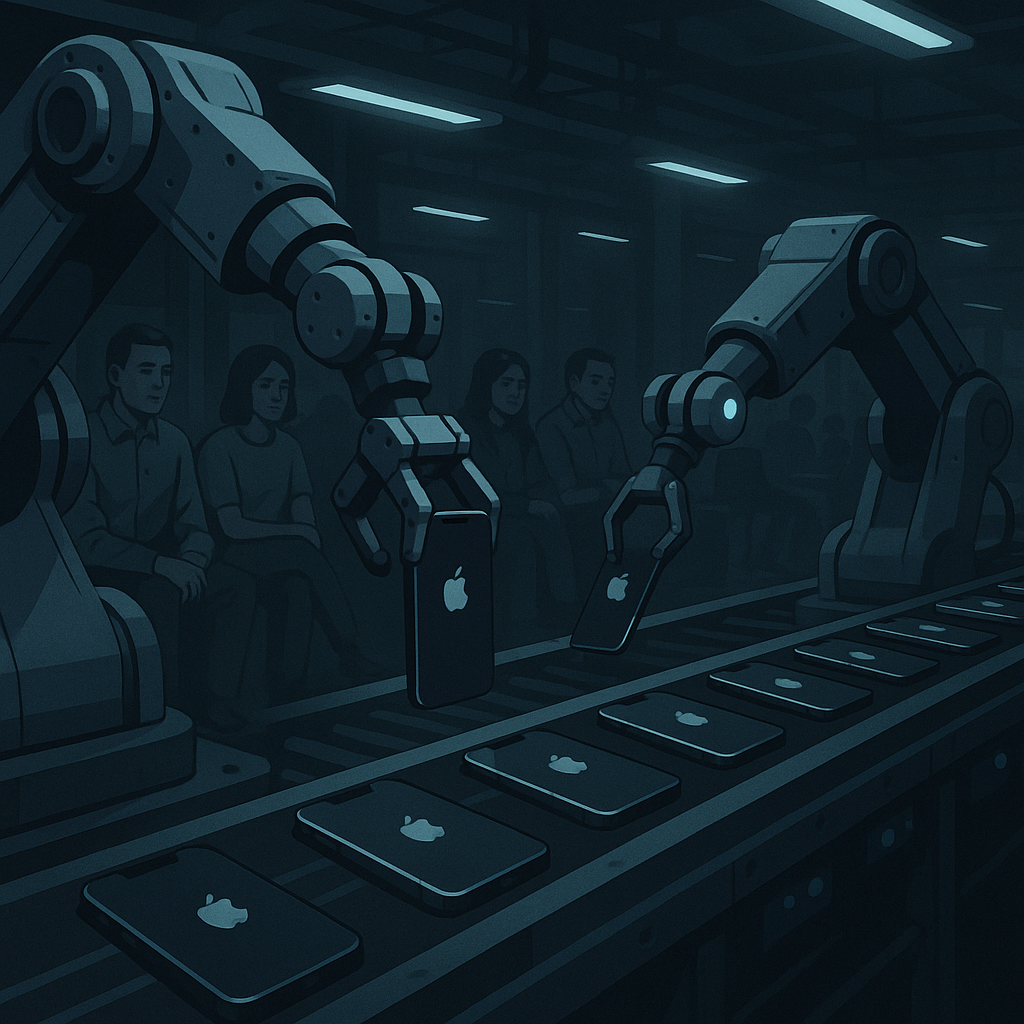

Big Tech is replacing workers with AI.

We are witnessing a silent revolution – the early stages of the AI jobs apocalypse — and while the headlines dance around the truth, the implications are massive.

Massive for workers. Massive for the economy. And absolutely massive for investors.

Let’s dive into what’s really happening.

Step One: Fire People

Over the past several months, the world’s most powerful companies have executed a coordinated campaign of layoffs across tech, media, finance, and more.

Let’s take a look:

- Meta (META) just announced another round of performance-based layoffs, trimming middle managers and software engineers. This follows earlier cuts in recruiting, communications, and business operations.

- Google (GOOG) slashed hundreds of jobs in ad sales and support, including “redundant” customer service and account manager roles. They’ve also made cuts to their HR and cloud units.

- Amazon (AMZN) cut jobs in Alexa, HR, and devices, saying it’s “refocusing resources” toward AI development.

- Microsoft (MSFT) laid off staff at LinkedIn, GitHub, and Azure, especially in operations and sales enablement.

- International Business Machines (IBM) quietly started trimming thousands of back-office roles, especially in HR — after CEO Arvind Krishna said 30% of non-customer-facing roles will be replaced by AI over the next five years.

And it’s not just tech.

- BuzzFeed, Business Insider, and Gannett have all slashed editorial staff while openly testing AI-generated articles.

- Goldman Sachs and JPMorgan are piloting AI tools for internal compliance, documentation, and research — replacing interns and first-year analysts before they even apply.

You might notice a theme: support staff, engineers, writers, HR teams, marketers, junior analysts — all disappearing.

Step Two: Replace Them With AI (Quietly)

Now, here’s where things get really interesting.

All of those layoffs happened within weeks — or even days — of major AI announcements from the same companies.

- Just weeks after cutting hundreds of support staff, Google expanded Gemini for Workspace, offering AI-powered writing, spreadsheet analysis, and customer service automation.

- After trimming its Alexa division, Amazon launched Rufus, its new AI shopping assistant, and said internal teams are now using generative AI to write product descriptions and code.

- As Meta announced its newest layoffs, Mark Zuckerberg said 2025 will be the year Meta builds AI agents as skilled as mid-level engineers — and began integrating LLaMA-based agents across internal coding, QA, and productivity teams.

- Microsoft laid off LinkedIn and GitHub staff while expanding its Copilot integrations across Office, Azure, and GitHub — including tools that write and review code automatically.

They’re not calling it “replacing humans with AI.” That’s a headline nightmare.

But they are doing exactly that.

Lay off humans. Roll out AI. Watch the profit margins widen.

The Big Tech Dominoes Are Already Falling

This is bigger than a few reorganizations.

What we’re witnessing is the beginning of an epochal labor shift — one that’s already being priced into the market.

Companies are being rewarded for cutting humans and replacing them with cheaper AI tools.

Just look at Meta, Amazon, and Google:

- Meta’s operating profit margin increased from 23% in early 2023 to 42% today.

- Google’s margin rose from 25% to 32%.

- Amazon’s margin jumped from 2% to more than 10%.

These companies’ profit margins are exploding — and so are their stock prices.

Since early 2023:

- Amazon stock has more than doubled.

- Google stock is up more than 150%.

- Meta stock has risen about 300%.

Wall Street is sending a clear message: “Replacing workers with AI? Great — we’ll reward you.”

That incentive is too powerful to ignore. Other companies will follow. The movement is already underway.

This Is the AI Jobs Apocalypse

Let’s call a spade a spade: this is the AI jobs apocalypse.

The world’s most powerful companies are building tools that automate white-collar labor — from entry-level coders to content writers to customer service teams.

And they’re already using those tools to quietly replace their own people.

Sure, they might not be saying it. But look at the data. It’s happening. Right now.

And while that raises big questions for the labor market, it creates even bigger opportunities for investors.

The Bottom Line

The AI jobs apocalypse is here. The headlines are soft-pedaling it, but the charts, transcripts, and job boards tell the real story.

- Jobs are disappearing.

- AI tools are replacing them.

- Stock prices are rising.

This is not just a technological shift — it’s an economic supercycle.

And like every disruptive shift before it — from steam to electricity to the internet — it will create enormous wealth for those positioned correctly.

So don’t fear the AI revolution. Invest in it.

Looking for the best stocks to buy for the AI jobs apocalypse?

Consider AI 2.0 stocks — not just the old, obvious names. We believe these next-wave companies could be the tip of the spear in the AI labor revolution.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.

Questions or comments about this issue? Drop us a line at [email protected].