Unity Software PT Lowered to $54 at Citi

Unity Software PT Lowered to $54 at Citi

Source link

Unity Software PT Lowered to $54 at Citi

Source link

Dogecoin turned a meager $200 investment into an impressive $10,200 in just four weeks in 2021, giving one of the most remarkable performances in cryptocurrency ever. Social media buzz, retail investor excitement, and well-publicized endorsements—most notably from Elon Musk—drove the spectacular surge of nearly 5,000% for the meme coin. Beginning the year at about $0.0047, Dogecoin surged to an all-time high of $0.73 by May, demonstrating how rapidly a crypto asset may rise when momentum is behind it.Although community-driven excitement and speculation drove most of Dogecoin’s surge, a new cryptocurrency called Rexas Finance (RXS) is starting to show promise for replicating—or maybe even surpassing—such exponential increases. Rexas Finance is supported by a strong use case: real-world asset (RWA) tokenization, unlike Dogecoin, which had only nominal relevance outside its meme token status. Unlocking trillions of historically illiquid assets with this innovative approach would make RXS a considerably more sustainable investment than Dogecoin was during its speculative surge.

Rexas Finance is a leader in blockchain-powered asset tokenization, not just another cryptocurrency. The initiative lets users tokenize real-world assets such as real estate, art, goods, and intellectual property, allowing fractional ownership and more access to worthwhile investments. Since conventional asset markets remain mostly illiquid and centralized, this technology is predicted to cause disturbance in several sectors. Rexas Finance provides a transparent, quick, distributed approach to investing in assets hitherto impossible to trade using blockchain integration. Institutional-grade principles support Rexas Finance, unlike Dogecoin, which thrived on social media buzz and a vibrant community. Its ecosystem ensures that it works with many different blockchain apps by having smart contract features that work with ERC-20, ERC-721, and ERC-1155 tokens. Rexas Finance offers the technology to easily construct fungible tokens, NFTs, or hybrid assets, depending on investors’ wishes. With tokens valued at $0.20 each, Rexas Finance is in its last presale stage (Stage 12). The presale has already raised over $46 million, reflecting high investor confidence and demand. Once it enters the open market, the token will likely surge in value.As companies and investors search for more liquidity and transparency in asset ownership, blockchain-based solutions like Rexas Finance will see increasing adoption. This positions RXS as a high-growth token capable of sustaining long-term price appreciation. The real-world asset tokenization market is projected to hit $50 billion by the end of 2025 and $16 trillion by 2030.Rexas Finance has undergone CertiK security assessments unlike many speculative ventures, ensuring brilliant contract integrity and investor protection. With screened code and an open roadmap, it stands out from many high-risk crypto projects. The project also appears on major websites, raising professional investor knowledge. Rexas Finance has a fixed supply, unlike Dogecoin, which has an inflationary supply exceeding 140 billion coins. This model of controlled supply encourages long-term price growth and stops excessive value loss. This means that RXS is a deflationary asset that increases in value as demand rises.

Early Rexas Finance (RXS) investors could find remarkable profits if history repeats itself. A $200 presale price investment of $0.20 would guarantee 1,000 RXS tokens. Should RXS reach $10.20—an estimate based on the possible market acceptance of the token—that initial $200 investment would quadruple to $10,200, therefore echoing the 2021 achievement of Dogecoin. If RXS grabs even a tiny portion of the RWA tokenization market, some analysts say it might reach $15-$20 by 2026, producing greater rewards for early adopters. Fueled by excitement more than actual value, Dogecoin’s 5,000% spike in 2021 was an unmatched speculative surge fueled primarily by Elon Musk’s tweets and Reddit-fueled buying frenzy, casting doubt on its viability moving forward. Since then, Dogecoin has failed to regain those highs, demonstrating that speculation alone cannot be a long-term development plan. On the other hand, institutional adoption, actual use, and market demand form the foundation of Rexas Finance’s value. Rexas Finance is positioned as a pillar of the blockchain-finance revolution as companies and investors seek to tokenize actual assets. The important lesson is that RXS is an asset with actual economic worth rather than another speculative meme coin.

Given the right conditions, Dogecoin’s legendary run exemplified the rapid transformation of a small investment into a fortune. Although the meme coin space is still erratic, Rexas Finance offers investors seeking the next big breakthrough a considerably more ordered possibility. The time to purchase RXS at its present price is fast expiring with its presale concluding soon and significant exchange listings scheduled for June 2025. Rexas Finance gives investors who missed Dogecoin’s 2021 explosion a second chance to ride a high-growth crypto wave before it starts.If the project’s uptake and pricing path align with market estimates, a well-timed $200 investment in RXS today will turn into $10,200 or more by 2025. Multiple 100x gains in the crypto market indicate that Rexas Finance could be the next major winner.

For more information about Rexas Finance (RXS) visit the links below:

Website: https://rexas.com

Win $1 Million Giveaway: https://bit.ly/Rexas1M

Whitepaper: https://rexas.com/rexas-whitepaper.pdf

Twitter/X: https://x.com/rexasfinance

Telegram: https://t.me/rexasfinance

Disclaimer: The views and opinions presented in this article do not necessarily reflect the views of CoinCheckup. The content of this article should not be considered as investment advice. Always do your own research before deciding to buy, sell or transfer any crypto assets. Past returns do not always guarantee future profits.

President Donald Trump has imposed tariffs on U.S. trading partners and promised that many more will be implemented. A number of new tariffs are due to go into effect on April 2, which the president refers to as “Liberation Day.”

The tariffs, a cornerstone of Trump’s economic plan, have ever-changing parameters and deadlines. Some tariffs have been used as bargaining chips with other countries, while others are designed to bring manufacturing and jobs back to the U.S. They are also a way the president plans to offset some of the government’s spending.

However, Trump’s on-again, off-again approach to tariff policy has created uncertainty in the economy. Businesses and consumers alike worry that inflation will rise and that the economy could be headed toward a recession, and that uncertainty has weighed on investor sentiment, sending stocks sharply lower in recent months.

Want to know more about the broad implications of all these tariffs? Here are some of our latest headlines about how trade policies are affecting the economy and financial markets.

Investopedia has worked to gather all of Trump’s tariff proposals. Only those with some level of detail (either the proposed rate or the date it is to be enacted) and documentation are included. This page will be updated regularly as parameters change or more information becomes available.

Mexico: President Donald Trump announced trade policies on Mexico before he even took office. Since then, the policy toward our neighbors to the south has changed a number of times.

In the latest move, Trump taxed all items from Mexico at a flat 25% rate but then quickly made exceptions for USMCA goods. Those exceptions cover a bulk of what would be taxed, but Trump has said the exemptions are only temporary and will be lifted on April 2.

Canada: Canada has largely shared Mexico’s plight under Trump’s trade policies but has sometimes faced additional tariffs as Ottawa has hit back. Any non-USMCA items from Canada are taxed at a 25% rate, but that could change on April 2, the president said. Energy resources and potash were later included in tariffs on our northern neighbors and taxed at 10%. More tariffs on the country, such as on dairy and lumber products, could also be enacted on April 2.

Venezuela: While the Venezuelan taxes are geared toward the South American country, they will actually be implemented on others. The 25% tariff will be imposed on goods imported into the U.S. from countries that buy Venezuelan oil. This could include China, the Dominican Republic, India, Malaysia, Russia, Singapore, Spain, and Vietnam.

Oil accounts for more than 80% of Venezuela’s exports and more than 17% of its gross domestic product (GDP), and these tariffs are intended to affect the country’s economy. Trump has targeted Venezuela because he says it is “an unusual and extraordinary threat to the national security and foreign policy of the United States.”

Reciprocal: If it were to go through as planned, reciprocal tariffs would be the most widespread trade policy thus far. Under this proposal, the U.S. would mirror the tariffs imposed on U.S. exports of that country’s goods. For example, if items from the U.S. were taxed at a 5% rate when they were sent to the U.K., items from the U.K. would be taxed at 5% as they came into the U.S.

However, Trump has already walked back some of his original promises, saying he would be lenient on “a lot of countries.” It’s still unclear whether the reciprocal taxes would be a flat rate for an entire country or imposed on an item-by-item basis. These tariffs are set to kick in on April 2, so more information may be available then.

Automobiles: In his attempt to bring manufacturing back to the U.S., Trump is building a wall around U.S. automaking. The import tax on cars outside of the country will be permanent, and engines, transmissions, electrical components, and other parts are expected to be included. Parts that have been exempt under other tariff proposals that are included in the USMCA have a reprieve here, but it could be temporary, analysts said.

It’s unclear whether this manufacturing play will work. U.S. labor is still more costly than that of other countries. Analysts said that for many companies, it could still be cheaper to pay the tariff than to move vehicle manufacturing operations.

Pharmaceuticals: Trump has mentioned pharmaceutical tariffs in a number of press conferences but has not laid out any specific plans beyond the comments. At one point, Trump said import taxes on medications could be a tax of 25% or higher and could increase over a year to give companies an on-ramp. Prescription drug prices have been a particular area of concern for voters, but like with most tariffs, this could push up the price for those medications.

Let’s hop in a time machine and take a trip back to October 2009…

We’re at the San Jose Fairmont Hotel, where a little-known conference called GPU Technology Conference (GTC) kicked off its first year.

Hosted by a company called NVIDIA Corporation (NVDA), the event draws about 1,500 people. Not a bad showing, considering it’s mainly geared toward tech geeks who are fascinated by these things called graphics processing units (GPUs).

These GPUs are earning raves from gamers. But they also have the potential to help solve some pretty complex computing challenges.

Now fast-forward to last week.

Who would have guessed that this event would become an annual mainstay in the tech world? Or that tens of thousands of people would attend – from CEOs to Wall Street analysts to rabid fans and investors?

For example, this year’s event hosted a record-breaking 25,000 people. As founder and CEO Jensen Huang joked during his keynote, “GTC used to be compared to Woodstock. Now, it’s more like the Super Bowl. But here, everybody wins.”

Now, I’ve talked a lot about NVIDIA’s Quantum Day recently – especially in last Friday’s Market 360, where I shared my key takeaways from this day.

But GTC wasn’t just a one-day thing. And the reality is that there were a lot more announcements NVIDIA made during the week that we need to cover.

So, in today’s Market 360, I want to talk about everything else NVIDIA shared last week and why these announcements are so important. I would be remiss if I didn’t also address the fact that the stock is also down year-to-date currently. But as I will explain, I’m not concerned and you shouldn’t be either. In fact, as I’ll explain in a moment, we have a completely new wave of the AI Revolution on the horizon, and investors need to prepare…

Jensen Huang kicked off GTC 2025 (also referred to as AI Developers Conference) with a bang.

First, Huang introduced a powerful new line of AI chips, the “Rubin” chips, as part of the Vera Rubin GPU platform, coming in mid-2026. The Rubin platform will pack four times more GPUs than the current Blackwell Ultra, debuting later this year, making it 14 times more powerful than existing supercomputers while using less energy.

Huang also revealed that General Motors Co. (GM) will partner with NVIDIA to build a self-driving fleet. Specifically, GM will use NVIDIA’s DRIVE AGX hardware system. Interestingly, Toyota Motor Corporation (TM) is also jumping on board, planning to use the AGX system as well as NVIDIA’s DriveOS to power advanced driver-assistance features in its next-generation vehicles. I should add that NVIDIA’s chips are also used by BYD Company ADR (BYDDY), Mercedes-Benz Group ADR (MBGYY), and Volvo ADR (VLVLY).

Huang also shared more details about their plans for “Personal AI supercomputers.” These will bring the power of NVIDIA’s AI chips to the masses for as little as $3,000. This means researchers, developers and scientists won’t need to rely as much on being a part of a large organization (and their vast resources) to do important work.

Also, NVIDIA will help create “AI-native” wireless network hardware for new 6G networks for a wireless project involving T-Mobile US Inc. (TMUS) and Cisco Systems Inc. (CSCO).

I should also note that to wrap up his keynote speech, Huang was joined by “Blue,” a small robot (shaped like Pixar’s Wall-E). It’s powered by a physics engine made in partnership with Walt Disney Co. (DIS) and Google DeepMind as part of the Newton project.

Source: Tech Startups

The Newton project is NVIDIA’s latest open-source physics engine. And Blue was a clear demonstration of where AI is heading… Using advanced AI capable of learning and adapting with astonishing precision – and pairing it with devices interacting in and with the physical world.

Bottom line: It is impressive that other Silicon Valley companies have embraced NVIDIA. So, the “frenzy” that has fueled NVIDIA’s relentless growth will persist!

Now, I recognize that NVIDIA shares are down year-to-date, and I know that can be concerning. After soaring last year, investors are worried that NVIDIA has lost its mojo. That the valuation got stretched. They’re also jittery about rising competition from Chinese upstarts (including DeepSeek, which I addressed here) as well as companies like Advanced Micro Devices Inc. (AMD) and Intel Corp. (INTC).

Throw in macroeconomic concerns like interest rate and tariff worries, and it’s no wonder the entire tech sector has stumbled lately.

But let me be clear: I’m not worried about NVIDIA at all – and neither should you.

NVIDIA remains far ahead of its rivals when it comes to advanced AI chips. Their technology is everywhere. No competitor comes close. Plus, the innovations unveiled at this year’s GTC clearly show the company has multiple avenues for growth well into the next decade.

Nor am I worried about the AI Revolution.

In fact, if you’re paying attention to what’s really happening, this pullback should excite you.

You see, if the GTC conference taught us anything, it is that NVIDIA has its fingers in a lot of different pies. It’s involved in a host of projects that have the potential to advance and change not only technology but innovation and progress as well.

Self-driving cars, drug discovery, robotics, you name it.

So, NVIDIA is a dominant company, and it will continue to be. But the reality is that to make all of these lofty ambitions happen, it’s going to take more than just NVIDIA.

The fact is, the AI Revolution is just beginning. And we’re about to enter a completely new wave…

Soon, you’re going to witness the rise of “AI Agents” and “Physical AI.”

AI Agents are essentially like the brain behind a smart assistant or AI robot. They’re able to perceive their environment and act accordingly. These AI models are equipped with tools like sensors or algorithms that allow them to understand their environment, process that information, and take action.

Meanwhile, Physical AI brings together the digital and physical worlds. It will allow autonomous machines like robots and cars to perceive, understand and perform complex tasks in the physical world.

We’re about to see these two trends redefine nearly every aspect of our daily lives. And just like previous tech disruptions, those who understand these trends now will be the big winners. Those who don’t will quickly get left behind.

That’s why I’ve teamed up with my InvestorPlace colleagues Eric Fry and Luke Lango for our recent Technochasm broadcast. We’ve combined my quantitative stock-rating system with Eric’s global macro investing expertise and Luke’s technology insights to ensure you are on the right side of this divide.

We’ve even identified six stocks that are poised to profit during this time: three tied to AI Agents, and three linked to Physical AI.

I promise you don’t want to miss this.

Click here to watch this briefing now and learn more about how this will play out in the markets… before it’s too late.

Sincerely,

Louis Navellier

Editor, Market 360

The Editor hereby discloses that as of the date of this email, the Editor, directly or indirectly, owns the following securities that are the subject of the commentary, analysis, opinions, advice, or recommendations in, or which are otherwise mentioned in, the essay set forth below:

Whitman Brands™ has shipped the all-new 2026 Red Book from its Alabama distribution center. All print formats, including the Kindle e-book, will be available at major retailers starting April 8, 2025. A limited number of copies will be offered at the Whitman Expos™ Spring Show, March 27-29, 2025, in Baltimore, Maryland.

The 79th edition of the Red Book introduces a complete redesign, featuring a larger 6 x 9″ format, an intuitive layout, over 12,000 listings, updated market values in up to nine grades using Collector’s Price Guide (CPG®) Retail pricing, GSIDSM catalog numbers, the latest mint data, and more.

Collectors will notice several key updates. Circulation and Proof-strike charts are now separated, and Type-coin value charts have been added where applicable. The “Private and Territorial Gold” chapter has more than doubled in detail, while the “Commemoratives” chapter has been updated to better align with market conventions, grouping coins by denomination and listing them by familiar collector names.

“The evolution of this year’s edition has been truly awesome to watch, successful only because of the effort and collaboration by the editorial, pricing, design, purchasing, marketing, sales, and distribution teams,” said John Feigenbaum, Publisher and President/CEO of Whitman Brands.

“I can’t wait for collectors to get their hands on a copy of a 2026 edition – it promises to deliver an elevated experience for collectors of all levels,” he added.

Feigenbaum also extended special thanks to Jeff Garrett, Dianna Plattner, Matthew Heller, Matt Jeffirs, Patrick Ian Perez, and Billie Blattel for their contributions to this year’s redesign.

As with previous editions, readers will expand their knowledge with in-depth coverage of:

Other new additions include fun-fact spotlights, a regular and fully illustrated case study in the “Grading U.S. Coins” section (this edition’s focus: Morgan Dollars), and the “Collector’s Notebook” which covers a changing array of current issues in the hobby (this edition’s subject: Misinformation in Numismatics).

“Initial feedback for this year’s release has been overwhelmingly positive and pre-orders are up from last year,” said Dawn Burbank, Vice President of Sales and Operations. “So far, all our distributors, national accounts, and dealers like the larger 6×9″ format, the addition of a softcover to the lineup, and the pop of the 4-color art on the hardcover.”

Key Enhancements for 2026:

Published by Whitman®, the most trusted name in numismatic literature, all four formats (hardcover, softcover, spiral-bound, and large spiral-bound) can be purchased through Whitman.com, Whitman’s Ebay Store, Amazon, and Walmart.com, and bookstores, hobby shops, and other retailers nationwide starting April 8, 2025. Pre-orders are available now.

Elon Musk’s latest move might sound a bit like a math problem.

In a Friday afternoon message on his social media network X, the Tesla (TSLA) CEO said his artificial intelligence company, xAI, had acquired X in an all-stock transaction. The deal values the companies at $80 billion and $33 billion respectively, the latter number which he said reflects a $45 billion value for X and $12 billion of debt.

Those figures are in line with a recent Bloomberg report of about $1 billion in fundraising at X. Musk’s 2022 acquisition of Twitter, which he renamed X, valued the company at $44 billion.

“xAI and X’s futures are intertwined,” Musk wrote Friday. “Today, we officially take the step to combine the data, models, compute, distribution and talent. This combination will unlock immense potential by blending xAI’s advanced AI capability and expertise with X’s massive reach.”

Musk’s stated valuation for X, which he said has more than 600 million active users, compares with Visible Alpha’s estimates of about $20 billion for Reddit (RDDT) and more than $15 billion for Snap (SNAP). Tech giant Meta Platforms’ (META) estimated market cap is above $1.5 trillion.

Musk’s other companies include SpaceX, Neuralink and The Boring Company.

This morning, the Federal Reserve’s favorite inflation gauge came in hotter than expected, and the market isn’t taking it well. As I write Friday early afternoon, all three major indexes are sharply lower, led by the Nasdaq’s 2.7% decline.

The February Personal Consumption Expenditures (PCE) Price Index showed prices remaining above the Fed’s target rate.

Though the all-items PCE data were in line with forecasts, core PCE, which strips out volatile food and energy prices, increased 0.4% on the month and 2.8% on the year. Dow Jones Economists had forecasted respective numbers of 0.3% and 2.7%.

The monthly increase was the largest gain since January 2024.

Meanwhile, the Bureau of Economic Analysis report released this morning found that consumer spending rose just 0.4% for the month. This was below the 0.5% forecast.

At least there was good news with personal income. It climbed 0.8% for the month, much better than the estimate for 0.4%.

As always, the question is, “how will this impact the Federal Reserve’s interest rate policy?”

The market’s answer appears to be “not much.”

As you can see below, the CME Group’s FedWatch Tool shows that traders are still putting heaviest odds on the Fed enacting three quarter-point cuts in 2025.

Source: CME Group

As I write, the probability clocks in at 32.9%. For context, one week ago it was 34%.

Regular Digest readers know that legendary investor Louis Navellier believes this undershoots how many cuts the Fed will ultimately deliver.

Here’s Louis from last week:

I still expect four key interest rate cuts this year.

The reality is that global interest rates will collapse given weak economic growth in Asia, as well as economic contractions in the U.K., Canada, France, Germany and Mexico.

Global central banks like the Bank of England and the European Central Bank will need to continue cutting key interest rates to shore up their respective economies.

And Treasury yields will continue to decline as global central banks slash key interest rates. Since the Fed does not fight market rates, I expect our central bank will follow suit and cut rates four times this year.

As we’ve highlighted in the Digest, if Louis is right, we’ll face a new question:

Will Wall Street interpret four rate cuts as a bullish, proactive measure from the Fed that’s promoting steady growth by aligning interest rates with the neutral rate…

Or will four cuts be seen as a bearish, reactionary move from a Fed that’s playing defense against a looming recession?

The market’s answer will drive your portfolio value.

We’ll keep you updated.

In recent weeks, we’ve been highlighting the widespread uncertainty facing investors and corporate planners today. Much of it stems from President Trump’s tariff plans.

The fogginess is so pervasive that, today, we’re launching a new running segment: “Uncertainty Watch.”

(Hopefully, it’s a very brief running segment.)

The longer that corporate planners and U.S. consumers remain uncertain about upcoming economic conditions, the greater the likelihood that they hold off on capital expenditures and big-ticket purchases.

Enough of that and corporate profits fall… sentiment multiples contract… and our portfolios suffer the consequences. So, we’re going to track this uncertainty.

For today’s take, let’s zero in on Big Oil.

Yesterday, the Federal Reserve Bank of Dallas released the results of its quarterly survey of anonymous oil executives. I’ve read all the comments and they’re overwhelmingly negative.

The response below is, in my opinion, the best summation of the various issues, also tying in the investment impact:

As a public company, our investors hate uncertainty. This has led to a marked increase in the implied cost of capital of our business, with public energy stocks down significantly more than oil prices over the last two months.

This uncertainty is being caused by the conflicting messages coming from the new administration.

There cannot be ‘U.S. energy dominance’ and $50 per barrel oil; those two statements are contradictory.

At $50-per-barrel oil, we will see U.S. oil production start to decline immediately and likely significantly (1 million barrels per day plus within a couple quarters). This is not “energy dominance.”

This contradiction has been on our radar since I first read about “Drill, baby, Drill.”

Why would Big Oil drill more when the outcome would be lower oil prices?

Sure, there’s a hypothetical point at which lower prices might goose demand, resulting in higher overall consumption that increases Big Oil’s bottom line. But one step over that perfect supply/demand balance would eat into profits.

It appears that for many Big Oil executives, the risks associated with lower and lower prices outweighs the potential benefit of higher volumes.

We’ll keep tracking both oil and uncertainty and will report back.

Gold continues to have a banner year.

As I write, it’s notching the latest in a series of all-time highs here in 2025.

As you can see below, gold is up 17% on the year while the S&P has fallen more than 4%.

Source: TradingView

But if master trader Jeff Clark is right, the yellow metal is due for a pullback.

For newer Digest readers, Jeff is a market veteran with more than four decades of experience. In his service, Jeff Clark Trader, he uses a suite of indicators and charting techniques to profitably trade the markets regardless of direction – up, down, or sideways. And one of them is signaling a potential reversal in gold.

From Jeff:

The gold sector is overbought.

The Gold Bugs Index (HUI) is trading historically far above its 50-day moving average line. It recently rallied 10% in just one week.

There’s negative divergence on the technical momentum indicators. And it looks vulnerable to a swift pullback.

Take a look…

Source: StockCharts.com

HUI rarely strays more than 8% away from its 50-day moving average (the squiggly blue line on the chart) before reversing and heading back towards the line.

The red arrows on the chart point to the multiple times last year HUI traded 8% or more away from its 50-day MA.

Each time, the stock move reversed back towards the line almost immediately.

Now, if you’re in gold already, we recommend you snooze your way through any upcoming pullback. Given our federal government’s financial position, as well as soaring debt from global central banks, we anticipate far higher gold prices to come.

But if you’ve missed gold’s bull run this year, keep an eye on this over the coming days/weeks. Any substantial pullback could be a good entry point for a longer-term investor.

As you can see below, after sinking to roughly $78,000 earlier this month, bitcoin has been edging higher. As I write, it trades just north of $84,000.

Source: TradingView

For where it’s headed next, let’s go to our crypto expert, Luke Lango. From his latest issue of Crypto Investor Network:

We think cryptos put in a durable bottom last week. We think the worst of the 2025 sell-off is over.

And, most importantly, we think cryptos – Bitcoin and altcoins – are due to a big rally over the next few months.

Luke lays out a handful of reasons. Two of them you’d expect: coming relief from Trump’s tariff-related uncertainty and a shift back to risk-on sentiment.

But the third is a little different – a “Fed Bump.” Here’s Luke:

Cryptos are a risk-on asset, and as such, they have developed a strong correlation with money supply. When money supply is robust and growing, investors have more money to pour into risky assets and they pile into cryptos, pushing crypto prices up.

When money supply is constrained and shrinking, investors have less money to pour into risky assets and they rush out of cryptos, pulling crypto prices lower…

Money supply growth is very closely tied to the Federal Reserve’s interest rate actions.

When the Fed is cutting rates, money supply growth expands as more money enters the economy through more lending and more spending.

Luke explains that the Fed has moved to the sidelines and held rates steady since December. This has slowed money supply growth, which, uncoincidentally, has happened alongside a big drop in crypto prices.

Luke doesn’t expect this to last:

Money supply growth should pick-up over the next few months because the Fed will get back into rate-cutting mode.

The market is calling for about three rate cuts over the next 12 months.

If we do get three rate cuts over the next 12 months, then money supply growth should expand over the next 12 months.

History says that should boost crypto prices.

And that brings full circle to today’s PCE report and its potential impact on the Fed’s interest rate policy.

Yesterday, Louis Navellier, Eric Fry, and Luke Lango sat down to discuss the emerging divide between the “haves” and “have nots” in the market – and in our society. One of the most influential factors behind this growing divide is wealth generated from cutting-edge technology and artificial intelligence.

Our three experts delivered the step-by-step playbook you need to follow to make the most of the opportunity (If you missed it, I encourage you to check out the replay here).

A quick note on why this presentation was especially timely…

AI is not a trend. It’s not going away.

As we pointed out yesterday using an example from Microsoft founder Bill Gates, AI’s capabilities will render most human labor unnecessary far sooner than many people realize.

Having your wealth aligned with AI is a critical defense against such economic creative destruction.

Today, fear is weighing on the prices of leading AI stocks. For example, AIQ, The Global X Artificial Intelligence & Technology ETF, is down almost 15% since mid-February.

Source: TradingView

But with a longer-term perspective – and the awareness of the enormous changes AI will bring – such a pullback is just a more attractive entry price.

Could AI stocks go lower? Absolutely – and investors should be prepared for that.

But the more important question is whether today’s prices are ones that are likely to reward investors, say, five or 10 years from now.

Here’s Louis’ overall take (not on AIQ, but on top-tier AI stocks in general):

If you missed out on the big gains from AI stocks since 2023, this is a rare “second chance” to get in on some of the most innovative companies in the world.

In fact, our latest batch of picks easily has triple-digit upside in just a handful of months.

That’s why I teamed up with Eric and Luke to deliver a rare special broadcast yesterday.

In it, we revealed why nearly a trillion dollars of new investments could soon flood two little-known corners of the AI Revolution… how it could accelerate the lucrative AND destructive force behind the phenomenon known as the Technochasm… and what you need to do to prepare (and profit).

We’ll keep you updated on all these stories here in the Digest.

Have a good evening,

Jeff Remsburg

Collectors’ exhibits return, two Midwest museums will have displays, and a limited number of free ANACS-encapsulated Nebraska Homestead commemorative quarter-dollars with special insert labels will be featured attractions at the Central States Numismatic Society convention ([email protected]). The show will be in the Chicago suburb of Schaumburg, Illinois, April 24-26, 2025.

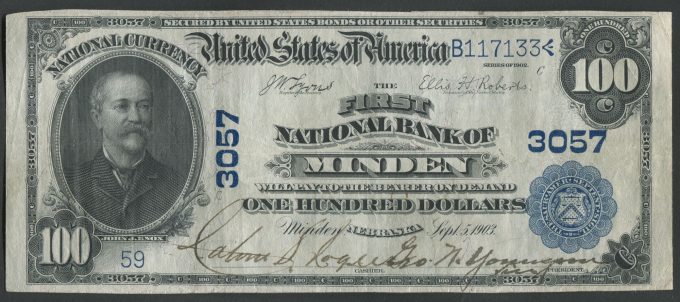

The Higgins Museum of National Bank Notes will display rare Nebraska money at booth #2200 as part of the CSNS multi-year program to honor all 13 states that comprise the organization’s geographical area.

“Nebraska is the second state we’re recognizing following last year’s salute to Iowa,” explained CSNS President Mitch Ernst.

The Higgins Museum of National Bank Notes (www.TheHigginsMuseum.org) located in Okoboji, Iowa will have a four-case exhibit of historic Nebraska paper money.

“The display will have examples from the museum’s collection of Large Size and Small Size notes including a cut sheet of four ($10, $10, $10, and $20) notes from the First National Bank of Wood River. There also will be the museum’s Number 1 Red Seal $5 note from the First National Bank of Clarks,” explained Museum Curator George Cuhaj.

The exhibit’s name is “C Nebraska” in recognition of several $100 denomination notes — a denomination popularly nicknamed “C notes” — in the display.

The Durham Museum in Omaha, Nebraska (www.DurhamMuseum.org) will have an informative display at booth #2201 with photographs of rare money in the historic collection housed at the museum.

“Visitors can learn about Omaha’s Byron Reed Collection, a varied set of coins and paper currency from a 19th century businessman and pioneer,” said Kristen Rowley, the museum’s Collection Manager.

“The collection will remain in Nebraska, but the display will feature images and information regarding the different facets of the collection,” explained Rowley.

“This includes Sutler tokens, pattern coins, ancient coins, territorial gold, Washingtonia, assay medals, and more. Visitors also can learn about some of the major highlights in the collection, including Byron Reed’s prized 1804 Class I Draped Bust silver dollar that he acquired around 1890,” she said.

After a two-year hiatus, collectors’ exhibits will return to the CSNS convention.

“We are especially looking for exhibits with a Nebraska theme this year,” explained Jack Huggins, CSNS Secretary/Treasurer and 2025 Exhibits Chairman.

“So far, we have collectors who will have exhibits on Obsolete Currency of Nebraska; Nebraska Centennial Medal Process Set; Types of Nebraska Centennial Medals; and Hometown Currency – National Bank Notes from Wahoo, Nebraska,” he said.

Collectors who want to exhibit can get an application at the CSNS website, www.CSNS.org.

Convention attendees also have a chance to receive a complimentary Nebraska-themed quarter dollar.

“While supplies last, we’ll be giving away to each visitor at the convention a mint condition 2015 Homestead National Monument of America quarter-dollar issued as part of the United States Mint America the Beautiful Quarters® Program. Donated by Littleton Coin Company (www.LittletonCoin.com), each coin commemorating the Beatrice, Nebraska landmark has been certified by ANACS (www.ANACS.com) with a distinctive special CSNS insert label in the holder,” Ernst said.

The Newman Numismatic Portal (https://nnp.wustl.edu) educational seminar at the convention will feature Mark Engler, former Superintendent of Homestead National Historical Park. He will present his behind-the-scenes perspectives on the experience of design, production, and scheduling a release ceremony for the Homestead quarter while he was superintendent at the park.

CSNS convention attendees will also have the opportunity to have counterfeit coins they unwittingly purchased marked with the conspicuous, incused word “COPY.”

“This will make the fakes legal to own in compliance with the Hobby Protection Act. As a public service, the non-profit Anti-Counterfeiting Educational Foundation (www.ACEFonline.org) will properly mark COPY on up to three counterfeit coins per owner free of charge at the ACEF bourse table #A9,” said ACEF Executive Director Beth Deisher.

Heritage Auctions (www.HA.com), booth #800, is the Official Auctioneer for the 86th Annual CSNS Convention.

“The auction will be brimming with exceptional coins, a trove that will include treasures from The Bruce S. Sherman Collection, Part II,” said Steve Lansdale, Heritage Auctions Senior Public Relations and Communications Specialist.

Among the auctions highlights will be four exceptional coins featured in the award-winning reference book, 100 Greatest U.S. Coins:

There will be a young numismatist’s scavenger hunt on Saturday, April 26, between 10 am and 2:00 pm.

“Each child gets a ‘goodie bag’ with some nice numismatic items in it,” said CSNS Convention Manager Cindy Wibker. “Admission to the show is free each day for attendees ages 17 and under, $15 for adults. Beginning at noon on Saturday everyone gets in free, so parents can bring the kids and the entire family gets in free for the final hours.”

The 2025 CSNS convention will be held at the same site as in recent years, the Renaissance Schaumburg Convention Center, 1551 North Thoreau Drive, in Schaumburg, Illinois.

Discount hotel room rates of $177 per night (plus taxes) are available at the conveniently adjoining Renaissance Schaumburg Hotel. Room reservations can be made by calling the hotel directly at 847-303-4100 or booked online at https://book/passkey.com/go/CentralState.

Additional information about the CSNS 86th annual convention will be announced in the coming weeks and posted online at www.CSNS.org/convention. Information is also available by contacting Convention Manager Cindy Wibker by phone at 407-221-8737 or by email at [email protected].

Updated on March 28th, 2025 by Bob Ciura

Mortgage Real Estate Investment Trusts (i.e., “REITs”) – often referred to as “mREITs” – can provide a very attractive source of income for investors.

This is because they invest in mortgages that are typically backed by hard assets (commercial and/or residential real estate) with fairly conservative loan-to-value ratios.

Mortgage REITs finance these portfolios with a mixture of equity (that they raise by selling shares to investors) and debt that they generally raise at an interest cost that is meaningfully lower than the interest rates they can command on their real estate mortgage investments.

The result is significant and stable cash flow for the mREIT.

You can download your free 200+ REIT list (along with important financial metrics like dividend yields and payout ratios) by clicking on the link below:

Moreover, as REITs they are exempt from having to pay corporate taxes on their net interest income and are required to pay out at least 90% of their taxable income to shareholders via dividends.

This generally means that mREIT shareholders earn very high dividend yields, making mREIT shares an exceptional source of passive income.

Of course, due to their significant amount of leverage, mortgage REITs come with risks that occasionally lead to dividend cuts.

As a result, investors need to be prudent when selecting which mREITs to invest in.

This article will list the 5 highest yielding mortgage REITs in the Sure Analysis Research Database.

You can instantly jump to any specific section of the article by using the links below:

American Capital Agency Corp is a mortgage real estate investment trust that invests primarily in agency mortgage–backed securities (or MBS) on a leveraged basis.

The firm’s asset portfolio is comprised of residential mortgage pass–through securities, collateralized mortgage obligations (or CMO), and non–agency MBS. Many of these are guaranteed by government–sponsored enterprises.

Source: Investor Presentation

AGNC Investment Corp. reported strong financial results for the third quarter ended September 30, 2024. The company achieved a comprehensive income of $0.63 per common share, driven by a net income of $0.39 and other comprehensive income of $0.24 from marked-to-market investments.

Net spread and dollar roll income contributed $0.43 per share. The tangible net book value increased by $0.42 per share to $8.82, reflecting a 5.0% growth from the previous quarter.

AGNC declared dividends of $0.36 per share, resulting in a 9.3% economic return on tangible common equity, which includes both dividends and the increase in net book value.

Click here to download our most recent Sure Analysis report on AGNC Investment Corp (AGNC) (preview of page 1 of 3 shown below):

Dynex Capital invests in mortgage–backed securities (MBS) on a leveraged basis in the United States. It invests in agency and non–agency MBS consisting of residential MBS, commercial MBS (CMBS), and CMBS interest–only securities.

Source: Investor Presentation

Dynex Capital released its fourth-quarter 2024 financial results, with book value ending the quarter at $12.70 per share and an economic return of 7.4% for the year.

Leverage increased slightly to 7.9x as the company deployed capital into higher-yielding agency RMBS, particularly 30-year 4.5%, 5%, and 5.5% coupons.

The shift from treasury futures to interest rate swaps was a key strategy, enhancing portfolio returns by 200 to 300 basis points and improving net interest spread.

Click here to download our most recent Sure Analysis report on DX (preview of page 1 of 3 shown below):

Ellington Credit Co. acquires, invests in, and manages residential mortgage and real estate related assets. Ellington focuses primarily on residential mortgage-backed securities, specifically those backed by a U.S. Government agency or U.S. government–sponsored enterprise.

Agency MBS are created and backed by government agencies or enterprises, while non-agency MBS are not guaranteed by the government.

On March 12th, 2025, Ellington Residential reported its fourth quarter results for the period ending December 31, 2024. The company generated a net loss of $(2.0) million, or $(0.07) per share.

Ellington achieved adjusted distributable earnings of $7.8 million in the quarter, leading to adjusted earnings of $0.27 per share, which covered the dividend paid in the period.

Ellington’s net interest margin was 5.07% overall. At quarter end, Ellington had $31.8 million of cash and cash equivalents, and $79 million of other unencumbered assets.

Click here to download our most recent Sure Analysis report on EARN (preview of page 1 of 3 shown below):

ARMOUR Residential invests in residential mortgage-backed securities that include U.S. Government-sponsored entities (GSE) such as Fannie Mae and Freddie Mac.

It also includes Ginnie Mae, the Government National Mortgage Administration’s issued or guaranteed securities backed by fixed-rate, hybrid adjustable-rate, and adjustable-rate home loans.

Unsecured notes and bonds issued by the GSE and the US Treasury, money market instruments, and non-GSE or government agency-backed securities are examples of other types of investments.

ARMOUR’s cash flow has been volatile since its inception in 2008, but this is to be expected with all mREITs. Of late, declining spreads have hurt earnings, leading to a sharp decline in cash flow per share.

Fortunately, ARMOUR is now seeing a measure of recovery, and should continue to see that recovery manifest itself in the coming quarters and years.

Click here to download our most recent Sure Analysis report on ARMOUR Residential REIT Inc (ARR) (preview of page 1 of 3 shown below):

Orchid Island Capital, Inc. is an mREIT that is externally managed by Bimini Advisors LLC and focuses on investing in residential mortgage-backed securities (RMBS), including pass-through and structured agency RMBSs.

These financial instruments generate cash flow based on residential loans such as mortgages, subprime, and home-equity loans.

In the fourth quarter of 2024, Orchid Island Capital, Inc. reported a net income of $0.07 per share, a decrease from $0.24 per share in the previous quarter. The company’s book value declined from $8.40 at the end of the third quarter to $8.09 at year-end.

As of December 31, 2024, Orchid Island Capital’s portfolio consisted of approximately $4.2 billion in residential mortgage-backed securities (RMBS), with a net weighted average coupon of 3.5%. The company’s leverage ratio stood at 8.1 times, reflecting its strategy of utilizing leverage to enhance returns.

Click here to download our most recent Sure Analysis report on Orchid Island Capital, Inc. (ORC) (preview of page 1 of 3 shown below):

As you can see from the dividend yields offered by the ten stocks discussed in this article, mREITs can be powerful passive income generators.

However, investors need to be careful before investing in this sector, given that dividend cuts can be common during periods of economic stress. As a result, diversification and a focus on quality are essential.

You can see more high-quality dividend stocks in the following Sure Dividend databases, each based on long streaks of steadily rising dividend payments:

Alternatively, another great place to look for high-quality business is inside the portfolios of highly successful investors.

By analyzing the portfolios of legendary investors running multi-billion dollar investment portfolios, we are able to indirectly benefit from their million-dollar research budgets and personal investing expertise.

To that end, Sure Dividend has created the following two articles:

You might also be looking to create a highly customized dividend income stream to pay for life’s expenses.

The following lists provide useful information on high dividend stocks and stocks that pay monthly dividends:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].

Just when the market was starting to regain some upward momentum, President Trump announced another new wave of tariffs. Now stocks are sinking once again.

Indeed, this past Wednesday, March 26, Trump issued a 25% tariff on all cars made outside the United States. That same day, the S&P 500 shed 1%, and the Nasdaq crashed 2%.

As a result, both indices broke a three-day winning streak – their first such streak since the market peaked (and this whole tariff drama began) on Feb. 19.

With these auto tariffs… and even more to come next week – Wednesday, April 2; what Trump is calling “Liberation Day” and “the big one” – we could be on the cusp of a global trade war bigger than anything we’ve seen in the past 100 years.

We think it’s time to prepare for that potential outcome.

A 25% tariff on all imported vehicles is significant.

Estimates vary. But generally speaking, about 50% of cars purchased by Americans are made in the U.S., and 50% are made abroad – a roughly equal split. That means 1 out of every 2 cars bought in America is now subject to a 25% tariff.

If all those costs pass through to the consumer, then 1 in every 2 cars will now be 25% more expensive. As Newsweek estimates, “the tariffs could raise vehicle prices by as much as $12,500… With average prices already near $49,000, many households may be priced out of the new car market.”

That’s a big deal. And it may be just the tip of the iceberg here…

Because 25% tariffs on most Mexican and Canadian goods are also set to resume next week.

These are two of America’s three biggest trading partners. Together, they import about $900 billion worth of goods into the U.S., including lots of household appliances, air conditioners, electrical components, surgical equipment, fresh produce, beer, oil, natural gas, timber, aluminum, and grains. In other words… just about everything.

All those goods and supplies will now be subject to a 25% tariff, potentially making them 25% more expensive to buy.

Not to mention, Trump is expected to enforce multiple reciprocal tariffs against major U.S. trading partners, such as the European Union, India, and others.

Those could dramatically disrupt global trade flows and create huge production bottlenecks…

So, yes, don’t let the mainstream media or political rhetoric fool you – these tariffs are a big deal. And everything comes to a head next week, on Wednesday, April 2.

But the question is – will things stick?

So far, very few tariffs have remained in play. For the most part, despite an avalanche of threats, the only tariffs that have stuck are some additional levies on Chinese goods.

There’s an identifiable pattern here:

It seems that Trump is only using tariffs as a strong-arm negotiation tactic to reach better trade deals for the U.S. We don’t think he intends to keep them in place.

But of course, there’s no way to know for certain. All these tariffs coming next week could stick around.

And if they do, it could spell major trouble for the markets.

Just look at how much damage tariffs have already caused on Wall Street so far.

The S&P is off to its worst start to a year since 2022, when stocks nosedived into a bear market on runaway inflation fears.

It crashed 10% in just 20 days for the fifth-fastest correction in the market’s history. And it lost its primary uptrend line – the 200-day moving average – for just the second time since this bull market began in early 2023.

And this has been the result of small and temporary tariffs. What happens if next week’s tariffs stick around?

The tariffs imposed so far have caused the fifth fastest 10% stock market crash in history. What damage will big, long-lasting tariffs cause?

Things could get ugly, folks. Risks are rising.

But, as we said, considering Trump’s pattern of behavior, these tariff threats could very well be much more bark than bite.

So…

While Trump’s trade war could cause a global recession and plunge stocks into a bear market… it likely won’t.

And the fears that it might have led stocks lower, creating what could be a fantastic buying opportunity.

What’s the best way to capitalize on it?

Well, as we mentioned recently, the AI trade is the most likely to offer a safe haven – even profits within a broader selloff – if things take a turn for the worst.

Bloomberg’s Artificial Intelligence Aggregate index (BAIAET) is a strong proxy for the sector at large. It currently stands at major technical support levels (the 250-day moving average) that it hasn’t yet broken. Additionally, at 21X forward P/E, it’s trading at its lowest valuation since its inception, all while estimates for AI companies are still rising like crazy…

Whether you’re looking for security or surplus, it seems that AI is the way to go.

But the broader AI trade is crowded. That’s why we’ve been hunting for the next big industry breakthrough…

And we’ve found it in what I call AI 2.0 – a development that could be an order of magnitude bigger than anything we’ve seen in the AI Boom so far.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.

P.S. You can stay up to speed with Luke’s latest market analysis by reading our Daily Notes! Check out the latest issue on your Innovation Investor or Early Stage Investor subscriber site.